Finance is a broad term that covers the study and system of money, investments, and other components that deal with money and finances. It is a very important aspect not just in the business industry, but in everything else that involves the circulation of money. Finances could easily dictate how a business operates and is one of the main determinants whether or not the business can grow by developing new projects and trying out new ventures. Even before beginning to develop the new project, developers would often conduct a project feasibility study to determine the rate of success and the return on investment of the proposed plan.

This document is already broad in of itself by examining the market, technical and production issues, economic factors, and environmental hindrances that might be encountered during the development of the project. However, finances make the writing of this document, even more complicated. Finances play a huge role in the development of a new venture and for most businesses, it’s already a really broad aspect that has to be tackled on its own. This is why aside from the main feasibility report, developers often design a financial feasibility analysis alongside it. To further support their claims and provide a more in-depth analysis on how a project is either feasible or not.

Especially finance feasibility analysis, feasibility reports are really difficult documents to write as it requires a lot of commitment to ensure that the data gathered is factual and the analysis is unbiased, more so when dealing with finances, as it can be construed as an entity of its own. Writing a financial feasibility report may be daunting, but don’t fret, as we’ll try our best to help you make sure that your financial feasibility analysis is factual, comprehensive, and effective overall. First, check out these samples listed below to give you an idea of what we’ll be working with, and what a well written report looks like.

9+ Financial Feasibility Analysis Samples

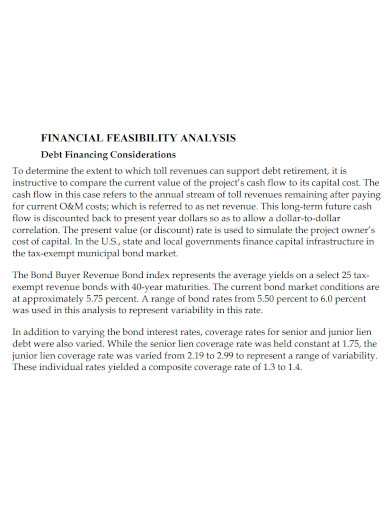

1. Financial Feasibility Analysis Sample

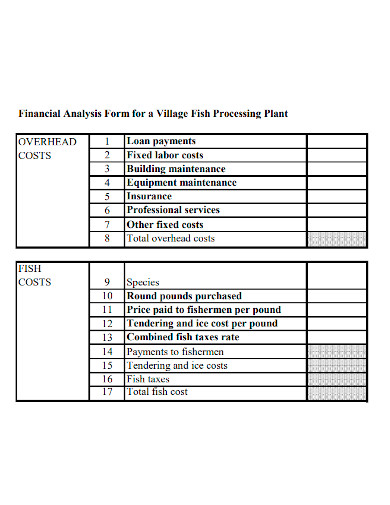

2. Financial Feasibility Analysis Form

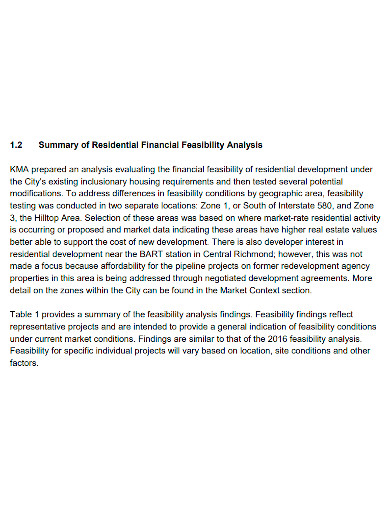

3. Residential Financial Feasibility Analysis

4. Development Financial Feasibility Analysis

5. Interim Financial Feasibility Analysis

6. Standard Financial Feasibility Analysis

7. Preliminary Financial Feasibility Analysis

8. Editable Financial Feasibility Analysis

9. Construction Project Financial Feasibility Analysis

10. Formal Financial Feasibility Analysis

What Is a Financial Feasibility Analysis?

