A budget is a microeconomic concept that depicts the exchange that occurs when one commodity is substituted for another. In respect of the bottom line—or the final outcome of this trade-off—a cash flow budget anticipates profits, a balanced budget anticipates revenues equaling expenses, and a shortfall budget anticipates expenses exceeding revenues. The majority of people require some method of determining where their money goes each month. A budget can help you regain a sense of control of your budget to make saving money for your objectives easier. The key is to find a method of keeping track of your finances that suits for you.

10+ Budget Outline Samples

A budget is a forecast of revenue and expenses over a particular determined period of time that is usually prepared and updated on a regular basis. Budgets can be created for an individual, a group of individuals, a company, a government, or almost anything else that generates and spends money. Budgeting is essential for managing monthly spending, preparing for life’s unanticipated occurrences, and being able to finance big-ticket things without falling into debt. Keeping track of your income and expenses doesn’t have to be a chore; it doesn’t need you to be a math genius, and it doesn’t mean you can’t buy the items you want. It simply implies that you’ll have more control over your budget because you’ll know where your cash goes.

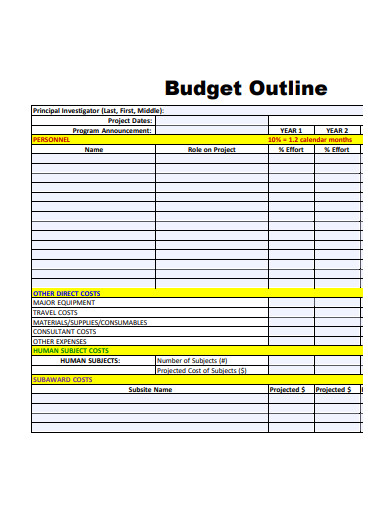

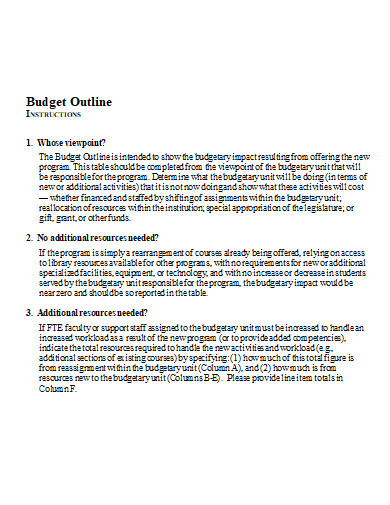

1. Budget Outline

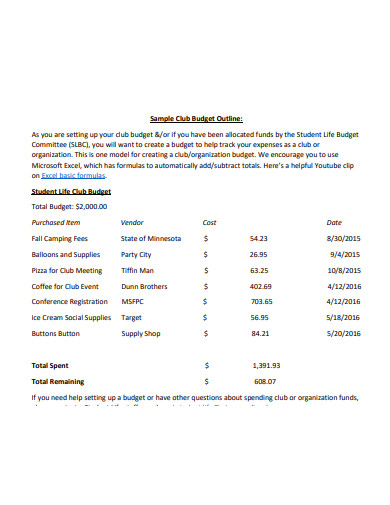

2. Club Budget Outline

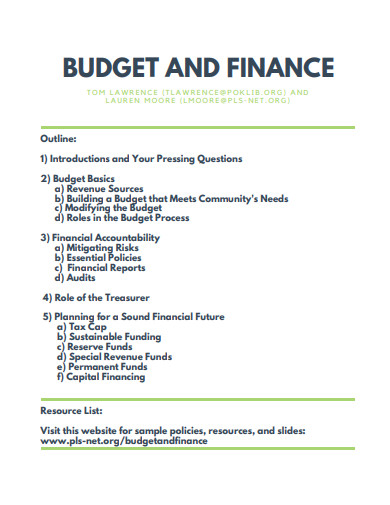

3. Budget and Finance Outline

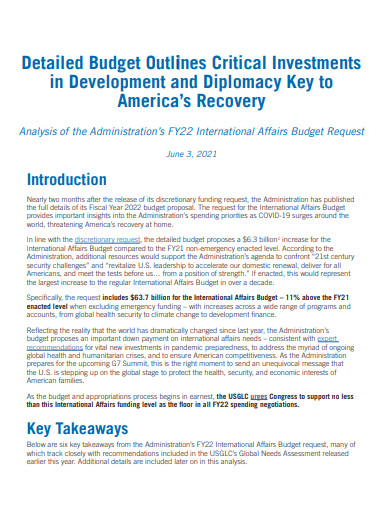

4. Investment Budget Outline

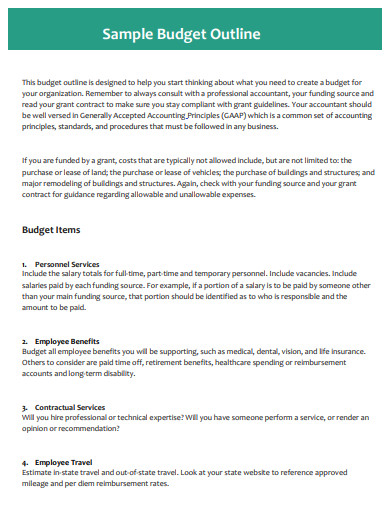

5. Sample Budget Outline

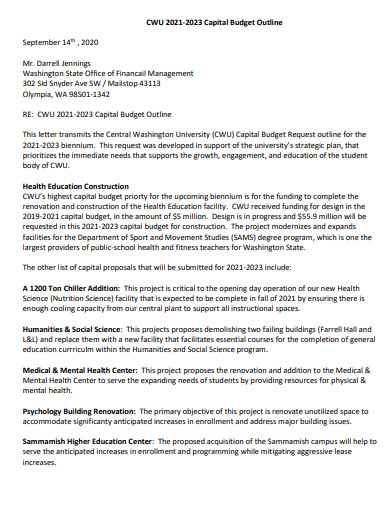

6. Capital Budget Outline

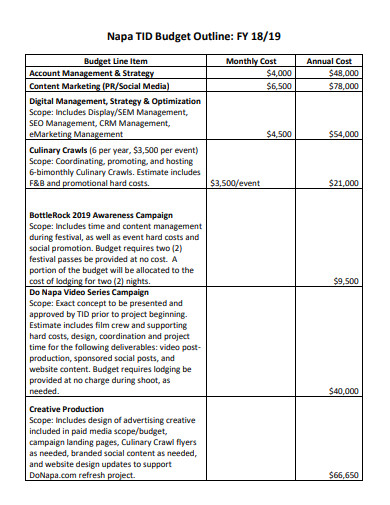

7. Simple Budget Outline

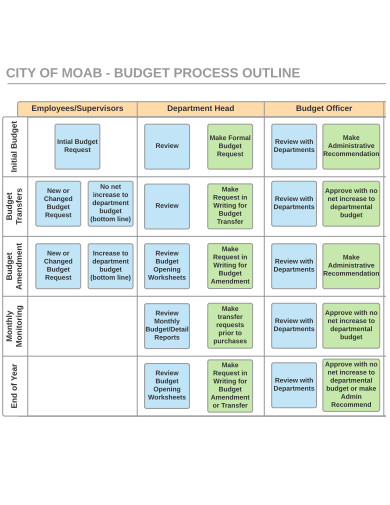

8. Budget Process Outline

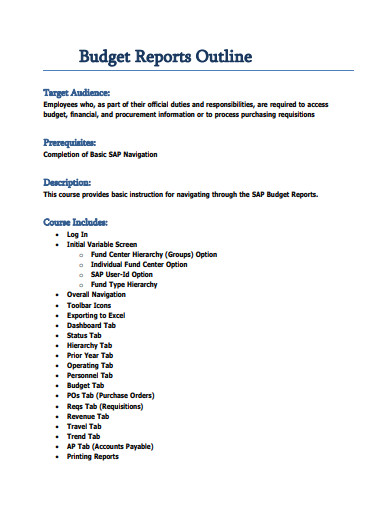

9. Budget Reports Outline

10. Professional Budget Outline

11. Printable Budget Outline

Creating a Budget

The budget is distributed in a packet that explains the guidelines and rules that went into its creation, including market estimates, key vendor relationships that give discounts, and details of how specific calculations were done.

Calculate your net income

Your net income is the bedrock of a successful budget. That’s your take-home pay, which is the sum of your income or salary excluding taxes and employer-provided benefits like retirement benefits and medical insurance. Relying on your total salary rather than your net income may lead to excessive spending because you will believe you have more cash than you actually do. If you’re a freelancer, gig worker, contractor, or self-employed, keep meticulous records of your contracts and payments to help you navigate fluctuating income.

Track your spending

The next stage is to determine where the money goes once you determine how much money would come in. Monitoring and classifying your expenses will help you figure out where you consume the most money and where you can save the most money. Start by making a list of your regular bills. Monthly bills such as mortgage payment, utilities, and auto payments fall into this category. Next, make a list of your different expenses, such as groceries, petrol, and entertainment, which can fluctuate from month to month. This is an aspect where you might be able to save money. Credit card and bank statements are fantastic places to start because they quantify and classify your monthly expenses.

Set realistic goals

Generate a checklist of your short- and long-term savings plan before you start combing through the data you’ve collected. Putting up an emergency fund or paying off credit card debt are examples of short-term goals that should take one to three years to fulfill. Long-term goals, like as retirement planning or funding your child’s school, might take decades to achieve. Remember that your goals shouldn’t have to be nailed down, but knowing what they are might help you stay on track with your budget. If you know you’re saving for a vacation, for example, it may be simpler to minimize costs.

Make a plan

This is where it all comes together: how much you’re spending vs how much you want to spend. To obtain an idea of what you’ll spend in the following months, use the variable and fixed expenses you accumulated. Then do a comparison using your net revenue and priorities. Consider establishing specific—and attainable—spending limitations for each expense area. You could further divide your costs into necessities and desires. For example, if you drive down the road every day, gasoline is a requirement. A monthly music subscription, on the other hand, can be considered a want. When you’re looking for strategies to channel money toward your savings goals, this distinction is critical.

Adjust your spending to stay on budget

You may make any required modifications now that you’ve documented your income and spending so that you don’t overspend and have money to invest toward your goals. Cuts should be made first in the area of your “wants.” If the figures still don’t work up, you might want to consider altering your fixed expenses. Could you, for example, save more money on auto or homes insurance by shopping around? Such selections entail significant trade-offs, so carefully consider your options. Remember that even modest sums of money can build up quickly. You might be amazed at how much money you can save by making small changes over time.

Review your budget regularly

Once you’ve established your budget, it’s critical to check it and your expenditures on a frequent basis to ensure you’re on track. Few aspects of your budget are set in stone: you might get a raise, your costs might change, or you might achieve one goal and wish to establish another. Whatever the cause, make it a practice to review your budget on a regular basis by following the procedures outlined above.

FAQs

What are corporate budgets?

Budgets are an essential component of running a successful and efficient business. The procedure starts with setting budget projections for the coming fiscal year. These assumptions are based on expected sales patterns, cost trends, and the market, industry, or sector’s overall economic outlook. Specific aspects that may affect possible expenses are discussed and tracked.

What are personal budgets?

Individuals and families can create their own budgets. Budgeting isn’t just for those who need to keep a close eye on their cash flow monthly payments because “money is tight.” Almost everyone, including those with large paychecks and lots of cash in the bank, may benefit from it.

In general, budgeting process begins with tracking expenses, debt elimination, and the creation of an emergency fund once the budget is set. However, you may begin by putting together a partial emergency savings to expedite the process. This emergency fund serves as a buffer while the remainder of the budget is put in place, and it should be used instead of credit cards in case of an emergency. The goal is to contribute to the fund on a regular basis, allocating a set amount of each paycheck to it and, if possible, adding whatever you can on top. This will also cause you to consider your spending.

Related Posts

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages

FREE 10+ Budget Tracker Samples in PDF | DOC

FREE 4+ Corporate Monthly Budget Samples in MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Profit and Loss Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF