In a simpler term, a chart of account is the generalized list of all the accounts that an organization, company, institute or an individual has. The accounting software uses this chart to create an aggregate of the financial status of that particular organization or individual. Here are some samples and templates that have been provided so that you can create the statement of account where you can easily list the details.

Chart Of Accounts

Chart of Accounts For Household

Chart of Accounts For Nonprofit

Chart of Accounts For Manufacturing Company

Chart of Accounts For Construction Company

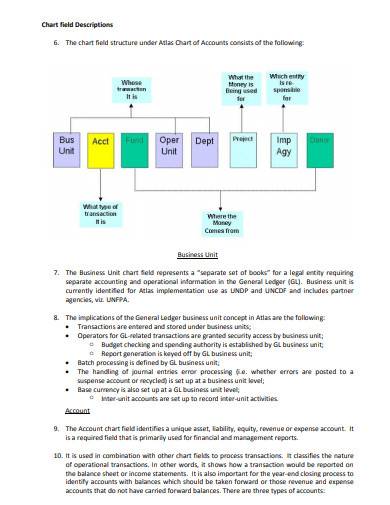

Browse More Templates On Chart of Accounts

Chart of Accounts Template

Why is the Chart of Accounts Beneficial?

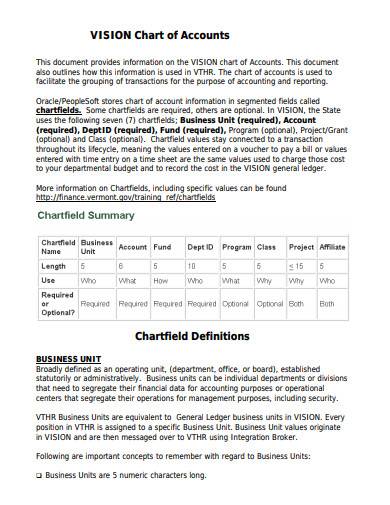

Sample Chart of Accounts Template

Company’s Chart of Accounts Template

Chart of Accounts for Small Business Template

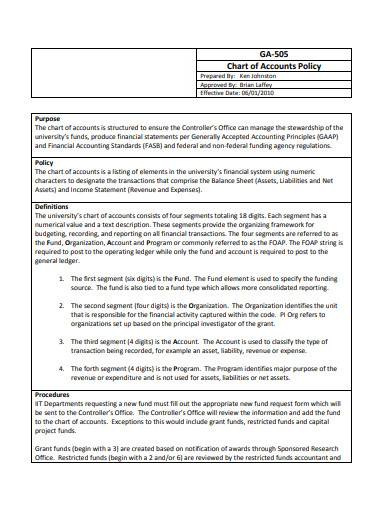

Chart of Accounts Policy Template

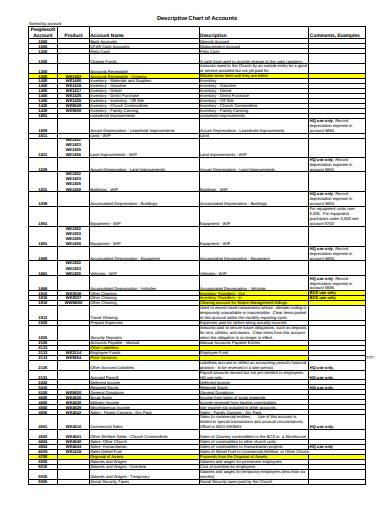

Descriptive Chart of Accounts Template

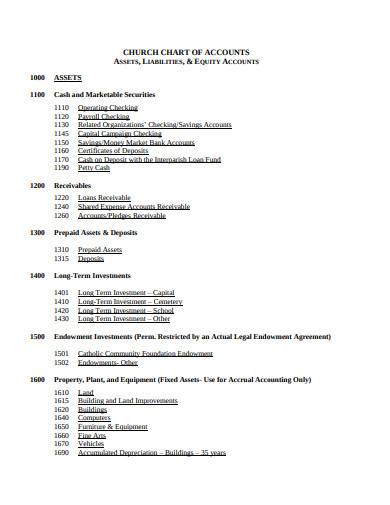

Church Chart of Accounts Template

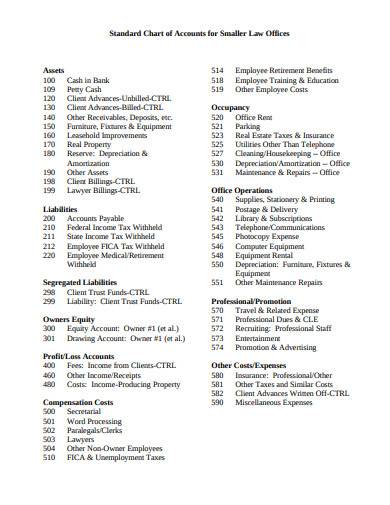

Standard Chart of Accounts Template

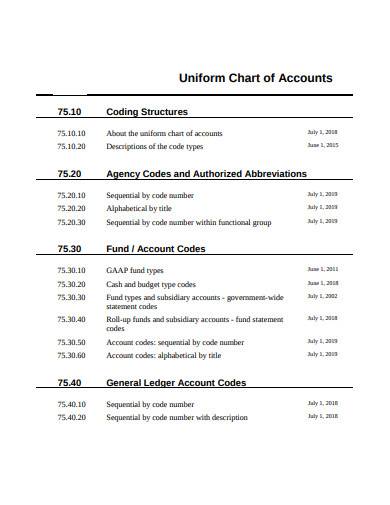

Uniform Chart of Accounts Template

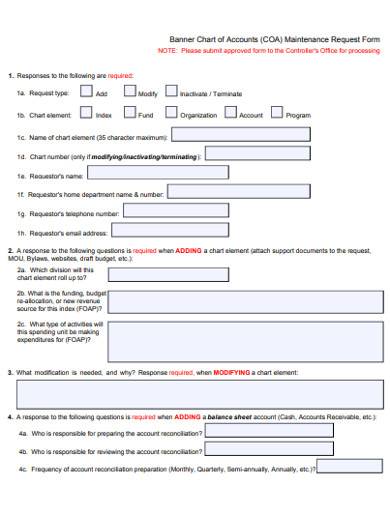

Chart of Accounts Maintenance Request Form Template

How should a chart of accounts be structured?

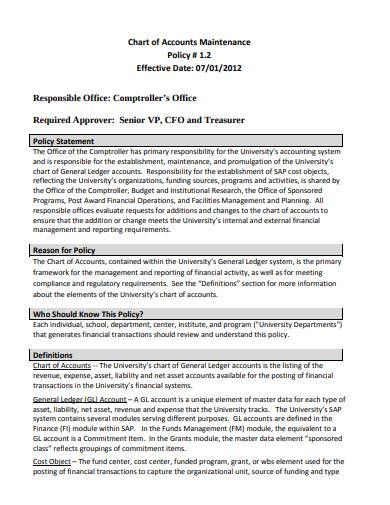

Chart of Accounts Maintenance Template

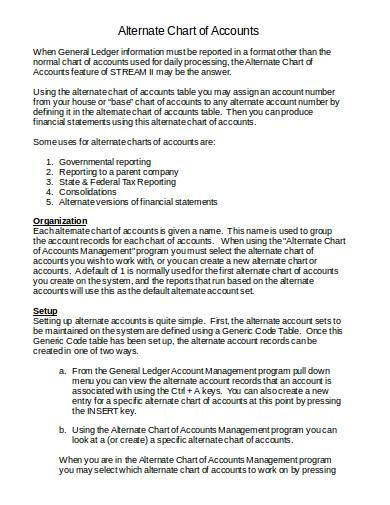

Alternate Chart of Accounts in DOC

Types of Chart of Accounts

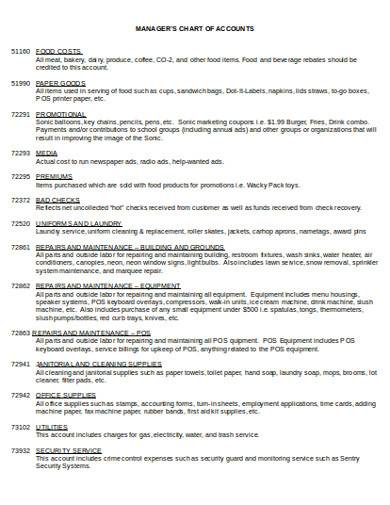

Manager’s Chart of Accounts Outline Template

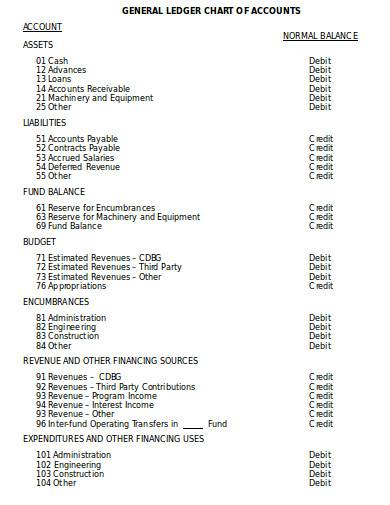

General Ledger Chart of Accounts in DOC

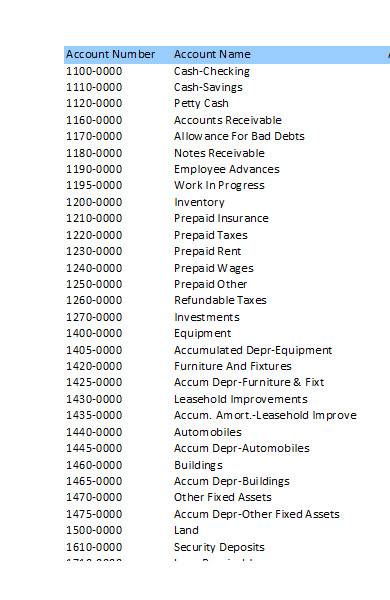

Chart of Accounts in Excel

Is a chart of accounts limited?

How do you categorize a chart of accounts?

Is a chart of accounts limited?

How do you categorize a chart of accounts?

Download Chart of Accounts Bundle

Chart of Accounts For Household

Executive Summary

A Chart of Accounts (CoA) for household finance management is a structured list of all financial accounts used in the household’s accounting system. It categorizes financial transactions into assets, liabilities, income, and expenses, enabling efficient tracking and management of household finances. This document outlines a sample CoA, designed to help households organize their finances for better clarity and control.

Assets

Current Assets

- Cash on Hand: Money available in physical form.

- Checking Account: Daily operational bank account.

- Savings Account: Account for emergency funds and savings.

- Investments: Stocks, bonds, and other investment vehicles.

Long-term Assets

- Retirement Accounts: 401(k), IRA, and other retirement savings.

- Real Estate: Property owned by the household.

- Personal Property: High-value items like cars, jewelry.

Liabilities

Current Liabilities

- Credit Card Balances: Outstanding credit card debts.

- Utility Bills Payable: Unpaid utility bills (electricity, water, internet).

Long-term Liabilities

- Mortgage: Home loan balance.

- Auto Loans: Outstanding car loan balances.

- Student Loans: Unpaid student loan debt.

Income

- Salaries and Wages: Income from employment.

- Investment Income: Dividends, interest, and other earnings from investments.

- Rental Income: Income from renting out property.

- Miscellaneous Income: Any other income (gifts, tax refunds).

Expenses

Fixed Expenses

- Mortgage or Rent: Monthly housing payment.

- Insurance Premiums: Home, auto, health insurance payments.

- Loan Payments: Monthly payments for loans other than the mortgage.

Variable Expenses

- Utilities: Electricity, gas, water, internet, and phone bills.

- Groceries: Food and household supplies.

- Transportation: Gasoline, public transit costs, auto maintenance.

- Entertainment: Movies, dining out, subscriptions.

- Healthcare: Out-of-pocket medical expenses, medications.

- Education: Tuition, books, school supplies.

- Savings and Investments: Contributions to savings accounts and investment funds.

Conclusion

This Chart of Accounts provides a comprehensive framework for managing household finances. By categorizing financial transactions into these accounts, households can gain a clearer understanding of their financial health, enabling better budgeting, saving, and investment decisions. Regularly reviewing and updating the CoA ensures it remains aligned with the household’s financial goals and circumstances.

Download In

Chart of Accounts For Nonprofit

Introduction

A Chart of Accounts (CoA) is an essential financial organizational tool for nonprofit organizations, categorizing all transactions into a structured list of accounts. This framework facilitates accurate reporting, budgeting, and compliance with financial standards specific to the nonprofit sector. Below is a sample CoA tailored for a nonprofit organization, encompassing assets, liabilities, net assets, revenues, and expenses.

Assets

Current Assets

- Cash: Funds available for immediate use.

- Accounts Receivable: Money owed to the organization.

- Prepaid Expenses: Payments made in advance for goods or services.

- Inventory: Goods available for sale or distribution.

Fixed Assets

- Land and Buildings: Property owned by the nonprofit.

- Equipment: Office equipment, computers, and other long-term use items.

- Furniture and Fixtures: Non-disposable items used for operations.

Liabilities

Current Liabilities

- Accounts Payable: Short-term debts to vendors and service providers.

- Accrued Expenses: Incurred expenses not yet paid.

- Deferred Revenue: Income received for services yet to be performed.

Long-term Liabilities

- Mortgage Payable: Long-term obligations for property.

- Notes Payable: Other long-term debts.

Net Assets

- Unrestricted Net Assets: Resources available for general use without donor-imposed restrictions.

- Temporarily Restricted Net Assets: Resources restricted by donors for specific purposes or time frames.

- Permanently Restricted Net Assets: Endowment funds that must be maintained permanently, not used for general operations.

Revenues

- Contributions and Donations: Funds received from donors.

- Grants: Funds received from governmental and private grants.

- Membership Dues: Income from membership fees.

- Program Service Revenues: Income from services provided by the nonprofit.

- Special Events Revenue: Funds raised from events, net of direct expenses.

- Investment Income: Earnings from investments.

Expenses

Program Expenses

- Program Services: Costs directly related to fulfilling the nonprofit’s mission.

Supporting Services

- Management and General: Administrative and operational expenses.

- Fundraising: Costs associated with raising funds.

Other Expenses

- Depreciation: Expense related to the reduction in value of fixed assets.

