Breaking down something into its component parts to determine its value is what a cost breakdown analysis is. This process of analyzing helps companies or businesses to effectively cut down certain business costs.

In this article, we will be learning about cost breakdown analysis, what it is, why is it important and other topics related to it. We have also gathered useful templates that will serve as your guide and that you can use personally. You may check them out below.

Cost Breakdown Analysis Template

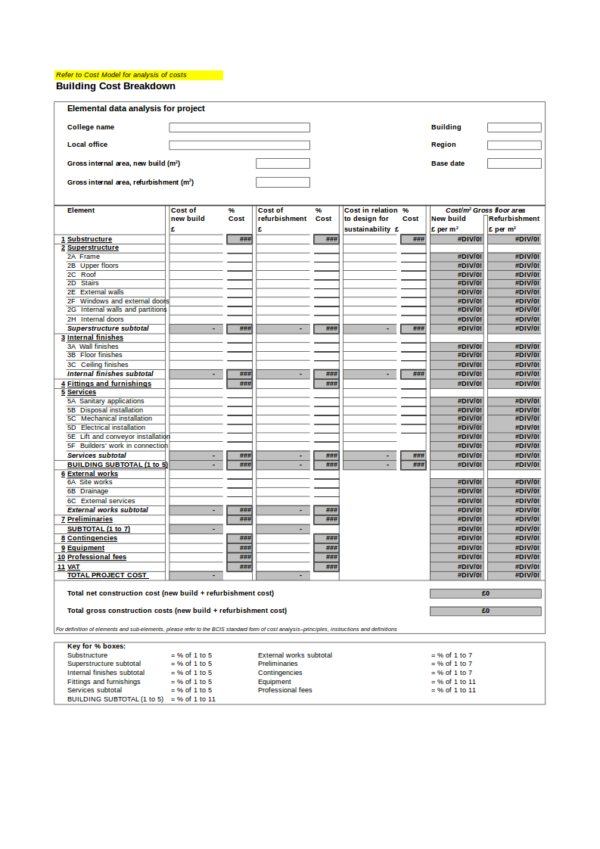

Printable Cost Breakdown Analysis

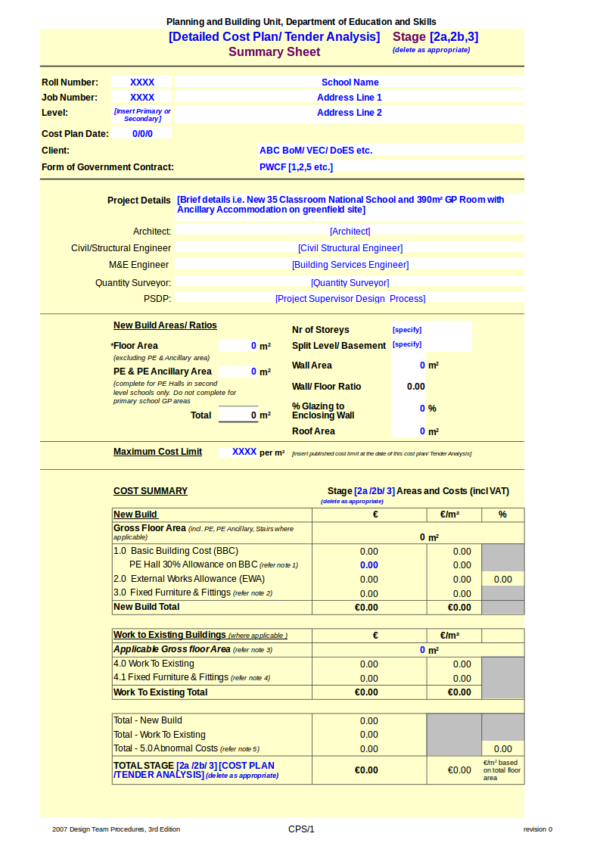

Detailed Cost Plan/ Tender Analysis Template

