You may be familiar with the terms invoice, bill, and bill of materials. An invoice is a document that is used to keep track of sales. So, what occurs if the worth of those invoices changes? Will you start working on the invoices? It is illogical to do so. You’ve already created the invoice and entered the transactions into your journal. The only way out is to create extra entries that show a change in the primary invoice value and supply a document as additional verification of the sale’s actual worth. Credit and debit notes are the names for these records.

10+ Credit and Debit Note Samples

When a customer returns goods to the supplier or seller of those items, a debit or credit note is released. A debit note is given to the supplier or seller of goods, whereas a credit note is given to the purchaser or buyer of goods. When the supplier or seller gets a return of goods, he or she obtains a debit note emphasizing that his or her account is billed with a respective amount, whereas when the customer or buyer returns goods, he or she receives a credit note emphasizing that his or her account is given credit with a value that is specified in the note.

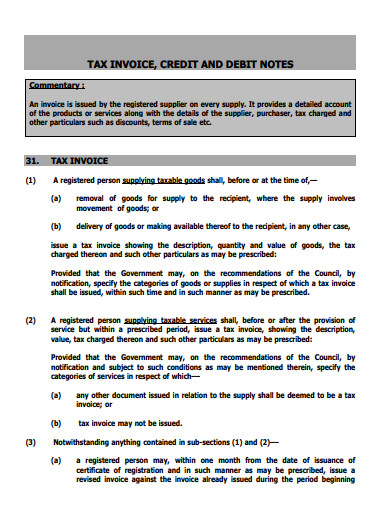

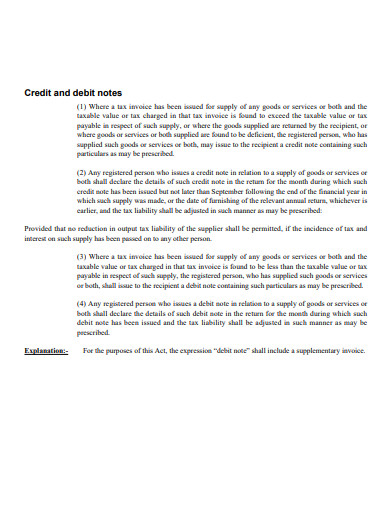

1. Credit and Debit Note

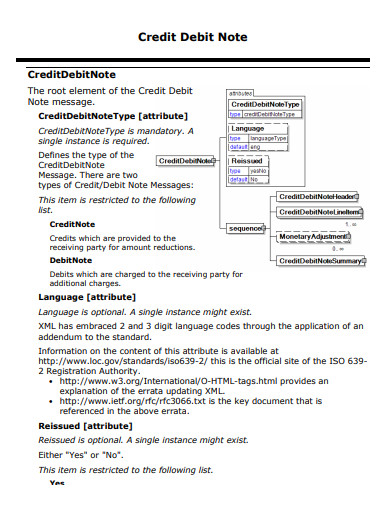

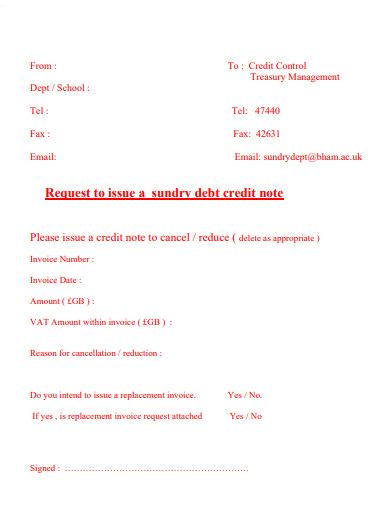

2. Sample Credit and Debit Note

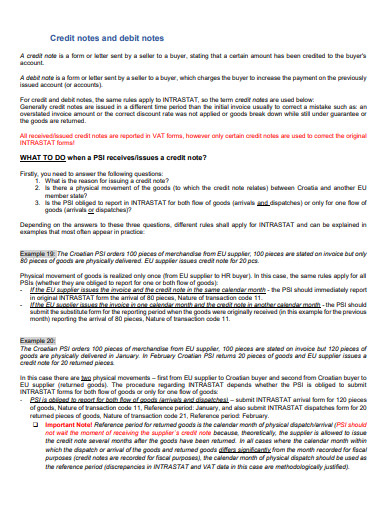

3. Simple Credit and Debit Note

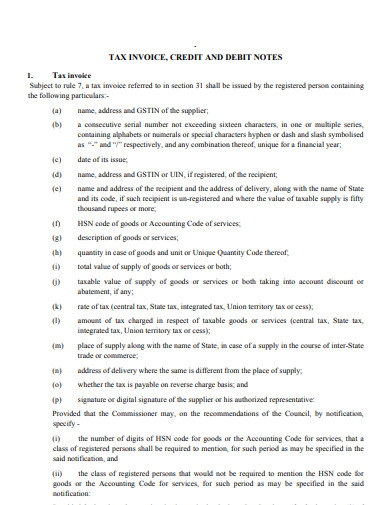

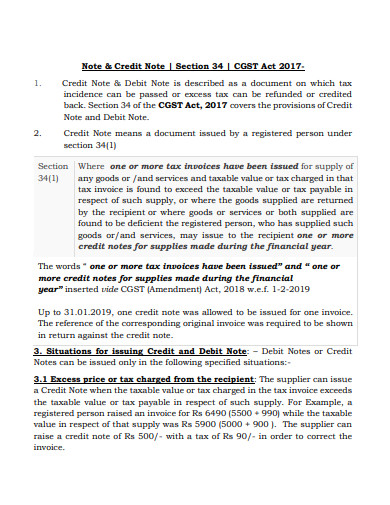

4. Tax Invoice, Credit and Debit Note

5. Basic Credit and Debit Note

6. Credit and Debit Note Example

7. Formal Credit and Debit Note

8. Credit and Debit Note Format

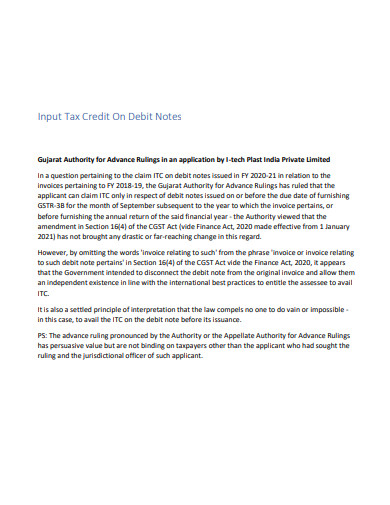

9. Input Tax Credit On Debit Notes

10. Professional Credit and Debit Note

11. Printable Credit and Debit Note

Debit Note

A debit memo is another name for a debit note. It’s a document that a buyer sends to a seller requesting a refund of payments due to inaccurate or damaged goods or services, or a withdrawal of a purchase. A debit note is provided by the buyer as a formal request to release a credit note before the supplier can offer a credit note.

A buyer can send a debit note to the seller, seeking the refund of a portion or the entire sum previously paid. It could be due to the delivery of defective or damaged goods, order cancellation, or other unforeseen situations. A debit note is used to prove a purchase return.

Debit notes differ from invoices in that they are usually written in letter format and do not demand urgent payment. This is true when a debit note is used to notify a buyer of impending financial responsibilities based on sums which have not yet been properly billed.

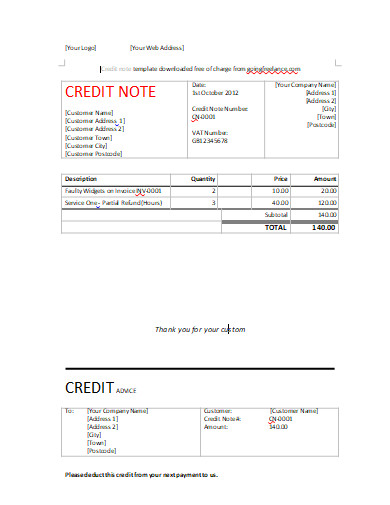

Credit Note