Conclusion

This Chart of Accounts provides a foundation for nonprofit organizations to systematically track and report their financial transactions. By categorizing assets, liabilities, net assets, revenues, and expenses, nonprofits can ensure financial transparency, meet reporting requirements, and effectively manage their resources to achieve their mission. Regular reviews and updates to the CoA are recommended to reflect changes in operations and financial practices.

Chart of Accounts For Manufacturing Company

A Chart of Accounts (CoA) for a manufacturing company provides a structured framework for recording and reporting financial transactions, tailored to the unique needs of manufacturing operations. This chart includes accounts relevant to production, inventory management, cost of goods sold (COGS), and more, facilitating detailed financial analysis and strategic planning.

Assets

Current Assets

- Cash: Funds available for immediate use.

- Accounts Receivable: Money owed to the company by customers.

- Raw Materials Inventory: Cost of raw materials not yet used in production.

- Work-in-Progress (WIP) Inventory: Cost of unfinished goods in production.

- Finished Goods Inventory: Cost of manufactured products ready for sale.

- Prepaid Expenses: Payments made in advance for goods or services.

Fixed Assets

- Property, Plant, and Equipment (PP&E): Long-term assets like factories, machinery, and equipment, net of depreciation.

- Leasehold Improvements: Enhancements made to leased property.

- Depreciation: Accumulated depreciation of fixed assets.

Liabilities

Current Liabilities

- Accounts Payable: Money owed by the company to suppliers or creditors.

- Accrued Liabilities: Expenses incurred but not yet paid.

- Short-term Loans: Loans that need to be repaid within a year.

Long-term Liabilities

- Long-term Loans: Loans that are due beyond one year.

- Deferred Tax Liabilities: Taxes that are assessed but not yet paid.

Equity

- Owner’s Capital: Funds invested by the owners or shareholders.

- Retained Earnings: Profits reinvested in the company, not distributed to the owners.

Revenue

- Sales Revenue: Income from the sale of goods.

- Service Revenue: Income from services provided.

- Interest Income: Income from investments.

Cost of Goods Sold (COGS)

- Raw Materials Used: Cost of raw materials used in production.

- Direct Labor: Cost of labor directly associated with production.

- Manufacturing Overhead: Indirect costs related to production, such as utilities for the manufacturing plant.

Expenses

Operating Expenses

- Selling Expenses: Costs associated with sales and marketing activities.

- General and Administrative Expenses (G&A): Overhead and administrative costs not directly tied to production.

- Research and Development (R&D): Costs related to the development of new products or services.

Non-operating Expenses

- Interest Expense: Cost of borrowing money.

- Depreciation Expense: Allocation of the cost of fixed assets over their useful lives.

Conclusion

The Chart of Accounts for a manufacturing company is designed to capture the complexity of manufacturing operations, from inventory management to the calculation of COGS and tracking of production costs. By maintaining a detailed CoA, manufacturing companies can improve financial transparency, make informed decisions, and enhance operational efficiency. Regular updates and audits of the CoA ensure it continues to meet the evolving needs of the business.

