When individuals or businesses cannot obtain loans from banks due to poor credit histories, or they are just looking for a simple way to obtain funds for new projects or ventures. Finance companies are there to offer such services, make loans to these prospects in exchange for a collateral. Finance companies do not receive cash deposits nor provide other services that a bank usually provide. Finance companies make profit from interest rates charged on the loans they provide, which is usually higher than the interest rates that banks charge their clients, and the collaterals that clients provide, whenever the loans are not paid on time.

Finance companies face quite a bit of competition not just from same businesses but also from banks who offer a much lower interest rate and other banking services. And although finance companies do not necessarily suffer from these competitors, they still need to stay on top of the market to ensure a good business. A well written company profile can provide a good boost to the marketing of your business and the company itself. Check out these finance company profiles listed below to help you draft and design a well written company profile.

10+ Finance Company Profile Samples

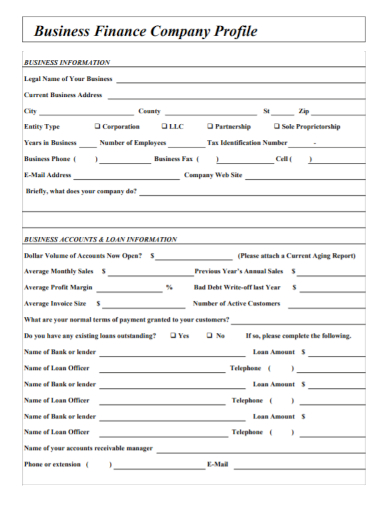

1. Business Finance Company Profile

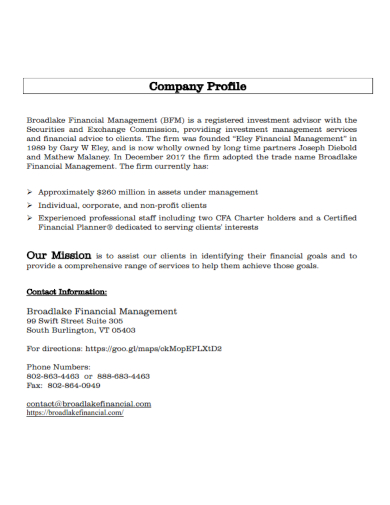

2. Financial Management Company Profile

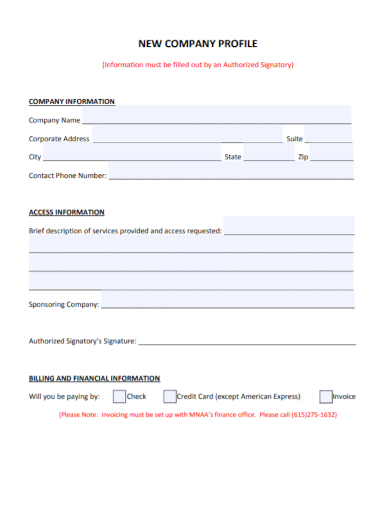

3. New Finance Company Profile

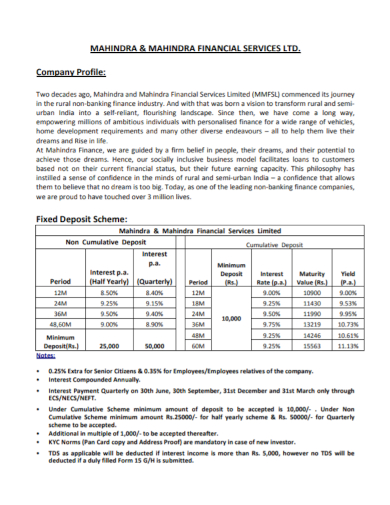

4. Finance Services Company Profile

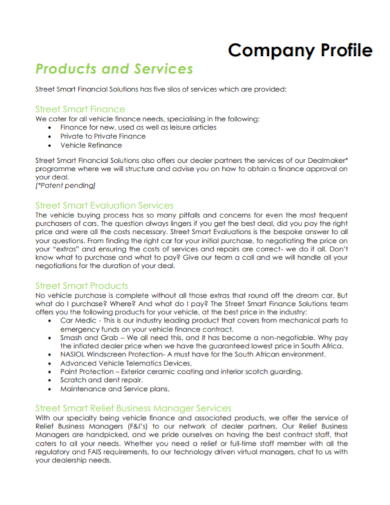

5. Finance Evaluation Company Profile

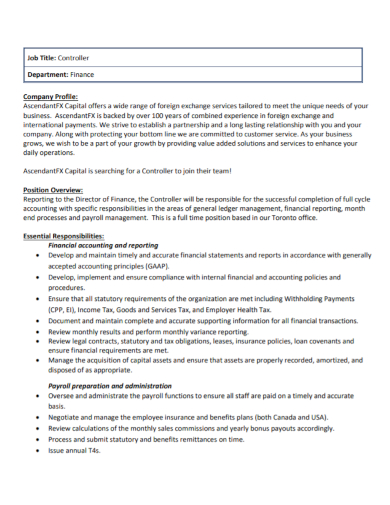

6. Financial Accounting Company Profile

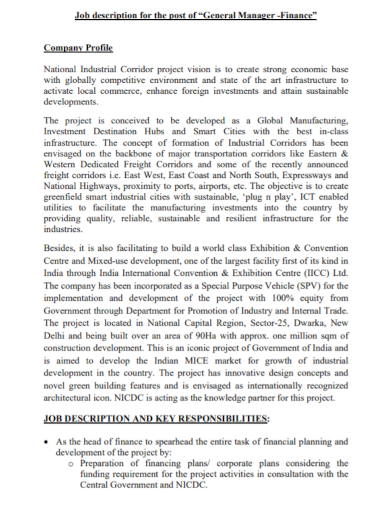

7. Finance Manager Company Profile

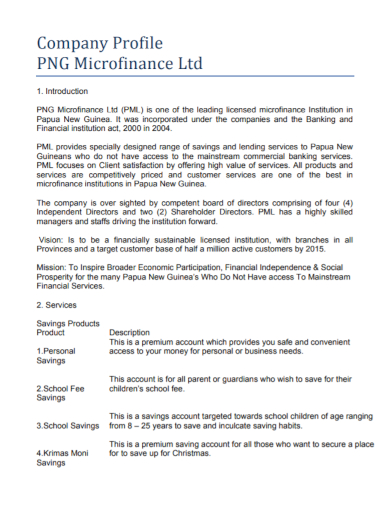

8. Microfinance Company Profile

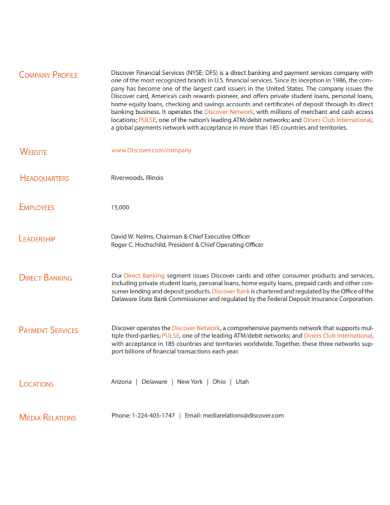

9. Banking Finance Company Profile

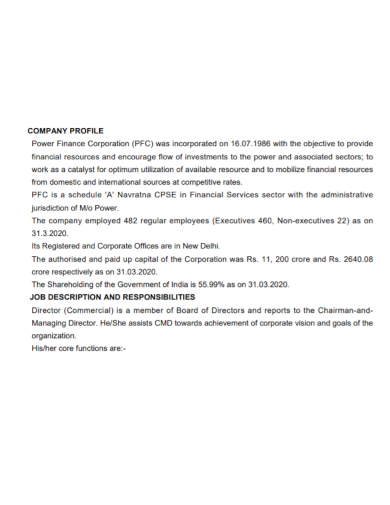

10. Finance Corporation Company Profile

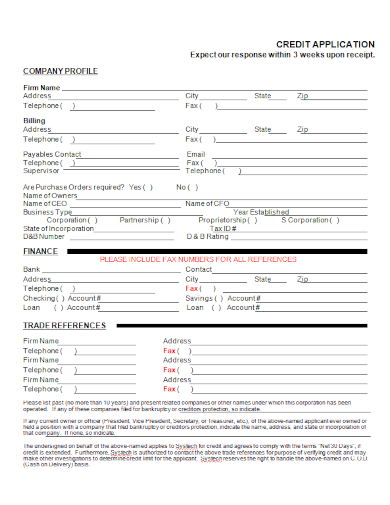

11. Credit Finance Company Profile

What Is a Finance Company Profile?

