Petty cash accounts are used by most businesses to track the physical cash they used to make small purchases. This cash can be kept in a small safe or cabinet and is often used to buy refreshments during meetings, reimbursements of office expenses an employee has purchased, and other miscellaneous expenses that need cash or coin as payment. A cash log template is used and taped to the envelope or stored with the money so you can easily record the date, payee, amount, and purpose of the additional and removed cash as you use them.

FREE 10+ Cash Log Samples

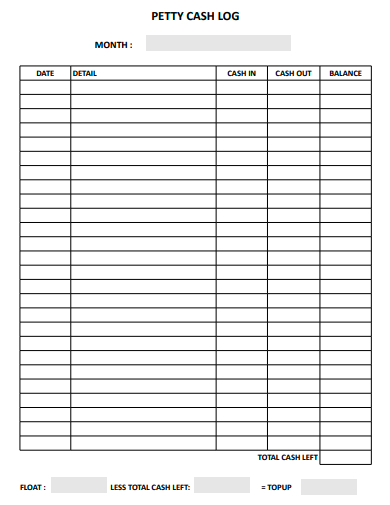

1. Petty Cash Log

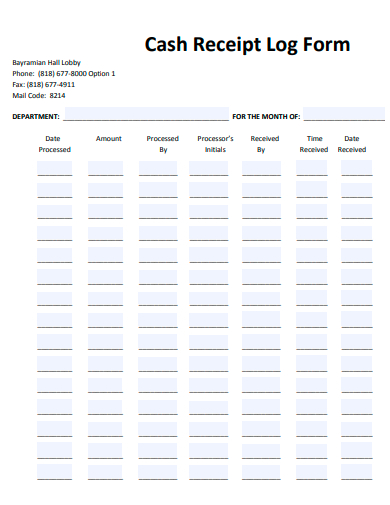

2. Cash Receipt Log Form

