Daily entry of a company’s financial projections into predetermined accounts is the core function of bookkeeping, which refers to the process as a whole. It might also refer to the various methods of record keeping that companies have at their disposal. There are several reasons why maintaining an accurate bookkeeping agreement is necessary to the scope of work for the accounting process. When transaction data are kept up to date, it is possible to compile reliable financial reports, which help evaluate the operation of a company business. If your taxes are audited, having detailed records will also come in helpful.

10+ Bookkeeping Samples

1. Priciples of Bookkeeping

2. History of Bookkeeping and Accounting

3. Introduction to Bookkeeping

4. Sample Bookkeeping Business Plan

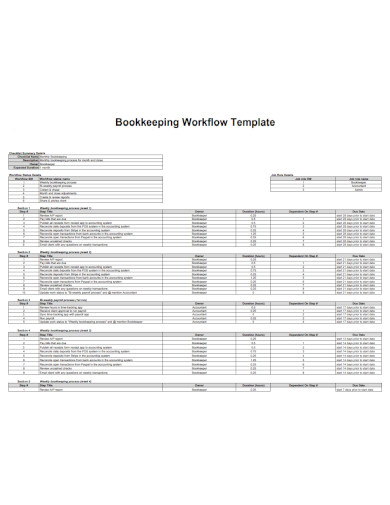

5. Bookkeeping Workflow Template

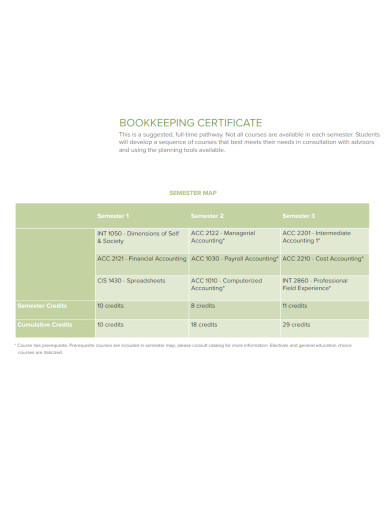

6. Bookkeeping Certificate Template

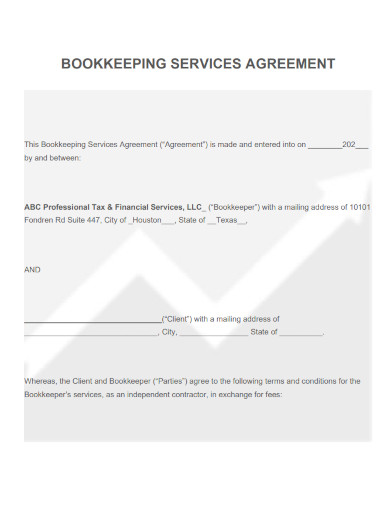

7. Bookkeeping Service Agreement

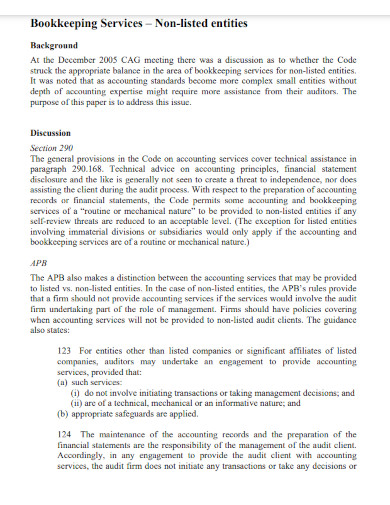

8. Bookkeeping Services

9. Double Entry Bookkeeping

10. Bookkeeping in Business Success

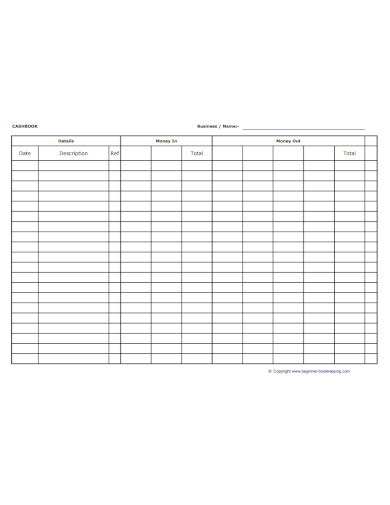

11. Bookkeeping Forms

What Is Bookkeeping?

