Budget planning plays a crucial role in personal and professional financial risk management plan. It involves the process of creating a comprehensive plan that outlines income report, prepaid expenses, and savings tracker, enabling individuals and organizations to make informed financial decisions. Whether you are an individual striving to achieve your financial goals or a business aiming for sustainable growth, effective budget planning is essential. Budgets provide a framework for prioritizing investments samples and capital expenditure budget. By assessing the financial impact and anticipated returns, businesses can allocate funds to project sample that contribute most effectively to growth and profitability.

20+ Budget Planning Samples

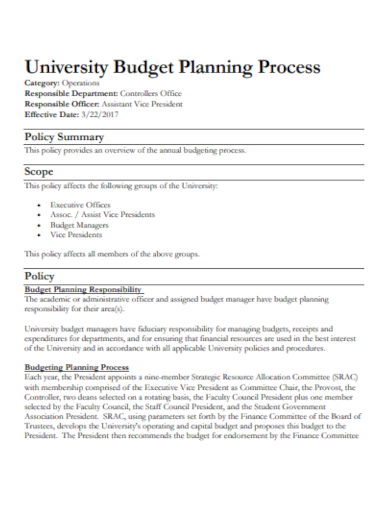

1. University Budget Planning Template

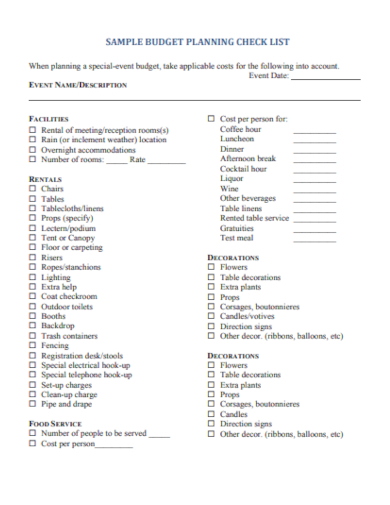

2. Budget Planning Checklist

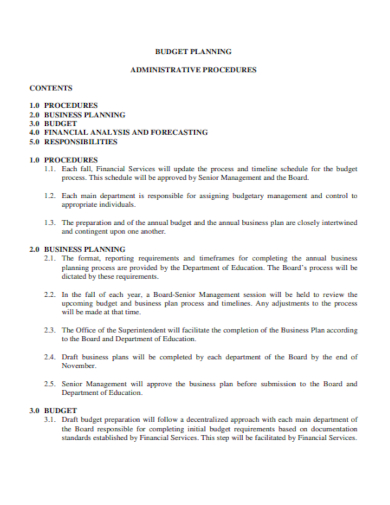

3. Business Budget Planning

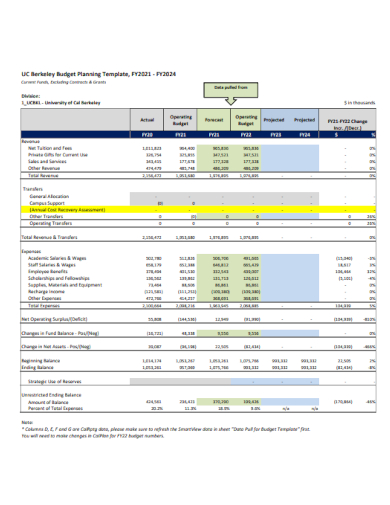

4. Printable Budget Planning

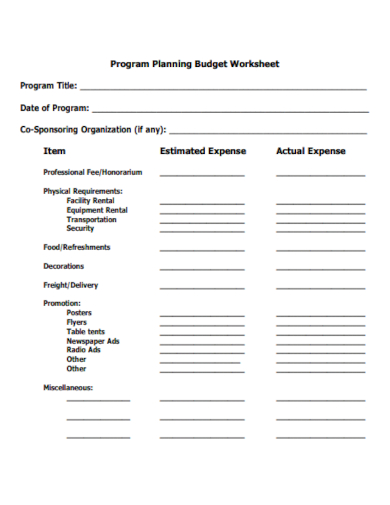

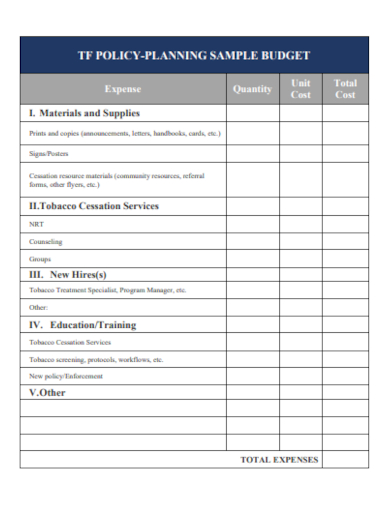

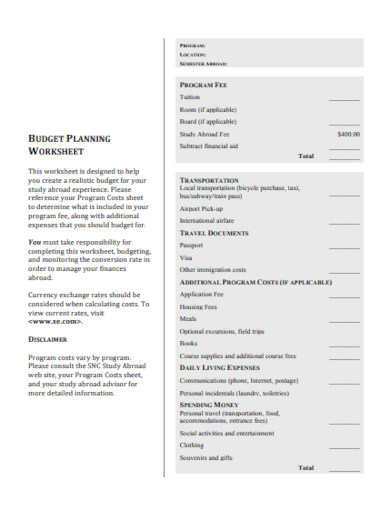

5. Program Budget Planning

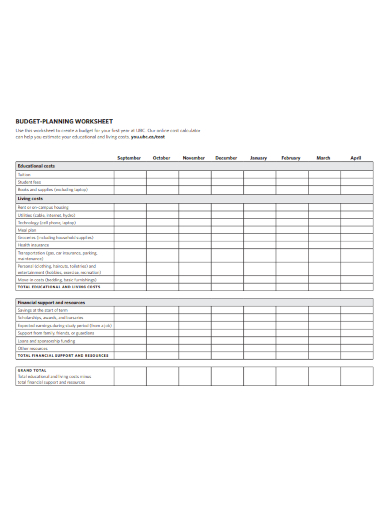

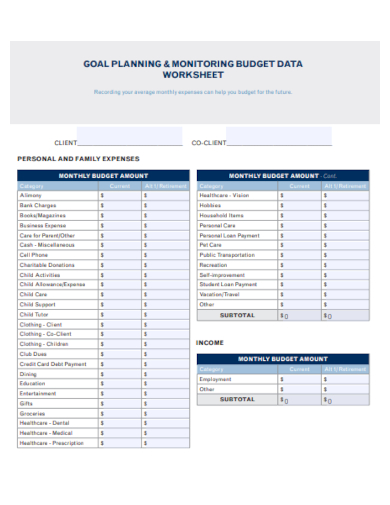

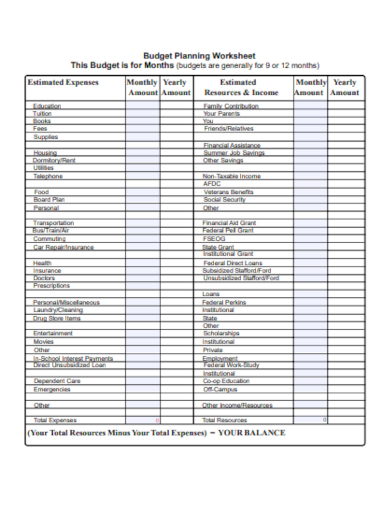

6. Budget Planning Worksheet

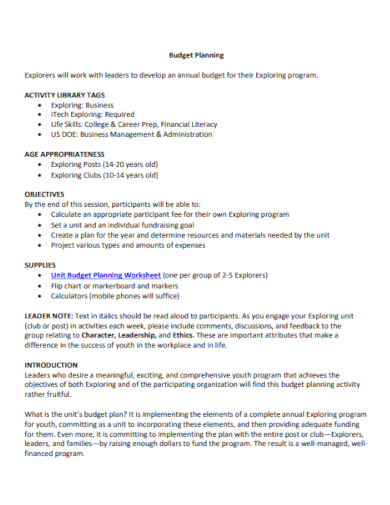

7. Blank Budget Planning

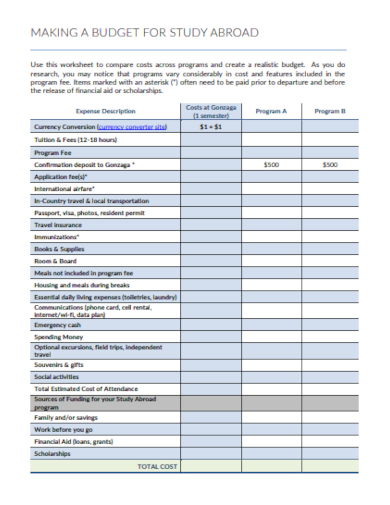

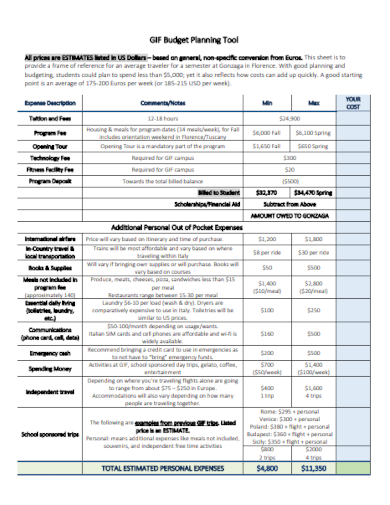

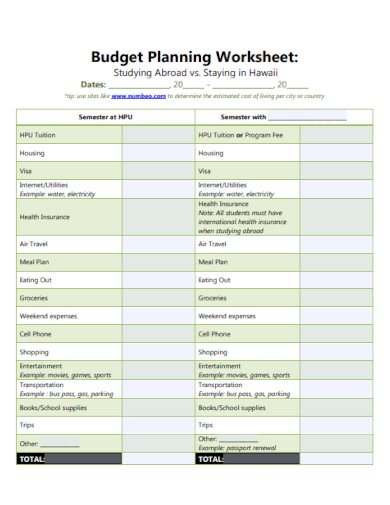

8. Student Budget Planning

