Some company businesses will bill customers for services and sold products that are not directly related to their core competencies using debit notes. For instance, if a company subleases some of the warehouse inventory space it owns, it may issue a debit note for the amount of the rent. Payment invoices that contain typos can sometimes be amended with the help of debit note sample. If a customer is underbilled on an invoice, a debit note may be issued for the amount that should have been billed to the customer.

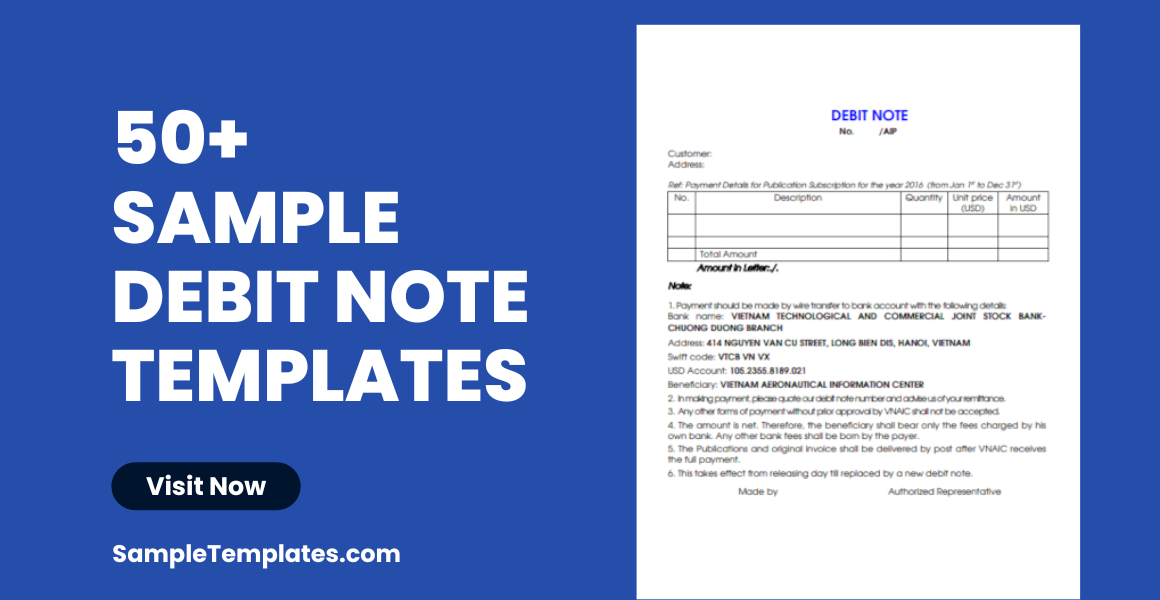

50+ Debit Note Samples

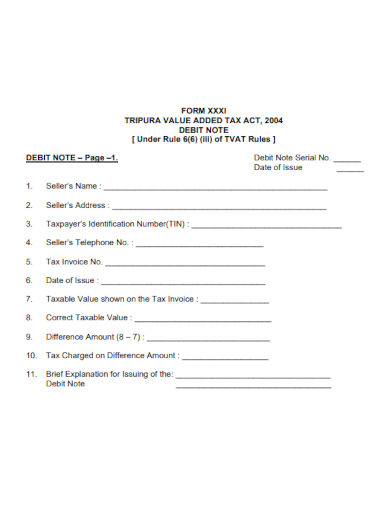

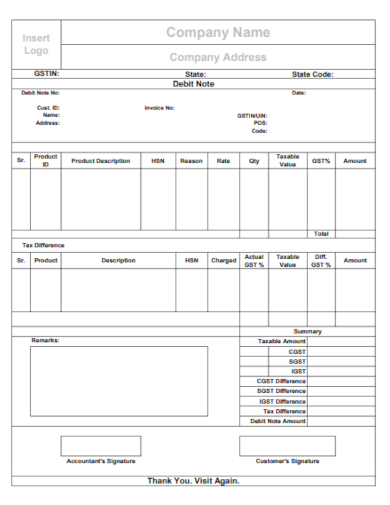

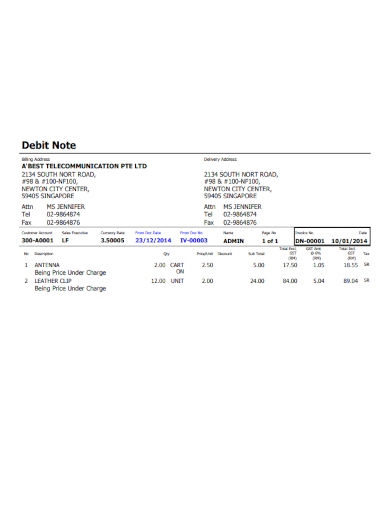

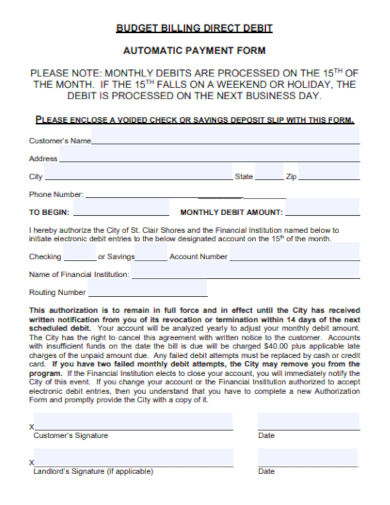

1. Debit Note Form

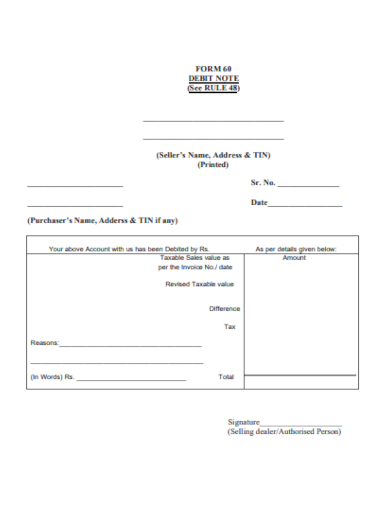

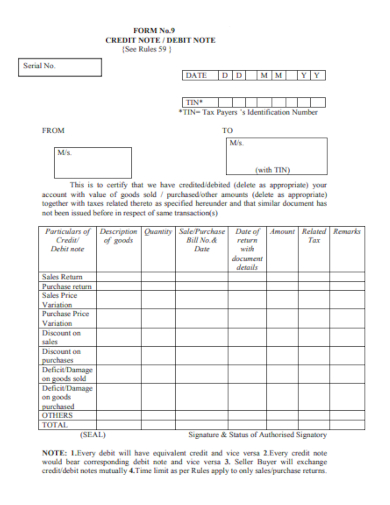

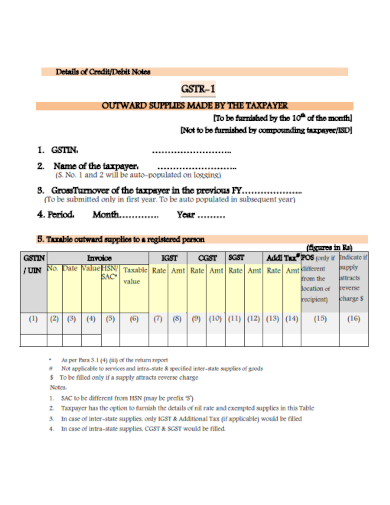

2. Taxable Debit Note

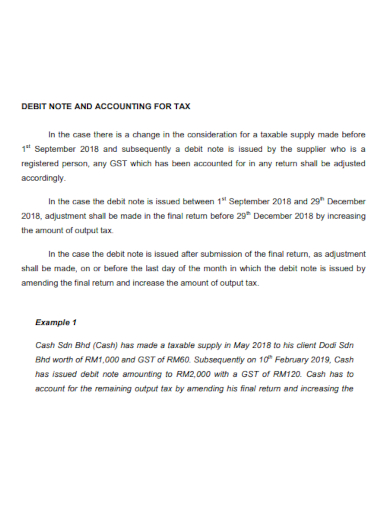

3. Format of Debit Note

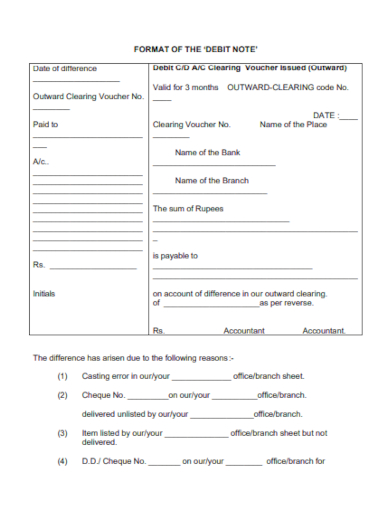

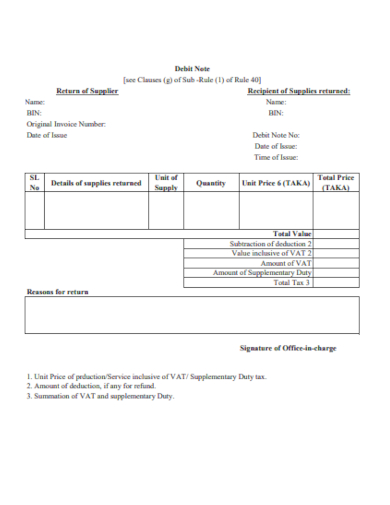