Financial feasibility analyses assess the financial aspects of the proposed plan or project. It examines factors like the capital, expenses, revenues, return on investment, reimbursements and disbursements, to create a more comprehensive report. Essentially, financial feasibility analyses both ask and answer the question, “Will the project or business have enough cash to complete the development of the project and return enough profit?”. This is the backbone of every business out there, it has to know whether or not it can support itself and any project it commences. Finances is a very valuable resource and of course, no one wants to just throw money away. Without financial feasibility analysis, or any feasibility report for that matter, a company would be diving blindly into every opportunity they see without assessing whether or not it’s good for their business. We want to avoid that, we want to know the adverse effects, if there are any, of the project that we are planning to work on. Especially in terms of finances.

How to Write a Financial Feasibility Analysis

Although writing a financial feasibility analysis is good business practice, writing it is really not the easiest thing to do. As we have already established, it tackles a couple of broad aspects and most of the time, require so much raw data to be analyzed. Having the knowledge readily available to make an informed decision about a project’s viability is really important, but you really do have to work for it as well. Knowledge, do come with a price. So, to start you off, I will be giving you a rough guide to write a well written financial feasibility analysis. It consists of three main parts, and these parts will be discussed in detail below.

- Determine startup costs

First of all, it is important for you to determine the startup costs of the project. Typical startup costs consists of the purchase of land or infrastructure, acquiring equipment, licenses and permits, leases, legal and accounting fees, furniture and other supplies, research, marketing, insurance, and other utilities that you have to buy, or at least, require money to be acquired. Most startup costs are one-time expenses, but they still need to be funded right off the bat, even before the development kicks off. - Projected profit and cash flow

After determining the startup costs, projection of profit and cash flow should be next. Cash flows comprise of sales, expenses, revenues, investments, and other matters that require, well, cash. This step is a huge factor in determining whether the proposed plan is financially viable or not. It also covers the funds needed for the startup development, and should be able to identify where the budget is from. It will also analyze negative cash flows, if there are any, and provide how these deficits are going to be covered. - Determine return on investment

The data gathered from the steps above will be used to determine the financial feasibility of the project. It should be able to assess the attractiveness of the project to investors and its overall return on investment. There are several common methods you can use to estimate the financial feasibility of the venture, I suggest you look these up and decide what method suits you best of easiest for you to use. These are the Net Present Value Method, Internal Rate of Return Method, and the Payback Period Method.

FAQs

What does a financial feasibility study include?

A financial feasibility study should include vital information and data needed to complete the project, the market opportunity, government regulations, risk factors, the strengths and weaknesses of the venture, the management team, and of course, the finances of the company.

What are the four types of feasibility?

Operational. Economic. Technical. Schedule.

What is the importance of financial feasibility?

Financial feasibility analyses looks at how the project can work on a long-term basis and if it is able to endure any financial risks should they arise. It examines cash flow and helps planners focus of the project dully without worrying about the finances of the project.

Well, that should be enough for you to begin your writing process. You know about its overall importance, and you are equipped with ample knowledge to effectively write your own, without encountering any issues along the way. It is indeed best to be prepared than diving into a venture without any idea of its possible outcomes. You don’t want to lose valuable resources or worse, even lead your business to bankruptcy. If ever you get on a bind again, especially with another corporate document, feel free to give us another visit, and we will do out best to be able to provide assistance.

Related Posts

FREE 10+ Rhetorical Analysis Samples in PDF

FREE 10+ Analysis of Alternatives Samples in PDF

FREE 10+ Failure Mode and Effects Analysis Samples in PDF

FREE 10+ Make or Buy Analysis Samples in PDF

FREE 10+ Fishbone Root Cause Analysis Samples in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 6+ Corporate Portfolio Analysis Samples in PDF

FREE 10+ Fault Tree Analysis Samples in PDF

FREE 10+ Comp Analysis Samples in PDF

FREE 10+ Fishbone Analysis Samples in PDF

FREE 10+ Individual Swot Analysis Samples in PDF

FREE 10+ 5 Year Analysis Samples in PDF

FREE 10+ Benefit Costs Analysis Samples in PDF

FREE 10+ Job Hazard Analysis Samples in PDF

FREE 10+ Primary Source Analysis Samples in PDF