Embarking on the cancellation of an insurance policy requires a formal approach, and a well-crafted insurance cancellation letter is the professional way to initiate the process. This template is designed to guide you through creating a clear and effective cancellation request, ensuring that your insurance provider receives all the necessary information to process your decision without delay. With the right template, you can confidently navigate through the specifics of policy termination, ensuring a smooth and hassle-free resolution to your insurance needs. Whether you’re moving to a new provider or adjusting your coverage, this Sample Insurance Cancellation Letter Template is an essential tool for communicating your intentions clearly and securing a prompt response from your insurer.

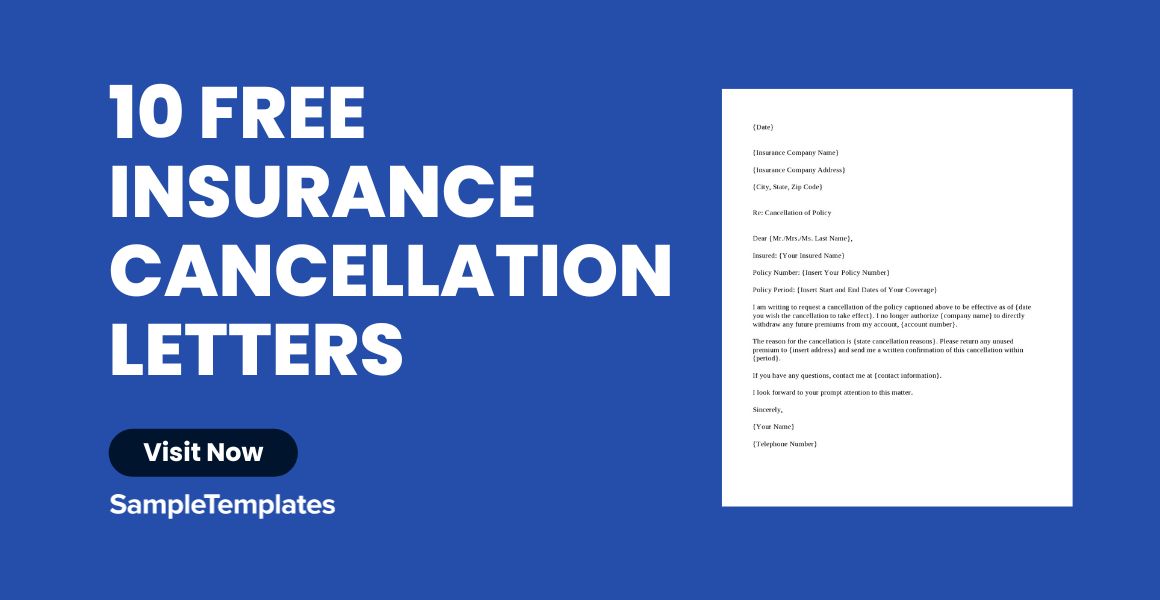

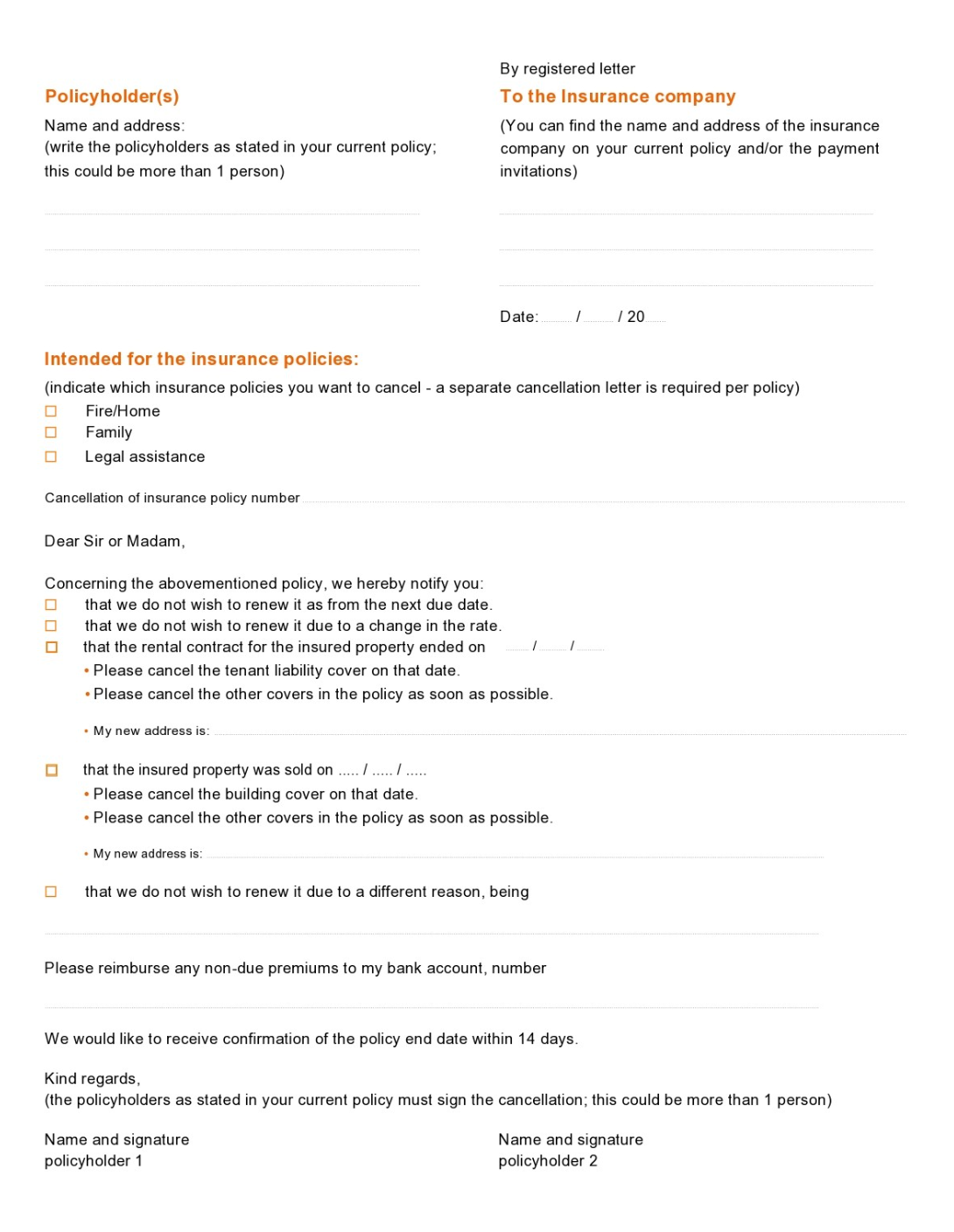

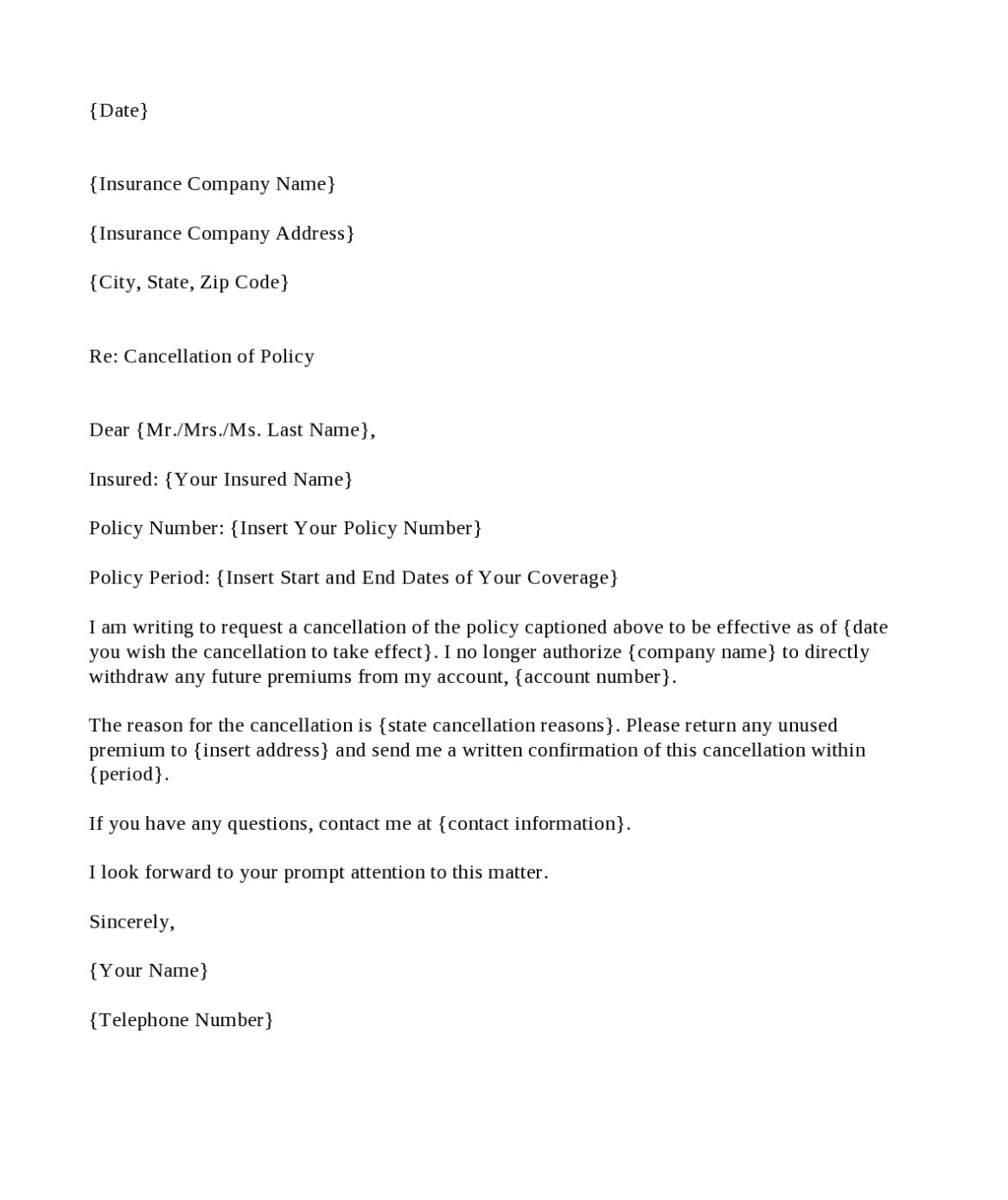

1. Sample Cancelation Letter Template

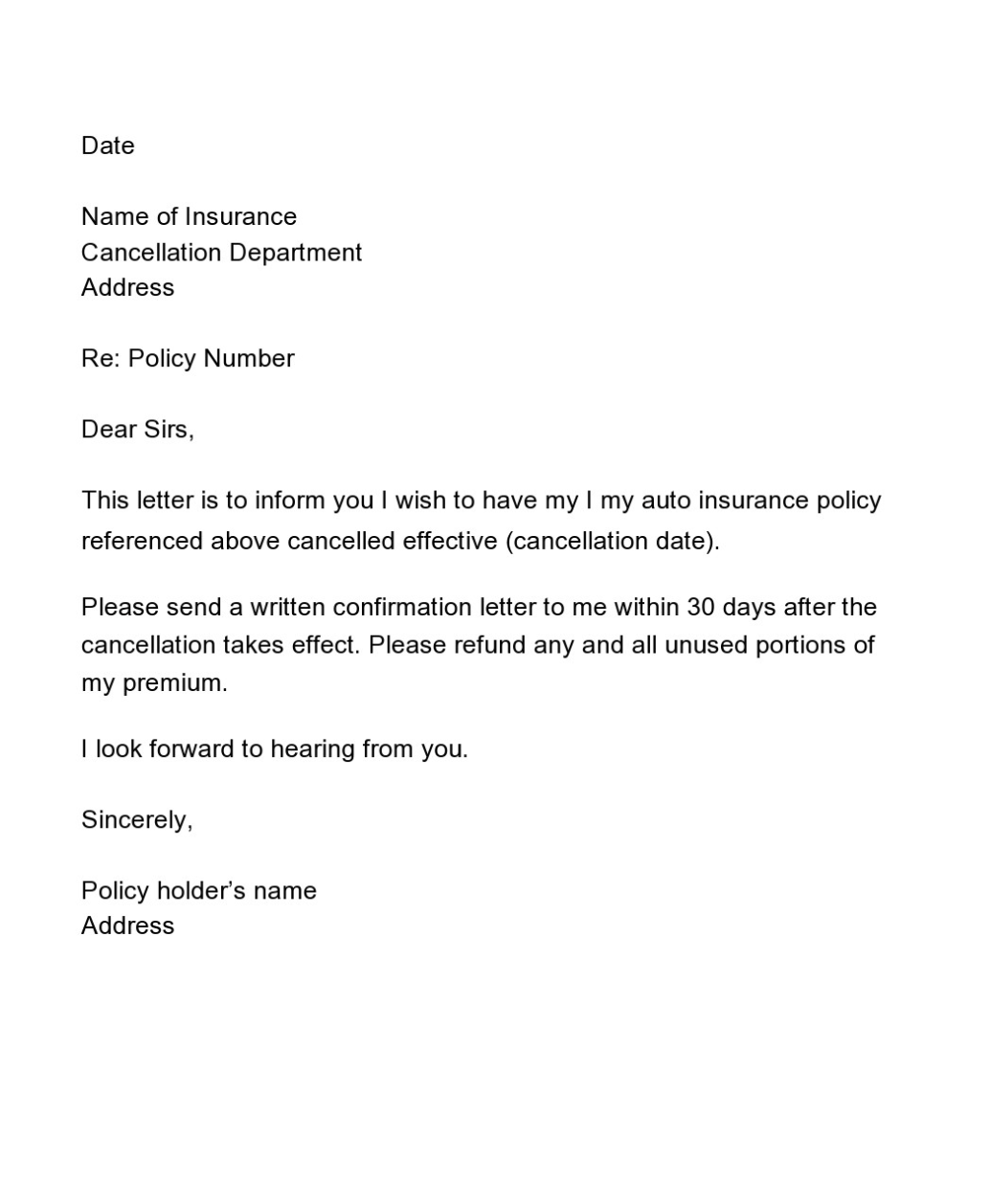

2. Sample Insurance Cancellation Letter Template

What is an insurance cancellation letter?

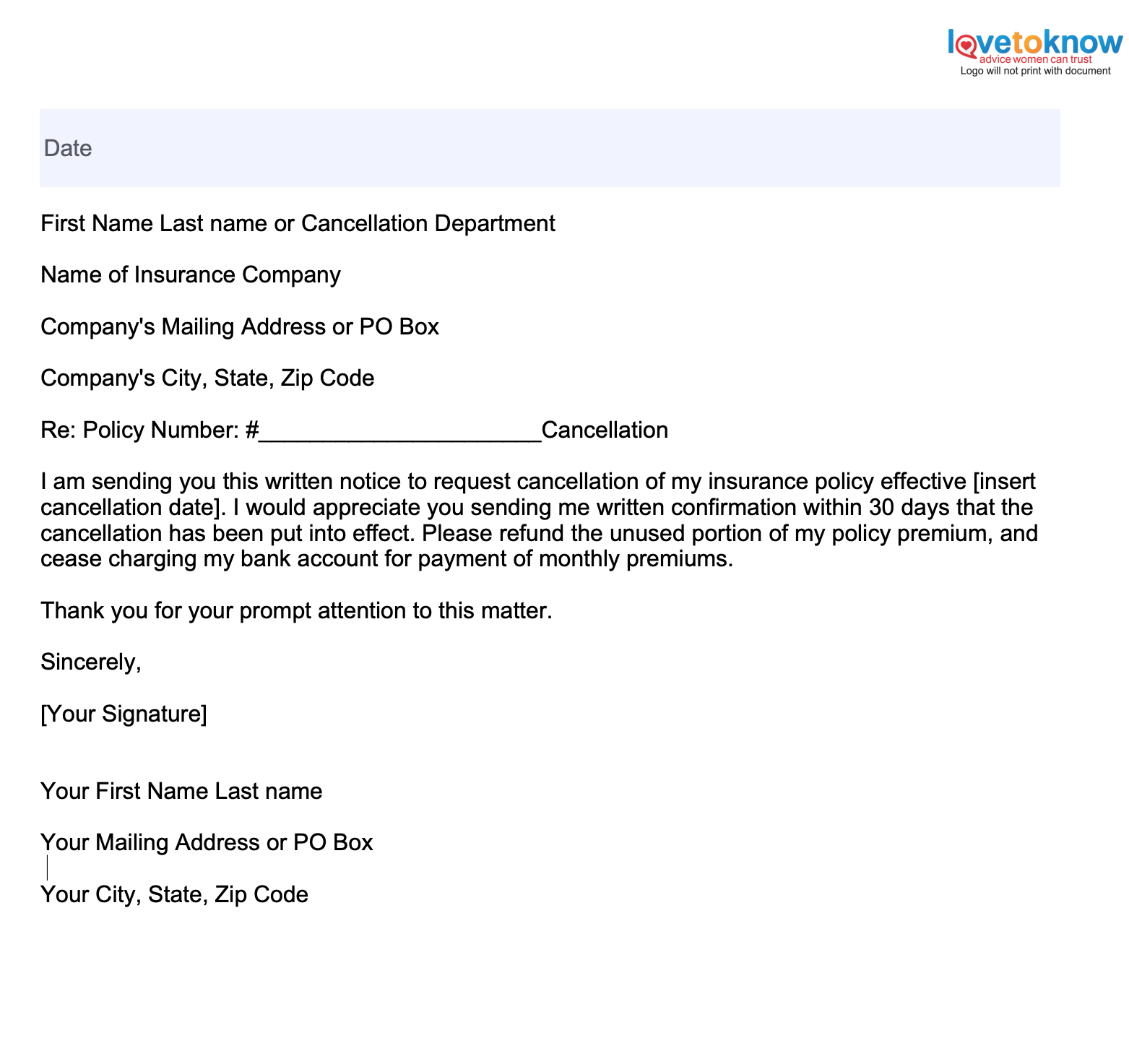

An insurance cancellation letter is a formal notification indicating an individual’s desire to terminate an insurance policy. This document serves as a written record of the policyholder’s decision to end the coverage before the policy’s natural expiration date. It’s a crucial step for anyone who has determined that their current insurance policy no longer aligns with their needs, whether due to changes in circumstances, finding a better rate elsewhere, or any other reason.

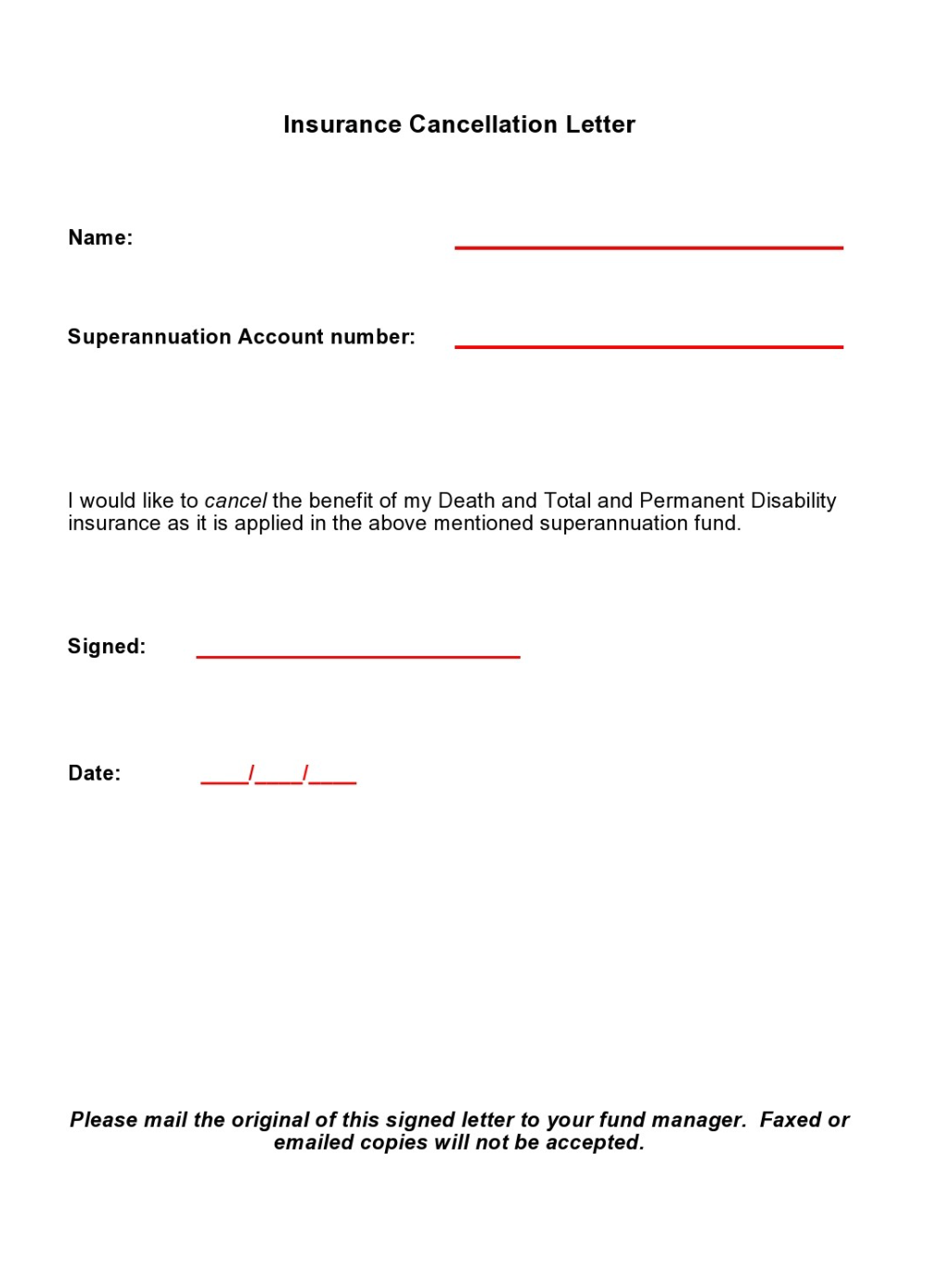

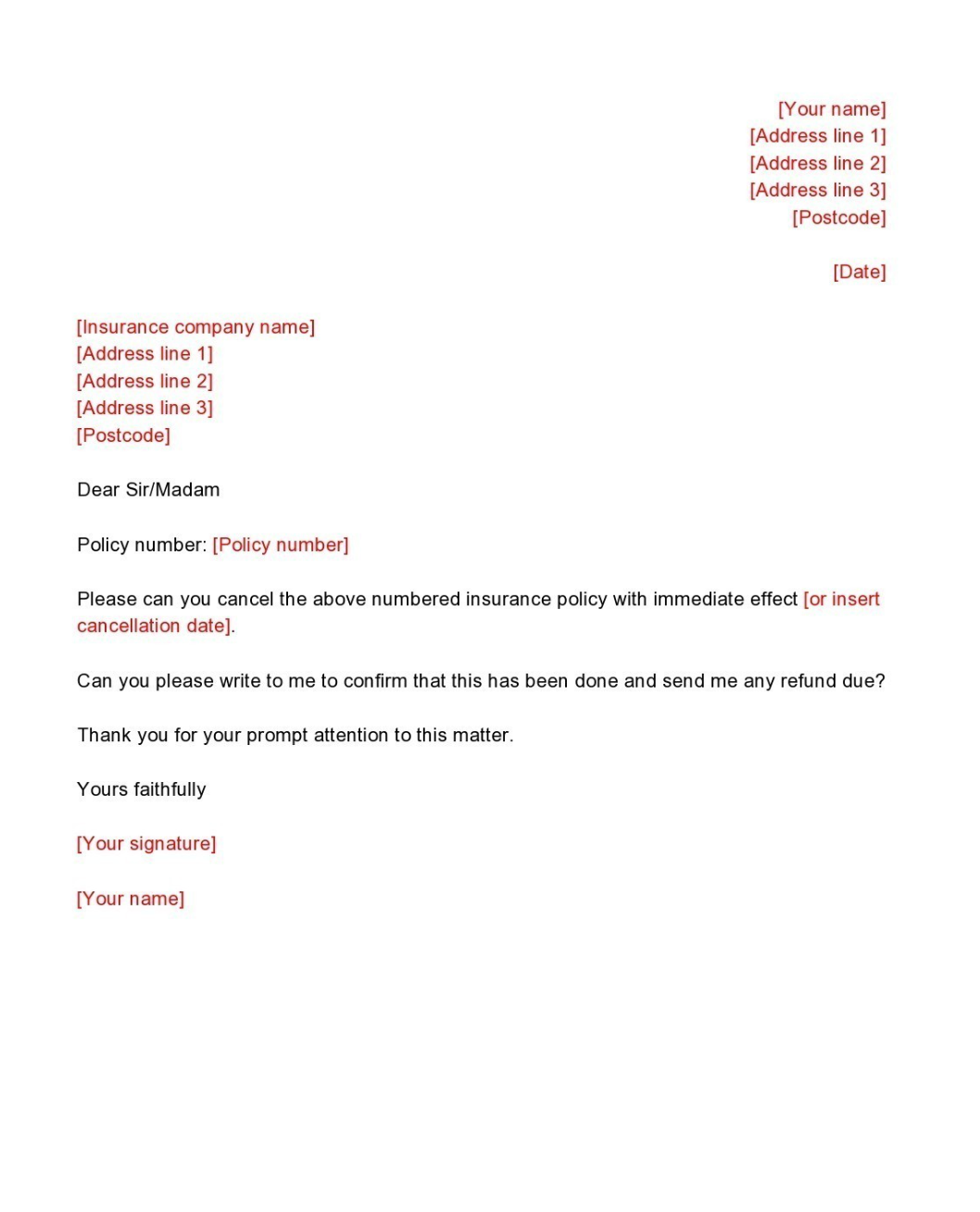

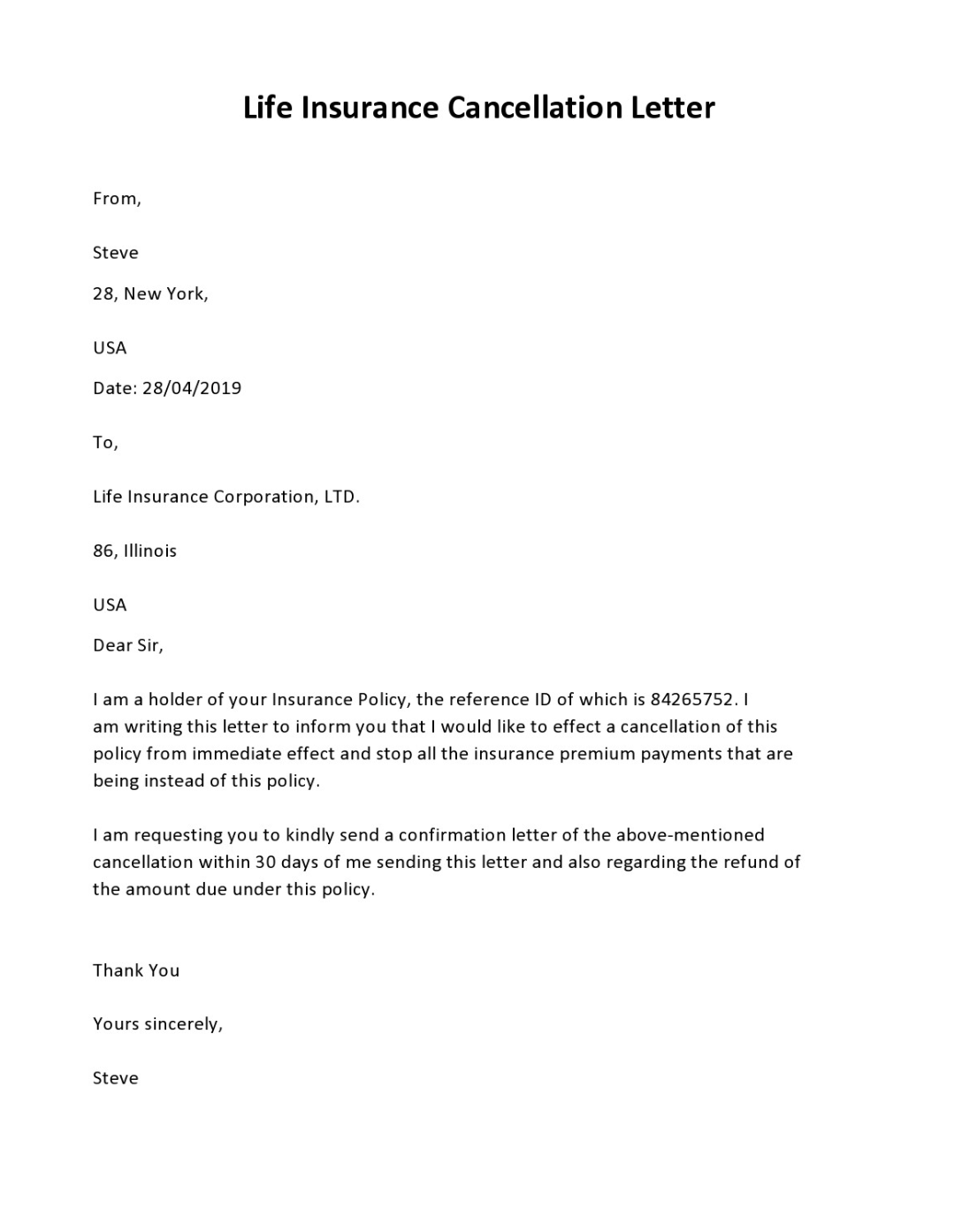

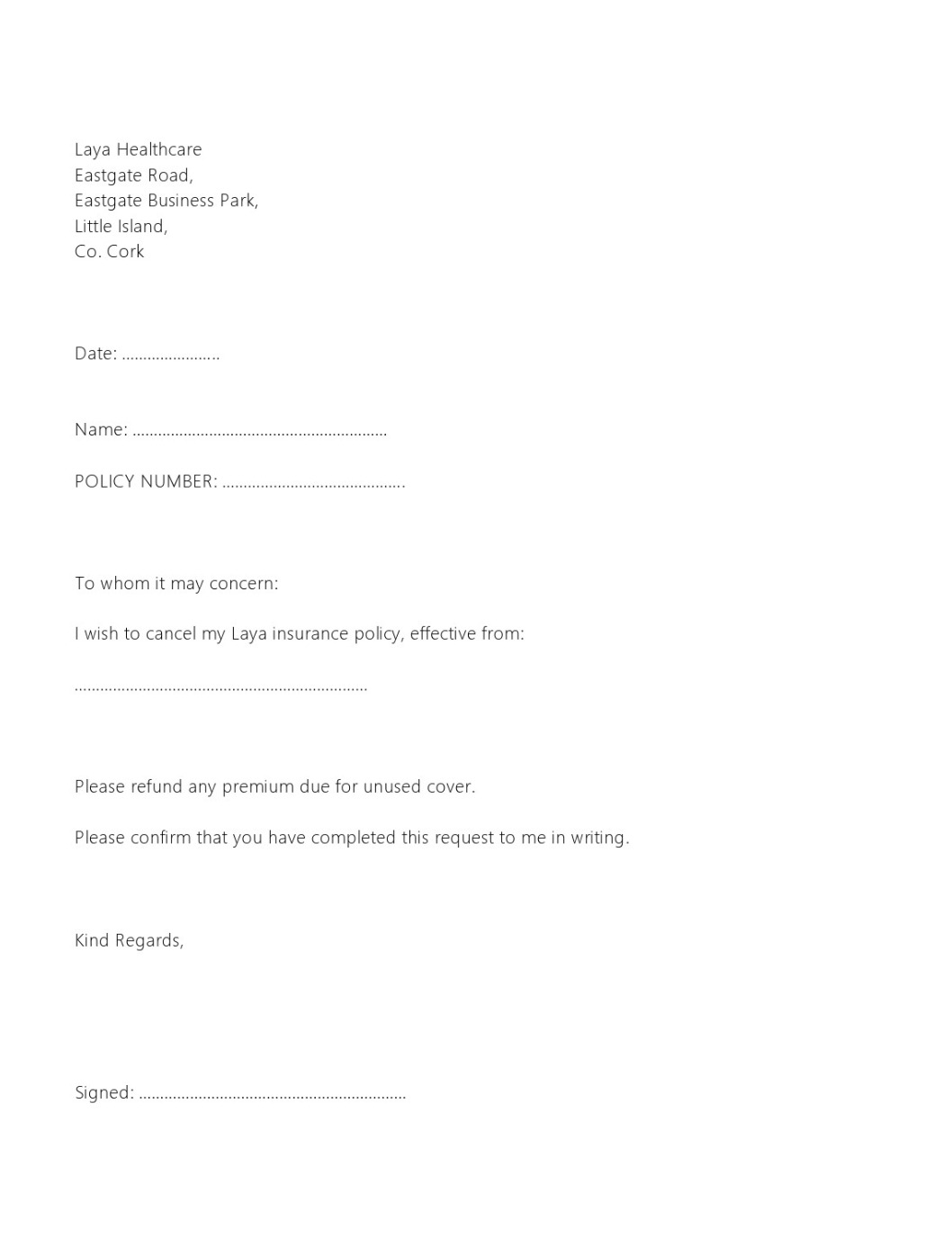

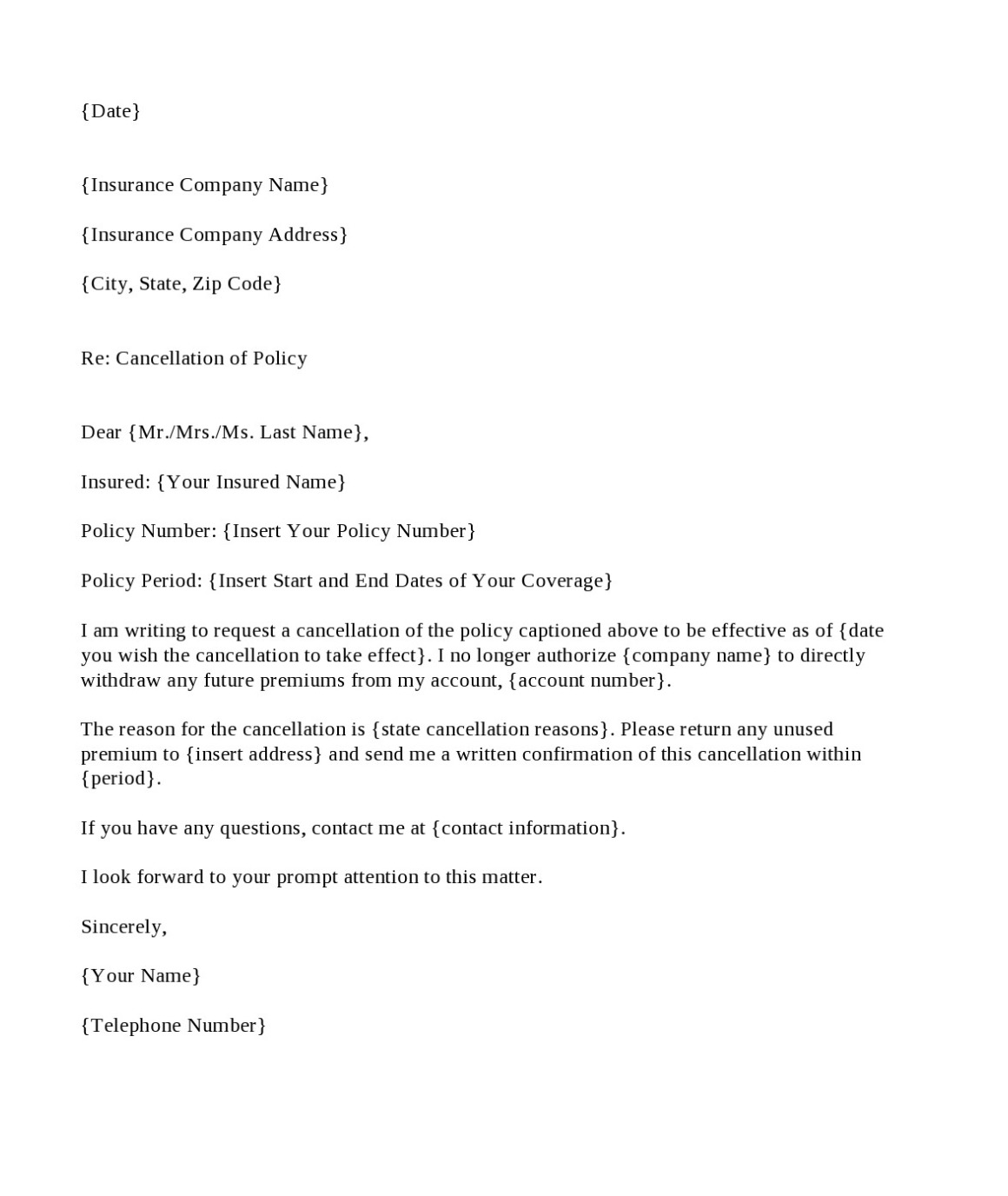

The letter should be clear and concise, providing all the necessary details to facilitate a smooth cancellation process. It typically includes the policyholder’s name, the insurance policy number, and the effective date of cancellation. It’s also important to state explicitly that the purpose of the letter is to cancel the insurance policy. This avoids any confusion that might arise from less direct communication.

Moreover, the cancellation letter serves as a formal request letter to the insurance provider for a confirmation of the cancellation and any expected refund of prepaid premiums. This is especially pertinent if the policy is canceled well in advance of its renewal date. Policyholders are often entitled to a refund of some portion of the premium, depending on the terms of the policy.

It’s essential to send the insurance cancellation letter via a method that provides proof of delivery, such as registered mail or email with a read receipt. This proof of delivery ensures that there is a record of the insurance company receiving the letter, which can be important if there is any dispute about the date of cancellation.

In addition to serving as a formal request to terminate the policy, the insurance cancellation letter also acts as a safeguard against any misunderstandings. It can prevent situations where an insurer continues to bill the policyholder or reports nonpayment to credit bureaus, assuming the policy is still active.

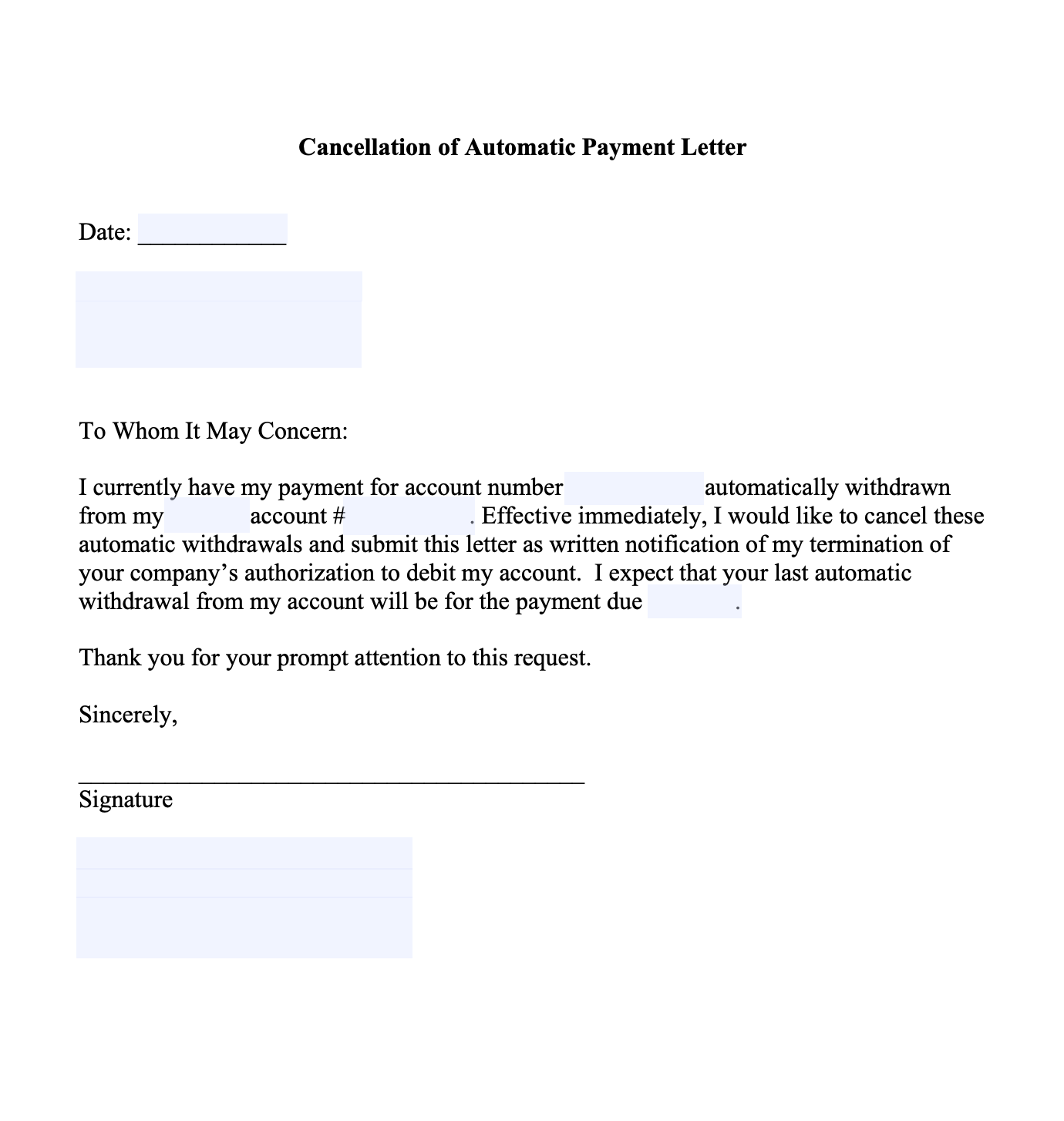

2. Insurance Cancellation of Automatic Payment Letter

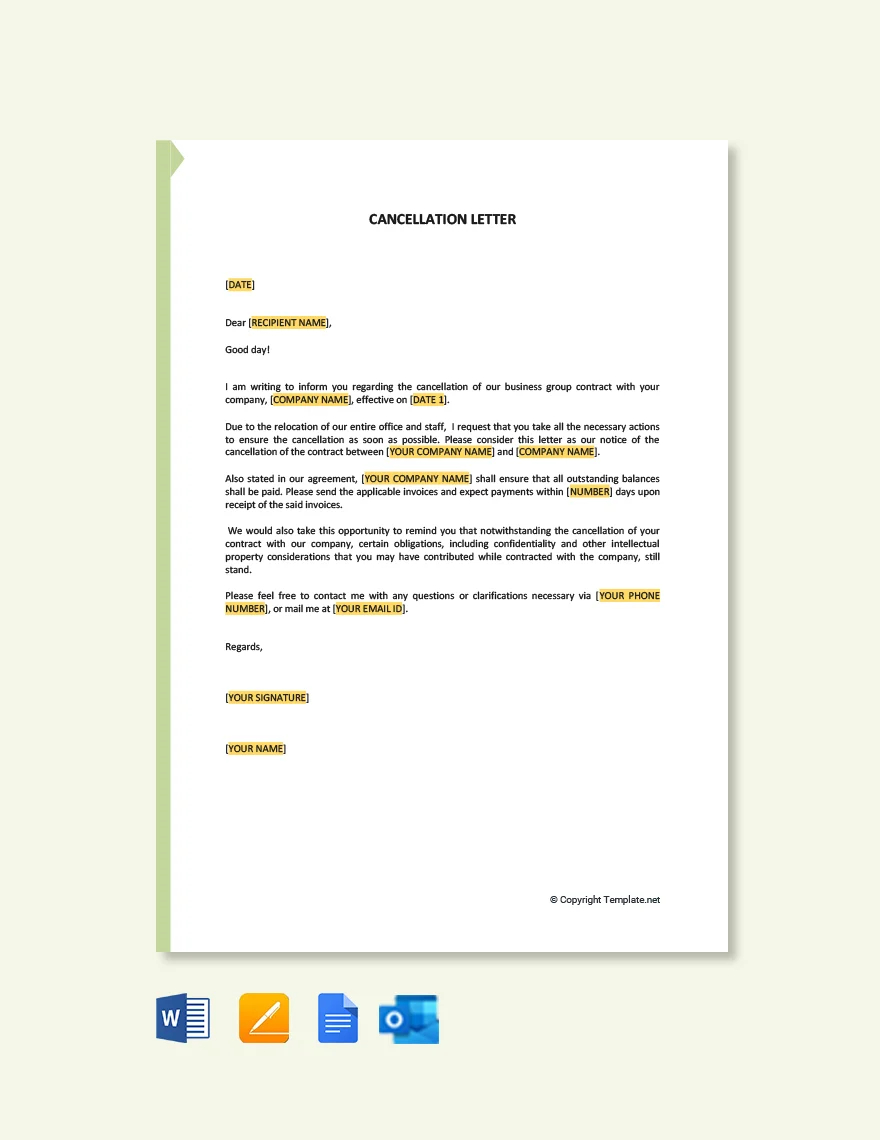

3. Company Insurance Cancellation Letter Template

4. Insurance Policy Cancellation Letter Template

What to Include in the Insurance Cancellation Letter

Your insurance cancellation letter should begin with your personal details. This includes your full name as it appears on the policy, your address, and other contact information such as your phone number and email address. Following your details, you should include the current date, which establishes when the request for cancellation was made.

Directly below your personal information, write the insurance company’s name and address. If you know the name of the department or the individual who handles cancellations, include this as well to ensure your letter is directed to the right place.

Specifying Policy Details

The next section of your sample letter should clearly identify the insurance policy you wish to cancel. Provide your policy number and specify the type of insurance—be it auto, life, home, or health insurance. This specificity is crucial as it prevents any confusion and allows the insurance company to quickly process your request.

Declaring Intent to Cancel

The most critical part of your insurance cancellation letter is the declaration of your intent to cancel. This should be a straightforward statement, such as I am writing to request the cancellation of my insurance policy. Immediately following this statement, include the policy number again for clarity.

