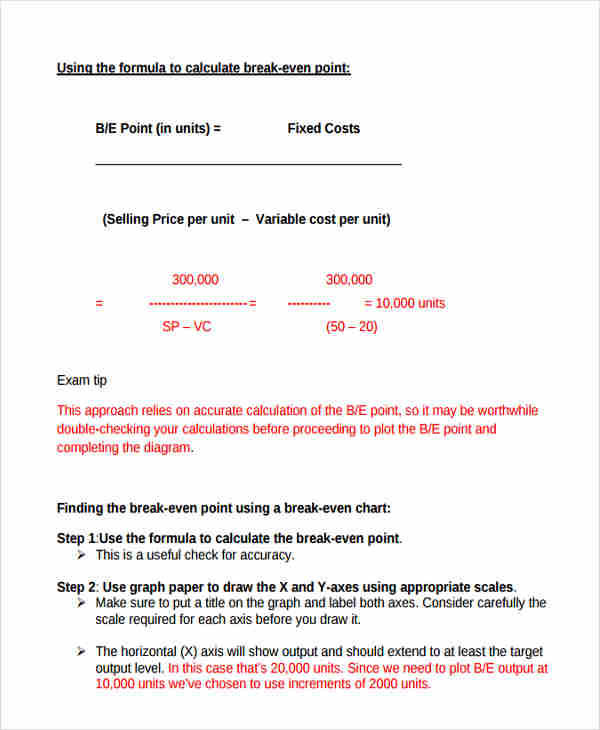

In the field of business, break even point means that both revenue and expenses are equal. Break even analysis is a way to determine when the company will be able to cover up the expenses spent and start making profit. Descriptive analysis, exploratory, predictive, inferential, and causal are some examples of analysis.

Additionally, critical analysis is more of a subjective kind. When you write this kind of analysis, you will express what you’ve observed, opinions and evaluation of the text, this is dependent to the individual. More so, analysis is a detailed observation, it involves studying the parts to gain understanding of the whole picture.

Hotel Break Even Analysis

Restaurant Break Even Analysis

Break-Even Analysis Calculator

Why Is Break Even Analysis Good for Budgeting?

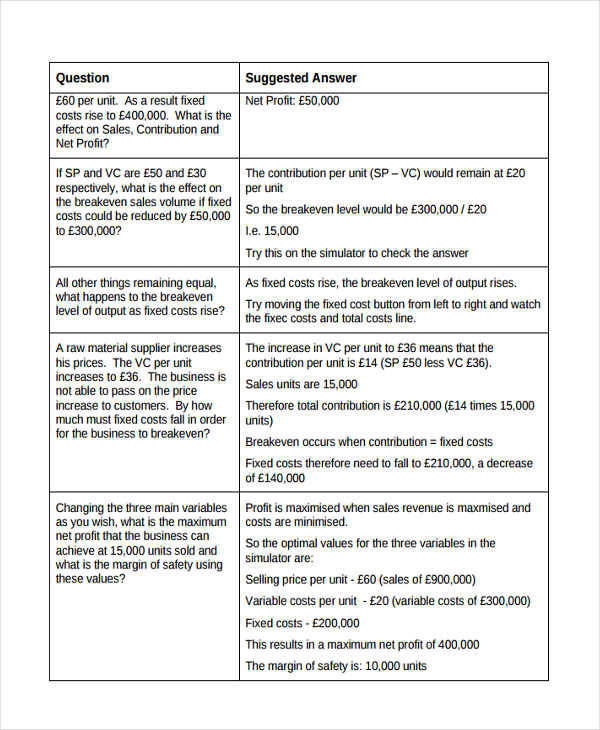

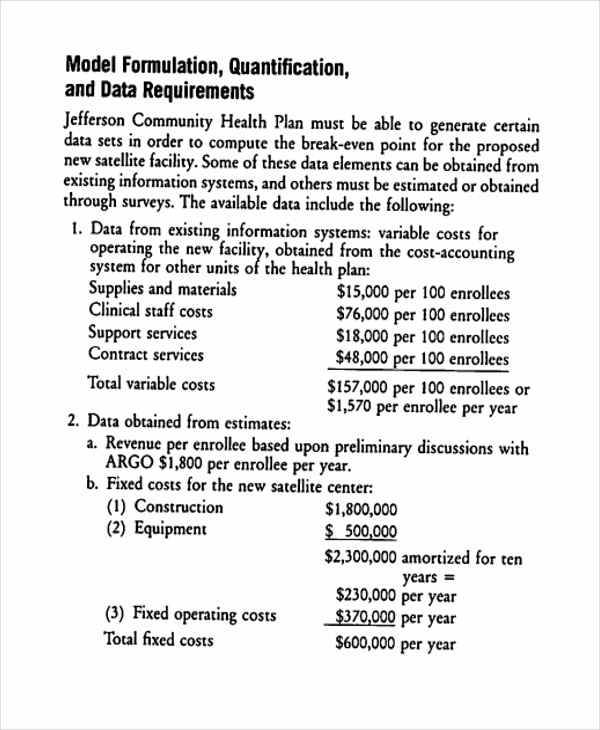

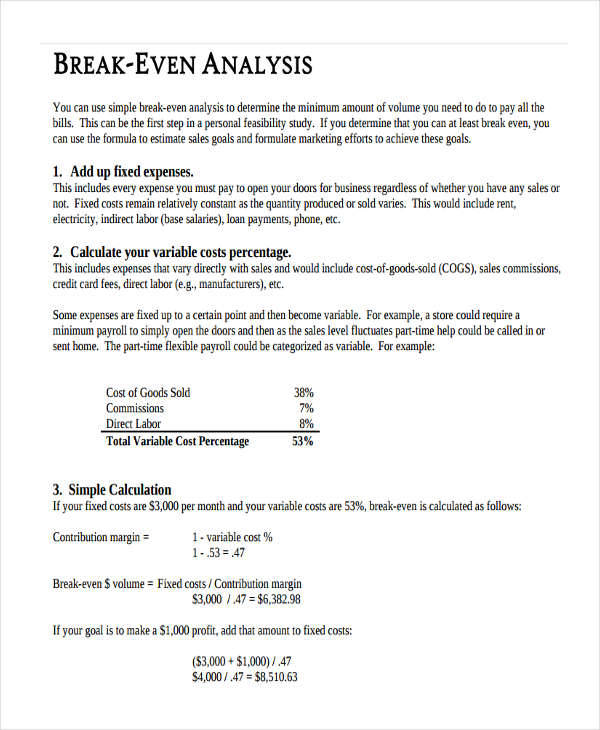

Break even analysis helps the business measure how much is gained and how much is lost at different production sales levels. This could be used in predicting future changes and progress in the financial analysis. This analyzes the relationship of the business expenses like fix and variable cost. Break even analysis could be a motivational tool because it could clearly show the impact of the current sales. These charts could help in the process of budgeting. This sets specific, manageable, attainable, realistic, and timely goals. Through this analysis, the company would be aware of the profits that the business would gain at some point.

Why Is Break Even Point Analysis Important?

A break even point is important especially in business SWOT analysis. This could help the company determine how fast the progress or the decline of the market is. This also helps the owners gain understanding on the cost that the business has to get around to earn a profit, this would allow them to strategize. Break even point is a way to determine pricing of the units or products. There are analysis samples that could be used to determine break even point.

Business Break-Even

Break Even Analysis Data

Sample Break Even Analysis

Simple Break Even Analysis

When Should Break Even Analysis Be Used?

In the world of business, case analysis is a tool in planning projects that involves financial risks and action, benefits and consequences of the said actions. In a case analysis, you are going to evaluate what next step you’re going to take since one mistake could lead to a lot of new issues that the business would have to face. This is where break even analysis comes in. You could use break even analysis for pricing of items and promotion of these products. This is when you’re going to weigh if the ideas are worth the cost for a better gain.

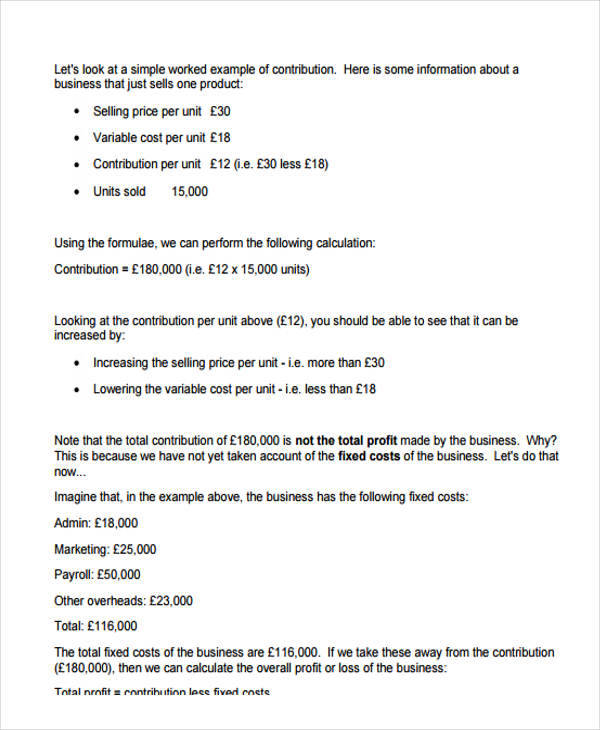

Assumptions Made When Using Break Even Analysis

The first assumption is the average per unit sales price. This is the value you receive per item. Second is average per unit cost. This is the value that costs the company to produce the items. Lastly, monthly fixed cost, a clear example for this is the monthly payroll for the staff of the business, hence the label. No matter how much the company gains, the pay to the staff is fixed. You can encounter all these in sales analysis as well. You could also use analysis template to minimize the time in creating and maximize the time in analyzing instead.

Related Posts

FREE 10+ Fishbone Root Cause Analysis Samples in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 6+ Corporate Portfolio Analysis Samples in PDF

FREE 10+ Fault Tree Analysis Samples in PDF

FREE 10+ Comp Analysis Samples in PDF

FREE 10+ Fishbone Analysis Samples in PDF

FREE 10+ Individual Swot Analysis Samples in PDF

FREE 10+ 5 Year Analysis Samples in PDF

FREE 10+ Benefit Costs Analysis Samples in PDF

FREE 10+ Job Hazard Analysis Samples in PDF

FREE 10+ Primary Source Analysis Samples in PDF

FREE 10+ Critical Path Analysis Samples in PDF

FREE 10+ Competition Analysis Samples in PDF

FREE 10+ Activity Hazard Analysis Samples in PDF

FREE 10+ Risk Benefit Analysis Samples in PDF