Download In

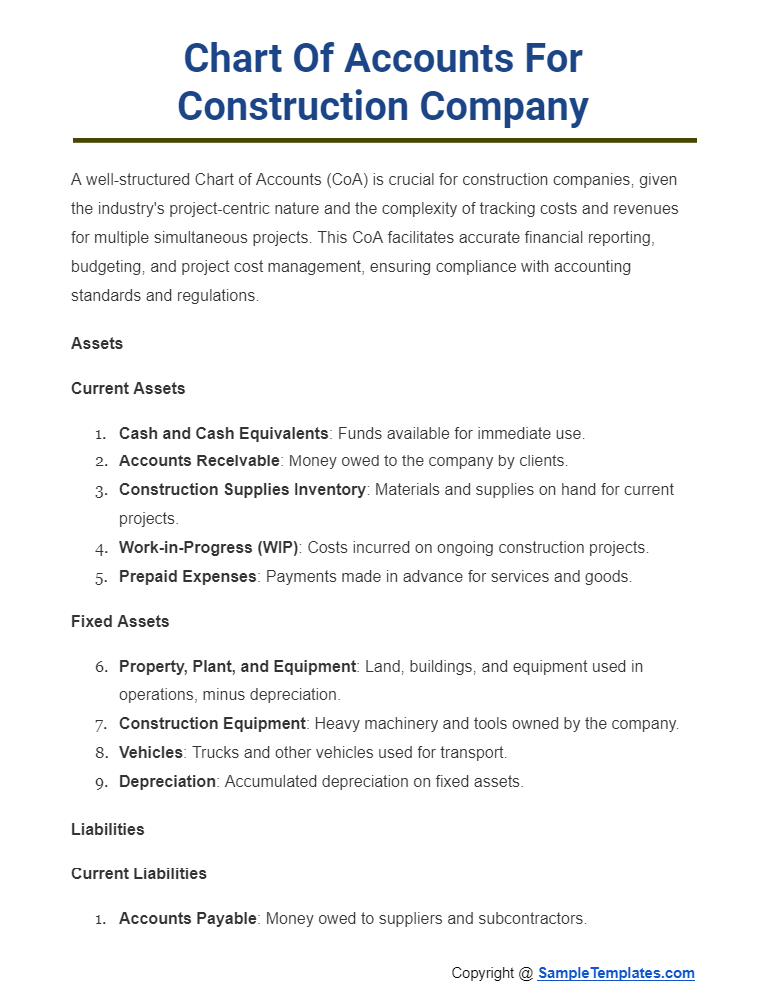

Chart of Accounts For Construction Company

A well-structured Chart of Accounts (CoA) is crucial for construction companies, given the industry’s project-centric nature and the complexity of tracking costs and revenues for multiple simultaneous projects. This CoA facilitates accurate financial reporting, budgeting, and project cost management, ensuring compliance with accounting standards and regulations.

Assets

Current Assets

- Cash and Cash Equivalents: Funds available for immediate use.

- Accounts Receivable: Money owed to the company by clients.

- Construction Supplies Inventory: Materials and supplies on hand for current projects.

- Work-in-Progress (WIP): Costs incurred on ongoing construction projects.

- Prepaid Expenses: Payments made in advance for services and goods.

Fixed Assets

- Property, Plant, and Equipment: Land, buildings, and equipment used in operations, minus depreciation.

- Construction Equipment: Heavy machinery and tools owned by the company.

- Vehicles: Trucks and other vehicles used for transport.

- Depreciation: Accumulated depreciation on fixed assets.

Liabilities

Current Liabilities

- Accounts Payable: Money owed to suppliers and subcontractors.

- Accrued Expenses: Incurred expenses not yet paid.

- Current Portion of Long-term Debt: The portion of long-term liabilities due within the next year.

Long-term Liabilities

- Notes Payable: Loans or notes that are repayable beyond one year.

- Mortgage Payable: Long-term loans secured by property or equipment.

Equity

- Owner’s Equity: Capital contributed by the owners or shareholders.

- Retained Earnings: Profits reinvested in the company rather than distributed to owners.

Revenue

- Contract Revenue: Income from construction contracts.

- Change Order Revenue: Additional income from changes or additions to original contract terms.

Cost of Goods Sold (COGS)

- Direct Labor: Wages and benefits for labor directly involved in construction projects.

- Materials Used: Cost of materials used in construction projects.

- Subcontractor Costs: Payments made to subcontractors for work performed.

- Equipment Costs: Depreciation and maintenance of construction equipment.

Expenses

Project Expenses

- Project Management: Costs associated with managing construction projects.

- Permits and Fees: Costs for necessary permits and regulatory fees.

Operating Expenses

- Office Expenses: Costs related to administrative functions.

- Salaries and Wages: Compensation for non-project staff.

- Rent or Mortgage: Costs for leasing or owning office space.

- Utilities: Electricity, water, and other utilities for office operations.

- Insurance: General liability, workers’ compensation, and other insurance costs.

- Vehicle Expenses: Fuel, maintenance, and depreciation of company vehicles.

Non-operating Expenses

- Interest Expense: Interest on loans and lines of credit.

- Depreciation and Amortization: Allocation of the cost of tangible and intangible assets over their useful lives.

Conclusion

This Chart of Accounts provides a foundational framework for construction companies to manage and report their financial activities accurately. It ensures that all financial transactions are categorized systematically, supporting effective project cost tracking, financial analysis, and strategic decision-making. Regular review and customization of the CoA are essential to accommodate the dynamic nature of the construction industry and the specific needs of the company.

Download In

Browse More Templates On Chart of Accounts

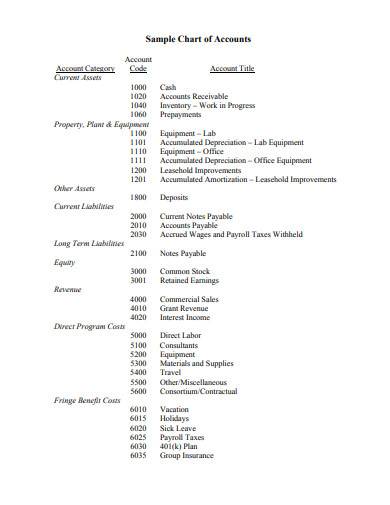

Chart of Accounts Template

Here is an example of the Chart of Accounts Sample in PDF. This sample has been prepared keeping in mind the necessity of the customers and clients. This template can be used to prepare the account ledger for your organization. The best about this template is that it is available in the editable PDF format, hence you can use the PDF editor to edit it.

Why is the Chart of Accounts Beneficial?

From the perspective of accounting, a sample chart of account is extremely beneficial because it is a summation or the organized version of all the accounts chart that an organizational

or an individual has. This helps in grouping up the details of all the different accounts which would otherwise have been scattered.

Here are 5 Importance of Chart of Accounts

- The first and foremost importance of the Chart of Accounts is that it helps in the segregation of the revenue, expenditures, assets, liabilities, etc. so that the viewer can immediately get access to the required information.

- Helps in the preparation of the balance sheet. That is, with the help of this chart you can easily develop a balance sheet which will provide you with the data of the purchase, of assets and liabilities made from the different accounts and the income or expenditure over a particular period of time.

- You can also draft the profit and loss statement with the help of these Charts of accounts. You will be easily able to collect the information about the sales made and the amount that has been invested and the amount that has been gained that is the return on investment.

- The most important thing is that you can develop the standard report at the end of the financial yearly or monthly and quarterly reports. This standard report is the document that usually contains all the information related to finance.

- Each account is mentioned in the numerical order or with the designated name arranged in alphabetical order. You can just type the number or the name and you will get the information of that account from the sample list.

Sample Chart of Accounts Template

This Sample Chart of Accounts Template is a basic structure designed to prepare an organizational chart regarding the various accounts that the organization has. You can easily download this template anytime and anywhere based on the requirements you have.

Company’s Chart of Accounts Template

You can use this Company’s Chart of Accounts Sample as a suitable structure for your required document. With this sample format, you can create an account plan to manage all the accounts. This is the best structure that you can avail of your listing the financial health of your organization.

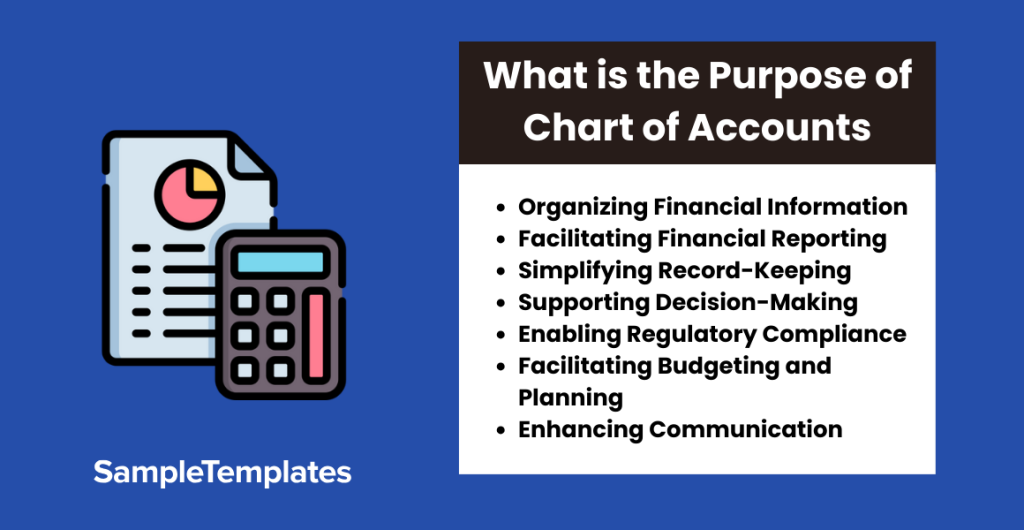

What is the Purpose of Chart of Accounts?

The Chart of Accounts serves as a foundational tool in accounting, fulfilling several essential purposes:

- Organizing Financial Information:

- It provides a systematic way to categorize and organize financial transactions, ensuring that all aspects of a business’s financial activities are accounted for.

- Facilitating Financial Reporting:

- The chart of accounts is instrumental in generating financial statements, such as the balance sheet, income statement, and cash flow statement. It ensures accurate and comprehensive reporting of a company’s financial performance.

- Simplifying Record-Keeping:

- By categorizing accounts based on their nature (assets, liabilities, equity, income, and expenses), it simplifies the recording and tracking of financial transactions, making it easier for bookkeepers and accountants.

- Supporting Decision-Making:

- It aids in financial analysis and decision-making by providing a clear overview of the financial health of the business. Decision-makers can quickly identify trends, assess performance, and make informed strategic choices.

- Enabling Regulatory Compliance:

- The chart of accounts helps businesses comply with accounting standards and regulatory requirements. It ensures that financial records are organized in a way that facilitates audits and regulatory filings.

- Facilitating Budgeting and Planning:

- It assists in budgeting and financial planning sample by providing a structured framework to allocate resources, track expenditures, and set financial goals.

- Enhancing Communication:

- The standardized structure of the chart of accounts facilitates communication among different stakeholders, including management, investors, creditors, and regulatory authorities.

Chart of Accounts for Small Business Template

Chart of Accounts comes under the basic organization charts. For the preparation of which you can download this Chart of Accounts for Small Business sample. This another different format that has been crafted for making it unique from the old-school patterns. The format is fully customizable, hence you can customize it as per your need.

Chart of Accounts Policy Template

Before drafting any kind of organizational chart you need to understand the policy that the organization has as a part of the company’s protocol. This Chart of Accounts Policy Template is an example of such policy. You can also draft the policy for your company’s Chart of Accounts with this template as the reference list.

Descriptive Chart of Accounts Template

This is a Descriptive Chart of Accounts Sample. By downloading this sample you will be able to understand the structure of such descriptive account charts. You can either use this same structure for your work by replacing the data analysis that you don’t need or you can take the help of this sample and prepare your required Chart of Accounts.

Church Chart of Accounts Template

A Church is also maintained by an organization, therefore it also has bank accounts for a different purpose statement. You can use this Church Chart of Accounts Template for maintaining the chart for the church’s bank accounts. The best part of this template is that it has been designed for the church. Therefore it is an exclusive sample that gives you information and a ready-made structure for the Chart of Accounts related to Churches.

Standard Chart of Accounts Template

For small law firms, you can use this Standard Chart of Accounts Sample as a format to manage all the accounts. You can either use it for your law firm or use it as a document for your client whose case you are handling. Isn’t it a convenient medium that gives you dual opportunities?

Uniform Chart of Accounts Template

Uniform Chart of Accounts deals with the financial transactions of the public school report. This is used to organize the data of the schools. Here is a sample that can help you in the process. This Uniform Chart of Accounts Sample template can be used to develop the framework of the required document. This template can be downloaded in both Windows and iOS.

Chart of Accounts Maintenance Request Form Template

This is a request form that can be used to make the request for the Chart of Accounts. This is a formal structure that can be used for requesting. You can input the details that are required. That means this template is modifiable. You can make your required modifications that your organization requires.

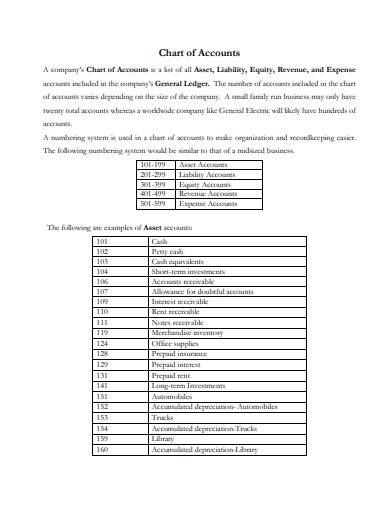

How should a chart of accounts be structured?

The structure of a Chart of Accounts (COA) can vary based on the specific needs and nature of a business, but it typically follows a standardized framework. Here’s a general guideline for structuring a Chart of Accounts:

- Assets (1000 – 1999):

- 1000 – 1099: Current Assets (e.g., Cash, Accounts Receivable)

- 1100 – 1199: Fixed Assets (e.g., Property, Equipment)

- Liabilities (2000 – 2999):

- 2000 – 2099: Current Liabilities (e.g., Accounts Payable, Short-Term Debt)

- 2100 – 2199: Long-Term Liabilities (e.g., Long-Term Debt)

- Equity (3000 – 3999):

- 3000 – 3099: Owner’s Equity (e.g., Owner’s Capital, Retained Earnings)

- Income or Revenue (4000 – 4999):

- 4000 – 4099: Sales

- 4100 – 4199: Other Revenue Streams

- Expenses (5000 – 5999):

- 5000 – 5099: Operating Expenses (e.g., Rent, Utilities)

- 5100 – 5199: Cost of Goods Sold (COGS)

- 5200 – 5299: Non-Operating Expenses

- Other Categories (6000 and above):

- 6000 – 6999: Other Income

- 7000 – 7999: Other Expenses

- 8000 – 8999: Gains and Losses

- Departmental or Functional Breakdown (Optional):

- Consider incorporating additional segments to track specific departments or functions within the organization.

- Numeric Order:

- Arrange accounts numerically within each category for ease of reference and organization.

- Consistency:

- Maintain consistency in account numbering and descriptions to ensure clarity and accuracy in financial reporting.

- Flexibility:

- Design the COA to accommodate the unique needs of the business, allowing for scalability and adaptation as the company grows or undergoes changes.

Remember that the COA is a tool tailored to the specific requirements of the business, so customization is often necessary. Regular review and adjustments ensure that the chart remains relevant and effective in reflecting the financial structure of the organization.

Chart of Accounts Maintenance Template

There are certain rules and regulations that have to be followed to maintain the Chart of Accounts. In this Chart of Accounts Maintenance Sample, you get the information and the format to develop the maintenance policy manual. The instructions are professionally designed so that it can be of your great help.

Alternate Chart of Accounts in DOC

In case you require a alternate structure, different from the general chart of accounts, you can choose this Alternate Chart of Accounts in DOC as the main format for the accounts reporting. With this sample in the DOC format, you can get all the important information that is necessary for this change in the accounts reporting.

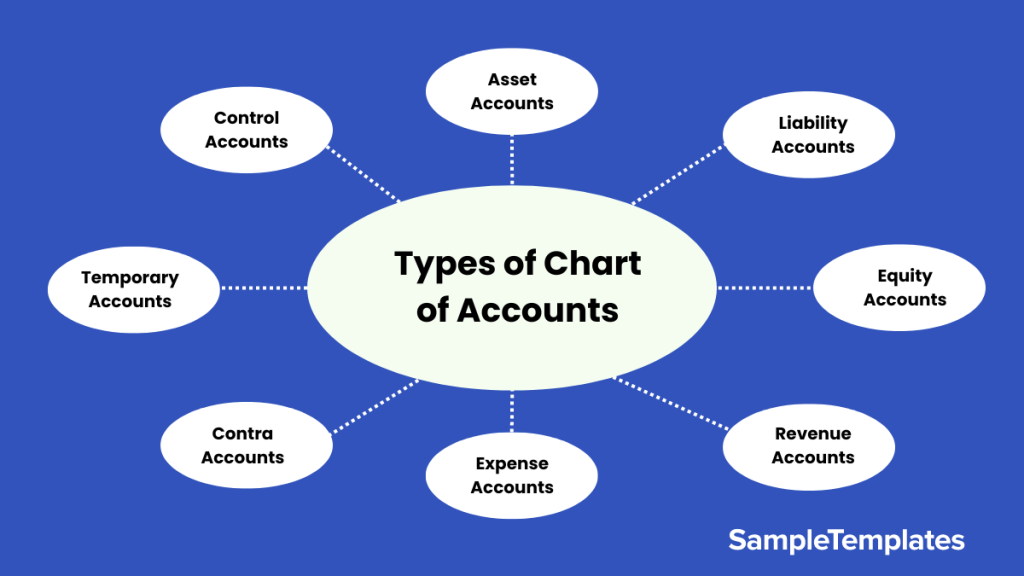

Types of Chart of Accounts

- Asset Accounts: Record resources owned by the business, such as cash, inventory, and equipment.

- Liability Accounts: Document the company’s obligations, including loans, accounts payable, and accrued expenses.

- Equity Accounts: Represent the owners’ stake in the business, such as capital investments and retained earnings.

- Revenue Accounts: Capture income generated from sales, services, or other business activities.

- Expense Accounts: Track the costs incurred in running the business, like rent, utilities, and salaries.

- Contra Accounts: Offset the balances in other accounts, such as accumulated depreciation or allowance for doubtful accounts.

- Temporary Accounts: Record transactions for a specific period, including revenue and expense accounts.

- Control Accounts: Summarize detailed transactions from subsidiary ledgers, like accounts receivable or accounts payable.

Manager’s Chart of Accounts Outline Template

A Manager’s Chart of Accounts Sample is the example of the Chart of Accounts for the Manager’s account. This is a sample template that provides enough detail on the development of the manager’s chart sample. This is slightly different from the rest of the organization’s chart. Hence you can download this get to gather the knowledge about the framework of the chart as well as the data that is supposed to be used.

General Ledger Chart of Accounts in DOC

Chart of Accounts in Excel

This is a General Ledger Chart of Accounts in DOC that you can use to list down all the transactions either credited or debited for the community development. If you download this template you will get the idea of the structure that you can use for this purpose. The template is available in the DOC format, hence you can edit it in the DOC editor.

Is a chart of accounts limited?

A Chart of Accounts (COA) is not inherently limited. It can be adapted and expanded to suit the needs of a business analysis, offering flexibility for customization.

Who uses chart of accounts?

A Chart of Accounts (COA) is used by accountants, financial professionals, and businesses to organize and classify financial transactions for accurate recording, reporting, and sample analysis.

How do you categorize a chart of accounts?

Categorize a Chart of Accounts by grouping accounts into major categories such as Assets, Liabilities, Equity, Income, and Expenses, providing a structured framework for financial recording and reporting.

Is a chart of accounts limited?

A Chart of Accounts (COA) is not inherently limited; it can be customized and expanded to meet the specific needs of a business, providing flexibility in financial reporting.

How do you categorize a chart of accounts?

Categorize a Chart of Accounts by grouping accounts into major categories such as Assets, Liabilities, Equity, Income, and Expenses, providing a structured framework for financial recording and reporting.

In conclusion, a well-organized Chart of Accounts is crucial for effective financial management, providing a structured framework for accurate recording, reporting, and analysis of a business’s financial transactions.

Related Posts

8+Sample Petty Cash Log Templates

61+ SOP Templates

8+ Impactful Resume

9+ Sample Bill Organizer

6+ Sample Task Tracking

8+ Blank Spreadsheet Templates

11+ Medical Records Job Description Sample

10+ Net Worth Calculator Samples

19+ Calculator Spreadsheet Samples

Statement Letter Sample

11+ Financial Statement Samples

7+Free Checkbook Register

25+ Sample Thank You Letter Formats

10+ Sample Requisition Forms

25+ Payroll Samples & Templates