Managing a business is a full-time job; from focusing on building your brand, finding new clients, to improving your products or services, you also need to focus on creating an efficient budget to stay top of all your operations. After all, your budget is one of the most crucial factors for you to consider when you make financial decisions. Financial decisions are what make your business thriving and sustainable especially since nowadays the market is volatile and unpredictable. Making a business budget is easy as long as you know the basics of what a budget is made up of. Read the article to know how to make a business expense budget.

10+ Business Expense Budget Samples

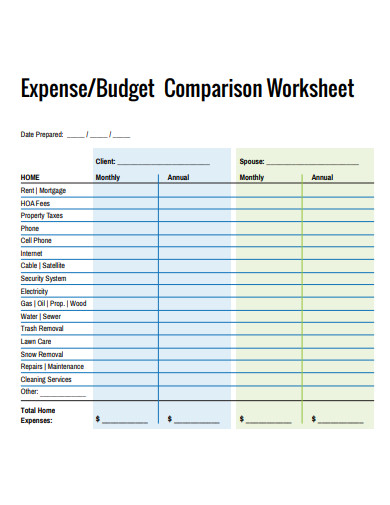

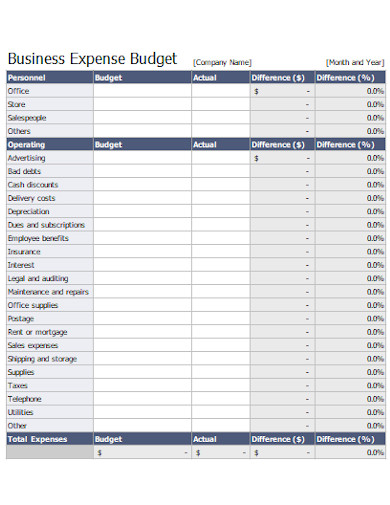

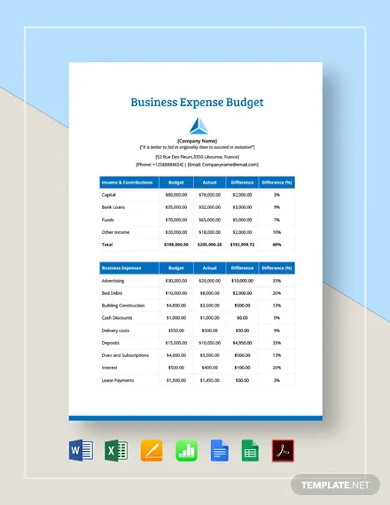

1. Business Expense Budget

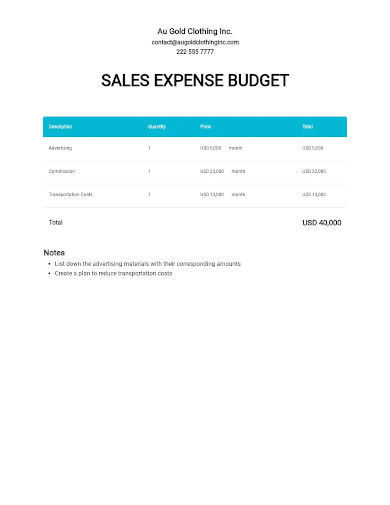

2. Business Sales Expense Budget

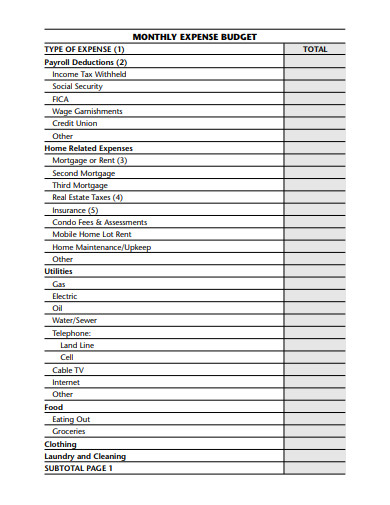

3. Business Monthly Expense Budget

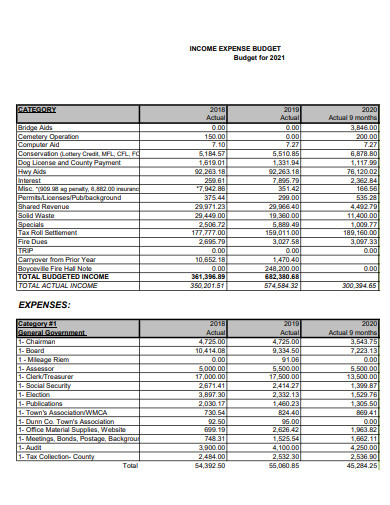

4. Business Income Expense Budget

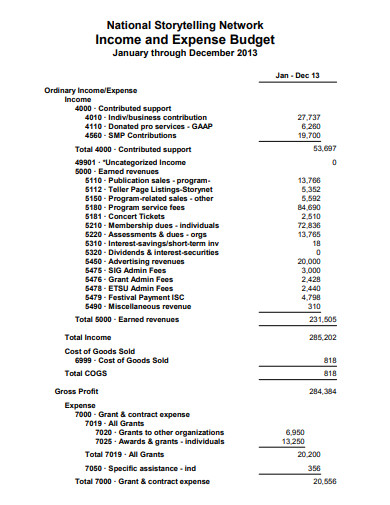

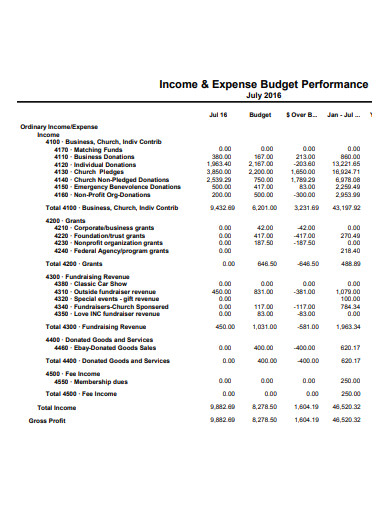

5. Business Income and Expense Budget

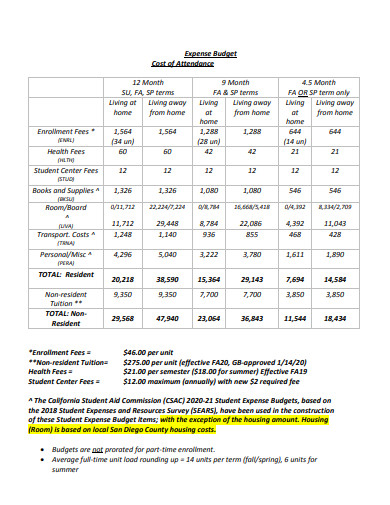

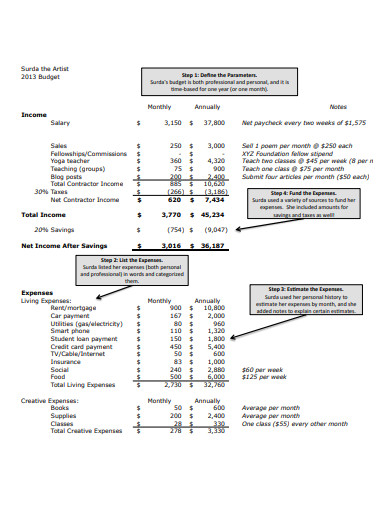

6. Sample Business Expense Budget

7. Simple Business Expense Budget

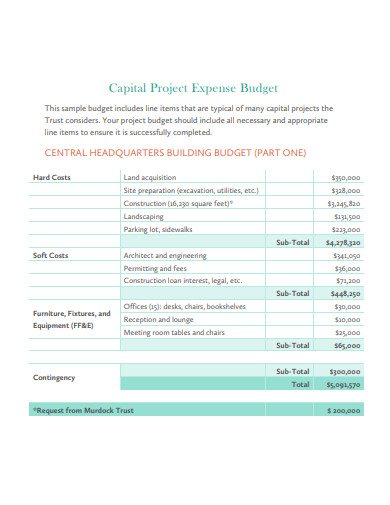

8. Business Project Expense Budget

9. Formal Business Expense Budget

10. Startup Business Expense Budget

11. Printable Business Expense Budget

What is an Expense Budget?

An expense business budget outlines a business’ finances. It serves as a financial roadmap that includes details such as the current state of the business’s income and expenses and their long-term financial goals. Business owners need to prioritize screening and analyzing their budget closely for them to evaluate where their finances currently stand to help them create future financial goals, identify where to cut spending, increase revenue and know how much money they have to land funding from investors or apply for business loans.

How to Make an Expense Budget for Your Business

1. Know Your Income Sources

Before you create your budget, you need to know first how much money your business is bringing in each month and find out where that money is coming from. You can do this by screening through your sales figure and other sources of income. Tally all of those to get a good picture of your monthly income.

2. Determine Your Fixed Costs

Now that you’ve gathered all details regarding where you get your income, it’s time to know what costs you have. Start by focusing first on determining your fixed costs. The fixed costs are those expenses that stay the same every month. Examples of fixed costs are rent, internet or phone plans, payroll costs, just to name a few. Once you’ve figured out your fixed costs, add them together to get their total amount. Categorize it as your monthly fixed expenses.

3. Determine Your Variable Costs

The next type of business cost you need to determine is your variable costs. These costs are the opposite of fixed costs; they vary each month depending on your business performance and activity. Some examples of variable costs are electricity, gas, shipping expenses, sales commissions, and travel costs. Tally all of your variable expenses and analyze how these expenses fluctuate every month. Analyzing the flow of these expenses is important to evaluate your business performance. This will determine if you need to spend more on the variable cost to help your business scale faster or you need to cut back some expenses if profits are lower than your projections.

4. Determine the One Time Purchases

Other types of costs that you also need to factor into your budget are the ones that you don’t regularly spend. If you need to make some one-time purchases such as buying new computers for your office, add these expenses to your budget to cover these expenses. These types of expenses are quite expensive so setting money aside for it can help protect your business from a large financial burden.

5. Set Aside a Budget for Unexpected Expenses

If there’s one thing certain in business, it’s that unexpected events happen. You might do any unplanned purchases or spend on any unexpected events like hiring IT consultants to deal with security breaches or fixing the interior pipes in your office that burst unexpectedly so you need to set aside some money to cover for those. Even if you’ve got insurance, it’s still smart to set aside money just in case the insurance doesn’t cover your unexpected expenses.

FAQs

What are the monthly expenses for a business?

The monthly expenses businesses usually have are:

Why is making an expense budget important?

Making an expense budget is important because it helps an individual control their spending by tracking their expenses. Through that, they can save money and stay focused on achieving their long-term financial goals.

What factors influence a business’s budgeting decisions?

The factors that could affect decisions when it comes to budgeting are:

- Size of available funds

- Long-term business goals

- Current events in both national and international

- Industry and competitor analysis

- Project return on investment

Once you’ve gathered all details of your income sources and your expenses, calculate and organize them to get a comprehensive view of your financial standing for the current month. Compare your income and your expenses to determine the overall profitability of your business. To help you get started making the budget for your business, download our free sample templates above to use as your guide!

Related Posts

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages

FREE 10+ Budget Tracker Samples in PDF | DOC

FREE 4+ Corporate Monthly Budget Samples in MS Word | Google Docs | Google Sheets | Excel