10+ Budget Worksheet Form Samples

Whether it would be for personal or business means, there is a need to track your budget. Doing so would help in figuring out the current state of your finances. It’s the instrument you’ll use to figure out, outline, quantify, and spend all of the resources you’ll require. This is important because being in charge of your finances might provide reassurance in these unpredictable times. Thankfully, budgeting worksheets enable us to confidently manage our finances. For this very reason and more, we provide you with FREE 10+ Budget Worksheet Form Samples in MS Word, MS Excel, Google Docs, Google Sheets, Apple Numbers, Apple Pages, and PDF. These are very easy to use and customize as well. Scroll down if you’re interested!

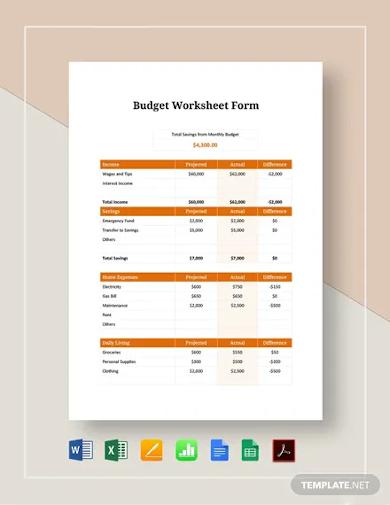

1. Budget Worksheet Form Template

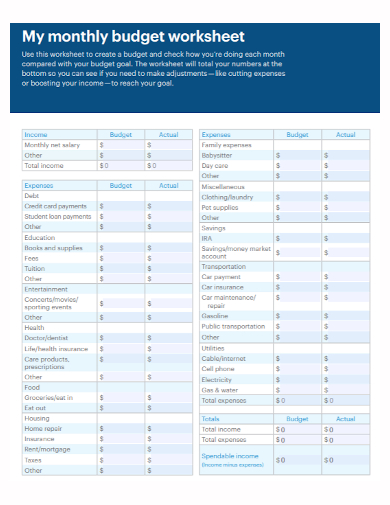

2. Monthly Budget Worksheet Form

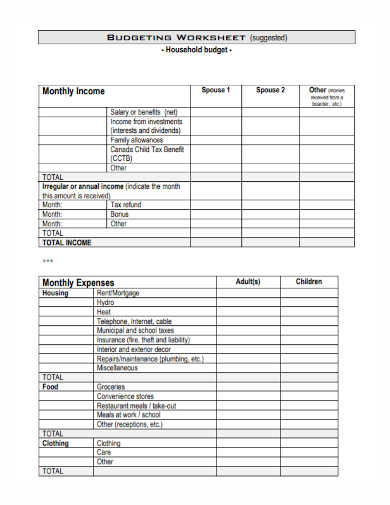

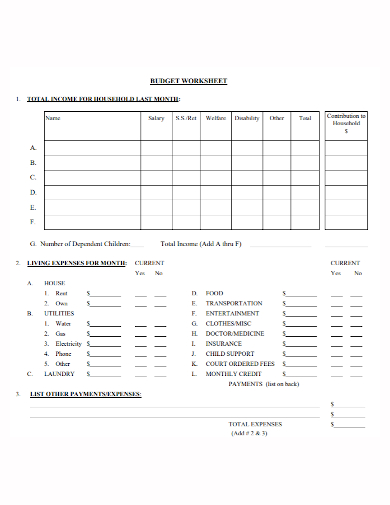

3. Household Budget Worksheet Form

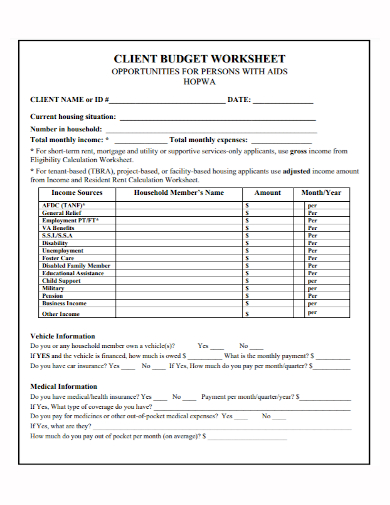

4. Client Budget Worksheet Form

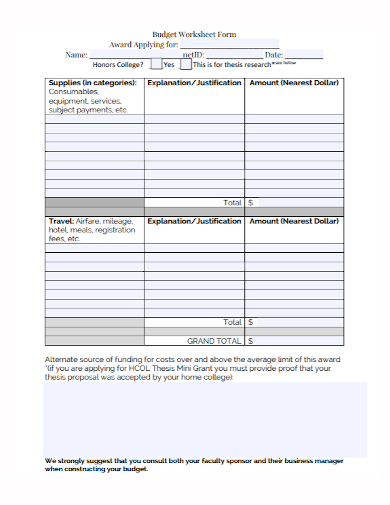

5. Sample Budget Worksheet Form

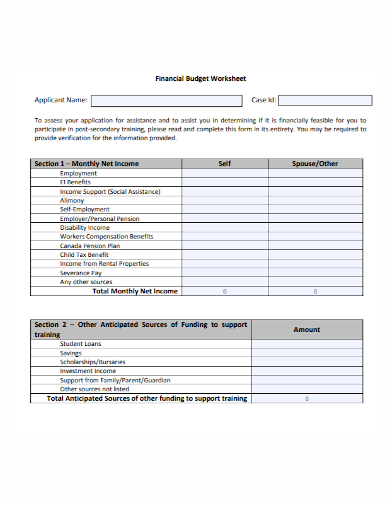

6. Financial Budget Worksheet Form

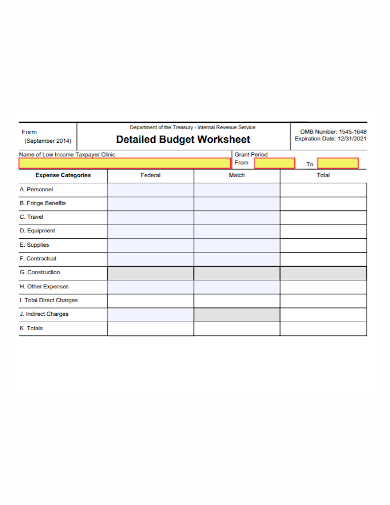

7. Detailed Budget Worksheet Form

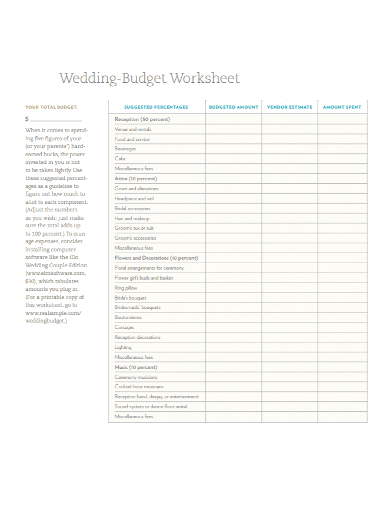

8. Wedding Budget Worksheet Form

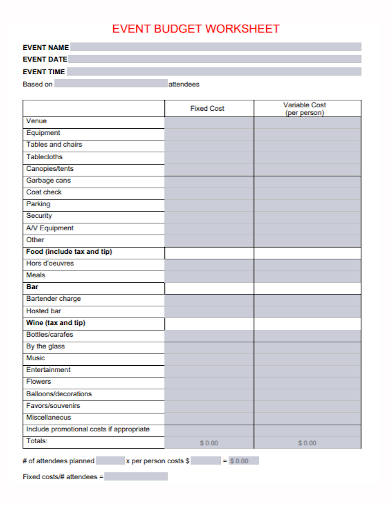

9. Event Budget Worksheet Form

10. Standard Budget Worksheet Form

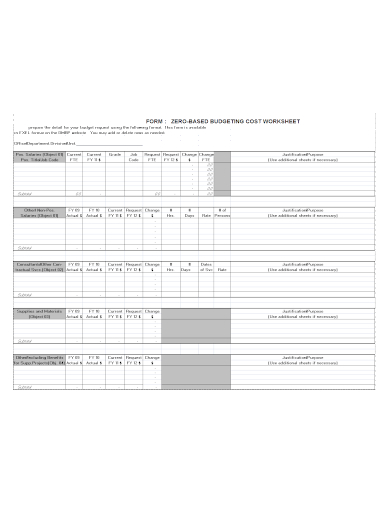

11. Budget Cost Worksheet Form

What Is Budget Worksheet Form?

A Budget Worksheet Form is a comprehensive way of breaking down and tracking both your income and expenses. It usually does so by grouping these into different categories. For each budget item, the worksheet contains a table with a number of pre-set headings and rows. Each project activity area has its own worksheet part with a list of all the resources required and in what quantities. This allows you to estimate how much each action will cost to complete.

How to Make Budget Worksheet Form

Money is controlled using a budget worksheet, and each cost is assigned a sufficient amount without depleting the coffers. A Budget Worksheet Form Template can help provide you with the framework you need to ensure that you have a well-prepared and robust worksheet on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Collect Financial Statements and Other Documents.

The best budget worksheet is the one that is the most accurate. This is why the simple act of gathering of all the documents that show you your personal or business’s income and expenses would be very beneficial. These could be from the bank, credit cards, investment accounts, paycheck stubs, benefits statements, and electronic equipment. You could confidently refer to these documents when doing the other steps that follow. However, you also have to make sure that these statements are dated appropriately and are in the correct timeframe.

2. Input Your Income and Sources.

List down your income by categorizing them into their respective sources. It is important to be knowledgeable of where the money comes from, because more often than not, there would be a certain pattern that comes from this source. This, then, would also help in predicting where to receive financial resources in the future. Include all of your regular income, including earnings (after taxes), commissions, self–employment income, child tax benefits, pensions, child maintenance and spousal support, and other sources of regular income.

3. Input Your Expenses.

In listing your expenses, you can check the financial statements that you have gathered to make sure of its accuracy. From these, you can calculate the expenses from that specified time. Expenses usually include utility costs, insurance, prescriptions, groceries, dining out, and student and other debts, mortgage, rent, and auto payments. Irregular bills like property taxes and car registration and insurance fees, which you may have to pay annually or semi-annually, should also be taken note of. Moreover, it is important to hold expenses accountable according to their different forms, whether the cost would be fixed, variable, or whatnot.

4. Check Everything.

After listing down everything, always check if you have inputted the correct amount (given the specified timeframe) and sources. Then, you can check if you’re budget is balanced or not. A balanced budget is one in which total expected income equal entire planned spending in the financial planning or budgeting process. If it’s not, then because of your detailed list, you can refer to which aspect of your budget is causing the unbalance, and adjust accordingly.

FAQ

What is the 50-30-20 rule in terms of budgeting?

The 50-20-30 rule is a money-management strategy that divides your salary into three categories: 50% for necessities, 20% for savings, and 30% for anything else.

What are the four phases to putting together a budget?

- Calculate your expenses.

- Calculate your earnings.

- Calculate your savings.

- Balance your budget.

Is there a personal budget template in Excel?

Managing your finances has never been easier than with an Excel budget template.

Thus, having a budget worksheet form is crucial in achieving financial responsibility. Not only does it refer to the past and present, but it would also help you in predicting the future state of your finances. More reasons to have a budgeting worksheet include making better financial decisions, planning for emergencies, getting out of debt, and staying focused on your long-term financial objectives. With our easy to download and edit samples, you are guided to making the most of your budget. So, go ahead and use them now!

Related Posts

Simple Will Forms

Sample Application Form Templates

Sample Employee Declaration Forms

Parent Consent Form Samples & Templates

Sample Release of Liability Forms

Sample Training Feedback Forms

Sample Sworn Affidavit Forms

Agreement Form Samples & Templates

Vehicle Inspection Forms Samples & Templates

Sample Employee Advance Forms

Sample Child Travel Consent Forms

Sample Testimonial Request Forms

Sample Employee Details Forms

Sample Divorce Forms

Sample Attestation Forms