It’s finally the new year and people are making resolutions to improve themselves to welcome the year. One of the most common new year’s resolutions is for people to save money or to control their lousy spending habits and be smarter about handling money. A wise thing to do to be able to accomplish that resolution is by making a yearly budget planner. It is different compared to a weekly or monthly budget planner since the yearly budget planner focus on the overall income and expenses a person might have in a year and it also takes note of the yearly expenses that a person might have such as tax payments, home, and auto repairs, insurance costs, and special events such as birthdays or holidays. Creating a yearly budget planner is almost similar to a monthly or weekly planner but you have to think and plan a lot to make one. Read the article below to know how to create one.

5+ Yearly Budget Planner Samples

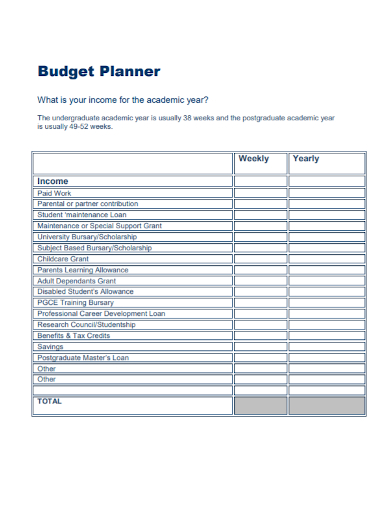

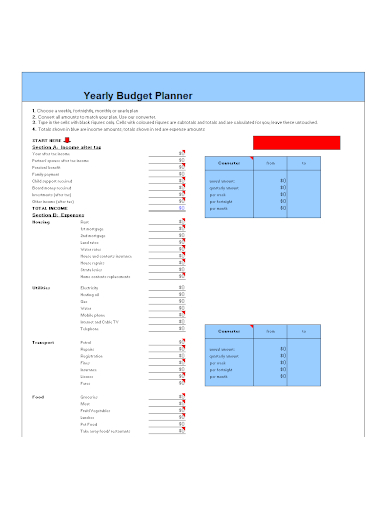

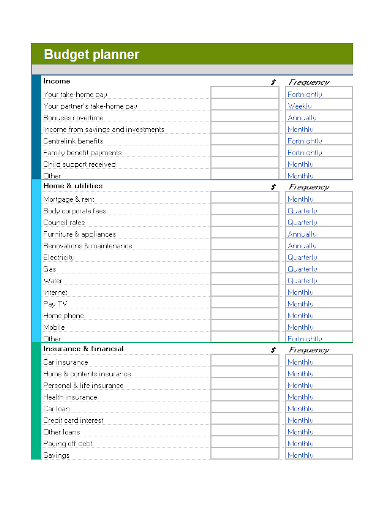

1. Yearly Income Budget Planner

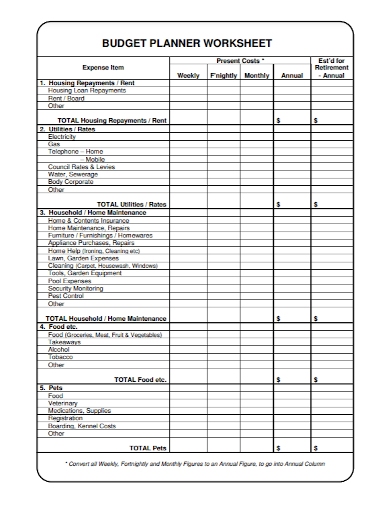

2. Yearly Budget Planner Worksheet

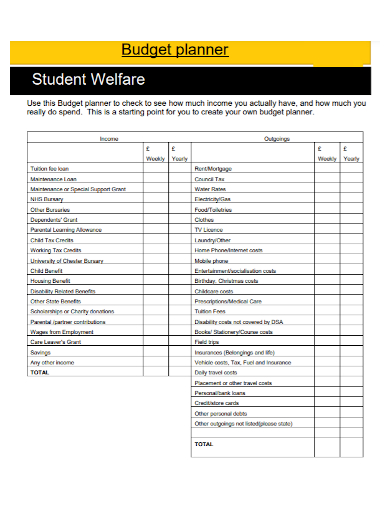

3. Student Yearly Budget Planner

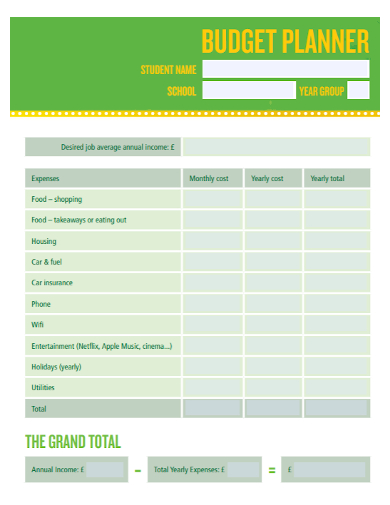

4. School Yearly Budget Planner

5. Sample Yearly Budget Planner

6. Standard Yearly Budget Planner

Importance of a Budget Plan

Budgeting, whatever type it is, is important because it helps a person control their spending by tracking their expenses to be able to save more money. Knowing how to budget helps a person to be more financially smart on making financial decisions and it prevents them from obtaining debt and even accomplishing their long-term financial goals.

How to Create a Yearly Budget Planner

- Take note of your monthly income and multiply it by 12 to estimate your annual income. If you’re paid weekly, multiply it by 52.

- Brainstorm and be creative to figure out all of your potential fixed weekly expenses and then multiply them by 52. Estimate then your fixed monthly expenses and then multiply them by 12.

- Add the weekly and monthly fixed expenses to obtain the total amount. This amount is your more or less will be your annual fixed expenses. If your expenses exceed your income, now is the time to think of any costs that you should cut off. This will prevent you from having any debt just to pay off your expenses.

- Take note then of your annual expenses. This may include tax payment, mortgage payment, renewal of licenses and permits, and other various expenses that you acquire yearly. Add the total of these expenses if you know their amount. Review these expenses costs just in case if there is an update to the costs.

- Another thing to take note of is to foresee any disasters that may potentially happen that will hurt your budget. Some of these examples are auto, home, or appliance repairs, utility costs, health insurance costs. Estimate the expenses of each of these situations and add them. The total amount must be the basis for your emergency fund.

- The last thing to take note of is special occasions that will dent your budget. Events such as birthdays, weddings, holidays, vacations, etc. occur yearly and you should set aside money to afford those fun events. The last thing you want to do is to cancel celebrating these events because you squandered your money. Estimate the total amount of the costs you might have.

- Add all the expenditures mentioned above to get the total. Your goal should be that your annual expenses are lower than your annual income.

- If you want to create a weekly or monthly budget planner, simply divide your annual budget by 12 to get your monthly budget and divide by 52 to obtain your weekly budget.

FAQs

What is the 50-20-30 budget rule?

The 50-20-30 rule is a smart technique that helps you manage your money by dividing your monthly income into three categories: 50% for the essentials (such as monthly bills, food, transportation, groceries, rent costs, etc), 20% for savings, and 30% for other costs or emergencies.

What are the seven types of budget in accounting?

The seven types of budget in accounting are performance budget, fixed budget, flexible budget, incremental budget, rolling budget, and cash budget.

Once you’re done creating your budget plan, make sure to use it as your guide on how to budget for your monthly or weekly spending by tracking your progress and your spending habits. This will help you improve on how you handle your finances and be wiser on spending it on things that matter. You can even fulfill your financial goals if you’re determined enough to follow your budget planner every day. To help you get started to create your budget calendar, download our free sample templates above to use as your reference!

Related Posts

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages

FREE 10+ Budget Tracker Samples in PDF | DOC

FREE 4+ Corporate Monthly Budget Samples in MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Profit and Loss Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF