Payroll managers basically pay employees and take care of most of the paperwork that compiles the payroll preparations, deductions, withholdings, and attendance. They also complete reports and maintain records pertaining to payroll information and make summaries based on all available data regarding employee statuses and salaries.

Our Job Description Samples for payroll managers come with an expansive list of duties and responsibilities that can be used as guides for employers looking to hire qualified payroll managers. These are all available free for downloading and can be modified to fit employer specifications.

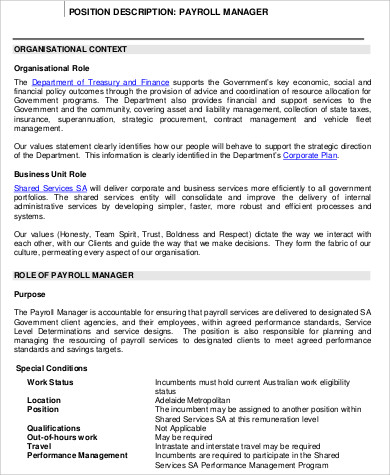

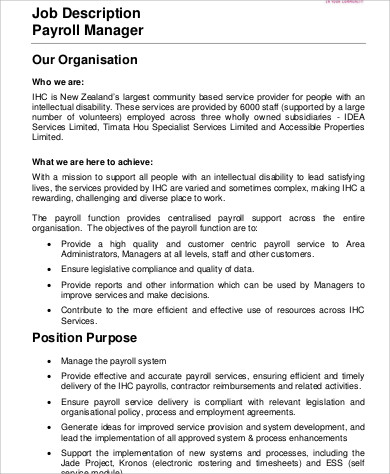

Payroll Manager Job Description Sample

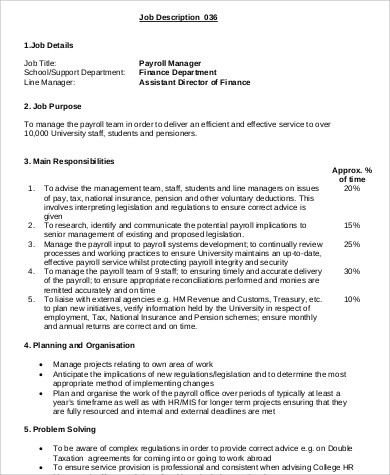

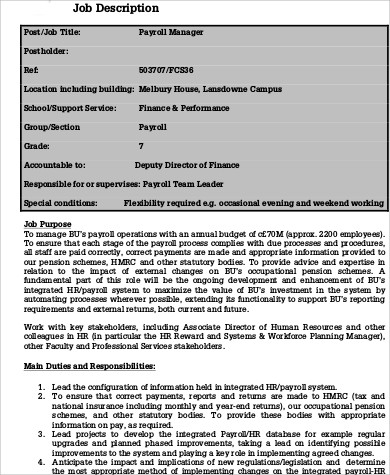

Payroll Manager Job Description Example

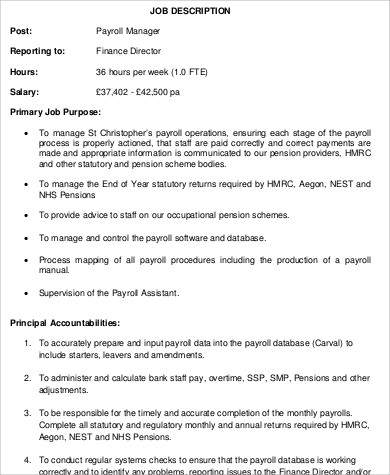

Payroll Manager Job Description Format

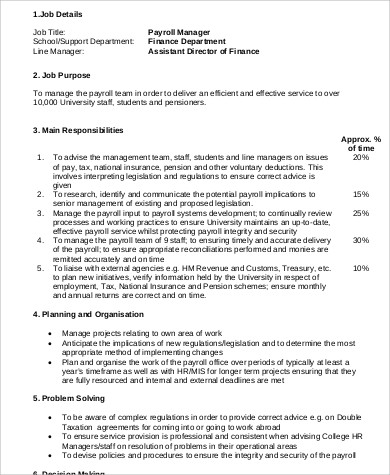

Payroll Tax Manager Job Description Example

Being a payroll manager means you need to record every employee’s attendance and hours for pay calculation purposes. You also need to keep track of paid leaves such as sick leaves and vacation leaves. While most of the work is being relegated to the human resources department, payroll managers are often attached to either the HR department or accounting staff computing the salaries to be paid to employees and keeping detailed track of overtime work, absences, and leaves. Oftentimes, mistakes in computations can mean employees do not get the correct pay.

Payroll manager job duties include the following:

- maintaining payroll information on the company’s design systems;

- making payroll guidelines through writing, printing, and disseminating updated policies and procedures;

- completing operational requirements of scheduling and assigning employees and following up on their results;

- directing the collection, calculation, and entering data on the company’s computerized payroll system;

- updating payroll records through the review of changes and approvals in changes on exemptions, deductions, insurance coverage, and department transfers;

- providing payroll information and answering employee queries and requests;

- resolving payroll discrepancies and balancing payroll accounts;

- preparing reports and compiling summaries of earnings, taxes, deductions, leave, disability, nontaxable wages, and allowances;

- directing the production and issuance of salaries to individual employees’ bank accounts; and

- determining payroll liabilities by calculating social security taxes and worker compensation payments.

For more payroll-related jobs, you can check out our Payroll Job Descriptions and Payroll Manager Job Descriptions. These samples describe the general nature of the job that can be used as reference for employers. These are all available free for downloading and can be edited and modified to user specifications.

Payroll Office Manager Job Description

Payroll Operations Manager Job Description

Sample of Payroll Manager Job Description

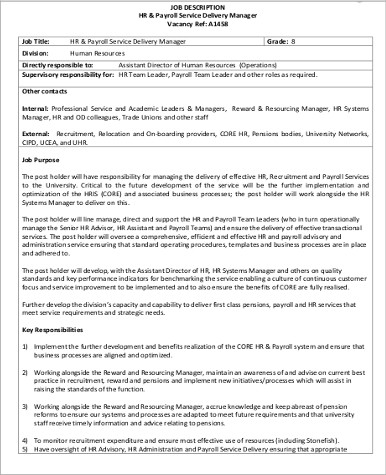

HR and Payroll Service Delivery Manager Job Description

Payroll and Benefits Manager Job Description

Computation and distribution of employee pay is a complicated process that needs a competent person who’s totally efficient for the job. In some countries like the United States, there’s no need for a college degree to become a payroll manager, although a background in business administration or accounting is necessary to do basic calculations when computing the payroll. Mastery in math, statistics, accounting, and computer programming is also needed.

For other payroll-related job descriptions, our website also offers free downloadable Payroll Accountant Job Descriptions. These samples indicate the general nature and essential duties and responsibilities of work performed by qualified individuals needed for the profession. These can be downloaded in both Word Doc and PDF file formats and can be edited or modified based on employer specifications.

Related Posts

FREE 8+ Sample Product Manager Job Description Templates in PDF | MS Word

FREE 10+ Company Description Samples [ Construction, Secretary, President ]

FREE 9+ Sample Secretary Job Description Templates in PDF | MS Word | Google Docs | Apple Pages

FREE 8+ Tutor Job Description Samples in PDF | MS Word

FREE 11+ Digital Marketing Job Description Samples in MS Word | PDF

FREE 12+ Sample Auditor Job Descriptions in MS Word | PDF | Google Docs | Pages

FREE 12+ IT Intern Job Description Samples in PDF

FREE 9+ Sample Software Developer Job Description Templates in PDF

FREE 9+ Sample Software Engineer Job Description Templates in PDF

FREE 10+ HR Payroll Job Description Samples in MS Word | PDF

FREE 14+ HR Director Job Description Samples in MS Word | PDF

FREE 10+ HR Intern Job Description Samples in MS Word | PDF

FREE 10+ Sample Treasurer Job Descriptions in MS Word | PDF

FREE 6+ Environmental Engineer Job Description Samples in MS Word | PDF

FREE 8+ Construction Worker Job Description Samples in MS Word | PDF