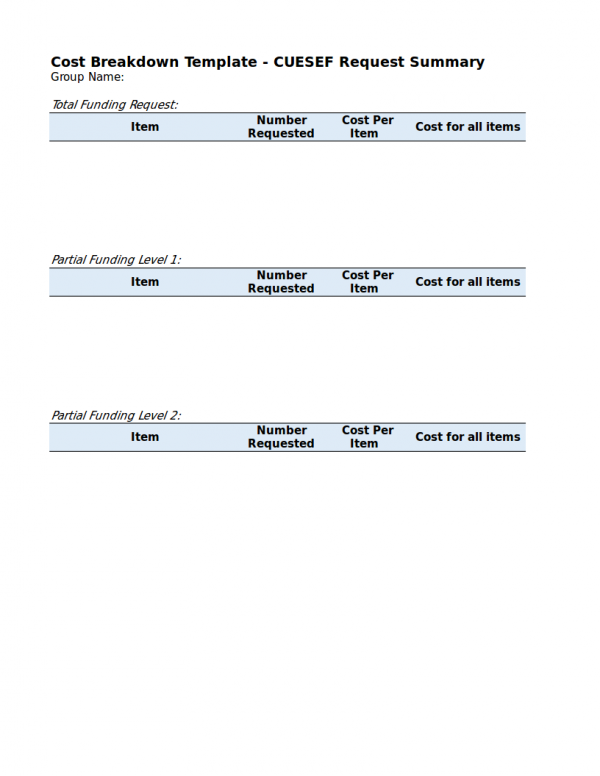

Cost Breakdown Template

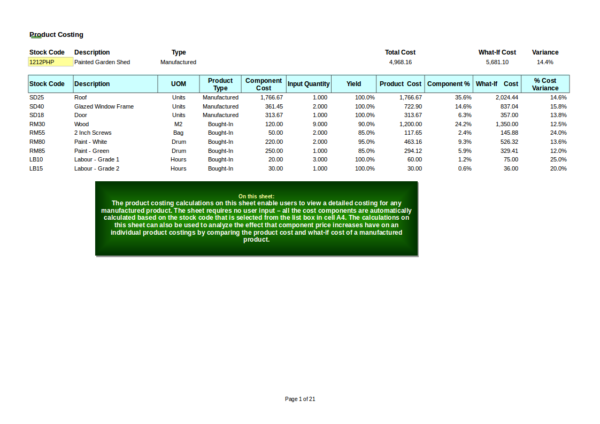

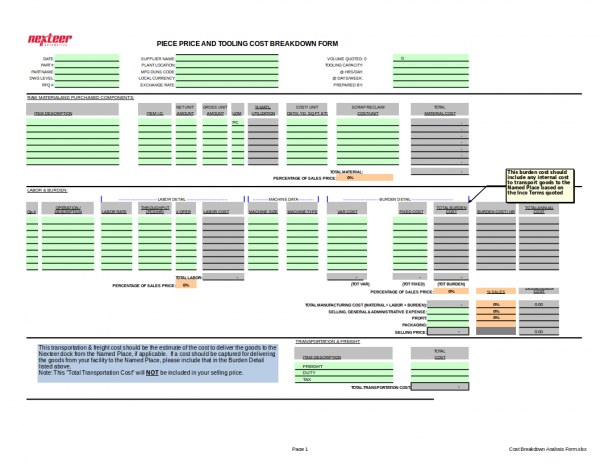

Product Costing Template

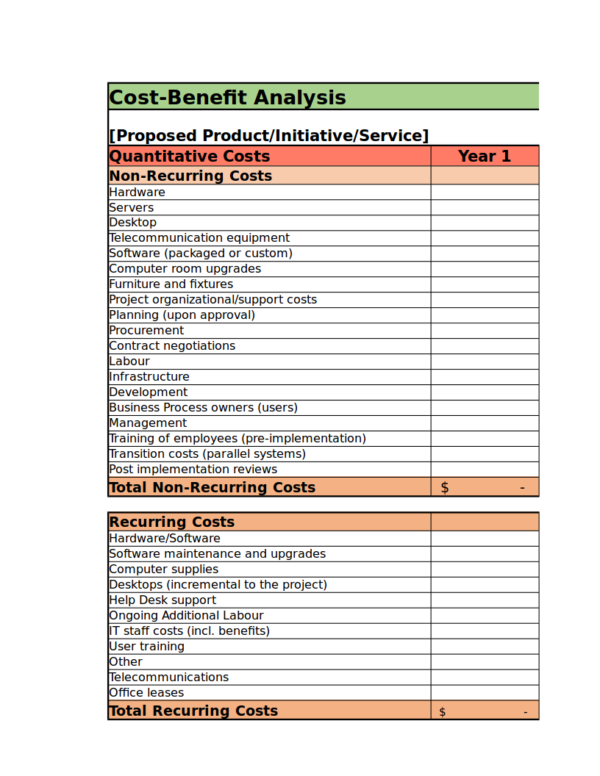

Cost-Benefit Analysis Template

What Is a Cost Breakdown Analysis?

A cost breakdown analysis is a cost analysis that involves itemizing all of the components of the cost of a particular product or service.The itemized components are called cost drivers. Different products and services have their own different sets of itemized cost drivers. A cost breakdown analysis is an effective tool used when cutting down costs on certain things.

In a cost breakdown analysis, every identified cost drivers are assigned with a specific dollar value that is equivalent to it. These dollar values are later on expressed as a percentage of the total or entire cost of the product or service whose cost is being analyzed. The results of the cost breakdown analysis should determine how and why the said product or service cost that way. If they price of the product or service seems to be significantly higher than that of the results of the breakdown, then the company or business may be overcharging. On the other hand, if the result of the breakdown seems to be significantly higher than the actual price of the product or service, then the company or business is likely to be undercharging and taking the loss for it.

There are many uses of a cost breakdown analysis and some of them are listed below.

- A cost breakdown analysis is used to justify how products and services are priced and why customers are charged with that specific amount.

- With the knowledge they have about the breakdown, clients or customers can come up with a rough estimate of the total price by simply looking at the elemental costs of the product or service. This is one way for them to figure out the price of a product of service if they don’t exactly know its total cost.

- Being able to figure out the breakdown of the costs of the product or service you want to take advantage of allows one to compare prices better and negotiate better rates.

- A cost breakdown analysis can also be used to ensure that sellers to verify that the client has been charged with everything that they need to take care of with with their purchase.

- Another good use of a cost breakdown analysis is identifying the specific reasons why the prices of products or services fluctuates. This information is useful both to companies and their consumers.

You may also want to check out other related topics offered on our website, like Cost Benefit Analysis Templates, Sample Employee SWOT Analysis Template, and Functional Behavioral Analysis Sample.

What Are the Different Types of Costs?

There are six common types of costs and they are labor costs, material costs, conversion costs, logistics costs, subcontracting costs and overhead costs. Let us take a closer look at each of these types of costs below.

Labor Costs

The most common starting point for manipulation when reducing costs are labor costs. This is because labor costs can be easily identified. It is defined as the sum of all the wages paid to every employee in a company or business and it includes the benefits that employees receive and part of the payroll taxes that is being paid by their employer. Labor costs can be divided into direct labor costs and indirect labor costs. Direct labor costs refer to the wages of employees who actually produce the products of the business, while indirect costs include the wages of those workers who work to maintain business equipment and other support labor services.

Material Costs

Material costs refers to the amount of money used in production and it covers all the costs of the materials that are purchased and used in the operations of a company or business, which includes parts and components of certain equipment, raw materials for the manufacturing of products, items used for the provision of business services, and other supplies used in the onsite or in an office setting. other costs that are included in material costs are freight expenses and insurance costs.

Conversion Costs

This type of cost refers to the amount required to process the raw materials and then turn them into finished products that the company or business sell.s Conversion costs includes the cost of manufacturing, the cost of the utilities used in manufacturing as well as the maintenance needed to take care of manufacturing utilities and equipment.

Logistics Costs

Logistics involves moving products or goods from the place of production to another place where it will be sold or used. It simply refers to the transportation of goods. This is another type of cost that must be considered with a cost breakdown analysis. Logistics costs include the cost of transportation, customs clearance, the cost of the warehouse where the products will be stored and its distribution. These costs vary depending on certain factors, like the destination country and their specific customs clearance policies.

Subcontracting Costs

Subcontract costs are direct costs to the business and subcontracting expenses involves outsourcing of different contracts for specific services from a third party contractor or business.

Overhead Costs

Overhead costs are also considered hidden costs as they cannot be directly allocated to a particular cost unit of the expenses of the business. It is however still a business expense, but it doesn’t generate income or increase the profit of the business. It does contribute something to the ongoing activities in the business that helps employees perform tasks or do things conveniently. Examples of things where overhead costs are spent on are company cars and buses. They are part of the expenses but they do not generate income to the company. They however can be used by employees to run errands, attend important business meetings or transport employees from a specific pick up point to the office to ensure that they arrive to work on time and avoid traffic.

Other related articles you may be interested in are Business SWOT Analysis Samples & Templates, Company Financial Analysis Template, and Workforce Analysis.

What Is a Tear Down Analysis?

If there is a cost breakdown analysis for products and services, there is also what is called a tear down analysis for products. Both types of analysis deal with breaking down things into their component parts. The difference between the two is that a cost breakdown analysis works both for products and services and helps determine their monetary value products and services. A tear down analysis on the other hand only works with products and literally means tearing down those products. The tearing down process is done by disassembling it and identifying its components and determining the value of each component parts to come up with the value of the product as a whole.

