When a consumer walks into a bank, they will often discover a stack of deposit forms with specified sections where they may fill in the necessary client information to finish the transaction. Before contacting the teller for bank investment and deposit money, the customer must complete the paperwork that has been provided. Deposit forms allow your financial institution to identify and get instructions from you. In addition to this, they produce a paper trail for each transaction.

FREE 10+ Deposit Form Samples

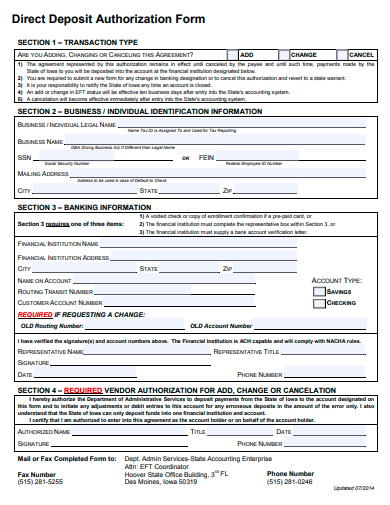

1. Direct Deposit Authorization Form

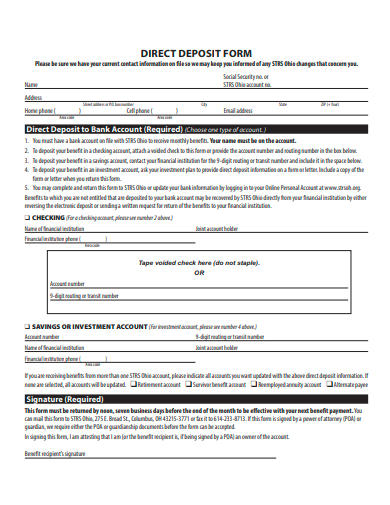

2. Direct Deposit Form

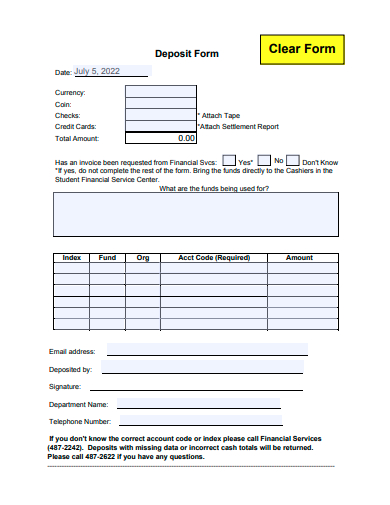

