10+ Expense Budget Samples

Managing expenditures is one of the most important aspects of excellent business management. It all starts with a spending plan. Set a target for your budget, then review and update it frequently to keep on track. Being on budget is typically a good thing, but excellent management requires a constant evaluation of the timeliness, efficiency, and results of your company’s expenditures. Estimate expenses based on sales and costs, as well as your planned activities, using your expertise, informed guessing, a little research, and common sense. Need some help with this? We’ve got you covered! In this article, we provide you with free and ready-made templates of Expense Budgets in PDF and DOC formats that you could use for your benefit. Keep on reading to find out more!

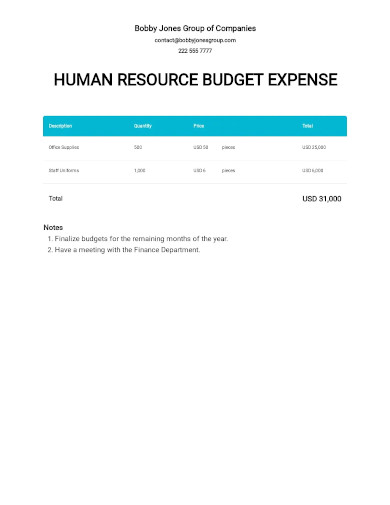

1. Human Resource Budget Expense Template

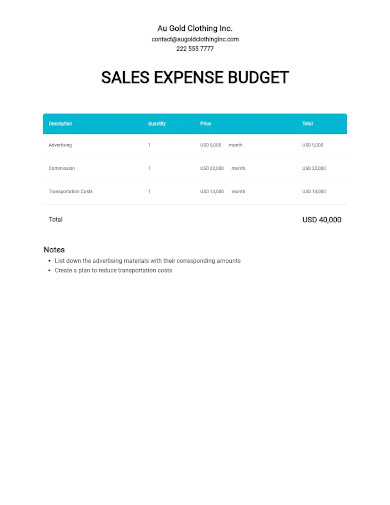

2. Free Sales Expense Budget Template

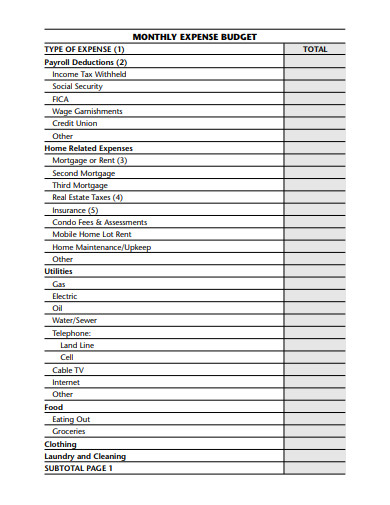

3. Monthly Expense Budget

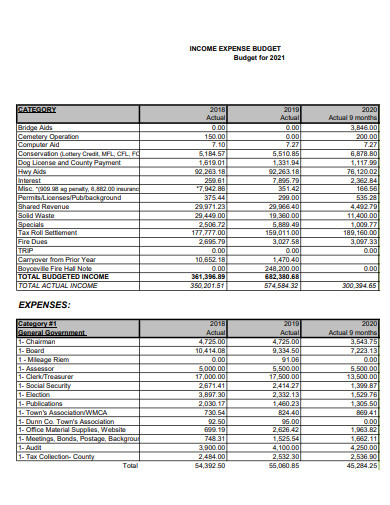

4. Business Income Expense Budget

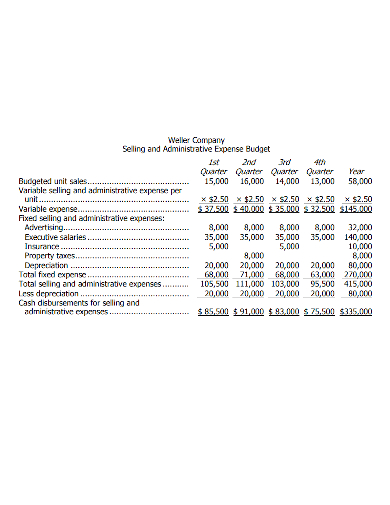

5. Company Sales Expense Budget

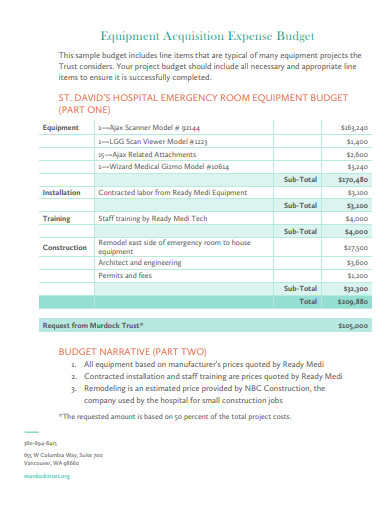

6. Equipment Acquisition Expense Budget

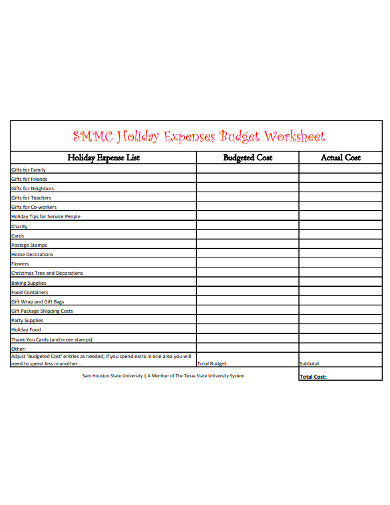

7. Holiday Expenses Budget Worksheet

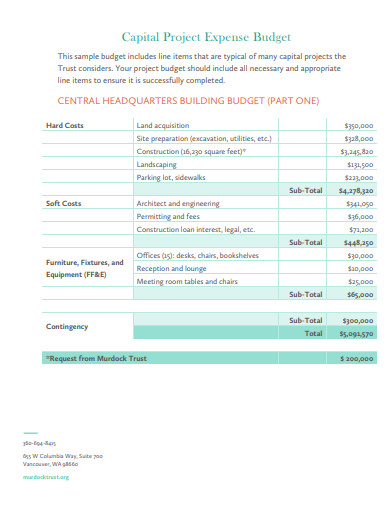

8. Capital Project Expense Budget

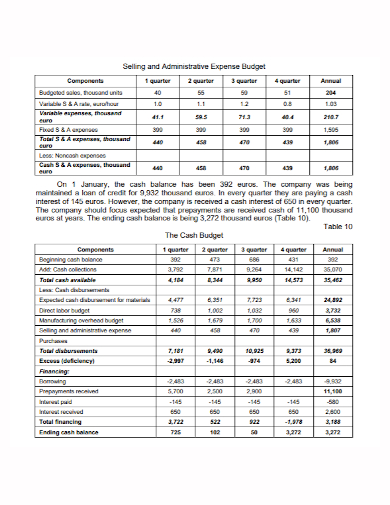

9. Sales Administrative Expense Budget

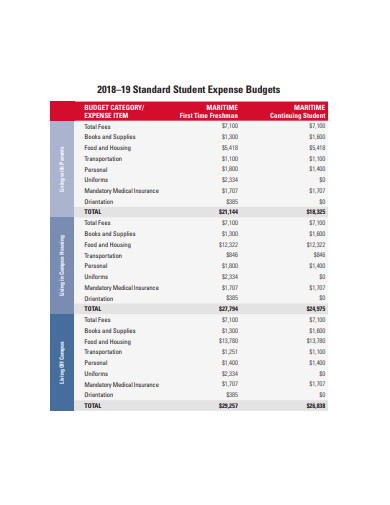

10. Standard Student Expense Budget

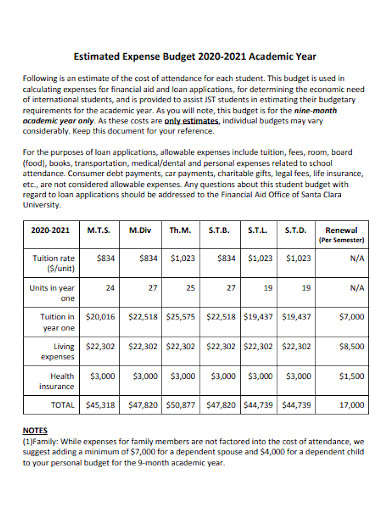

11. Estimated Expense Budget

What Is an Expense Budget?

Budgeting determines existing capital, estimates expenditures, and forecasts incoming revenue. Businesses can use an expense budget to keep track of purchases and keep running costs to a minimum. Managers may align spending with tax strategies and cash flows by carefully preparing and analyzing their budgets. It provides a thorough examination of various sorts of expenditures as well as a general explanation for the differences in estimates.

How to Make an Expense Budget

Businesses may compare performance to expenditures and ensure that resources are available for projects that promote business growth and development by consulting the budget. An Expense Budget Template can help provide you with the framework you need to ensure that you have a well-prepared and robust budget on hand. To do so, you can choose one of our excellent templates listed above. If you want to write it yourself, follow these steps below to guide you:

1. Recognize the objectives of your company.

It’s critical to have a clear knowledge of the goals your business is pursuing throughout the budget period before you start putting together your budget. You may design a budget that corresponds with and helps those goals by first knowing them. Consider a firm that is launching a new product or service. To expand the budding business line, the corporation may invest more substantially in it. In order to achieve this goal, the corporation may need to cut costs or scale down growth ambitions elsewhere in its budget.

2. Involve the appropriate individuals.

It’s advisable to request estimates of figures for your budget from workers with financial responsibilities, such as sales objectives, manufacturing expenses, or specialized project control. You’ll come up with a more realistic budget if you compare their projections to your own. They will be more committed to sticking to the budget as a result of their engagement.

3. Include all required information in the budget.

On a month-by-month basis, your cash budget estimates your future financial situation. This type of budgeting is critical for small businesses since it allows you to identify any problems you may be facing. It should be checked at least once a month. You can anticipate earnings for the following 12 months using your sales and spending estimates. This will allow you to examine your margins as well as other important ratios like your return on investment.

4. Make use of your budget to track your progress.

You will be establishing a financial action plan if you base your budget on your company strategy. This may serve a number of purposes, especially if you examine your finances on a regular basis as part of your annual planning process. Comparing your budget year to year may be a great method to evaluate your company’s success – you can compare your predicted statistics, for example, to past years to see how well you’re doing.

FAQ

What exactly is an expense plan?

A small firm might utilize an expenditure plan, also known as a spending plan, as a strategic tool to manage money.

What is an expense budget’s purpose?

An expenditure budget aids organizations in keeping track of purchases and keeping running costs to a minimum. Managers may align spending with tax strategies and cash flows with proper planning and research.

What is the 72-hour rule?

The Rule of 72 is a formula that calculates how long it will take to double your money at a certain rate of return.

You’ll need to examine and update your budgets on a regular basis if you want to make the most of them. This is especially true if your company is expanding and you want to expand into other sectors. To help you get started, download our easily customizable and comprehensive samples of Expense Budgets today!

Related Posts

FREE 10+ Annual IT Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Personal Budget Planner Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Numbers | Apple Pages | PDF

FREE 5+ Yearly Budget Planner Samples in PDF | XLS

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages