One of the most significant aspects of a company is payroll. It impacts employee morale and represents the financial stability and credibility of a company. Payroll refers to the form from which staff earns their wages. Functions include balancing and reconciling payroll records and taxes being deposited and reported. Most of the time, it is the job of the human resource department to produce payroll. As an HR representative, how would you create a payroll sheet? Scroll our payroll worksheet template and learn more about this article below!

FREE 10+ Payroll Worksheet Samples

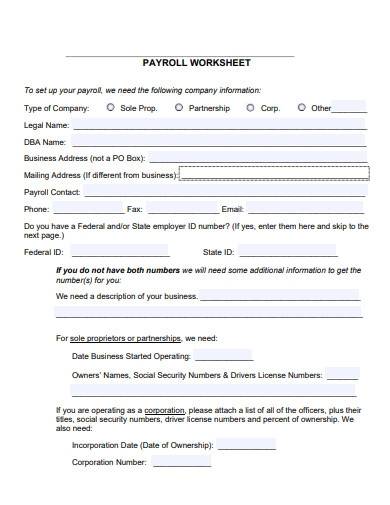

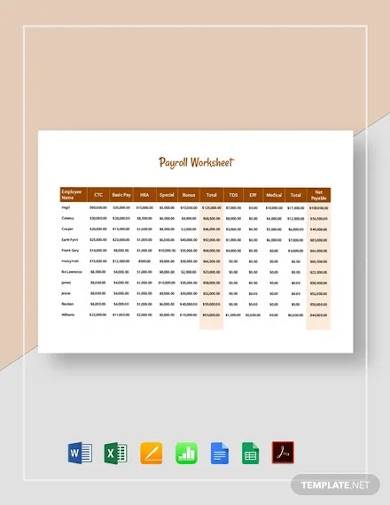

1. Payroll Worksheet Template

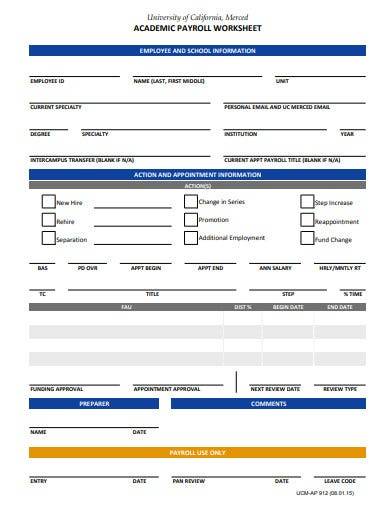

2. Sample Academic Payroll Worksheet

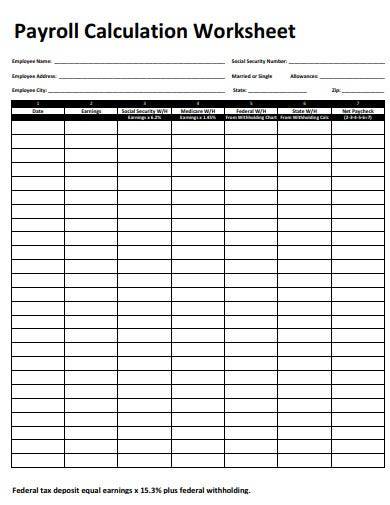

3. Payroll Calculation Worksheet

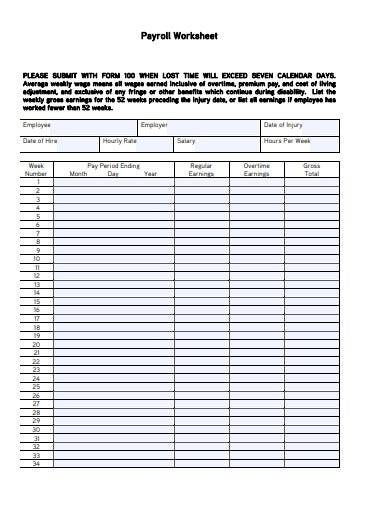

4. Payroll Worksheet Template

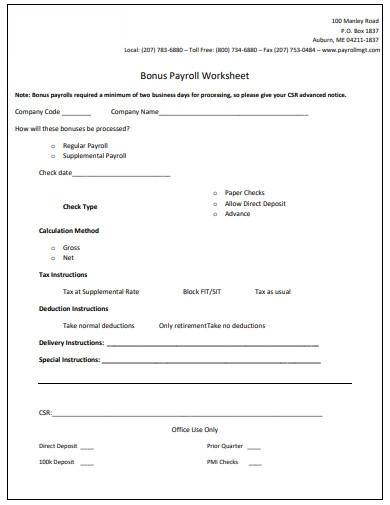

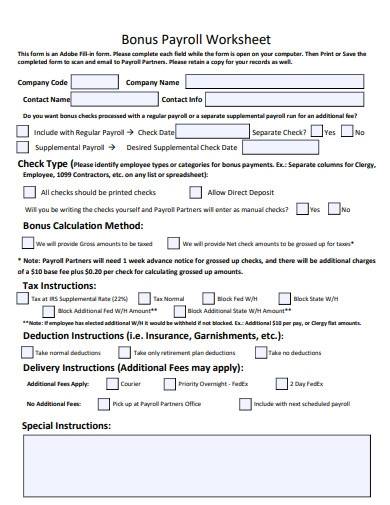

5. Sample Bonus Payroll Worksheet

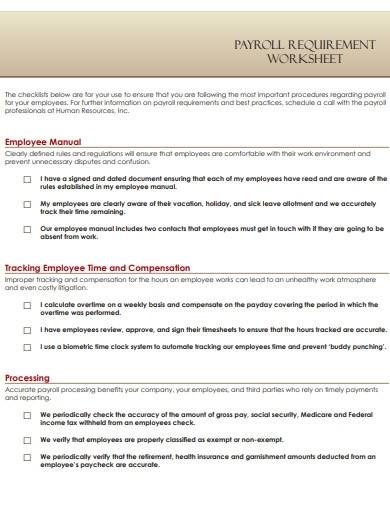

6. Payroll Requirement Worksheet

7. Editable Payroll Worksheet

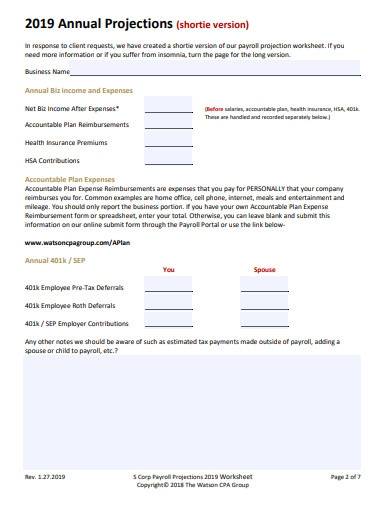

8. Corporate Payroll Worksheet

9. Sample Bonus Payroll Worksheet

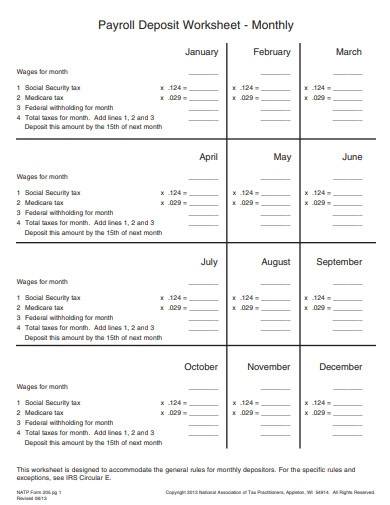

10. Monthly Payroll Deposit Worksheet

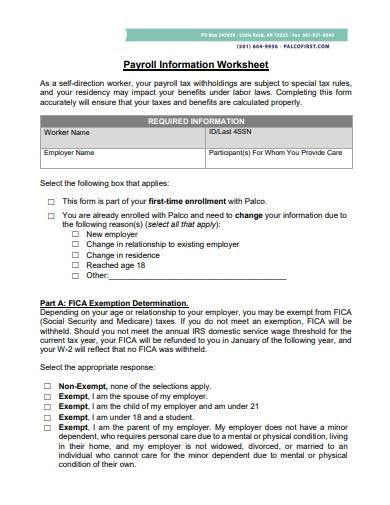

11. Payroll Information Worksheet

What Is a Payroll?

Payroll is the employees’ salary calculation. It can also be known as the process of providing workers with compensation for the work they carry out on behalf of their companies. It is one of the most crucial factors of a company. And, it is managed and produced by the human resource and accounting departments. Usually, the human resource department collects its employees’ data to include in their payroll book, while the accounting department usually managed and completes other calculations such as benefits, wages, and taxes.