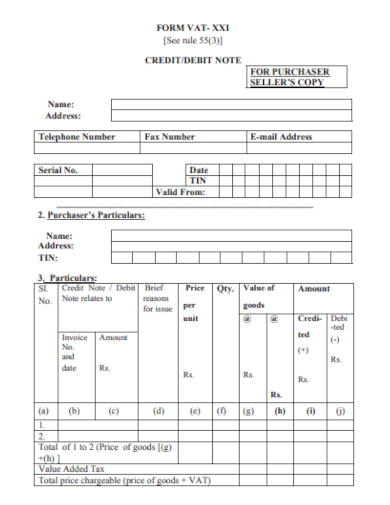

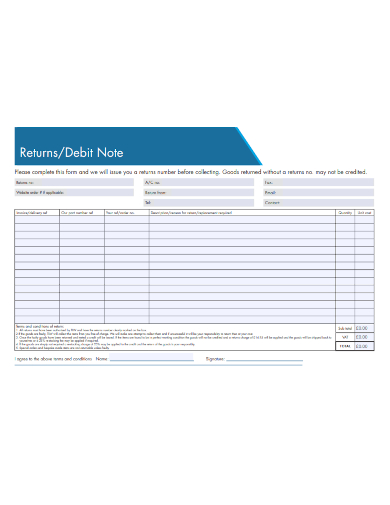

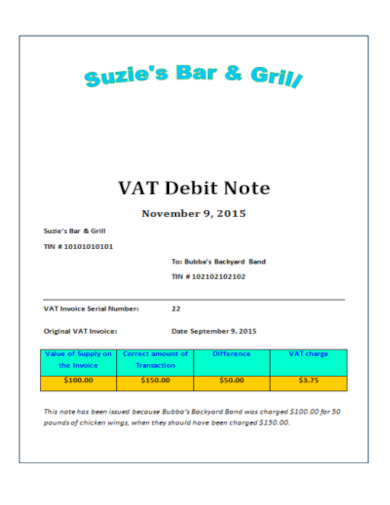

4. Value Added Debit Note

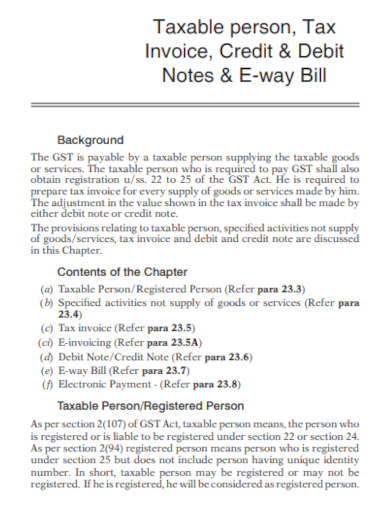

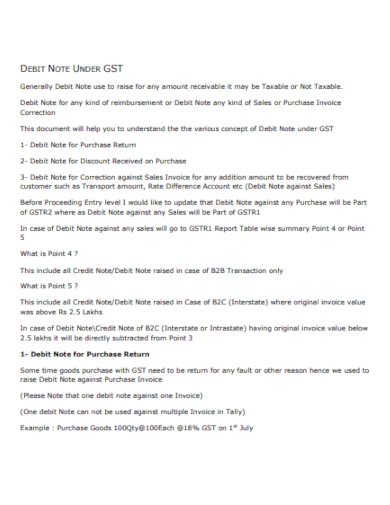

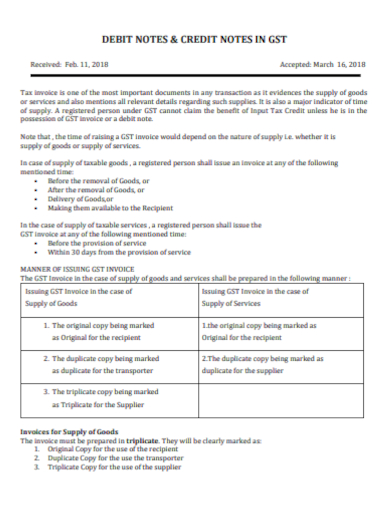

5. Debit Note Under GST

6. Invoice Debit Note

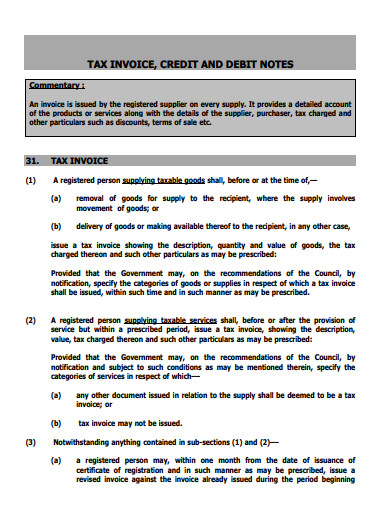

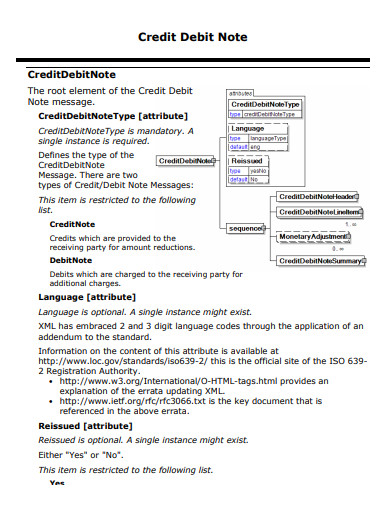

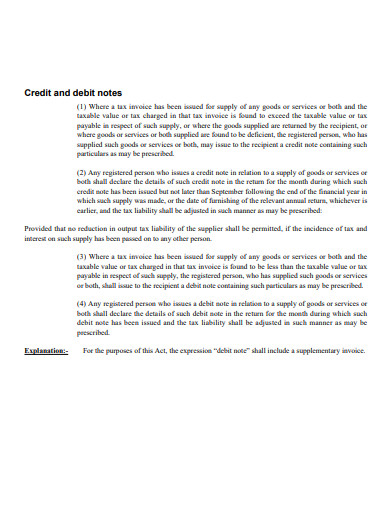

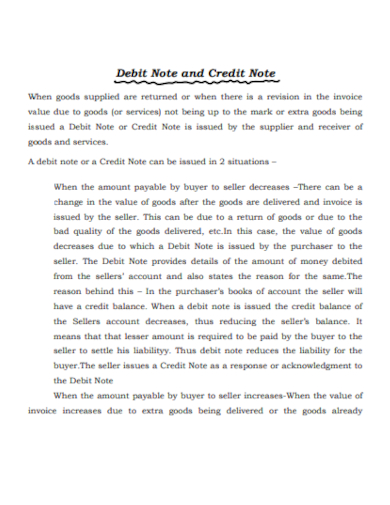

7. Credit and Debit Note

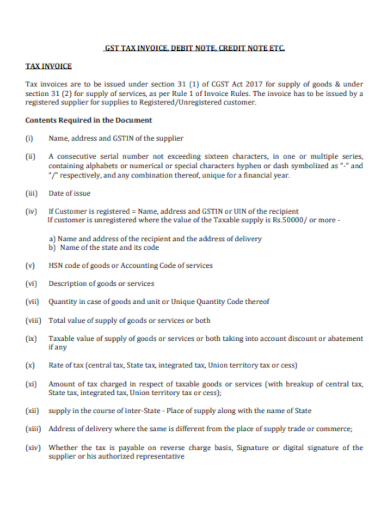

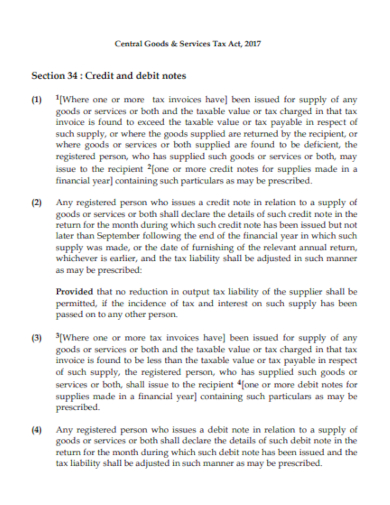

8. GST Tax Debit Note

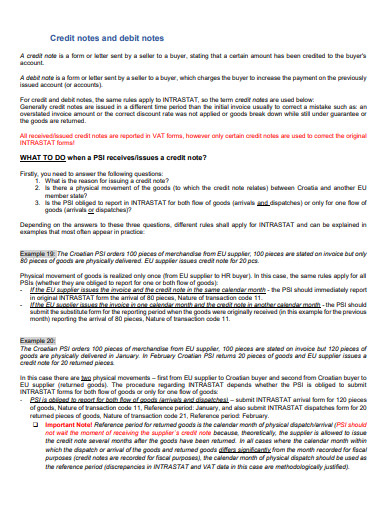

9. Sample Credit and Debit Note

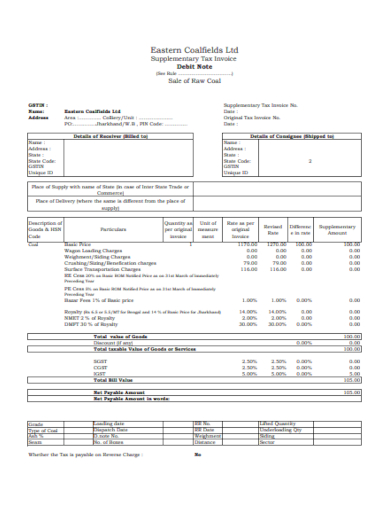

10. Supplementary Tax Invoice Debit Note

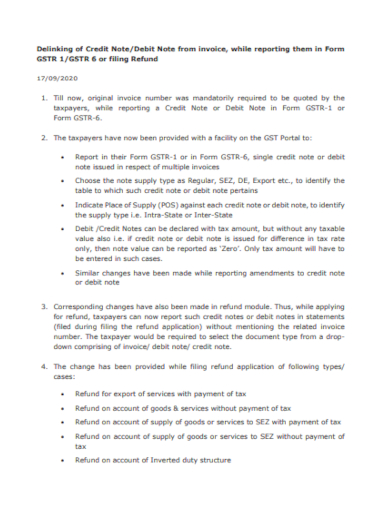

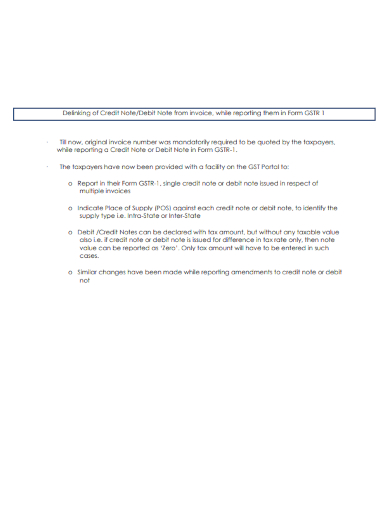

11. Debit Note from Invoice

12. Simple Credit and Debit Note

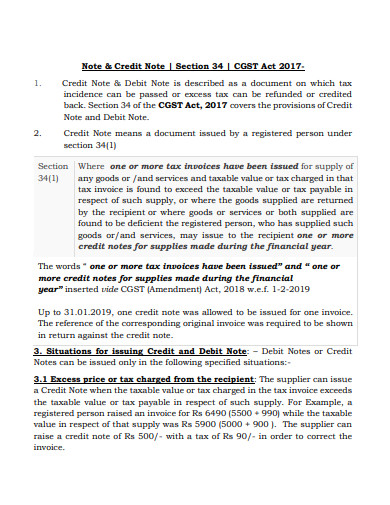

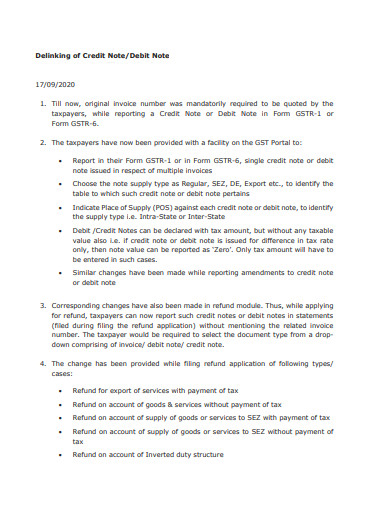

13. Credit and Debit Note in GST

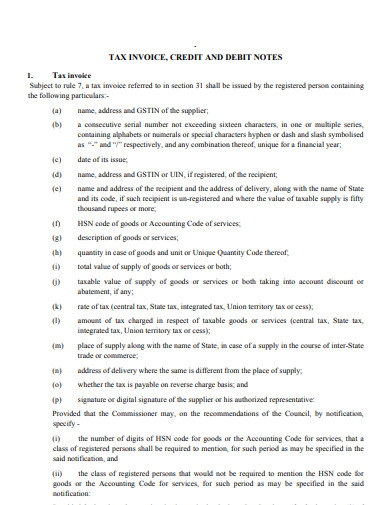

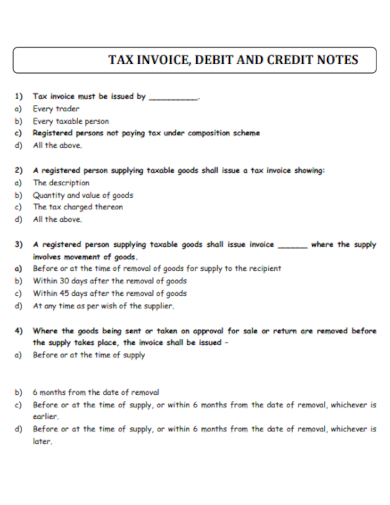

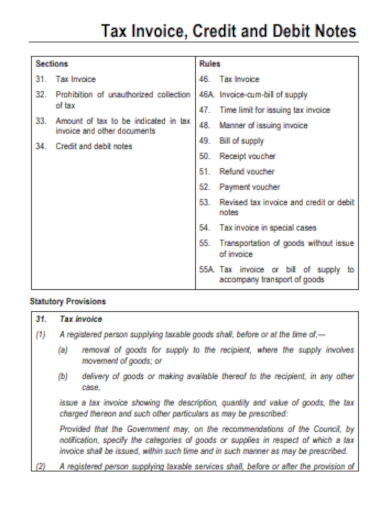

14. Tax Invoice, Credit and Debit Note

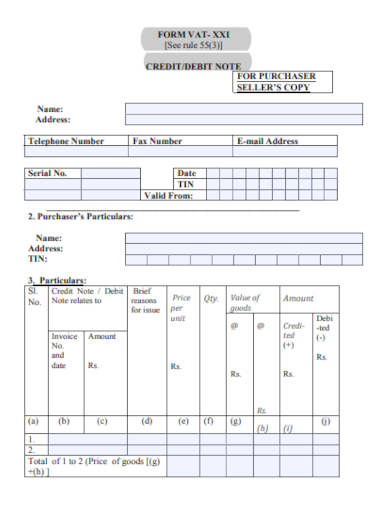

15. Purchaser Credit and Debit Note

16. Formal Debit Note

17. Basic Credit and Debit Note

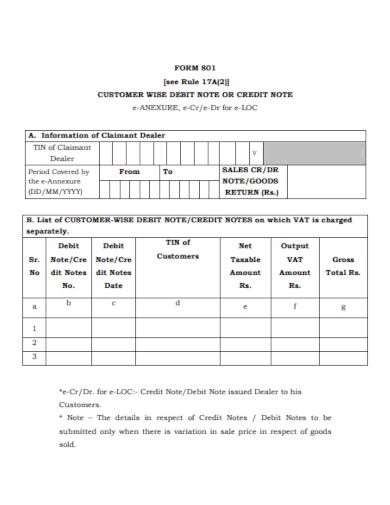

18. Customer Wise Debit Note

19. Credit and Debit Note Example

20. Goods and Services Debit Note

21. Credit and Debit Note Format

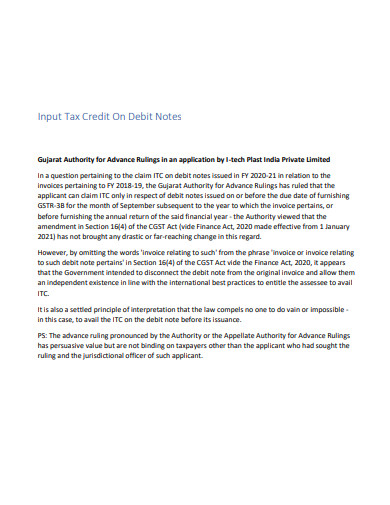

22. Input Tax Credit On Debit Notes

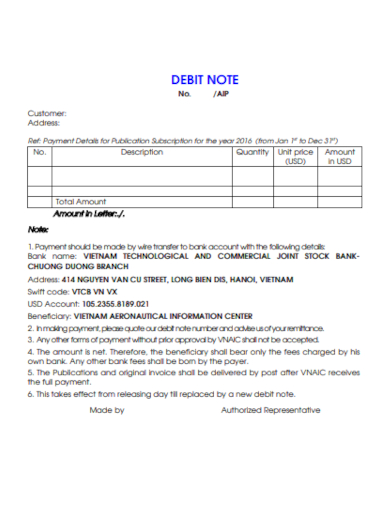

23. Customer Payment Debit Note

24. Professional Credit and Debit Note

25. Debit Note Document

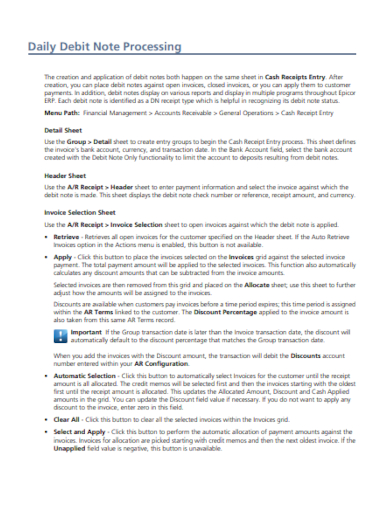

26. Daily Debit Note Process

27. Company Debit Note

28. Supplier Debit Note

29. Tax Invoice Debit Credit Note Test

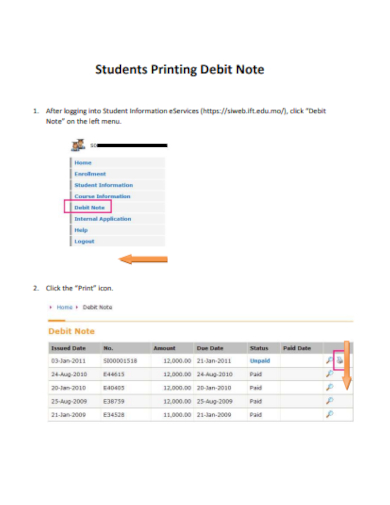

30. Students Printing Debit Note

31. Sales Debit Note

32. Standard Debit Note

33. Credit and Debit Note Form

34. Report Debit Note

35. Seller Debit Note

36. Draft Debit Note

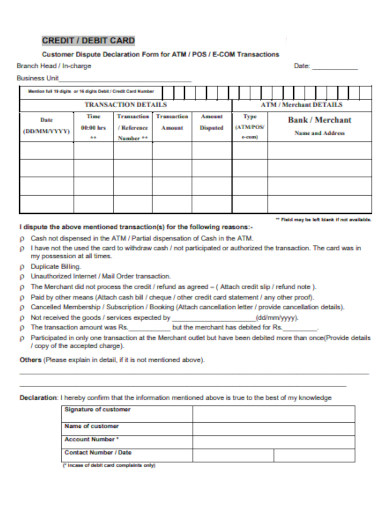

37. Debit Card Note

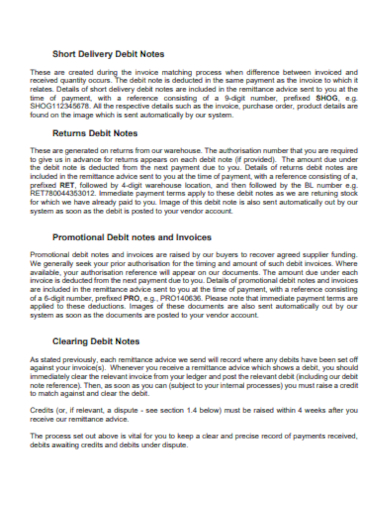

38. Short Delivery Debit Note

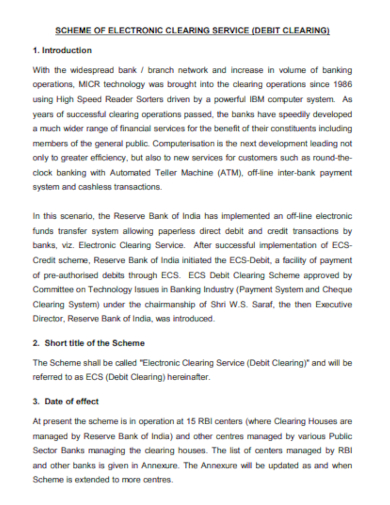

39. Debit Clearing Note

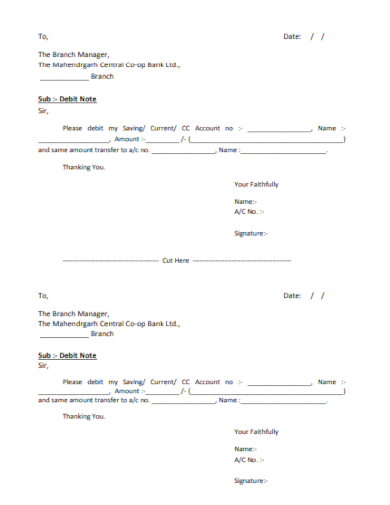

40. Direct Debit Note Form

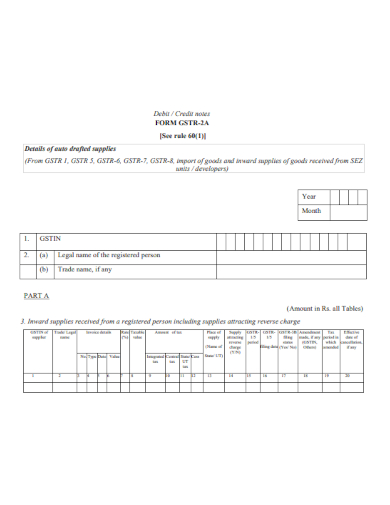

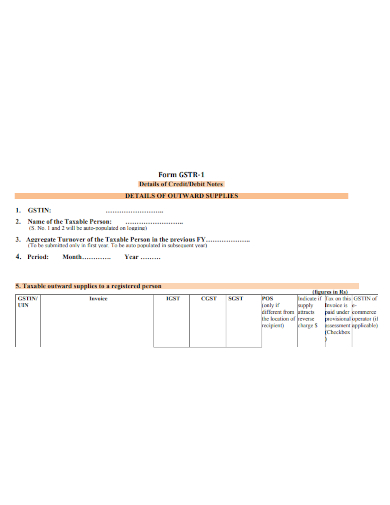

41. GST Debit Note Form

42. Debit Note Accounting for Tax

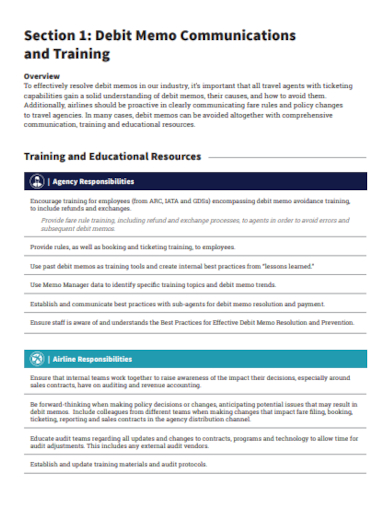

43. Returns Debit Note

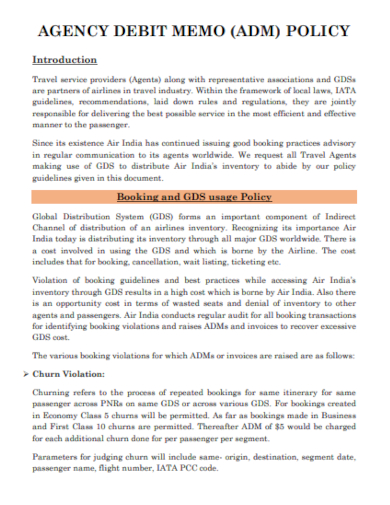

44. Agency Debit Memo Note

45. Credit Debit Supply Note

46. Debit Tax Invoice Note

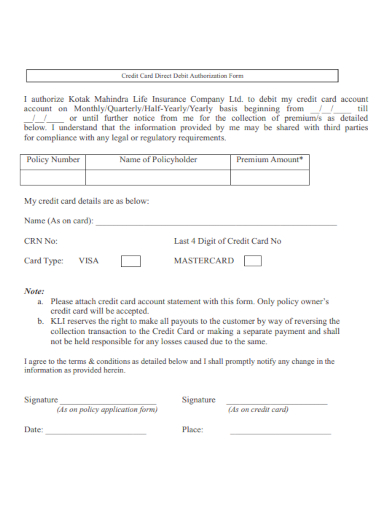

47. Credit Card Direct Debit Authorization Note Form

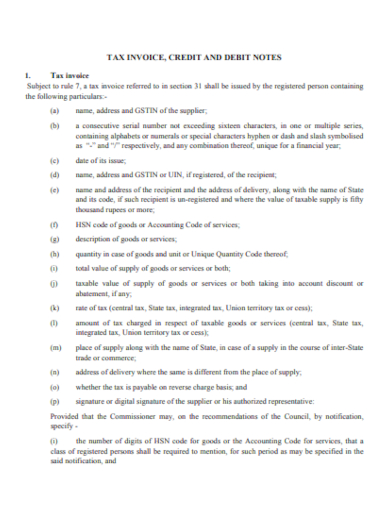

48. Tax Invoice Credit and Debit Note

49. Professional Debit Note

50. Debit Note Memo Communications

51. VAT Debit Note

What Is a Debit Note?

A debit note is a document that can be generated by a buyer when returning goods that were received on credit or by a vendor to inform a buyer of current debt obligations. A vendor can also create a debit note to inform a buyer of current debt obligations. The debit note can serve as a reminder for funds that are currently due or offer information regarding an upcoming invoice. In the case of returned items, the note will specify the total amount of credit dispute that is expected to be issued, along with a business inventory of the items that are being returned and an explanation of why they are being returned.

How To Make a Debit Note?

Another name for a debit note is a debit memo, and both of these names are commonly used in the context of business-to-business transactions. These deals additionally necessitate the extension of credit, which ensures that a seller is obligated to send a shipment of products to a customer even before the customer has paid the cost of the goods. Therefore, if you want to write a note like this for your company, we suggest you follow the steps listed below.

1. Determine The Amount and Format

Determine how much money the customer is responsible for paying. Include any interest or additional fees for being late. Your debit note can be typed, emailed, or written by hand. A debit note is typically formatted like a letter because that is the most common type. Nevertheless, the debit note could also be a postcard or a payment slip that looks like an invoice. Both of these formats are possible.

2. Use a Professional Tone

Utilizing a professional tone is one way of making a debit note. Maintain a polite tone while getting right to the point in the debit business letter. Inform the client that a reminder to pay the account balance or correct a billing error will be sent to them shortly.

3. Have a List

Include the amount that the buyer is responsible for paying to clear up the debt. Include all your contact information, such as a phone number, an email address, and a mailing address. Having this in place is essential so you can easily monitor your buyer at any time.

4. Include The Date

Indicate the date by which payment is expected and any applicable late fees. Because the debit note is not an invoice in and of itself, you do not need to include any information regarding the payment terms or acceptable