To avoid any legal conflict, you need to adhere to the laws about your consultancy business and comply with the government requirements. One of the crucial tasks that you need to adhere to is to provide your clients with a consultant tax invoice for the service your company has rendered. In this article, we are going to discuss more of it. We have also included a set of examples that you can use as a reference if you are planning to customize a consultant tax invoice template for your consulting business.

What is a Consultant Tax Invoice

A Consultant Tax Invoice is a type of invoice that a consultant provides to the customer before or after the firm renders its consulting service. Take note, though, that if the firm issues the tax invoice only after it renders the service, the firm has 30 days from the service provision date to provide the tax invoice. In general, this legal document includes vital information, such as service description, value, and the tax charged.

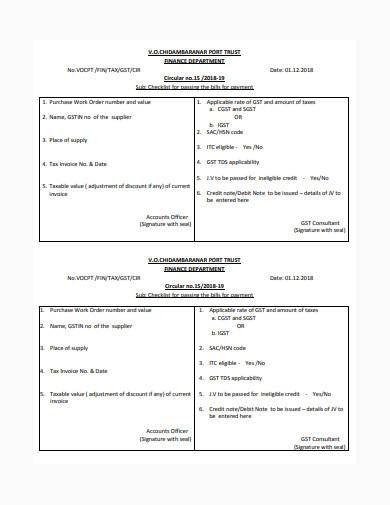

Components of a Consultant Tax Invoice

A consultant tax invoice is a crucial legal document that you have to generate. Thus, whether you are an independent contractor or a general contractor, you need to ensure that it has all the necessary information. Below are the essential details that you may want to include in your tax invoice template.

1. Business Info

The information about your business should be the first thing that the reader sees. We recommend that you place it in the top-left corner. This section should consist of the business name, logo, address, mail id, and contact information to make a proper representation of your company to the buyer and other relevant entities.

2. Customer Information

In this part, you will include details about the customer or client. You may include the person’s complete name, address, contact information, and other essential information about your customer.

3. Invoice Details

Indicate the transaction details by clearly stating the document type(Tax Invoice), invoice number, invoice date, invoice due date, and total amount. Place these details in a way that the reader, such as the tax authority, can easily find since it is one of the primary information that they will look for.

4. Service Information

Aside from the invoice details, they will check the services you rendered, which is the leading information that they will scan. Thus, it is imperative to include the necessary information about the services, such as the price, discount, tax rate, and other relevant information.

5. Tax Summary

Depending on which country or states you are operating, the government may require businesses to include information, such as total taxable amount – the total taxable amount minus the discounts, and other necessary deductions or additions.

6. Terms and Condition

There are particular service details that you may want to include, such as the Terms and conditions, which will serve as the clients’ reference for the service they avail. By adding this information, you can set the expectations that the client will agree with. As a result, you can expect to lessen unnecessary customer complaints.

7. Signature

Lastly, you will reserve an area where you can put your signature. Alternatively, you can include your company’s stamp if available.

5+ Consultant Tax Invoice Samples in PDF | DOC

With the components that we have listed in the previous section, you can now determine which design may fit your business needs. Refer to the following samples to accomplish your task more quickly.

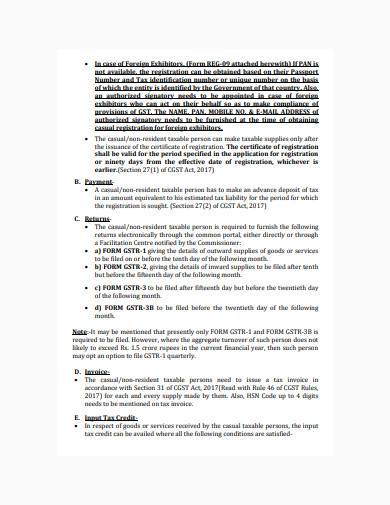

1. Consultant Tax Invoice Sample

2. Consultant Tax Invoice Template

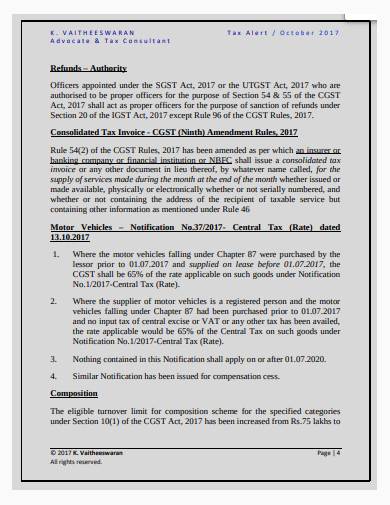

3. Consultant Tax Invoice Example

4. Consultant Tax Invoice in PDF

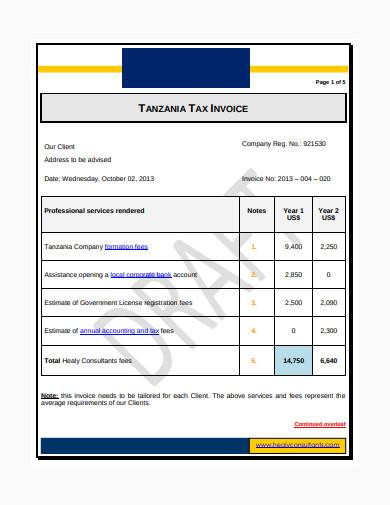

5. Formal Consultant Tax Invoice Sample

6. Consultant Tax Invoice in DOC

Best Practices in Customizing a Consultant Tax Invoice

By now, you must have an idea on how you will design the consultant tax invoice for your consulting business. Take note, however, that what’s important in the receipt you provide to the client is for them to get the information that they need. To ensure that they will capture the data that they actually need, follow the tips below.

1. Make it Clean

Using boxes and lines may contribute to making your tax invoice more organized. However, excessive usage of these objects can be painful to watch. Thus, it is more beneficial to minimize the boxes and lines in the template. We recommend you to use it only when you are separating the main components.

2. Comply

We have mentioned the crucial elements that you have to include in a consultant tax invoice. Make your tax invoice more productive by only adding relevant information. You can use the information that we have discussed earlier as your guide.

3. Careful with the Colors

We are living in an era where you can easily add colors to anything you print. However, don’t over-apply it in your tax invoice. You can simply use black and white or any color that will properly contrast once printed. The goal is to ensure that the content is readable to the reader.

4. Make Your Company Logo Visible

Your business information is the first on the list of the necessary components on purpose. This object will serve as your identification. The output of this tax invoice will reflect on your business. Believe it or not, it also provides you a marketing edge as a small business since the customer will most likely pass this document to many people.

5. Don’t Forget the Signature

To verify the material, include your signature in the tax invoice. Depending on the purposes and which state you are operating, the government may require you to add a company stamp or representative signature.

In 2018, Statista posted a statistic suggesting that the most reputable company in the consulting industry in the US in 2017 was McKinsey & Company. If you intend to obtain the same standing, you will have to persevere on undergoing the crucial steps that they have taken. Start by providing a Consultant Tax Invoice to your clients for the services that you render, which is a good step towards your firm’s full law compliance. Complying with the law is essential to maintain the reputation of your business, making it a vital ingredient in your business goal attainment. With the information that we have discussed in this article, you have made a step towards this achievement.

Related Posts

Employee Uniform Form

Self-Declaration Form

To Whom It May Concern Letter

10 FREE Notice To Quit Letter Samples & Templates

Security Company Profile

Written Warning

Event Program

OMR Sheet

Building Inspection Report

Employment Certificate

Teacher Lesson Plan

Deed of Assignment

Contract Termination Letter

Student Research Proposal

Diet Plan