Cost Breakdown Analysis Form

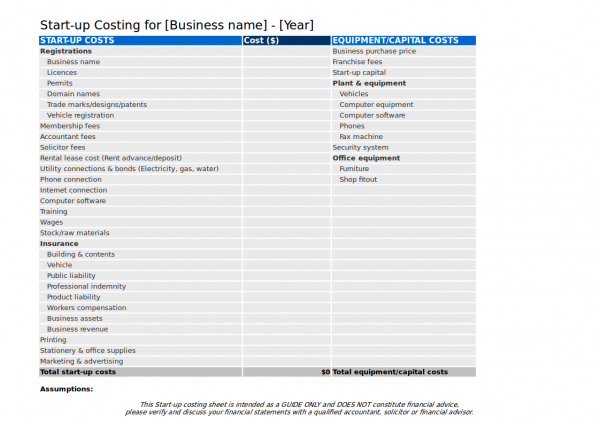

Start-up Costing Analysis Template

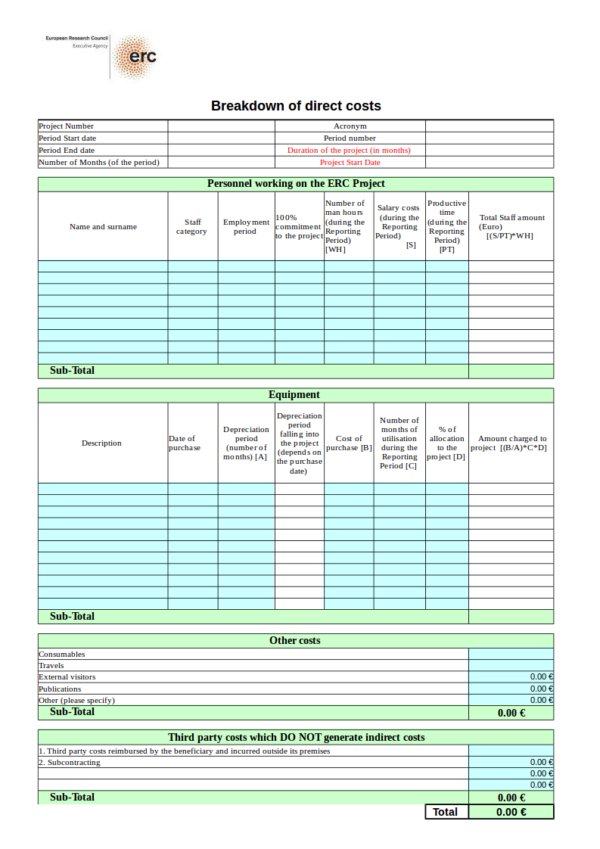

Breakdown of Direct Costs

Monthly Cost Breakdown Analysis Template

Veterans Affairs Cost Benefit Analysis Template

Why Is a Cost Breakdown Analysis Important?

There are mainly a lot of reasons why a cost breakdown analysis is considered important one of them is that is helps in identifying the risks and benefits of the decisions or actions that one makes. This is especially important in companies or businesses. Doing a cost breakdown analysis helps point out the risks that you and your business will be taking if you push through with a certain decision or action. This prevents wasting of money, time and resources. It is actually better than guessing which is may lead to failure in the business.

Another important use of a cost breakdown analysis is that it can help in project evaluations. How? Before accepting a project you need to consider if it is something that you and your company can handle and if there are benefits in it for you. Also, it can project potential risks and other benefits if you decide to invest on it.

Preparing the budget and projecting the possible sales of your company or business can also be done with a cost breakdown analysis. It can make budgeting easier and forecast how much is needed for undertaking a particular project if you have all the possible costs listed.

Those are the reasons why a cost breakdown analysis is important. If you free and downloadable templates for related topics, you can always drop by our website. Some of the titles you may be interested in are How to Apply Cost Analysis in Market Research Methods, HR SWOT Analysis Samples & Templates, and Marketing Analysis Samples.

Related Posts

FREE 10+ Failure Mode and Effects Analysis Samples in PDF

FREE 10+ Make or Buy Analysis Samples in PDF

FREE 10+ Fishbone Root Cause Analysis Samples in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 6+ Corporate Portfolio Analysis Samples in PDF

FREE 10+ Fault Tree Analysis Samples in PDF

FREE 10+ Comp Analysis Samples in PDF

FREE 10+ Fishbone Analysis Samples in PDF

FREE 10+ Individual Swot Analysis Samples in PDF

FREE 10+ 5 Year Analysis Samples in PDF

FREE 10+ Benefit Costs Analysis Samples in PDF

FREE 10+ Job Hazard Analysis Samples in PDF

FREE 10+ Primary Source Analysis Samples in PDF

FREE 10+ Critical Path Analysis Samples in PDF

FREE 10+ Competition Analysis Samples in PDF