Company profiles serve as the introduction of your company and its service for prospective clients and potential investors. Its purpose is to attract these prospects by gauging their attention making them consider your company and its services over other competitors. A well written company profile can easily provide the push your company needs to further expand your business and ensuring a steady stream of patrons availing your services.

Company profiles usually include the history of the company, achievements over the years and milestones acquired. Most company profiles also contain the company’s mission and vision values. Finance company profiles lean more on to the specifics of its own industry and well generally talk about interest rates, collaterals, loan amounts they offer and more.

How to Write a Finance Company Profile

Writing a company profile is not the hardest thing in the world. You just have to make sure that the information presented is clear and concise, easy to follow and understand, and is enough to get the readers intrigued, for them to want to know more about your company and possibly, avail your services. There are key steps to ensure these and they will be discussed in detail below.

- Establish a purpose

The purpose of your profile usually dictates its style, how its written, and the information you have to include. Companies usually use company profiles for circumstances such as marketing initiatives, investment plans, tax reports, and website use. The purpose also gives it a more structured body to help with overall coherence. - Pick a style

The style of your profile is how information will be largely presented. A set style will ensure consistency all throughout and will make sure that your readers don’t get confused with the presentation, especially if there is a lot of information involved. It is also best to stick to one or an overall profile, not changing the format in the middle of the profile, to further ensure coherence. - Tell a story

Stories are a great way to connect and relate to your customers. Stories give a personality to your company, and good written stories will most likely connect with customers leading to a higher rate of business. You can tell them about how you started your business as a small lending company, and what achievements and milestones you acquired to reach the current status that you have today. Also include your mission and vision values, and the commitment towards quality service as well. This section is also where you talk about your company rates, loan amounts, collateral values and the like. - Contact information

Don’t forget to include your contact details such as contact numbers, address of your office, and website if you have one. This ensures that your audience will have somewhere to reach out to in case they want to know more about your company and inquire about its services.

FAQs

How much money do you need to start a finance company?

Requirement will vary by state, but usually, financing companies have to have a minimum of $35,ooo to $50,000 of cash reserves.

What are two types of finance?

The two types of finance are equity finance and debt finance.

What is finance?

Finance is defined as the management of money including activities like investing, borrowing, lending, budgeting, and saving.

Financing companies give a much needed second chance to smaller businesses that just want to prosper, but cannot make a significant enough loan from banks to do so. Individuals may also avail the services of a finance company if they feel like they might need just a little push, budget wise. Finance and lending companies have seen steady growth over the years, considering that businesses of all types and sizes have popped up almost everywhere. And as long as the trend to seek a viable option to lend money does not let up, finance companies will probably stay in the mainstream market for a little while.

Related Posts

FREE 10+ Real Estate Company Profile Samples

FREE 9+ Chief Financial Officer Job Description Samples

FREE 9+ Sample Accounting Assistant Job Descriptions

FREE 9+ Sample Staff Accountant Job Descriptions

FREE 9+ Senior Director Job Description Samples

FREE 9+ Business Loan Proposal Samples

FREE 7+ Sample Financial Analyst Resume

FREE 7+ Financial Summary Samples

FREE 5+ How to Write Investment Summary Samples

FREE 37+ Sample Fact Sheet

FREE 12+ Operations Director Job Description Samples

FREE 11+ Sample Finance Resume

FREE 11+ Personal Profile Samples

FREE 10+ Sample Analyst Job Description

FREE 10+ Agency Profile Samples