9. Simple Budget Planning

10. Editable Budget Planning Worksheet

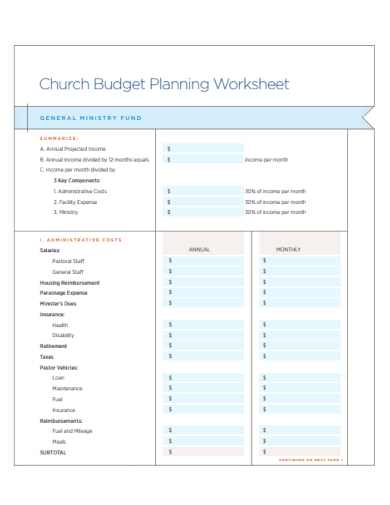

11. Professional Budget Planning

12. Budget Expense Planning

13. Basic Budget Planning

14. Personal Budget Planning

15. Startup Budget Planning Worksheet

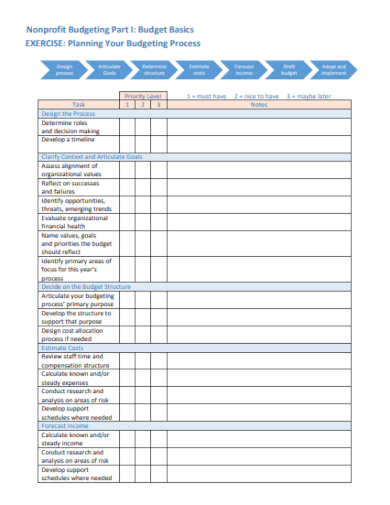

16. Nonprofit Budget Planning

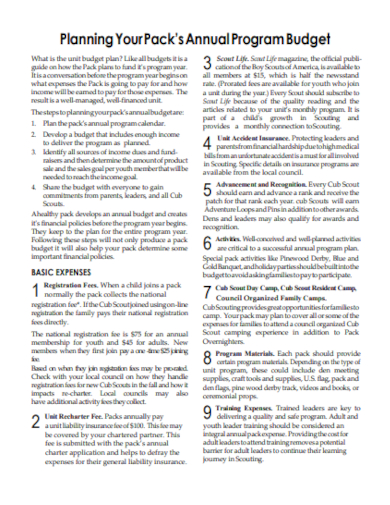

17. Annual Program Budget Planning

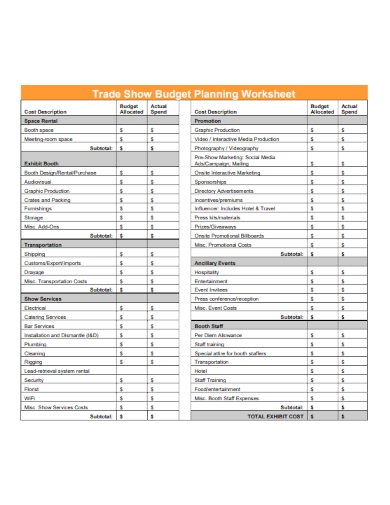

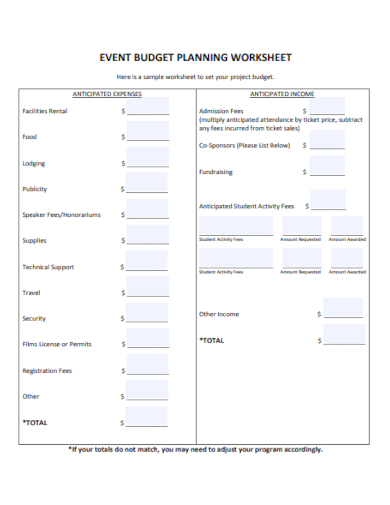

18. Event Budget Planning

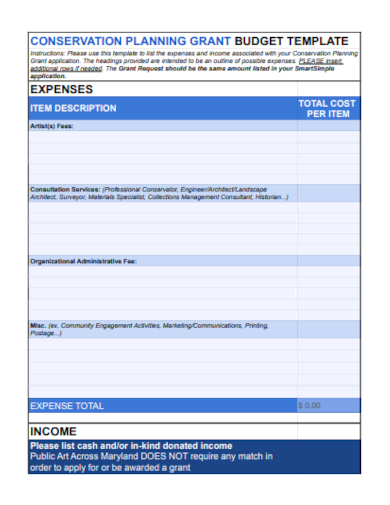

19. Expense Grant Budget Planning

20. Payroll Budget Planning

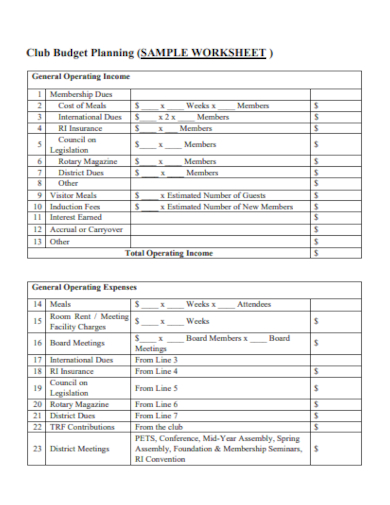

21. Monthly Budget Planning

What is Budget Planning?

Budget planning refers to the process of creating a comprehensive financial plan that outlines the anticipated income, projected expenses, and proposed investments over a specific period. It involves assessing available resources, setting financial goals, and allocating funds to various categories or activities based on priorities and objectives.

How To Make Budget Planning?

Budget planning enables individuals, organizations, or businesses to effectively manage their finances, make informed decisions, and track their financial performance. Creating a budget plan involves several key steps. Here is a general outline of how to make a budget plan:

Step 1- Assess Your Income

Identify all sources of income, including salaries, wages, freelance work, investments, or any other regular income streams. Determine the total amount of income you can expect to receive during the budgeting period.

Step 2- Track Your Expenses

Gather and review your financial records, including bank statements, receipts, and bills. Categorize your expenses, such as housing, transportation, groceries, utilities, entertainment, debt payments, and savings. Calculate the average monthly expenses for each category.

Step 3- Set Financial Goals

Identify your short-term and long-term financial goals, such as saving for a down payment on a house, paying off debt, or building an emergency fund. Determine the timeframe and monetary target for each goal.

Step 4- Allocate Funds

Start with essential expenses like housing, utilities, transportation, and debt payments. Allocate a portion of your income to cover these fixed expenses. Prioritize savings by setting aside a portion of your income towards your financial goals. Allocate funds for variable expenses like groceries, entertainment, and discretionary spending, ensuring they fit within your budget.

How far in advance should I create a budget plan?

It is recommended to create a budget plan for a specific period, such as monthly, quarterly, or annually. The timeframe depends on your financial goals and the level of detail you require.

How do I prioritize expenses in my budget plan?

Prioritizing expenses depends on your financial goals and needs. Start by covering essential expenses such as housing, utilities, transportation, and debt payments. Then allocate funds towards savings and financial goals.

How often should I review and adjust my budget plan?

It is advisable to review your budget plan regularly, such as monthly or quarterly, to ensure it remains aligned with your financial circumstances and goals.

Budget planning is an indispensable tool for achieving financial stability and success, both at the individual and organizational levels. By creating a realistic budget and adhering to it, individuals can take control of their finances, effectively manage expenses, and work towards their financial goals. Similarly, businesses can optimize resource allocation, minimize wasteful spending, and plan for sustainable growth.

Related Posts

FREE 9+ 30-Day Marketing Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 3+ Sales Team Action Plan Samples in PDF | MS Word | Apple Pages | Google Docs

Marketing Plan For Small Business Samples

FREE 7+ Fashion Business Plan Samples in PDF

FREE 10+ Sprint Planning Samples In MS Word | Google Docs | PDF

FREE 10+ Wedding Planning Samples in MS Word | Apple Pages | Powerpoint | PDF

FREE 9+ Monthly Study Planner Samples in PSD | Illustrator | InDesign | PDF

FREE 9+ Sample Curriculum Planning Templates in PDF | MS Word

FREE 10+ Teacher Development Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Basketball Practice Plan Samples in PDF

FREE 12+ School Business Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 7+ Client Strategic Plan Samples in PDF | MS Word

FREE 11+ Trucking Business Plan Templates in PDF | MS Word | Google Docs | Pages

FREE 7+ Small Hotel Business Plan Samples PDF | MS Word | Apple Pages | Google Docs

FREE 14+ Bakery Business Plans in MS Word | PDF | Google Docs | Pages