3. Basic Deposit Form

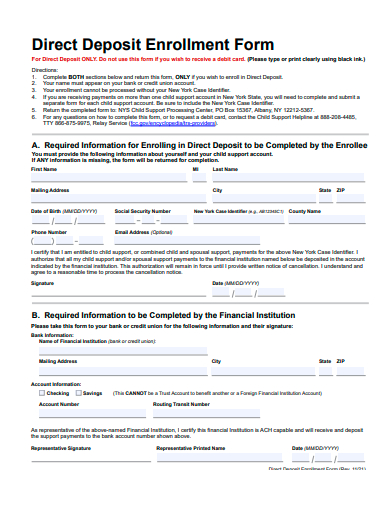

4. Direct Deposit Enrollment Form

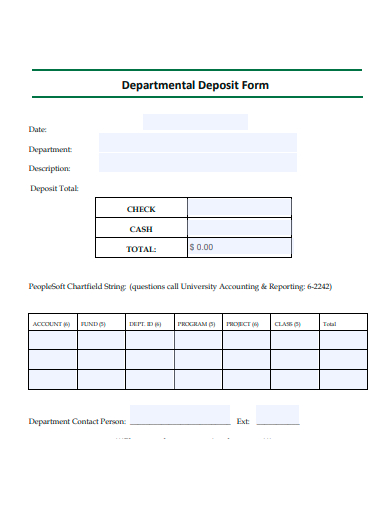

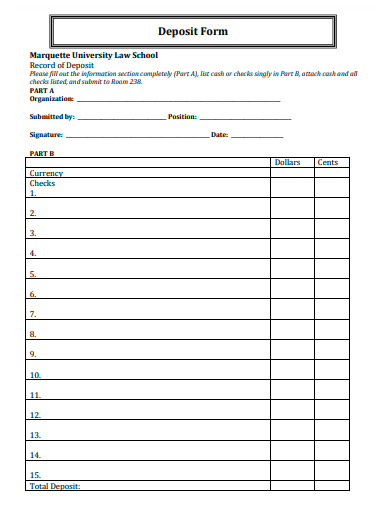

5. Departmental Deposit Form

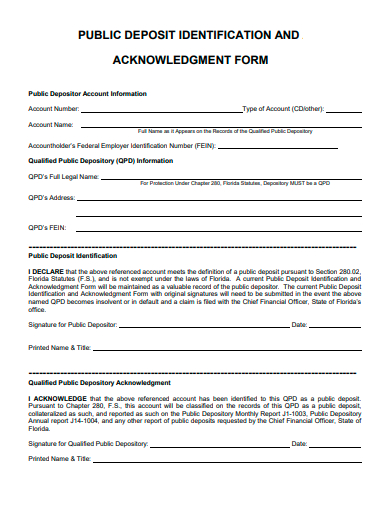

6. Public Deposit Identification and Acknowledgment Form

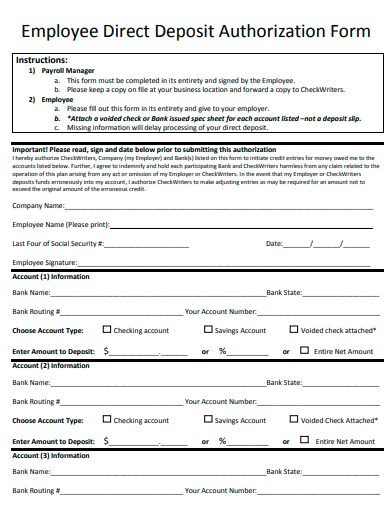

7. Employee Direct Deposit Authorization Form

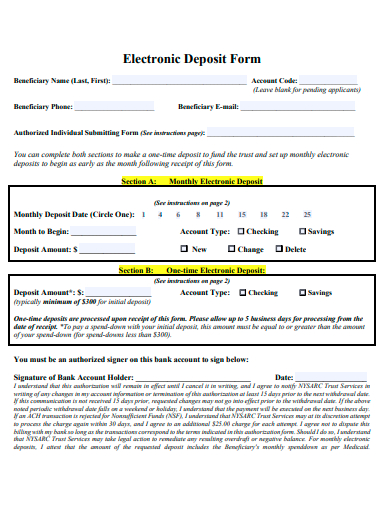

8. Electronic Deposit Form

9. Deposit Form Example

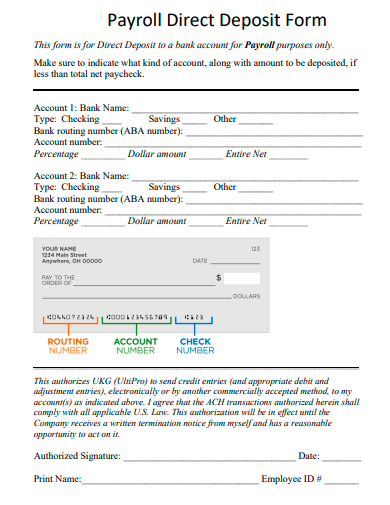

10. Payroll Direct Deposit Form

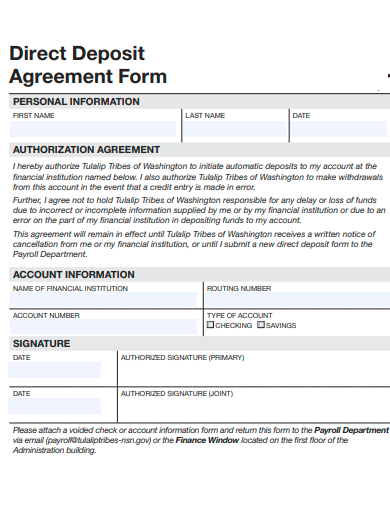

11. Direct Deposit Agreement Form

What is Deposit Form?

A deposit form is a short piece of paper that a bank customer must fill out and include whenever they deposit into their bank account. The definition of the form stipulates that it must include the date, the name of the depositor, the depositor’s account number, and the sums being deposited. The bank will acknowledge the payment received from the customer once the deposit form has been completed and submitted. When a consumer walks into a bank, they will discover a stack of deposit form waiting for them, each of which has specified fields where they may fill in the necessary information to finish the deposit policy and procedure.

How To Make a Deposit Form?

A deposit form is a short piece of paper that a bank or supplier-customer must fill out and include whenever they deposit into their bank account. Additionally, the form can be found here as evidence that the bank acknowledged receiving the startup funds from any consumer. If you are interested in learning more about creating such a form, you can continue reading the below steps. Take note; you can make it from scratch or avail form sample online.

1. Include Personal Information

The deposit slip should always be a section for the depositor’s name and account number. This allows you to keep track of every single consumer who has ever deposited money into your financial institution.

2. List The Cash Value

This is the entire amount of money, including notes and coins, that you have available to put down as a deposit. Leave this field blank if you do not have any cash to deposit if you do not have any cash to deposit. In addition, you have the option of include a space for the check number as well as the amount of each check in its own column.

3. Add The Subtotal

This is the sum of cash and checks that you need to put into your account. If you wish to determine the sum of all the individual deposits made during a specific financial transaction, you need to include this component. Moreover, you can add the sum of any deposits minus any cash your customer takes now.

4. Sign The Deposit Slip

You must sign the slip in order to withdraw cash from your deposit. In this regard, ensure that there is a space for the consumer to sign the document so that the deposit transaction can be completed legally and accurately.

When is it necessary to include your signature on a deposit slip?

Signing a deposit slip is not normally required unless you intend to withdraw cash from the account associated with the deposit. You don’t need to sign the deposit slip if all you are doing is depositing monies. If you are depositing an automated teller machine, it is possible that you will not require a deposit slip at all, which means that you will not be required to sign anything.

On a deposit slip, where should one look for the routing number?

Generally speaking, the routing number is located at the bottom of the deposit slip. If you utilize a pre-printed deposit slip, your account number will also be printed on the label itself.

Where can I acquire a form to make a deposit at the bank?

Request a direct deposit form either in writing or online format. If that isn’t an option, you can request one from your financial institution, such as a bank or credit union.

At the bottom of the form, you will need to write the account number to which the funds will be sent. Failing to do so will result in the transfer not going through. Before approaching a bank teller with monies to deposit, you are required to fill out the information on a deposit slip beforehand. On the slip it will also mention whether the deposit was made with cash, a check, or whether the person making the deposit needs some cash from the check.

Related Posts

Sample Employee Declaration Forms

Sample Release of Liability Forms

Sample Training Feedback Forms

Sample Sworn Affidavit Forms

Vehicle Inspection Forms Samples & Templates

Sample Employee Advance Forms

Sample Child Travel Consent Forms

Sample Testimonial Request Forms

Sample Employee Details Forms

Sample Divorce Forms

Sample Attestation Forms

Employee Performance Appraisal Form Templates

FREE 9+ Sample Presentation Evaluation Forms in MS Word

FREE 10+ School Admission Form Samples & Templates in MS Word | PDF

FREE 30+ Patient Consent Form Samples in PDF | MS Word