A budget is a projection of revenue and expenses for a given period of time. Corporations, governments, and homes all use budgets, and they’re an important element of running a successful business. Companies use budgeting as a plan of action for management as well as a point of comparison at the conclusion of a term. In most businesses, creating a budget is a critical step. By doing budget analyses at regular intervals, you can maximize the value of a solid budget. A budget analysis may help you figure out where money is coming in and going out of a firm, as well as how to maximize profitability. In this article, we’ll show you how to design a budget analysis and suggest some situations when you can do it yourself.

10+ Business Budget Analysis Samples

What is budget analysis? A budget analysis is a method of assessing a company’s financial health. By examining the budget, you can keep track of how much money the company makes and compare it to how much it spends over time. Budget analysis can assist business leaders in making critical decisions regarding the company’s spending and revenue streams. Many firms examine their budgets on a weekly basis, but you may prefer to do it quarterly, annually, or on another timetable of your own.

1. Business Budget Analysis Template

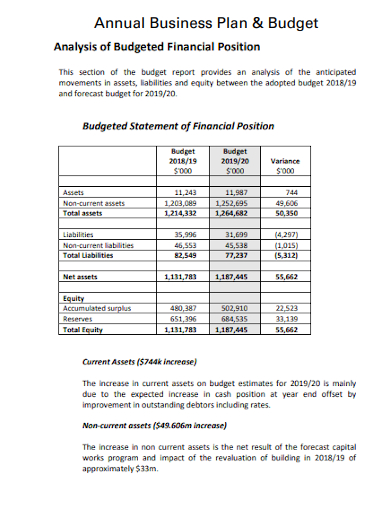

2. Annual Business Plan Budget Analysis

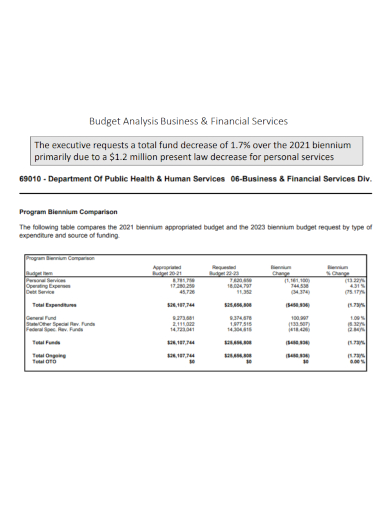

3. Business Financial Budget Analysis

4. Business Project Budget Analysis

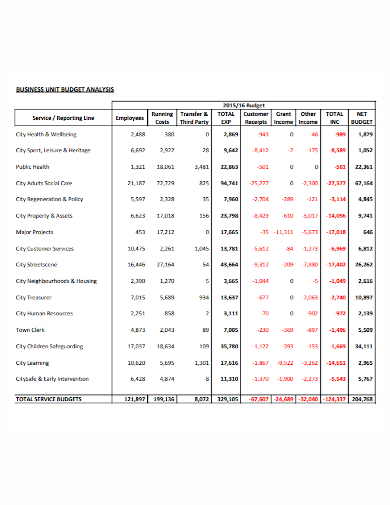

5. Business Unit Budget Analysis

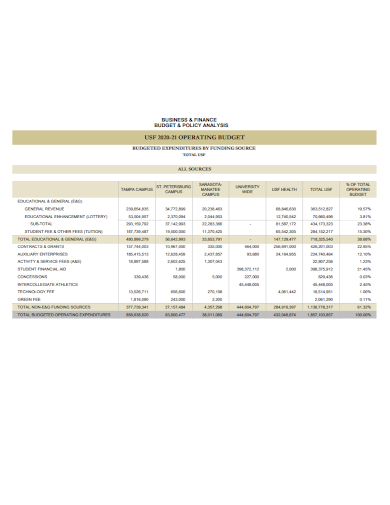

6. Business Budget Policy Analysis

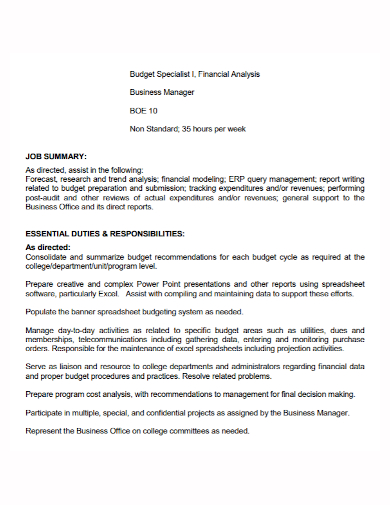

7. Business Specialist Budget Analysis

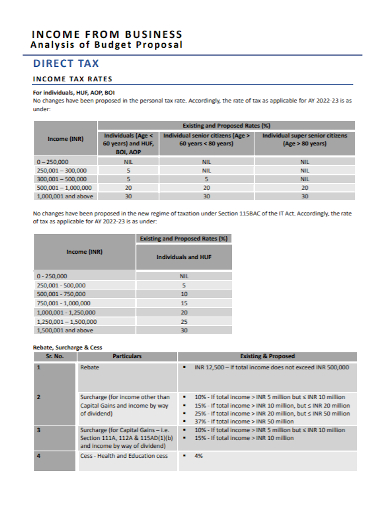

8. Business Income Budget Analysis

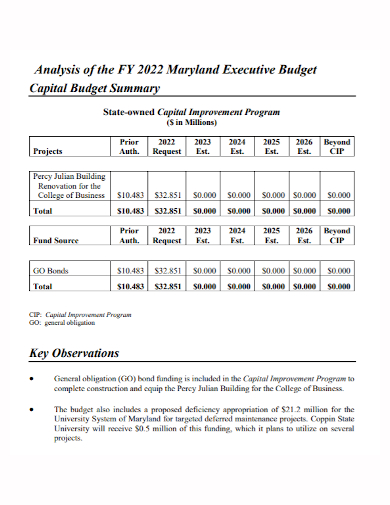

9. Business Capital Budget Analysis

10. Business Management Budget Analysis

11. Business Services Budget Analysis

Conducting Business Budget Analysis

- Choose the right budgeting strategy – You must first create your budget before you can assess it. Different budgeting methodologies, such as comprehensive, problem-solving, and planning budgets, are frequently used by different firms. Investigate various budgeting systems and select the one that best suits your needs. To help you select which budget to employ, you might want to consult with colleagues and stakeholders.

- Decide on a time frame – Consider the time range you want to utilize for your budget analysis after you’ve determined which type of budget to use. Many budget analysis cycles take place on a monthly basis, but you might opt for a different time frame, such as a business quarter or fiscal year. You could also want to look at your budget over several time periods, such as monthly and quarterly. When deciding on a time span to analyze, think about how quickly money goes in and out of your company and acquire any relevant financial information.

