An IOU stands for “I owe you” and is a written acknowledgement of a debt owed to another person or organization. When you need to document a transaction without the hassle of complicated documentation, an IOU template is a good option. IOU users are friends, family members, or business partners who trust each other. An IOU form is a brief document that details the amount of money owed by one entity or person to another. The document is simple to create since it is a simple option for two parties that want to finalize a transaction without the use of complicated documentation. The already built connection between the two parties is one of the most crucial features of this treaty.

10+ IOU Sample

When utilized as a repayment agreement, an IOU can be a strong binding instrument. An IOU can then be used to set the parameters of repayment as long as there is a lender and borrower in the process. The proposed structure for putting a relatively informal agreement or contract in writing is an IOU letter. Since an IOU could be as simple as phrases written on a notepad, which is how most people perceive of the document, it is the only reference to the specifics that should be included. Its brevity, nevertheless, should not give the idea that it is not legally enforceable or that it does not have the same legal basis as a complex agreement in a court of law.

1. IOU Balanced Loss Functions

2. IOU Sample

3. Alpha-IOU Template

4. Boundary IOU Sample

5. IOU Annual Report

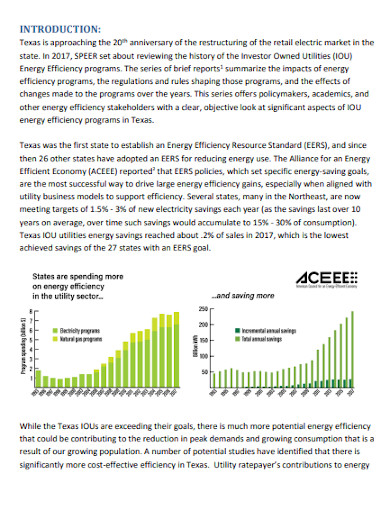

6. IOU Energy Efficiency Programs

7. IOU Prediction for Object Detection

8. IOU Presents Future or Past

9. IOU in PDF

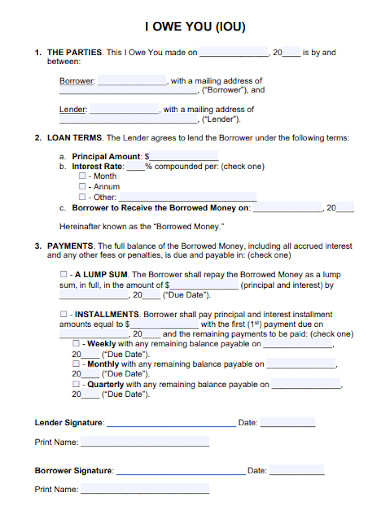

10. I Owe You (IOU) Template

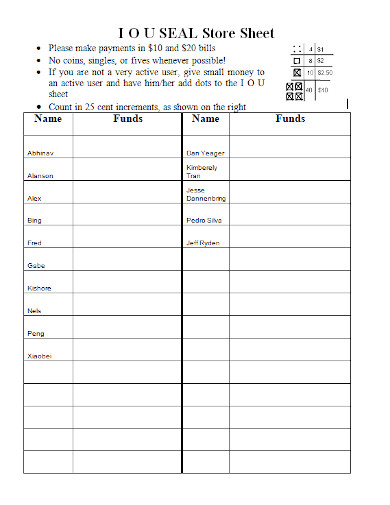

11. IOU Sample in DOC

An IOU is based on the idea that it should be as basic as feasible and not require a deep understanding of contract law. However, it is essential that it provide the following critical information:

- The debtor’s name.

- The creditor’s name.

- The sum of money at issue (written out in both words and numbers).

- When do the debt be paid off? If the debt is to be repaid in installments, the value of each installment and the

- due dates should be specified.

- If interest will be imposed until the loan is paid off, the specifics of how the interest will be computed should be specified.

- Both parties’ signatures are required. This is required in order for the document to be legally enforceable.

- A witness’ signature is required.

Although an IOU is typically a somewhat informal agreement among members of the family, colleagues, and associates, and charging interest may seem uncomfortable, it can be a sensible move for several reasons:

- By lending money, you are foregoing the opportunity to put it to better use elsewhere. You shouldn’t be punished for being generous, and depending on how long the loan has been outstanding, inflation may render your money useless once it is repaid.

- Many people sign an IOU with the right intentions of paying off the debt. Unfortunately, like everyone knows, if there isn’t an immediate need to pay it off, other bills can take its place. If a person understands that the longer a debt is outstanding, the more they will have to pay, the IOU is unlikely to be placed to the bottom of the pile.

- That isn’t to say you should impose outrageous interest rates. Because of predatory lending laws, many places require interest rates of far more than 20% to be unlawful.

FAQs

Why do you have to include the payment information?

Indicate the loan amount as well as any payment details such as minimum payments, payment due dates, interest rates (if applicable), and late fees. Include the payment options you accept, such as cash, internet payments, and bank deposits. You may include as much details as you wish in this section. You may, for example, indicate that the borrower should make monthly payments and notify you when they have done so. You can also indicate the payment amount as well as any late payment costs that the borrower must pay.

What are some situations wherein you will need to make an IOU?

- You’ve done business with someone previously and are willing to accept an IOU.

- You don’t have enough money to purchase anything, so you give the person an IOU for the remaining amount.

- A down payment for a particular event necessitates borrowing funds.

A basic IOU form normally specifies the amount of money lent and the date by which the borrower will repay you, including any interest. Without the basic document, you or the other party may become upset if the other party fails to honor your pledge to lend or repay the money.

Related Posts

FREE 10+ Social Media and Analytics Samples in PDF | MS Word

FREE 10+ Dog Tag Samples in PDF | MS Word

FREE 5+ User Stories Samples in PDF

FREE 10+ Student Artist Statement Samples [ Personal, Approval, Originality ]

FREE 10+ University Personal Statement Samples [ Business, Job, Structure ]

FREE 10+ Health Insurance Exchange Notice Samples in PDF | DOC

FREE 10+ Restaurant Income Statement Samples [ Proforma, Monthly, Projected ]

FREE 10+ Customer Fact Sheet Samples in PDF | DOC

FREE 10+ Stop Direct Deposit Form Samples [ Cancel, Unemployment, Authorization ]

FREE 10+ Business Purpose Statement Sample [ Small, Roundtable, Continuity ]

FREE 10+ Social Media Audit Samples in PDF | MS Word

FREE 5+ Information Security Proposal Samples [ Project, Awareness, Request ]

FREE 5+ Job Interview Assessment Samples in PDF | DOC

FREE 10+ Evaluation Scope of Work Samples in PDF

FREE 3+ Payroll Verification Report Samples in PDF