According to a blog in GetSmarter, payroll is important for two reasons: financial management and legislation compliance. Financially, payroll calculation helps to ensure that a business accurately pays its employees. It involves ensuring the employees get what they deserve.

How to Calculate Payroll for Employees?

Workers must get the pay for the job they do, and the employer must ensure that this occurs. Through an in-house computerized system or outsourcing it to a payroll provider, you can manage employee payroll in various ways. However, managing payroll is not an easy task. Each system requires various tasks to manage it properly. Below are some of the tips that might help you:

1. Computation for Hourly Workers

Hourly employees are usually paid based on their time card or timesheet data that includes the number of hours worked per week. Pay them based on the pay frequency. If applicable, pay their overtime. Suppose the employee earns $10 per hour and get paid biweekly. It will reflect in his time card that he worked 40 hours for two consecutive weeks. The regular computation for that would be 40 hours x 2 weeks= 80 hours x $10/per hour= $800 (gross regular pay). While in the computation of the overtime pay, you have to multiply the hourly salary to 1.5, then use the same formula.

2. Computation for Salaried Workers

The U.S. Department of Labor (DOL) states that each pay cycle usually pays a fixed salary to salaried workers. Prominently, the DOL has strict terms for salaried employees about overtime, so consult with your state labor board to understand who are the excluded salaried employees from overtime protection laws. For non-excluded salaried employees, pay their overtime if they work it. To get the salary worker’s pay, you have to divide the annual salary by the total yearly pay periods.

3. Statutory Deductions

When it comes to statutory deductions, you need to subtract the statutory deductions from the gross income. These deductions are from the taxes that an employee must pay. You can use your payroll calculator software to calculate the tax for you, or you may do it manually.

4. Voluntary Deductions

These voluntary deductions are the employees’ contribution to their insurance, retirement, and other sorts of benefits. The amounts to deduct may vary. It depends on the type of deduction and the company’s plan. Particularly, employers must not hold more than 25 percent of disposable payments for garnishments.

5. Issue Checks and Direct Deposits

The salaries of workers are charged through paper check or direct deposit. It is normally seamless to issue paper checks, but it is necessary to ensure the accuracy of the check’s information. Another choice is direct deposit: you can provide workers with a form in which they provide bank account information. The payroll processor, or your bank, may facilitate direct deposits into the personal accounts of employees from your payroll account.

FAQs

Who prepares a payroll?

The one who prepares the payroll is from the human resource and accounting departments. The payroll sheet will usually release two to three days before the payday. They will sign the sheet to certify that they have prepared it.

Is it hard to prepare a payroll?

Even if your business is small, payroll management can be difficult. Even if your business is small, payroll management can be difficult. It takes time to manage and analyze everything.

What is inside a payroll?

They include wages for workers, workplace contributions for health insurance or related benefits, employer-paid payroll taxes, bonuses, commissions, and similar expenses.

What are the functions of HR?

The following five core functions come under human resource activities: hiring, development, compensation, safety and health, and employee and labor relations. The human resource department performs a broad range of tasks within each of these core functions.

Managing and preparing payroll sheets are not easy. In fact, it is difficult and tricky, especially if your company has a lot of employees. It will surely take a lot of time to finish. That is why it is more convenient to use payroll software and templates to lessen and make it easier to manage it. The next time you will prepare a payroll sheet, you can visit our page. We have a lot of downloadable payroll worksheet templates that you can choose from. Visit us today and download!

Related Posts

FREE 8+ Sample Certified Payroll Forms in PDF

FREE 6+ Payroll Authorization Forms in PDF

FREE 7+ Payroll Accountant Job Description Samples in MS Word ...

FREE 15+ Annual Budget Samples in PDF MS Word | Excel

FREE 6+ Payroll Coordinator Job Description Samples in MS Word ...

FREE 8+ Payroll Administrator Job Description Samples in MS Word ...

FREE 8+ Payroll Analyst Job Description Samples in MS Word PDF

FREE 11+ Sample Payroll Timesheets in Google Docs | Google ...

FREE Payroll Tips from a Tax Professional

FREE 11+ Payroll Job Description Samples in MS Word PDF

FREE 9+ Payroll Timesheet Calculators in PDF Excel

FREE 8+ Payroll Officer Job Description Samples in MS Word PDF

FREE 9+ Payroll Manager Job Description Samples in MS Word PDF

FREE Payroll Tax Basics for Small Business [ How to Report, Why Is ...

FREE 7+ Sample Payroll Register Templates in MS Word PDF