- Track your budget – You can start tracking your budget data once you’ve decided on a budgeting approach and time range. To make this procedure easier, many businesses employ computer applications and other technology. Make sure to maintain track of all expenses and income throughout the company. Many budgeting systems need itemization of income and expenses, so pay attention to the specifics of your budget plan.

- Analyze the results – Evaluate your budget information based on the time range you’ve chosen. Consider if your income or expenses are bigger, and why. Consider measures to reduce spending or raise sales if you observe that more money is leaving the business than is coming in. You might also use your budget analysis to request additional cash through a loan or to attract outside investors.

- Set up next budget cycle – Finally, you can use data from previous budget cycles to plan for the next. This implies that your selected time period’s final total becomes the starting dollar amount for the next cycle. Make any necessary adjustments depending on your budget analysis.

FAQs

How do budgets work?

Although the budgeting process for businesses can be complicated, at its most basic level, a budget compares a company’s revenue against its expenses over a specific time period. Of all, figuring out how much to spend on various expenses and forecasting sales is only one half of the equation. Executives must also consider a variety of other considerations, such as capital expenditure projections, which include substantial acquisitions of fixed assets such as machinery or a new factory. They must also account for continuing financial requirements, revenue gaps, and the overall economic environment. The ability to measure performance using budgets is crucial to a company’s overall financial health, regardless of the type of business.

What is business budget?

A budget is a thorough plan that lays out how you want to spend your money on a monthly or annual basis. A budget will assist you in forecasting how much money you intend to earn, planning where you will spend that money, and identifying the gap between your plan and reality.

Making a budget is similar to dreaming in that it is essentially fictitious. Budgets become beneficial when you can utilize accurate historical financials to plan for the future year and compare your budget to real data.

Related Posts

FREE 10+ Failure Mode and Effects Analysis Samples in PDF

FREE 10+ Make or Buy Analysis Samples in PDF

FREE 10+ Fishbone Root Cause Analysis Samples in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 6+ Corporate Portfolio Analysis Samples in PDF

FREE 10+ Fault Tree Analysis Samples in PDF

FREE 10+ Comp Analysis Samples in PDF

FREE 10+ Fishbone Analysis Samples in PDF

FREE 10+ Individual Swot Analysis Samples in PDF

FREE 10+ 5 Year Analysis Samples in PDF

FREE 10+ Benefit Costs Analysis Samples in PDF

FREE 10+ Job Hazard Analysis Samples in PDF

FREE 10+ Primary Source Analysis Samples in PDF

FREE 10+ Critical Path Analysis Samples in PDF

FREE 10+ Competition Analysis Samples in PDF