Employee loyalty begins with the employer’s support. Running and managing a business is a challenge, and it takes an entire village for operations to run smoothly. As an employer, it’s one of your responsibilities to constantly boost team morale– this can be achieved through recognizing your employees hard work with the help of incentives. A happy workforce, after all, makes a successful business. What are examples of incentive-based programs that you could use? In this article, we provide you with free, ready-made, and downloadable samples of Profit Sharing Plans that you could implement in your own company. Keep on reading to find out more!

10+ Profit Sharing Plan Samples

1. Profit Sharing Plan Sample

2. Printable Profit Sharing Plan

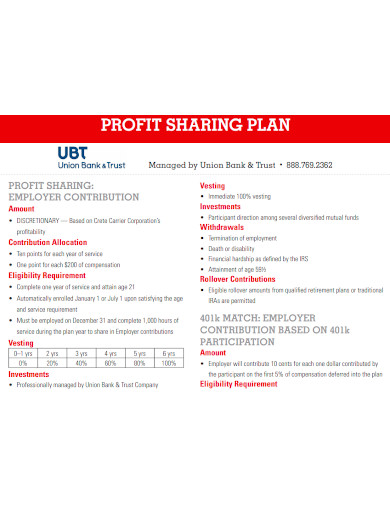

3. Bank Profit Sharing Plan

4. Small Business Profit Sharing Plan

5. Savings and Profit Sharing Plan

6. Standard Profit Sharing Plan

7. Retirement Profit Sharing Plan

8. Pension and Profit Sharing Plan

9. Profit Sharing Plan Format

10. Pension Services Profit Sharing Plan

11. Formal Profit Sharing Plan

What Is a Profit Sharing Plan?

A profit-sharing plan is a contribution plan that allows businesses to assist their employees with retirement savings. Employees are given a share of the company’s profits as part of an incentive-based compensation program. Profits can be taken in the form of cash or company stock by the employees. A profit-sharing plan is similar to a 401(k) plan but it is more flexible. Companies have the discretion to contribute to a profit-sharing plan, especially if it’s financially stable. Nonresident aliens, those under the age of 21, and those covered by collective bargaining agreements are all examples of employees who can be legally excluded by the company from the plan.

How to Make a Profit Sharing Plan

A profit sharing plan entirely depends on the financial capability of a company, as profits can vary from time to time. However, if you are thinking of setting up this incentive-based compensation program, here are some steps you should ponder on before you set it up:

1. Meet with a qualified profit-sharing-plan consultant/administrator that can assist you.

If a business intends to make a profit-sharing payment in a particular year, it must use a predetermined formula to determine which employees get what and how much they get. A percentage of compensation is usually used to establish an employee’s allocation. This can mean a lot of upkeep and administrative work, hence a plan consultant/administrator is essential for this– usually, they will help establish a system for tracking contributions, investments, and dividends, as well as file an annual return with the government.

2. Be clear of the plan’s goals and objectives.

What is your purpose in implementing this sort of plan? It’s important to be clear of what you intend to achieve on the get go. Is it intended to help with recruitment, retention, or productivity? A profit-sharing plan can be benefitable as it motivates employees to remain in the company for a long time. This can also help persuade new talent to join the firm. After all, the benefits reaped should be a two-way street for both parties. If you intend to offer a profit-sharing plan to your employees, this can entice them to be more productive with their duties and in turn your company’s profit can marginally increase.

3. Use your creativity to customize your profit-sharing plan specifically catered to your business.

Remember, a profit-sharing plan is not required. Stock options aren’t necessary for every business. This plan might be beneficial to your workforce, or it might not. It’s important to keep in an open mind in this process because there are plenty of other ways to boost team morale. One of the key factors to success is to integrate the plan with the culture of ownership; let your employees feel that they are part and actively involved in the plan and decision-making process, provide them the training and equipment that they need to boost productivity in order to achieve their best.

4. Keep an eye on the plan and how well employees are following it.

As the company grows over time, the plan might also need readjusting. Revenue and profits have the tendency to vary year after year, which is why it’s also helpful to closely monitor your employee participation. Manage your staff well to maintain and increase team productivity.

FAQs

Is a profit sharing plan the same as a 401k?

401(k) A profit sharing plan differs from a 401(k) in that only employers contribute to a profit sharing plan. A 401(k) plan is one in which employees can make pre-tax, salary-deferred contributions (k).

Is profit sharing considered a bonus?

Employees who participate in a cash profit sharing plan get profit sharing payments in the form of cash, cheques, or shares. The sum is considered a form of employee bonus because it is taxed as part of their normal salary.

Is Profit Sharing a form of Ownership?

The profit share is the portion of a company’s earnings that goes to the owner and investors. The size of an investor’s or business owner’s ownership interest is referred to as equity share.

All in all, implementing a profit sharing plan is entirely up to the discretion of your company. You can help invest in your employee’s financial security through this, and consequently they can help empower your workforce in aiding to the success of your business. With the help of our free and downloadable samples of Profit Sharing Plans, you can set one up today! Print these out and you’re good to go. Check out our other samples to improve the efficiency of your business.

Related Posts

FREE 3+ Contractor Business Plan Samples in PDF | MS Word

FREE 10+ Compliance Action Plan Samples [ Corrective, Risk, Audit ]

FREE 13+ Communication Management Plan Samples in PDF | MS Word

FREE 10+ Common Core Spending Plan Samples in PDF | MS Word

FREE 7+ Chronic Disease Management Plan Samples in PDF | DOC

FREE 10+ Child Care Risk Management Plan Samples in PDF | MS Word

FREE 10+ Behavior Incident Report Samples [ Employee, Daycare, Student ]

15+ Asset Management Plan Samples in PDF | DOC

FREE 10+ Academic Lesson Plan Samples & Templates in MS Word | Pages | PDF

Diet Plan

FREE 18+ Sample Compensation Plan Templates in PDF | MS Word | Google Docs | Apple Pages

FREE 9+ Contingency Plan Samples in MS Word | PDF

FREE 10+ Traffic Management Plan Samples in PDF | DOC

10+ Scope Management Plan Samples in PDF | DOC

FREE 14+ Schedule Management Plan Samples in PDF | DOC