You likely won’t begin a nonprofit to gaze at spreadsheets and Google “how to document an in-kind donation,” but accurate accounting (and the analysis it allows you to undertake) is critical to your organization’s existence. What drew you to your nonprofit when you first started working there? What was the impetus for you to start working there? It wasn’t likely tiresome paperwork, difficult computations, or compliance restrictions. The nonprofit’s mission was probably (and still is) what drew you in. However, paperwork, computation, and other time-consuming duties are all part of the job of running a successful nonprofit. Nonprofit accounting is one such task that many nonprofit professionals would rather avoid.

10+ Nonprofit Accounting Samples

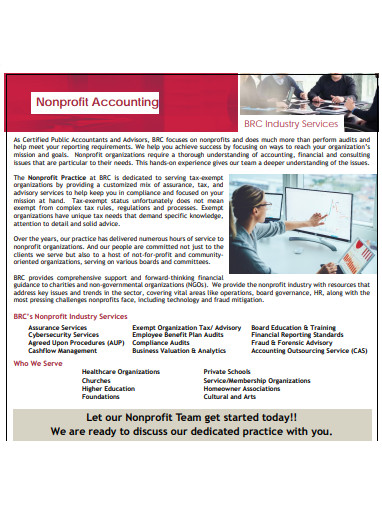

Nonprofit accounting refers to a specific system of recording and reporting that a nonprofit group uses for its commercial activities. A nonprofit organization is one that has no shareholders, operates for a goal other than profit, and accepts large contributions from third parties who do not expect a return. Nonprofit accounting is distinguished from for-profit accounting by the following principles. It’s a one-of-a-kind method for NGOs to plan, track, and report on their finances. While for-profit companies are primarily concerned with making a profit, nonprofit organizations are more concerned with accounting accountability. They adhere to a system of regulations and processes that assist them in remaining accountable to their supporters and contributors.

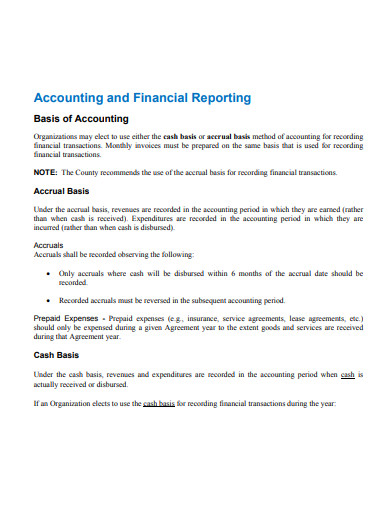

1. Nonprofit Accounting

2. Nonprofit Accounting Services

3. Sample Nonprofit Accounting

4. Simple Nonprofit Accounting

5. Nonprofit Accounting and Budgeting

6. Basic Nonprofit Accounting

7. Formal Nonprofit Accounting

8. Nonprofit Accounting Example

9. Nonprofit Accounting Format

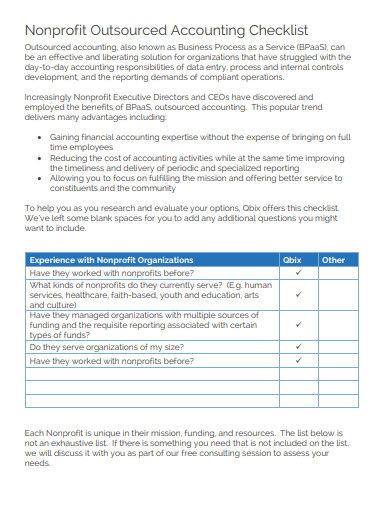

10. Nonprofit Outsourced Accounting Checklist

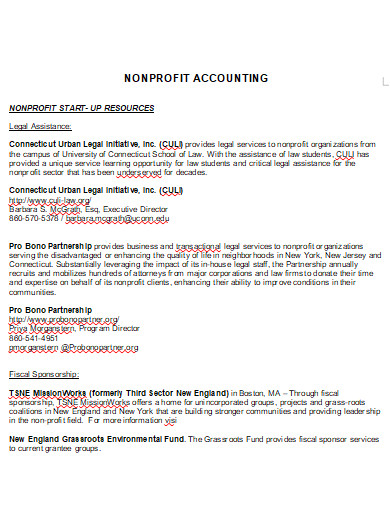

11. Printable Nonprofit Accounting

Nonprofit Accounting Reports and Statements

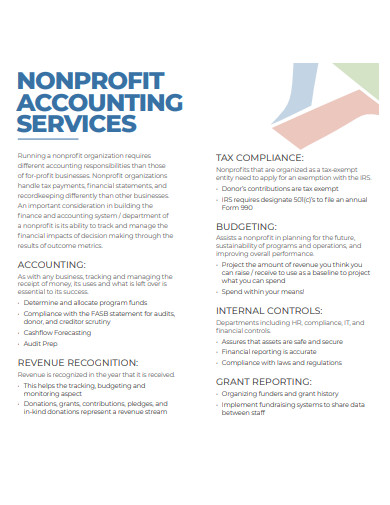

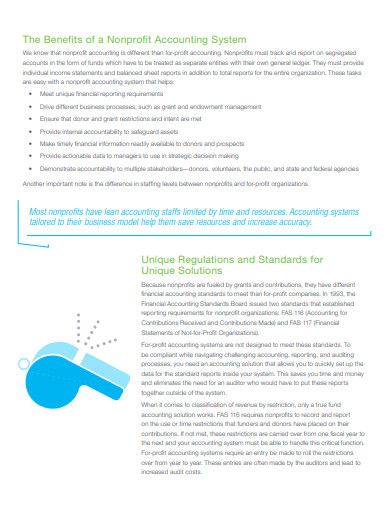

Accounting for non-profits isn’t a free-for-all. When creating reports for nonprofits, accounting professionals must follow specific requirements. The GAAP standards are the most important principles your company should be aware of. Generally Accepted Accounting Principles (GAAP) stands for “Generally Accepted Accounting Principles.” These are general accounting principles that accountants in all industries accept. The Financial Accounting Standards Board is in charge of establishing these rules (FASB).

There are numerous forms of paperwork that your business should be aware of in accordance with these criteria. We’ll go over the various types of paperwork that your finance department is likely to encounter on a regular basis.

#1. Nonprofit Budget

The budget for your NGO is the document that most people in your organization are acquainted with. Your management or finance team creates this document with details from your development team and historical spending trends from your company. Your nonprofit budget is a planning document that helps you forecast spending and allocate resources. It outlines both the expenses and revenue that your business expects to incur over a specific time period, typically a year.

#2. Statement of financial position

The statement of financial status is another name for your nonprofit’s balance sheet. This is the statement that best reflects your nonprofit’s fiscal condition. The lists of assets and liabilities for your organization can be found in this document.

#3. Statement of activities

The income statement of your organization is also known as the statement of activities. This report depicts your company’s revenue and expenses over time. It’s utilized to organize your many revenue and spending sources. You may also use this record to evaluate your net asset change from the start to the finish of the year.

#4. Statement of functional expense

The statement of functional expense for your organization breaks down your expenses into different common categories and assigns a “purpose” to each one. This classification will divide expenses into three categories: program expenses, expenses incurred, and fundraising effort expenditures.

#5. Statement of cash flow

The statement of cash flow for your nonprofit demonstrates how money and funds flow in and out of the organization. It enables you to determine how much money you have available to cover your bills at any one time. This nonprofit accounting statement shows how money flows at the organization by breaking down operational, financing, and investment activities. Analyze this statement to discover how your nonprofit spends the money it raises from fundraising, grant writing, and other sources of revenue.

FAQs

What is the role of budget in nonprofit accounting?

A budget is not required in a for-profit firm, but it is an important part of the accounting for a nonprofit organization. This is because a nonprofit often has limited funding sources and must keep a tight grip on its spending at all times. As a result, its budget must be meticulously created based on realistic income projections, with all expense variances being investigated as soon as possible.

Why are purchase orders important?

A purchase order is a document given from a buyer to a seller to confirm a specific purchase of products or services, and it’s a fantastic method to keep you and your supplier on the same page. It becomes a legally enforceable contract once your vendor signs it, detailing how much you ordered from your provider, how much you paid, and when the supplier committed to deliver your order.

Nonprofit accounting is a special type of accounting. Understanding the concept of accounting will enable your nonprofit fully appreciate its own financial status. Decide to outsource your accounting to a firm if your accounting obligations are still rolled up under your executives. They’ll ensure that all standard procedures and internal controls are followed, resulting in more informed financial decisions.

Related Posts

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF

FREE 11+ Liability checklist Samples & Templates in PDF | MS Word

FREE 11+ Annuity Checklist Samples & Templates in PDF | MS Word