payment methods. Deliver the debit note to the client by sending it to them. Send an extra debit note to the customer’s account if the payment is not received by the due date.

Is the debit note the same as the invoice?

On a debit note, information is presented on a previous transaction that has not yet been paid for. On the other hand, information is provided regarding a sales transaction that has been finalized on an invoice.

Is a debit note a refund?

A debit note, which may also be referred to as a debit memo, is a document sent from a buyer to their seller to request the refund of payments owing to faulty or damaged items, the cancellation of purchase, or other circumstances that have been outlined.

How many different kinds of debit notes are there to choose from?

It can be broken down into three primary categories: transaction entries, adjusting entries, and closing entries.

Debit notes are typically utilized in commercial transactions involving corporations or businesses and their respective clients. A credit may be awarded for this type of transaction since the seller must first finish the cargo before receiving the variable amount. A sale is usually considered finalized when the products are purchased with cash and invoices are issued.

Related Posts

FREE 10+ Narrative Notes Samples in PDF

FREE 10+ After Interview Thank You Note Samples in PDF

FREE 14+ Money Promissory Note Samples in PDF

FREE 10+ Thank You Notes For Coworkers Samples in PDF

FREE 10+ Meeting Notes Samples in PDF

FREE 9+ Inpatient Progress Note Samples [ Psychiatric, Hospital, Complaint ]

FREE 10+ Note Taking Samples in PDF

FREE 10+ Credit and Debit Note Samples in PDF | MS Word

FREE 3+ Comprehensive Soap Note Samples in PDF

FREE 8+ Student SOAP Note Samples [ Medical, Pharmacy, Doctor ]

FREE 10+ Return Delivery Note Samples [ Product, Service, Electronic ]

FREE 3+ Car Sale Delivery Note Samples [ Transfer, Private, Vehicle ]

FREE 6+ Goods Delivery Note Samples [ Vehicle, Movement, Return ]

FREE 10+ Doctors Excuse Note Samples [ Office, Visit, Medical ]

FREE 5+ Discharge Summary Nursing Note Samples [ Progress, Patient, Home ]