Setting the Cancellation Date

After stating your intent, you must specify the date you wish the cancellation to take effect. This date is important for both you and the insurance company, as it will be the last day you are covered under the policy. Be sure to check your policy for any conditions or required notice periods before setting this date.

Explaining the Reason for Cancellation

While not always required, providing a reason for your cancellation can be helpful for your records and for the insurance company’s feedback. Whether you’re dissatisfied with the service, you’ve found a better rate elsewhere, or you no longer need the insurance, a brief explanation can be included.

Requesting Written Confirmation

It’s important to request a written confirmation of the cancellation from your insurance provider. This confirmation should include the date the policy is set to be canceled. Having written proof is essential in case of disputes or if you need to show future insurers that your previous policy was canceled appropriately.

Inquiring About Premium Refunds

If you have paid any premiums in advance, you should inquire about a refund. Most insurance policies will have a prorated refund policy for any premiums paid ahead of time that have not been used. Be sure to ask how the refund process works and what timeline you can expect for the refund.

Signing Off Professionally

Conclude your letter with a courteous and professional closing. Thank the insurance company for their service up to this point. Sign the letter to authenticate it; if you’re sending it electronically, include a scanned image of your signature.

By including all these elements, your insurance cancellation letter will be comprehensive, clear, and professional, ensuring that your cancellation process is as smooth as possible.

5. Medical Insurance Cancellation Letter Template

6. Refund Insurance Cancellation Letter Template

7. Car Insurance Cancellation Letter Template

8. Auto Insurance Cancellation Letter Template

How do I cancel my insurance policy?

Canceling an insurance policy is a decision that should be made with careful consideration. If you’ve decided that canceling your insurance policy is the right step for you, here’s a comprehensive guide on how to proceed:

Review Your Policy

Before initiating the cancellation process, thoroughly review your insurance policy. Look for any specific terms regarding cancellation, such as required notice periods, potential penalties, or refund policies for prepaid premiums. Understanding these details will help you avoid unexpected charges or gaps in coverage.

Contact Your Insurance Provider

It’s often a good idea to first contact your insurance provider directly. Many companies have a customer service department that can guide you through their specific cancellation process. They may also offer alternatives to cancellation, such as adjusting your coverage or premium.

Write a Cancellation Letter

A written cancellation letter is a reliable way to convey your decision to the insurance company. This letter should include:

- Your name, address, and contact information.

- The date of the letter.

- The insurance company’s name and address.

- Your policy number and the type of insurance.

- A clear statement of your intent to cancel.

- The effective date of cancellation.

- Your reason for canceling (optional).

- A request for written confirmation of the cancellation.

- An inquiry about any refund of prepaid premiums.

- Your signature.

Send the Cancellation Letter

Send your cancellation letter by certified mail or any method that provides proof of delivery. This will ensure you have a record that the insurance company received your letter. Keep a copy of the letter and any receipts or confirmations for your records.

Follow Up

If you do not receive a confirmation of cancellation from your insurance company within a reasonable time frame, follow up with a phone call or email. Keep a record of all communications in case there are any disputes or misunderstandings about the cancellation.

Check for Refunds

If you’ve paid premiums in advance, you may be entitled to a refund. The amount will depend on the company’s policies and the terms of your insurance contract. Make sure to ask when and how the refund will be issued.

Confirm Cancellation with Your Bank

If you have automatic payments set up, inform your bank or credit card company about the cancellation to stop future withdrawals. This will prevent any accidental charges after the policy has been canceled.

Consider Coverage Gaps

Ensure that you have new coverage in place if needed before your current policy ends. This is especially important for essential insurances like health, auto, and home insurance, where gaps in coverage can lead to significant financial risk.

Document Everything

Keep all documentation related to the cancellation of your policy, including the cancellation letter, any correspondence with the insurance company, and proof of mail delivery. This documentation will be vital if there are any questions or issues about the cancellation in the future.

By following these steps, you can cancel your insurance policy in a manner that is clear, documented, and in accordance with your rights as a policyholder. Remember to consider the implications of canceling your insurance and ensure that you are making the best decision for your circumstances.

9. Life Insurance Cancellation Letter Template

10. Health Insurance Cancellation Letter Template

11. Insurance Request Cancellation Letter Template

How to Write an Insurance Cancellation Letter

Understanding the Importance of Clarity and Precision

When it comes to canceling an insurance policy, clarity and precision are key. Your letter must unequivocally state your intention to cancel the policy, leaving no room for misunderstanding. It should be formal, concise, and complete with all the necessary details to facilitate a smooth cancellation process.

Starting with Personal and Policy Information

Begin your letter with your personal information, including your full name, address, and contact details. This should be followed by the date of the letter. Below this, include the insurance company’s name and address. If you have a contact person within the company, address the letter directly to them.

Clearly State Your Intent

The first paragraph should immediately inform the reader of your intention. Clearly state that you wish to cancel your insurance policy and include the policy number. Mention the type of insurance policy you are canceling to avoid any confusion.

Detailing the Cancellation Date

It’s important to specify the effective date of cancellation. This is the date from which you will no longer require coverage from the policy. Make sure this date is after the minimum required notice period stipulated in your policy terms.

Providing Reasons for Cancellation

While not always necessary, you may choose to provide a brief explanation for your decision to cancel. This could be due to a change in your financial situation, finding a better rate with another company, or no longer needing the coverage.

Requesting Confirmation of Cancellation

Ask for a written confirmation of the cancellation from your insurance provider. This should include the date the policy is to be canceled. Having written proof is essential in case there are any disputes or if you need to show future insurers that your previous policy was canceled properly.

Addressing Premium Refunds

If you have paid any premiums in advance, inquire about the refund policy. You should ask for details on how the refund will be processed and when you can expect to receive it.

Closing the Letter

End your letter with a polite and professional closing. Thank the insurance company for their service and sign off with your signature and printed name.

Proofreading and Sending

Before sending the letter, proofread it to ensure there are no errors and that all the information provided is accurate. Send the letter via certified mail or any other service that provides a tracking number and delivery confirmation.

By following these guidelines, you can write an effective insurance cancellation letter that clearly communicates your intentions and helps ensure a hassle-free cancellation process.

Related Posts

Resignation Letter for Medical Samples & Templates

Letter of Intent Samples & Templates

Letter of Intent for a Job Samples & Templates

Lease Proposal Letter Samples & Templates

Letter of Inquiry Samples & Templates

Character Reference Letter Samples & Templates

Claims Letter Samples & Templates

Response Letter Sample & Templates

Follow Up Letter Samples & Templates

Sample Project Proposal Letter Templates

Donation Letter Samples & Templates

Addressing a Formal Letter Samples & Templates

Grievance Letter Samples & Templates

Sample Sponsor Thank You Letter Templates

Sample Letters of Request