Part of a company’s expenses goes to payroll. So if you’re working in a certain company, you should expect your name to be on the employee payroll list. If not, then all your hard work will not be paid. Although it is just and right that employees get paid for the work they rendered, paying employees is said to be a costly expense for a company. That is why it is important that all of the company properly records all of their expenses, including their payroll journal entries.

What Is a Payroll Journal Entry?

A journal is used in accounting to record or document a detailed account of a business’s financial transactions. The journal shows the income and expenses of a company, which is also known as debit and credit. Every employee is compensated for the work that they have rendered, and this payment is recorded as a payroll journal entry. All of the information found in an accounting journal is incorporated into the company’s financial statement. In payroll accounting, the expenses that are recorded in the accounting journal also include salaries, payroll taxes, gross wages, federal withholding payables, and state withholding payables. Payroll journal entries must be appropriately recorded to ensure the accuracy of data or information. Accurate information will result in a sound and reliable financial statement.

How to Enter a Payroll Journal Entry

Entering payroll journal entries is mainly the job of the compensation and benefits department of a company. This department primarily consists of certified accountants who know the job better than anyone else. If you find entering journal entries troublesome, well, here are steps that will make it simple.

1. Prepare Your Accounting Journal

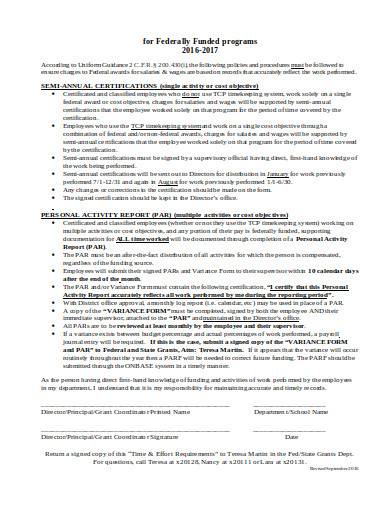

Regardless of the size of the company or business, they should have an accounting journal to record their financial transactions. There are printable payroll templates that you can customize and use for your company or business. It’s also a great tool to use to practice entering payroll journal entries, including payroll samples. Other documents that you need to prepare are payroll deduction forms and certified payroll forms.

2. Identify Payroll Expenses and Payroll Liabilities

Payroll expenses refer to the amount of payment made while payroll liabilities refer to the amount that a company or business owes that is not yet paid. These are the entries that you will be entering into your journal. Another entry that you need to identify are assets. This often refers to cash or the amount of money that you have. You not only need to know what to put into your journal, but you also need to know where to put a particular entry.

3. Record Both Payroll Expenses and Liabilities

Now that you have identified which entries belong to expenses, liabilities, and assets, you should be able to record them into your journal accordingly. Be careful with the information you enter because accuracy is very critical when entering journal entries. Make sure to double-check and review your entries.

4. Accounting Periods Transition

This is where you balance your book or journal. You can reduce the cash account by making more entries in your journal. Doing so will also eliminate the liability account balance. Debits can decrease liability, so you can use it to decrease your liability account.

FREE 2+ Payroll Journal Entry Samples in MS Word | PDF

1. Payroll Journal Entry in DOC

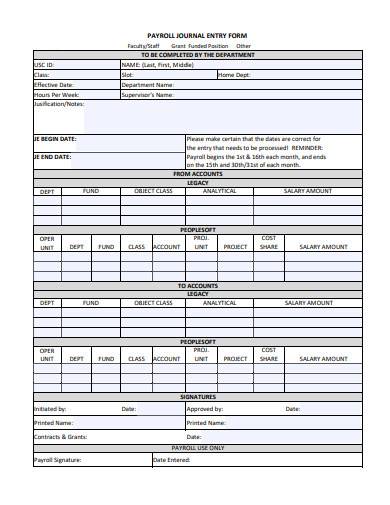

2. Payroll Journal Entry Form Sample

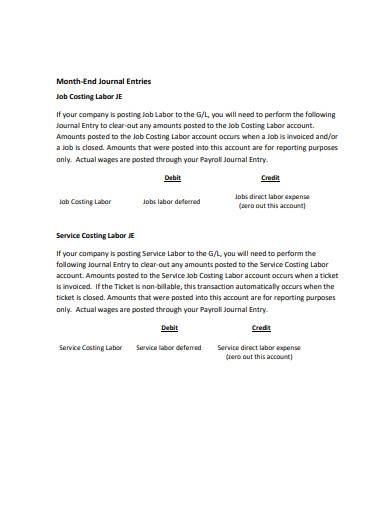

3. Payroll Journal Entry in PDF

What are the three types of payroll journal entries?

Payroll journal entries have three key types, and they are initial recordation, accrued wages, and manual payments. Initial recordation is a primary payroll journal entry, which records the employees’ gross wages and withholdings from their pay. It also includes additional taxes that the company owes to the government. Accrued wages is a payroll journal entry that is meant for recording the amount of wages that the company owes to employees that have not been paid yet. At the end of each accounting period, this entry is recorded and then reversed when paid. Initial recordation entries then take its place in the accounting journal. Manual payments or manual paychecks are occasionally printed by companies when there is a need to make pay adjustment or during employment termination.

What are the examples of payroll expenses and liabilities?

Payroll expenses are labor costs and include the salary of employees, payroll taxes, bonuses received by employees, payments made by the employer to health insurance and other employee benefits, retirement contribution, and commissions. Payroll liabilities refer to the amount of money that is withheld from an employee’s pay that is going to be paid to another entity or institution. The most common examples of payroll liabilities are federal income tax, state income tax, Medicare, and Social Security.

What is debit and credit in journal entries?

The concept of debit and credit is important in payroll accounting and are used to either increase and decrease an account. Assets and expense accounts are increased by debit and are decreased by credit. On the other hand, equity accounts and liabilities are increased by credit and decreased by debit. Debit accounting entries are placed to the left, while credit entries are placed to the right.

Managing payroll and entering payroll journal entries are tasks that certified accountants can do best. That is why it is important to entrust payroll accounting to the experts and professionals of that field. It is also good to learn of the basics of payroll accounting to give you an idea of what’s going on inside accounting journals and why entries look that way. You’re never too young or too old to learn something new, especially if it’s something you can use to grow a company or business. Sample payroll journal entries are perfect materials for studying. They’ll help you learn the concepts and format of payroll accounting easily. You can view and download the samples anytime you want for free!

Related Posts

Weekly Schedule Samples & Templates

Contractual Agreement Samples & Templates

FREE 9+ Amazing Sample Church Bulletin Templates in PSD | PDF

Sample Business Card Templates

Sample Cashier Job Descriptions

Questionnaire Samples

FREE 10+ Sample HR Resource Templates in PDF

FREE 10+ HR Consulting Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 49+ Sample Job Descriptions in PDF | MS Word

FREE 16+ Nonprofit Budget Samples in PDF | MS Word | Excel | Google Docs | Google Sheets | Numbers | Pages

FREE 13+ Academic Calendar Templates in Google Docs | MS Word | Pages | PDF

FREE 10+ How to Create an Executive Summary Samples in Google Docs | MS Word | Pages | PDF

FREE 23+ Sample Event Calendar Templates in PDF | MS Word | Google Docs | Apple Pages

Company Profile Samples

FREE 10+ Leadership Report Samples [ Development, Training, Camp ]