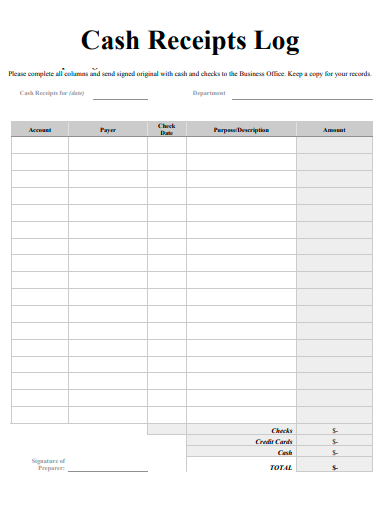

3. Cash Receipts Log

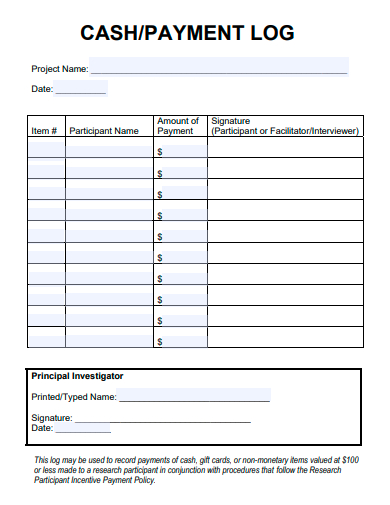

4. Cash Payment Log

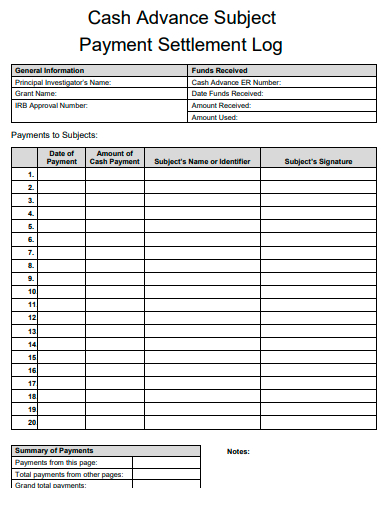

5. Cash Advance Subject Payment Settlement Log

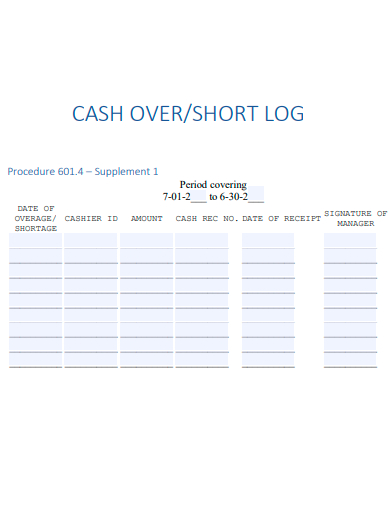

6. Cash Over Short Log

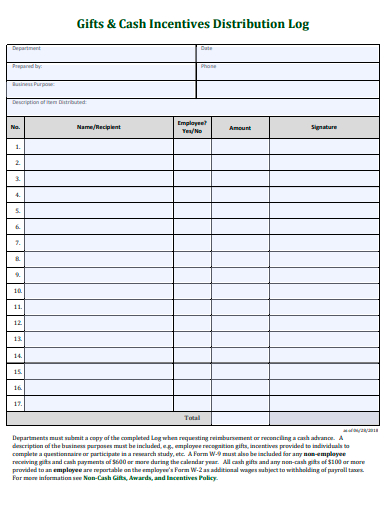

7. Gifts and Cash Distribution Log

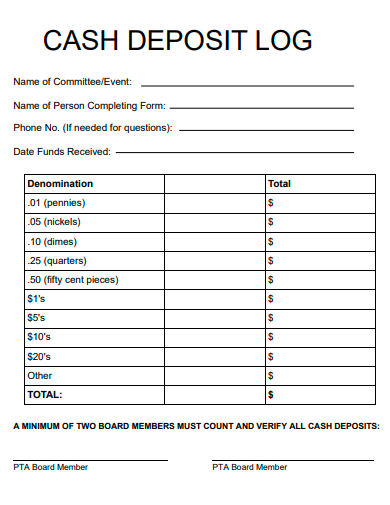

8. Cash Deposit Log

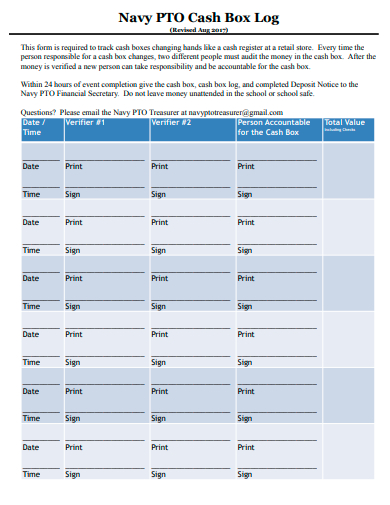

9. Navy Cash Box Log

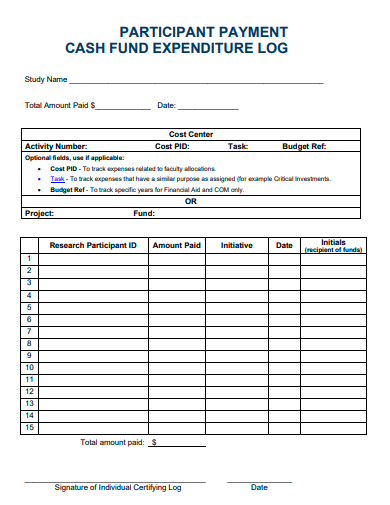

10. Participant Payment Cash Fund Expenditure Log

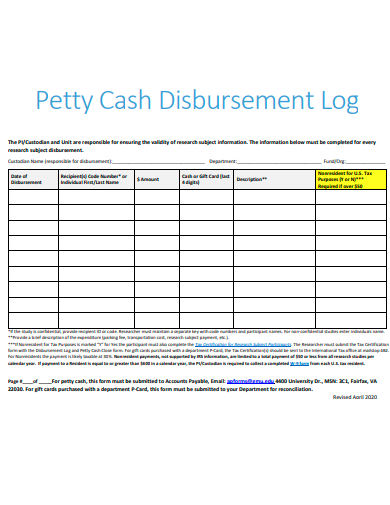

11. Petty Cash Disbursement Log

What is a Cash Log Template?

A cash log or petty cash log template is an official document used to keep track of cash payments made by businesses, nonprofits, and other types of companies. Businesses also collect their cash receipts and record them on a business log sheet to document cash transactions that were made without receipts or cash registers. At the end of a certain reporting period or when the cash log is filled up with entries, the person in charge will count the money and compare it to the ending balance on the form. In case of differences, they will resolve it and create a new balance for the next reporting period.

How to Create a Cash Log?

A petty cash fund is a small amount of money that is often used to purchase smaller expenses. Keeping a record using a log template that is customized for recording petty cash flow or transactions. You can download a template from the internet or make your own spreadsheet using software applications such as Excel which enables you to format the sheet’s columns according to your needs.

Step 1: Determine Policies and Procedures for your Petty Cash

Keeping a petty cash fund is an important practice in cash management so you must establish standard policies and procedures when keeping it. Start by listing the allowed expenses, delegating a person in-chard for the fund, and setting the maximum fund and reimbursement threshold.

Step 2: Keep Your Cash in a Lockbox

The assigned person in chard will keep all the funds inside a lockbox and only they can access it and must not be left open or unattended. The lockbox also contains the necessary receipts and currencies they will need when they balance the fund at the end of their business operation.

Step 3: Reimburse Expenses

You can reimburse the expenses made by your employees by requiring a receipt from them. You will provide them with the exact amount of cash and coins from the petty cash funds inside the lock box when you ask an employee to purchase an item. Place the receipt in the lockbox and write the expense on the cash log by entering the necessary information.

Step 4: Replenish Cash

Once the owner or person in charge listed down all the expenses made within the day in the cash log, the cash must be taken from the checking account so they can replenish the petty cash fund.

FAQs

What are the purposes of columns in a cash log?

The columns in a cash log are made for different purposes such as a column for any cash withdrawals, checks that were written from the petty cash account, to document the purpose expenses made by an employee, and a column for information regarding relevant deposits.

What are the advantages of using cash logs?

Cash logs are documents that provide a systematic way to keep records of all petty payments and expenses, provide the necessary information about small transactions, serve as a reference when comparing expenses, lessen the amount of workload, and help in saving time when making payments.

What are the types of petty cash logs?

The types of petty cash logs are the simple type which is the most basic and only contains columns for the amount and date of the transaction, the analytical type which requires you to create separate columns for each of your expenses’ heading, the columnar type which contains a number of columns for the amount of money to record daily expenses, and the imprest type which requires you to provide the fixed amount of money to the petty cashier in advance to cover any expenses.

A cash log template is a document used to record and keep track of cash transactions for small business expenses such as office supplies. This template is printed and kept along with the petty cash fund that a person in charge will be storing in a safe or lock box so they can easily record the transactions made as well as the date, purpose, payee, and amount of money involved in the transactions.

Related Posts

FREE 8+ Sample Action Log Templates in PDF

FREE 6+ Expense Transaction Samples in PDF MS Word

FREE 10+ Cash Book Samples in PDF MS Word

FREE 14+ Petty Cash Receipt Samples & Templates in PDF MS ...

FREE 9+ Sample Travel Log Templates in PDF

FREE 15+ Sample Log Sheet Templates in PDF MS Word | Excel

FREE 30+ Sample Log Templates in PDF MS Word | Excel

FREE 13+ Petty Cash Voucher Templates in AI MS Word | Pages ...

FREE 5+ Sample Printable Work Log Templates in PDF MS Word

FREE 12+ Cash Receipt Templates in Google Docs Google Sheets ...

FREE 9+ Sample Petty Cash Request Forms in MS Word PDF

FREE 5+ Sample Printable Phone Log Templates in PDF MS Word

FREE 7+ Sample Cash Slip Templates in MS Word PDF

FREE 10+ Running Log Templates in MS Word Excel | PDF

FREE 5+ Sample Sales Log Templates in PDF Excel