10+ Wealth Action Plan Samples

Wealthy people don’t merely aspire to generate more money; they plan and work for their financial objectives. They know exactly what they want and are willing to put up the effort required to obtain it. To get rich, your main objective is to be financially secured. Financial security is the peace of mind you have when you don’t have to worry about your money covering your costs. It also implies that you have enough money set aside to handle unexpected expenses as well as your long-term financial objectives. Do you want to be rich? Then, you need a plan. You’ve come to the right place! In this article, we provide you with free and ready-made samples of Wealth Action Plans in PDF and DOC formats that you could use to achieve your dreams. Keep on reading to find out more!

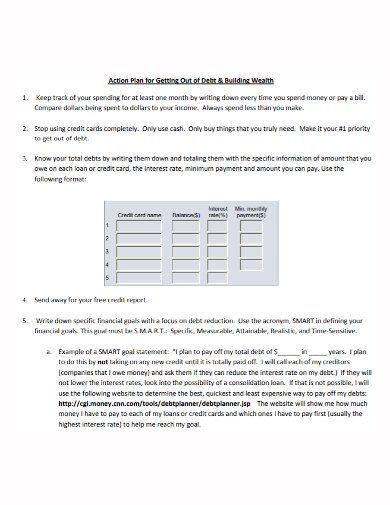

1. Wealth Action Plan Template

2. Wealth Action Plan

3. Community Wealth Action Plan

4. Financial Wealth Action Plan

5. Wealth Management Action Plan

6. Wealth Building Action Plan

7. Community Wealth Building Action Plan

8. Wealth Individual Action Plan

9. Common Wealth Action Plan

10. Wealth Action Goal Plan

11. Wealth Strategy Action Plan

What Is a Wealth Action Plan?

A wealth action plan is a useful tool for assessing where you are now and determining what you need to do to achieve your objectives. A careful examination of your assets, obligations, income, and spending is the first step in developing a wealth plan. It’s the process of organizing your assets in order to preserve, grow, and pass them on to your loved ones. When tax reduction measures coincide with your goals, wealth planning integrates wealth protection, investments, and company succession planning.

How to Make a Wealth Action Plan

Planning for wealth growth is a significant undertaking that needs a long-term strategy and planning. Each situation is unique, and it is determined by your own goals, limits, and how you choose to handle your assets, investments, and initiatives. A Wealth Action Plan Template can help provide you with the framework you need to ensure that you have a well-prepared and robust action on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Examine your existing circumstances.

Before you begin the real planning phase of the process, you must first determine where your journey will begin. This entails assessing your current financial status. Take your last half to full year bank statements and color-code every typical outgoing spend in one color, then color-code your unusual expenses in a different hue.

2. Set short and long term objectives.

You now have a starting point for your financial independence path. When it comes to making financial decisions, having firm goals provides you direction and clarity. Your objectives will show you if you’re on the correct track.

3. Make a liabilities strategy.

If your interest and repayments are dragging you down, you won’t be able to make significant progress toward your short and long-term goals. So first and foremost, find out how to pay what you owe. The bottom line is that you must take action and begin the process of being debt-free.

4. Create an emergency fund.

Unexpected illness, losing your job, or simply forgetting to pay a payment are all situations that emergency savings safeguard you from.

FAQ

What exactly is a wealth protection strategy?

At the policy’s maturity, wealth insurance assures that you receive a lump sum payment.

What does it mean to be a wealth management consultant?

A wealth management adviser is a high-level expert who, for a fixed charge, manages a wealthy client’s money holistically.

What are the three wealth-creation principles?

Three well-known guidelines for accumulating wealth over time, such as saving early, purchasing and holding, and diversifying, may be used to describe it.

In essence, wealth planning serves as a guide as you go through life. It enables you to keep track of your income, spending, and investments, allowing you to manage your finances and reach your objectives. To help you get started, download our easily customizable and comprehensive samples of Wealth Action Plans today!

Related Posts

FREE 10+ Healthcare Corrective Action Plan Samples in PDF

FREE 10+ Project Corrective Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Business Corrective Action Plan Samples in PDF

FREE 10+ Audit Corrective Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Incident Corrective Action Plan Samples in MS Word | Google Docs | Apple Pages PDF

FREE 10+ Remediation Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Assessment Action Plan Samples in MS Word | Google Docs | PDF

FREE 10+ Workplace Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Business Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ School Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Event Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Church Emergency Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Recruitment Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Earthquake Action Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Disciplinary Action Plan Samples [ Progressive, Corrective, Student ]