Wealth management is a corporate business that involves an advisory service that combines several other financial services to address the needs of its clients. It’s an entire process that involves consultation and information gathering to be able to come up with a specific strategy that uses a range of financial products as well as services. When approaching different cases of wealth management, a holistic approach is often taken t0 meet the specific needs of a client. These needs vary from one client to another, and would usually range between investment advice, estate planning, to accounting, retirement, and tax services.

Businesses are already very complicated entities to manage, even more when you have a venture that aims to handle the finances of your own clients. Starting a business within the realms of coaching, consultation, and management can be really expensive and quite difficult to find your place. It can be quite the chore to keep track of everything that needs to be taken care of, to make sure that every component is taken into account. That is why for most businesses and ventures, it is very important to be able to come up with a comprehensive enough layout or a plan for their own business. Regardless if the venture is a startup business or not. A well-laid out plan helps with keeping everybody on track for the entire duration of the business, especially managers and supervisors since they often oversee all business operations. A well written business plan can do wonders for the sake of your business. Letting you move forward without much of a struggle.

Running a business without a business plan is highly discouraged. That’s because doing so is synonymous to doing something without a clear goal in mind. Without a path to follow. Without direction. And business plans give you that kind of direction. Aside from that, it also provides you with a whole another set of benefits, like including, but not limited to, being able to come up and experiment with new ideas without having to invest too much time and resources on experimentation since you’ve already got that part covered in your business plan. Before you actually begin writing the document, check out these wealth management business plan samples that we have listed down below first, and when you’ve acquainted yourself with the document pretty good, feel free to use these samples as guides or maybe even as templates for when you decide to write your own wealth management business plan.

9+ Wealth Management Business Plan Samples

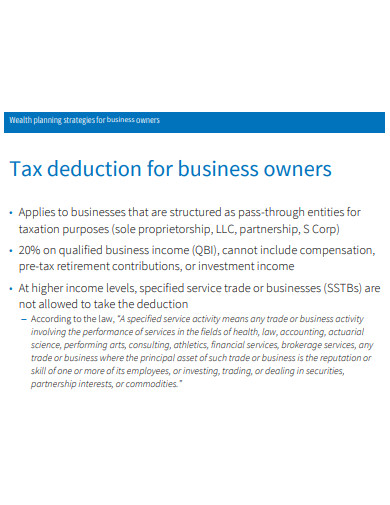

1. Wealth Management Business Plan

2. Business Continuity Plan and Wealth Management

3. Sample Wealth Management Business Plan

4. Efficient Wealth Management Business Plan

5. Simple Wealth Management Business Plan

6. Wealth Management Strategic Business Plan

7. Sample Wealth Management Business Continuity Plan

8. Simple Wealth Management Business Continuity Plan

9. Wealth Management Business Plan Example

10. Printable Wealth Management Business Plan

What Is a Wealth Management Business Plan?

A business plan is essentially a document that presents how a business would define their own objectives and what steps are the management willing to take to reach the goals that they have set. A business plan works like a guideline that the company can follow depending on the the inputs provided by their own respective departments like marketing, financial, and operational. Aside from being a document that guides the entirety of business operations, a business plan can also be used to attract potential business partners and investors even before the company has been properly established, making the document even more valuable, especially for new businesses and startup companies. Though that doesn’t mean that a business plan is only for startup ventures.

Every company should be able to draft their own business plan so that they have a document that they can regularly review and update to see if they are any closer to the goals that they have projected and inspect how the circumstances that they have been working on has changed over time. A well drafted business plan should be able to outline the estimated costs of the project as well as its projected outcomes. It should also be able to assess the potential pitfalls that a decision from the management may have. Despite being used prominently in the business and corporate industry, it is still pretty rare to see two different business plans from two different companies to be completely identical because every organization faces their own unique problems, which then leads to unique solutions for those problems.

Elements of a Wealth Management Business Plan

The length of your business plan differs depending on the nature and the scope of the business that your plan will focus on. Though it is pretty common for business plans to be around 15 to 20 pages long. And even if no two business plans are completely alike, they still operate with about the same elements. These elements are listed and will be discussed in more detail down below.

1. Executive summary

A business plan should begin with a paragraph that presents the company and what the organization stands for. This section is called the executive summary, and executive summaries present the mission-vision values of the company itself, the overall company leadership, employee operations, and where the business is generally located.

2. Products and services

The following section should then contain a list of the products and services that the company is currently offering. It should include the list of prices, product lifespan, duration of services, as well as the benefits that the client may have once they choose to do business with your company. You can also include other components like manufacturing and production processes if you think it is necessary.

3. Market analysis

Every business needs to have a perfectly clear understanding of their own customer base and its respective demographic. Market analyses will give you an idea of who or what the competition is, and how difficult it would be to overtake them.

4. Marketing strategy

After analyzing your market, identify the strategies that you think are necessary to attract your target market and your plans on how to keep them engaged with your business. Outline a clear distribution channel to show how the management plans to reach out to your customers, as well as inspect the marketing and advertising campaigns that you plan to put in place.

5. Financial planning

Financial plans can be very attractive especially for investors and potential business partners who wish to be a part of a company that has the capabilities to return a good investment. You should be able to include your financial statements, balance sheets, and other relevant financial information.

6. Budget

A company needs to have a budget in place to operate properly. Your budget should be able to showcase the costs, manufacturing, development, and the expenses that your business will make.

FAQs

What does a wealth manager do?

A wealth manager provides financial advice to high net-worth clients. They conduct financial planning, investment management, and assists with preserving and generating wealth.

What is the difference between Asset Management and Wealth Management?

If you really think about it, the difference of the two is already in its name. Asset Management concerns with assets like cash, stocks, bonds, and real estate, while Wealth Management concerns all aspects of wealth including tax, business, and legacy issues.

Can you make a lot of money in wealth management?

Financial advisors typically earn a lot from their clients. Private wealth managers can easily make around $500,000 from one client.

Another thing to remember about a business plan is that the document is not supposed to be left static. The writing process does not stop once all components are written and put into paper. It’s a live document, meaning that the business plan should be reviewed and updated over time. It should be able to adapt to the changes within the business and how the business operates, as well as its own environment.

Related Posts

FREE 9+ 30-Day Marketing Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 3+ Sales Team Action Plan Samples in PDF | MS Word | Apple Pages | Google Docs

Marketing Plan For Small Business Samples

FREE 7+ Fashion Business Plan Samples in PDF

FREE 10+ Sprint Planning Samples In MS Word | Google Docs | PDF

FREE 10+ Wedding Planning Samples in MS Word | Apple Pages | Powerpoint | PDF

FREE 9+ Monthly Study Planner Samples in PSD | Illustrator | InDesign | PDF

FREE 9+ Sample Curriculum Planning Templates in PDF | MS Word

FREE 10+ Teacher Development Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Basketball Practice Plan Samples in PDF

FREE 12+ School Business Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 7+ Client Strategic Plan Samples in PDF | MS Word

FREE 11+ Trucking Business Plan Templates in PDF | MS Word | Google Docs | Pages

FREE 7+ Small Hotel Business Plan Samples PDF | MS Word | Apple Pages | Google Docs

FREE 14+ Bakery Business Plans in MS Word | PDF | Google Docs | Pages