A credit memo is another name for a credit note. It is a document that the seller issues to signify a complete or partial refund of payments. It may occur as a result of an improper or faulty supply of products, a purchase withdrawal, or an invoice error. It is frequently raised in reaction to a customer’s debit note. The buyer or purchaser can also use this record to place a subsequent order. You may issue several credit notes as long as the total invoice amount is not surpassed.

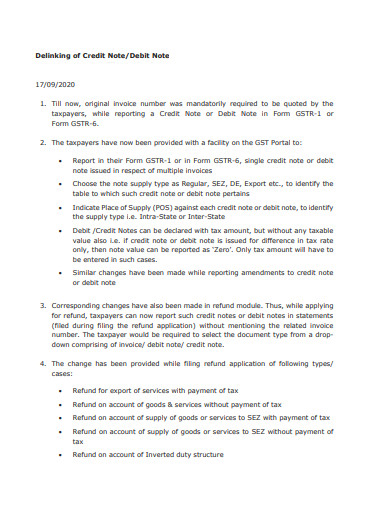

A credit note is defined as follows in the GST Act.

“Where a tax invoice has been issued for the supply of any goods or services or both, and the taxable value or tax charged in that tax invoice is found to exceed the taxable value or tax payable in respect of such supply, or where goods are returned by the recipient, or where goods or services or both supplied are found to be deficient, the registered person who has supplied such goods or services or both may issue to the recipient a credit note containing such taxable value or tax.”

FAQs

What is another form of debit and credit note?

Another type of purchase return of items is a debit note. A credit note is another type of product return.

What are the possible effects of credit and debit note?

Account receivables are reduced by debit notes. Account payables are reduced via credit notes.

Purchase returns (return outbound) are usually issued on a debit note, whereas sales returns are usually issued on a credit note (return inward). When the items are handed back to the supplier, the customer releases a debit note, and the supplier provides a credit note to the customer. The ink on a debit note is blue, while the ink on a credit note is red. A debit note has a positive balance, whereas a credit note has a negative balance. A debit note has an affect on account receivables and enables them to decrease, whereas a credit note has an impact on account payables and causes them to decrease.

Related Posts

FREE 14+ Money Promissory Note Samples in PDF

FREE 10+ Thank You Notes For Coworkers Samples in PDF

FREE 10+ Meeting Notes Samples in PDF

FREE 9+ Inpatient Progress Note Samples [ Psychiatric, Hospital, Complaint ]

FREE 10+ Note Taking Samples in PDF

FREE 3+ Comprehensive Soap Note Samples in PDF

FREE 8+ Student SOAP Note Samples [ Medical, Pharmacy, Doctor ]

FREE 10+ Return Delivery Note Samples [ Product, Service, Electronic ]

FREE 3+ Car Sale Delivery Note Samples [ Transfer, Private, Vehicle ]

FREE 6+ Goods Delivery Note Samples [ Vehicle, Movement, Return ]

FREE 10+ Doctors Excuse Note Samples [ Office, Visit, Medical ]

FREE 5+ Discharge Summary Nursing Note Samples [ Progress, Patient, Home ]

FREE 6+ Labor and Delivery Note Samples [ Nurse, Progress, Admission ]

FREE 8+ Company Delivery Note Samples in PDF | DOC

FREE 5+ Material Delivery Note Samples in PDF