Retail business has existed since the early ages, started with the barter system, evolved to using coins, and gradually emerged in digital mediums. Today, we cannot deny that it is indeed a lucrative business. In fact, according to statistics posted in Statista, in 2017, the total global retail sales have reached 23 trillion US dollars. Since the beginning of this profitable industry, many businesses have emerged. While there have been a handful of successful companies, a lot of them failed. Unsurprisingly, one of the main reasons for these failures is the lack of business planning. In planning a retail store, there are different areas that you need to attend to. The retail budget is one of the crucial areas in this business development phase.

What is a Retail Budget?

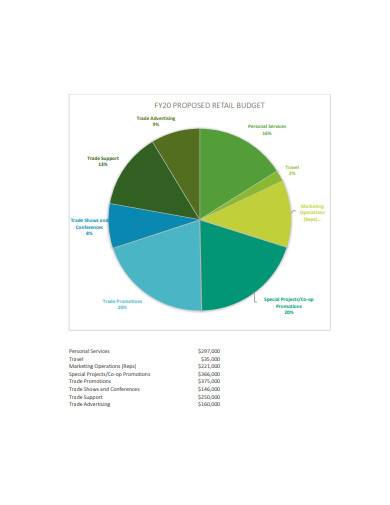

A retail budget is an essential part of a retail business plan that outlines the financial goals of your entire organization, such as retail budgeting and resource allocation. In developing a retail budget process, you may create subcategories to make a more detailed retail budget. Subcategories may include retail advertising budget, marketing, and many more. Additionally, you should know that planning a budget goes beyond starting a new business. You will have to revise your plan, but, most likely, you will have to create a new one for various reasons such as business expansion.

Most Common Types of Retail Budget

Each business uses at least one retail budget method for its corporate goals. The following are the most common methods they use, which you can also apply in your retail business plan.

1. Zero-based Budgeting

You can say that this is the most common budgeting type that existing businesses use. From the word itself, with this method, you don’t have to set a monthly budget amount. As a budget manager, you have to start from scratch in allocating resources such as expenses. The retail budgeting process of this method mostly involves creating a proposal, justifying each cost before its implementation, making it an effective way to reduce the budget of a retail business.

2. Activity-based Budgeting

In this budgeting type, you will set a financial goal for the month or year. You will, then, create an action plan to attain this business goal. For example, you will set a $100,000 monthly revenue goal. The team will, then, come up with productive activities to materialize this goal.

3. Incremental Budgeting

This budgeting type is the easiest method to understand. In this method, you will take note of the previous year’s numbers and either subtract or add a percentage to get the current year’s budget. This type of budgeting is quite common to the budget category, which cost drivers do not change yearly.

3+ Retail Budget Samples in PDF | DOC

Below are the downloadable examples that you can use as a reference if you are planning to create a retail budget.

1. Retail Budget Sample

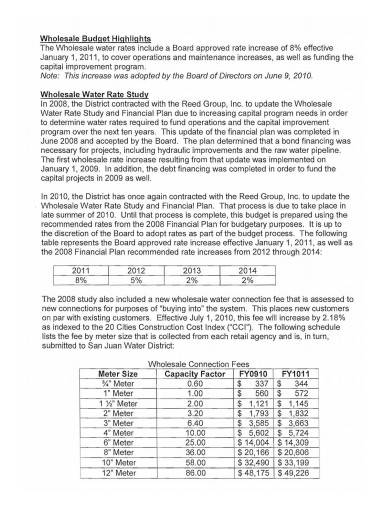

2. Retail Budget Template

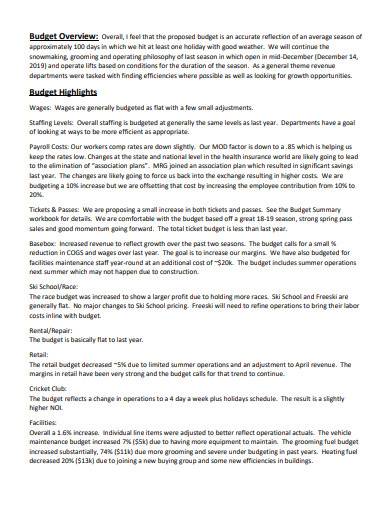

3. Retail Budget Example

4. Retail Budget in DOC

Best Practices in Retail Budgeting Process

The retail industry has been around for a long time now. Therefore, you can use the methods that the existing successful participants in the industry have proven to be effective. Read the following tips to minimize the possibility of business failures in terms of budget.

1. Be a Little Bit of a Pessimist

While maintaining positivity in running a business can help, too much of it in creating business projections can cause adverse effects. Be a devil’s advocate of your own budget. What we are trying to say is, analyze the plan that you are proposing. Study its possible outcomes.

2. Come Up with a Solid Plan

The constant changes in the economic conditions are one of the biggest challenges that you have to overcome as a business owner. By developing a solid plan that covers the possible dilemmas that you will encounter, you can efficiently deal with the potential pitfalls ahead. Start by acknowledging the challenges your business encounters and look for ways to overcome them.

3. List Down All of Your Resources

Your sources are part of your company’s significant defense. As you plan the business budget, you may realize that there are specific problems that require money and other resources to deal with. For short-term financing options, you can list credit cards, short-term loans, etc.

4. Use Personal Money

Loans can be a dangerous path to startup businesses. Many businesses failed, which left people in the industry with a massive loan amount. You don’t want that to happen to you. That’s why it is essential to have a personally saved money as a primary source to address cash flow challenges. Make sure to gauge what you can feasibly take, though. Otherwise, if things go south, it will leave you with a massive amount of loans.

Retail store advertising budget, among other items of retail budget, is crucial in growing a business. It requires careful planning and sacrifices. Nonetheless, these activities will ensure that your company strives. With the retail budget examples and other relevant items that we gathered in this article, you should have an idea of what step to take next from here.

Related Posts

FREE 9+ Sample Hazard Analysis Templates in PDF

FREE 10+ Food Catering Business Plan Samples in MS Word | Google Docs | Pages | PDF

FREE 10+ Evaluation Scope of Work Samples in PDF

FREE 7+ Double Entry Bookkeeping Samples in MS Word | PDF

FREE 10+ Decision Matrix Samples in MS Word | PDF | DOC

FREE 13+ Daily Sales Report Samples [ Restaurant, Activity, Cash ]

FREE 10+ Customer Segmentation Strategy Samples in PDF | MS Word

FREE 5+ Customer Perception Survey Samples in PDF | DOC

FREE 7+ Customer Ledger Samples in PDF | MS Word | Excel

FREE 10+ Corporate Social Responsibility Policy Samples in PDF | MS Word

FREE 10+ Corporate Bylaws Samples in PDF | MS Word

FREE 8+ Consultant Business Plan Samples in PDF | MS Word

FREE 11+ Construction Application Samples in PDF | MS Word

FREE 9+ Client Information Sheet Samples in MS Word | Excel | Pages | Numbers | Google Docs | Google Sheets | PDF

FREE 10+ Cleaning Business Proposal Samples in PDF | MS Word | Google Docs | Pages