Payroll is one of the most important aspects of a company. It is a document that consists of the employee’s data and income from the company. As the payroll personnel or human resource manager, it is your job to prepare and create the payroll. But how would you make payroll? We have shared our downloadable payroll sheet templates below to help you get started. Keep scrolling and learn more about this topic in this article.

FREE 10+ Payroll Sheet Samples

1. Payroll Sheet Template

2. Sample Payroll Timesheet Template

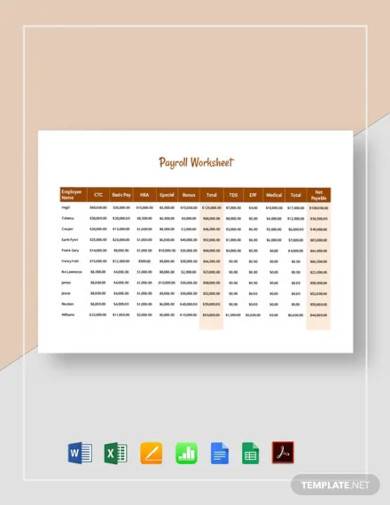

3. Payroll Worksheet Template

4. Payroll Weekly Timesheet Template

5. Daily Payroll Timesheet Template

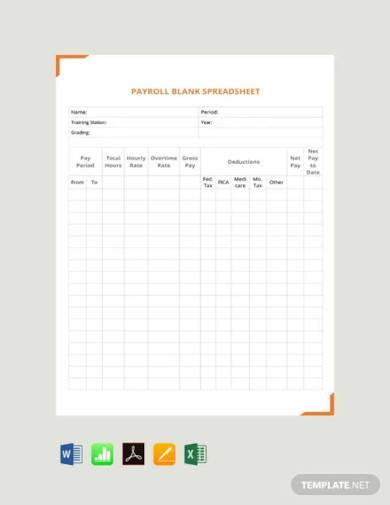

6. Free Payroll Spreadsheet Template

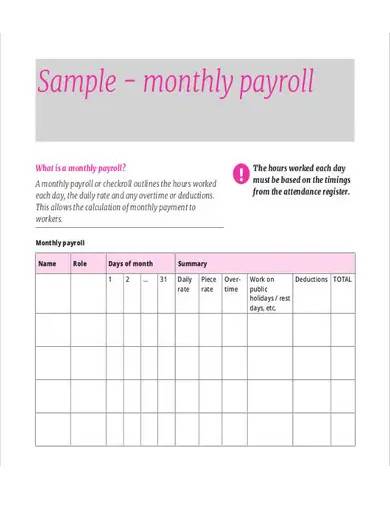

7. Sample Monthly Payroll Sheet

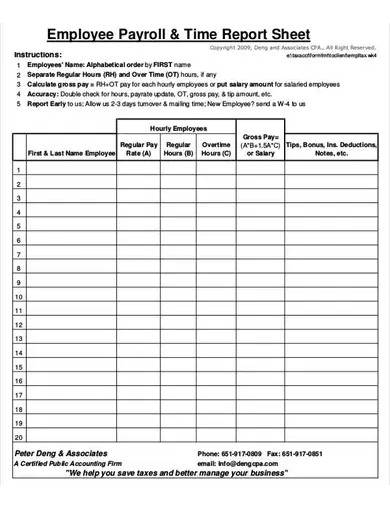

8. Employee Payroll Sheet

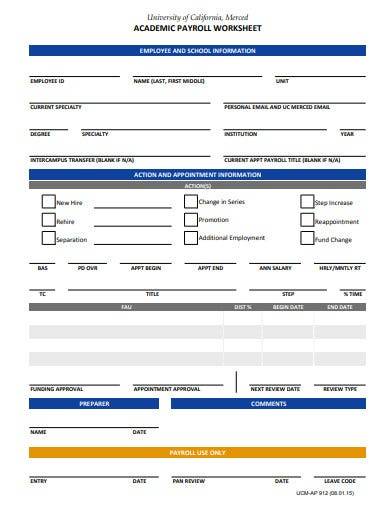

9. Sample Academic Payroll Worksheet

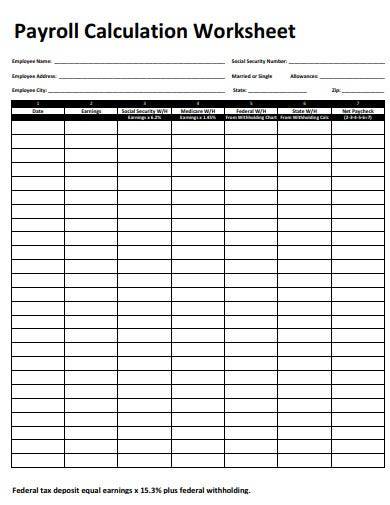

10. Payroll Calculation Worksheet

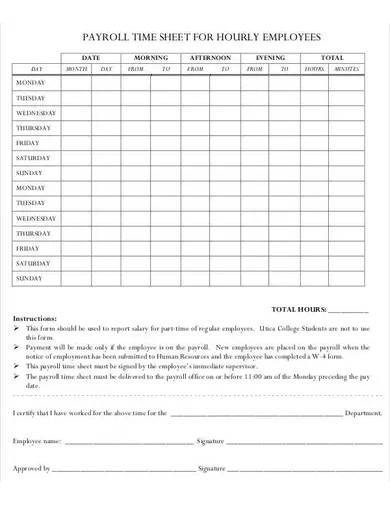

11. Payroll Time Sheet Template

What Is a Payroll?

Payroll is the list of any company employees who are eligible to earn compensation, as well as other job benefits and the salary that should be paid by each company. Payroll may also apply to a company’s records of payments previously paid to workers, including salaries and benefits, bonuses, and withheld taxes, or the company’s department concerned with compensation, along with the amount that each employee can earn for time spent or tasks performed. For various factors, payroll plays a significant role in a business’ internal operations. Payroll and payroll taxes are subject to laws and regulations from the viewpoint of accounting. Payroll in the United States is subject to federal, state, and local rules, including exemptions of staff, record keeping, and tax provisions. Payroll also plays a significant role in the perspective of human resources. Payroll mistakes are a sensitive subject that can create conflict between workers and their bosses.

What Is a Payroll Sheet?

A compiled list of employees, which displays the gross deductions and net salaries owed to them, is called the payroll or wage sheet. Moreover, the payroll provides information such as the employees’ ticket numbers, occupations, grades, and pay rates. Such data are obtained from the employee’s record card.

How to Compute Payroll?

Computing or calculating payroll is not easy. It requires too much attention and work. However, there are some initial considerations for payroll calculations to help you calculate payroll accurately. Here are the following:

1. Pay Periods

Pay periods are usually the cut-off dates. It is the time where payroll personnel calculates the payroll of the employees. It is a recurring period during which the time of the employee is reported and compensated. To compute the gross income per pay period, you have to divide the yearly salary by the number of pay periods in the year.

2. Salary Structure

A salary structure or pay scale is a method used by employers to assess employees’ compensation. Compared to similar jobs, a typical salary structure takes factors such as merit, the period of employment, and pay into account. There are three types of salary structure. They are traditional, broadband, and market-based. According to a blog in Patriot, a survey says that the most commonly used salary structure is market-based, while broadband is the least.

3. Types of Employees

For various types of employees, there are different wage components and taxation laws. You have to classify the types of employees to give them the compensation that best applies to them.

4. Statutory Requirements

Statutory requirements are the requirements specified by an authority mandated by a legislative body. These requirements come from statutes. In other words, these are the legal requirements that come from the laws of the government. You have to be aware that statutory requirement varies in each state.

5. Salary Calculation Modes

The employer is responsible for specific deductions, so it is necessary to determine the origin of the salary calculation, write it, and share it with all employees. You may include this in your company’s policy document. Most businesses use ‘absent without leave’ or days of work to calculate a suitable salary. Besides the base pay, additional payout devices may include pieces created for those piece-rate employees and sales achieved to those commission-based employees.

6. Employee’s Bank Information

In today’s generation, salaries are mostly automatically transferred to the employees’ bank account. For a smooth transaction, you have to check and verify the employee’s bank information.

FAQs

Where did the name payroll come from?

In the 1750s, the term came into use as a variation of the words Pay (a verb) and Roll (a noun), referring to a list of annual payments made as salary to employees. It is managed by a paymaster, a person whose role in some companies, government and military were to pay wages or salaries.

Why is payroll important?

One of the most significant aspects of a company is payroll. It impacts employee morale and represents the financial stability and prestige of an organization. Since workers depend on their paychecks, mistakes, or early payment may trigger a loss of trust.

Who prepares the payroll?

A representative from the finance or human resource department prepares the payroll calculation sheet days before the payday. They will usually sign the sheet to certify that they have prepared it.

Even if your company is small, preparing a payroll is not easy. You have to consider many things, and you have to be mindful and follow the intended regulations. The next time you will prepare payroll for the employees, you can download our payroll sheet templates. Check out our site and download it now!

Related Posts

FREE 15+ Payroll Samples (Ledger, Schedule)

FREE 22+ Payroll Templates in Excel

FREE 50+ Payroll Templates and Samples in PDF Google Sheets

FREE 9+ Payroll Timesheet Calculators in PDF Excel

FREE 13+ Payroll Spreadsheet Samples & Templates in Excel PDF

FREE 43+ Printable Payroll Templates in PDF MS Word | Excel

FREE 9+ Sample Payroll Calendar Templates in PDF Excel

FREE 7+ Sample Payroll Tax Calculator Templates in PDF Excel

FREE 10+ Biweekly Timesheet Templates in Google Docs Google ...

FREE 31+ Payroll Samples &

FREE 8+ Sample Sheet Templates in MS Word PDF

FREE 7+ Sample Payroll Register Templates in MS Word PDF

FREE 7+ Blank Payroll Form Templates in PDF MS Word

FREE 6+ Sample Payroll Hours Calculator Templates in MS Word ...

FREE 9+ Sample Biweekly Timesheet Calculators in MS Word ...