Bookkeeping is the process of tracking and recording a business’s financial transactions. These business activities are recorded based on the company’s accounting principles and supporting documentation. Moreover, business actions can be recorded by hand in a journal report or an Excel spreadsheet. Many startup businesses use bookkeeping software to track their financial history to make things easier. Your company will be able to maintain a close eye on its financial capabilities and its monthly progress toward increased earnings, groundbreaking account growth, and the success that it rightfully deserves if you have your bookkeeping in order.

How To Make a Bookkeeping?

There is nothing more frustrating than having to sift through an excessive number of statements to locate a single nugget of data that, despite its size, is essential for accurate bookkeeping. As a result, to be of assistance to you, we strongly suggest you create such a document by following the instructions below.

1. Consider a Phased Strategy

Putting your company in jeopardy by attempting to manage too many tasks at once is a fruitless endeavor. Consider a phased transition to digital bookkeeping if you are interested in switching from manual bookkeeping. Performing a complete overhaul all at once can be stressful and depressing; therefore, it is advisable to take things gently and make changes that are significant and thoughtful.

2. Keep The Latest General Ledger

A general ledger is a set of accounts used to organize and keep all of the records linked with an organization’s financial activities. Accounts from the balance sheet (liabilities, equity, and assets) and accounts from the income statement are included in the general ledger (revenue, expenditure, gains, losses).

3. Plan For Taxes

Maintaining your company’s financial records and costs throughout the year is essential, whether this involves keeping your books up to date or communicating with your tax consultant. When it comes time to file your taxes with the IRS, you will be well prepared if you do it in this manner. You can confidently enter tax season without worrying about any hitches or last-minute scrambling.

4. Keep Your Personal and Business Finances Separate

As you progress further into the process of bookkeeping, it may be tempting to blur the lines between your personal finances and those of your business. However, doing so is not the wisest course of action. If you steer clear of doing this, you will lessen the likelihood of drawing the attention of the Internal Revenue Service (IRS), and you will be able to obtain a more precise picture of the financial state of your company.

Do you allow me to keep my books?

Single-entry bookkeeping is probably the best option if you are just getting started, keeping your books on your own, and are still in the hobby stage of bookkeeping.

What is bookkeeping easily?

Daily entry of a company’s financial transactions into predetermined accounts is the core function of bookkeeping, which refers to the process as a whole.

What are the differences between the two kinds of bookkeeping?

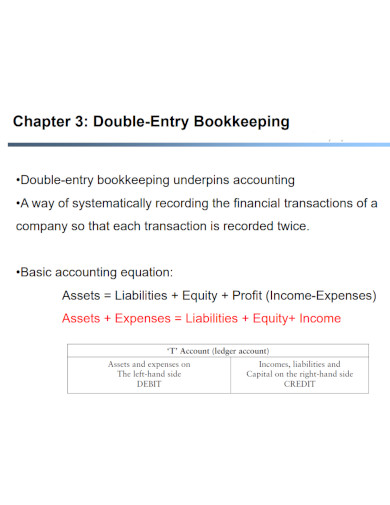

The two most frequent bookkeeping approaches are known as the single-entry and double-entry systems.

Creating financial statements for your company, such as balance sheets, income statements, and cash flow statements will assist you in gaining a better understanding of the current state of your company and evaluating its overall performance. You must have records of your transactions that are adequately recorded for these reports to provide an accurate portrayal of your company. When you are trying to reconcile your accounts, keeping these data as up-to-date as possible is beneficial.

Related Posts

Sample Material Lists

Sample Excuse Letter for School

Feature Writing Samples

FREE 14+ Sample Music Concert Proposal Templates in MS Word | Google Docs | Pages | PDF

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Assurance Agreement Samples In MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF