Inventory management and asset management plans are two of the various areas that business owners must inform themselves about to ensure the continued success of their company or organization. Small businesses use spreadsheets to manage these areas while larger enterprises have a department of accountants and auditors to handle their physical assets especially those that can affect their cash flow, debt, and financial plans. Most companies have machinery and pieces of equipment they use to add value to their business which are called fixed assets.

FREE 10+ Fixed Asset Register

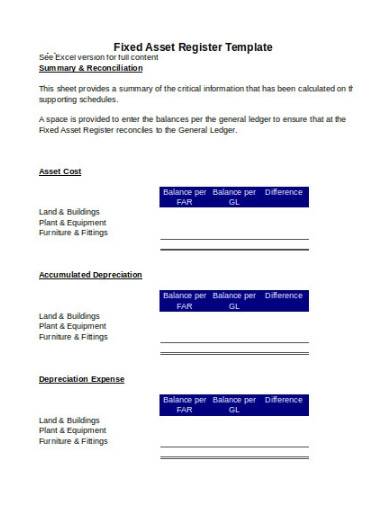

1. Fixed Asset Register Format in Excel

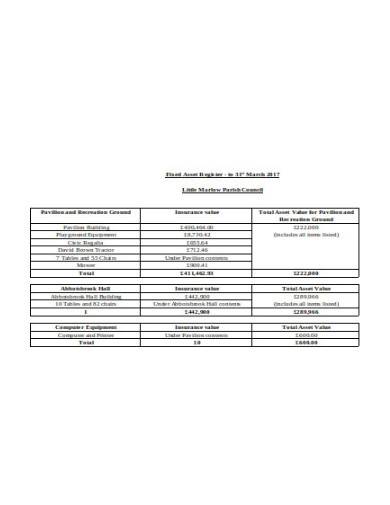

2. Fixed Asset Register

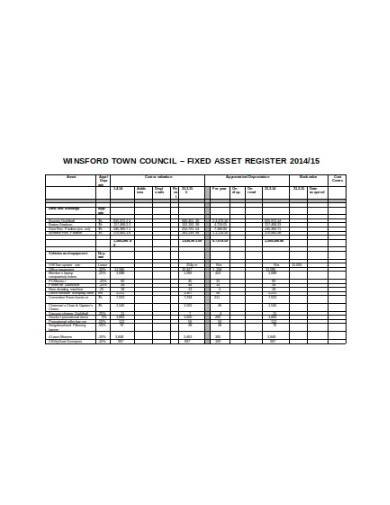

3. Standard Fixed Asset Register Template

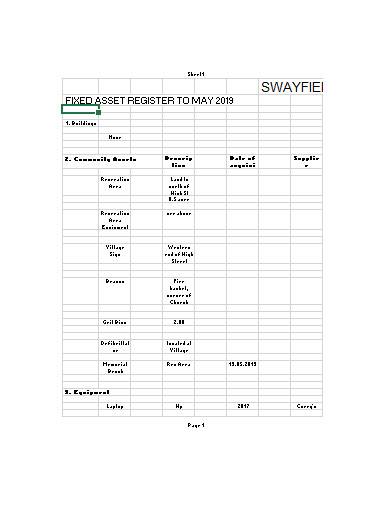

4. Sample Fixed Asset Register Template

What is in a Fixed Asset Register?

A Fixed Asset Register (FAR) serves as a crucial tool for organizations to systematically record and manage their tangible assets. This comprehensive ledger provides a detailed overview of an entity’s fixed assets, helping streamline financial processes, enhance decision-making, and ensure regulatory compliance.

The primary purpose of a Fixed Asset Register is to maintain an accurate and up-to-date record of all tangible assets owned by a business. These assets, often referred to as fixed or capital assets, include property, plant, equipment, and other long-term assets that contribute to the company’s operations.

Here are key components and functionalities of a Fixed Asset Register:

- Asset Identification:

- The register includes a unique identification number for each asset to facilitate easy tracking and retrieval of information.

- Asset Descriptions:

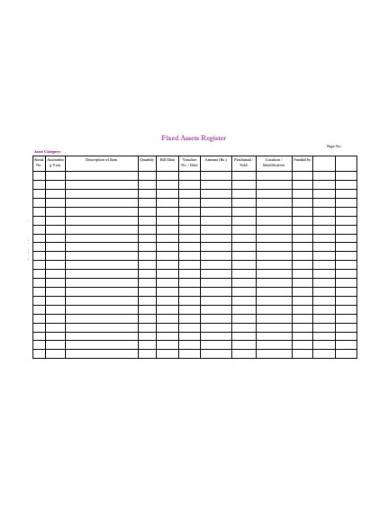

- Detailed descriptions of each asset, including specifications and relevant details, are recorded to provide a comprehensive understanding of the asset’s characteristics.

- Acquisition Details:

- Information related to the acquisition of assets is documented, including the purchase date, cost, and any associated expenses such as installation or transportation costs.

- Depreciation Information:

- For assets subject to depreciation, the Fixed Asset Register includes details on the depreciation method used, useful life, and the accumulated depreciation over time.

- Current Values:

- The register reflects the current value of each asset, considering factors such as depreciation and any impairments.

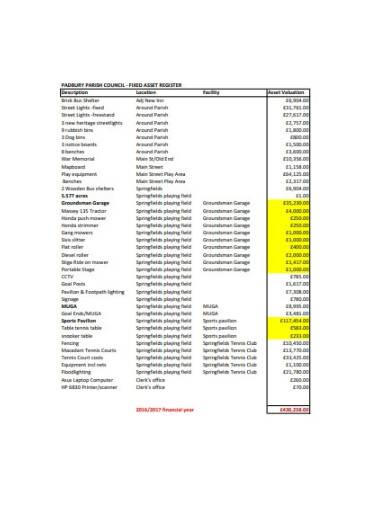

- Location Tracking:

- For organizations with multiple locations, the register may include information on the physical location of each asset, facilitating effective asset management.

- Maintenance Records:

- Maintenance and service records can be incorporated to ensure that assets are adequately cared for and to sample schedule preventive maintenance.

- Compliance and Reporting:

- The Fixed Asset Register aids in compliance with accounting standards and regulations. It provides the necessary information for financial reporting, including balance sheets and depreciation schedules.

- Disposal Information:

- When assets are sold, scrapped, or otherwise disposed of, the register captures details of the transaction, including the disposal date and proceeds.

- Audit Trail:

- An effective Fixed Asset Register maintains an audit trail, documenting changes or updates to asset information over time. This ensures accountability and transparency.

5. College Fixed Asset Register Template

6. Simple Fixed Assets Register Template

7. Fixed Assets Register Template

8. Basic Fixed Assets Register Template

9. Fixed Assets Register Example

What is fixed assets register examples?

Examples of items that could be included in a Fixed Asset Register (FAR) as fixed assets vary across different industries and organizations. However, here are some common examples of fixed assets that might be found in a register:

- Land and Buildings:

- Office buildings, factories, warehouses, and other real estate properties owned by the organization.

- Machinery and Equipment:

- Manufacturing equipment, production machinery, computers, servers, and other equipment used in day-to-day operations.

- Vehicles:

- Company-owned vehicles such as cars, trucks, vans, and specialized vehicles used for business purposes.

- Furniture and Fixtures:

- Office furniture, fixtures, and fittings like desks, chairs, cabinets, and lighting.

- Computers and IT Hardware:

- Desktop computers, laptops, servers, networking equipment, and other IT hardware.

- Intangible Assets:

- Intellectual property, patents, copyrights, trademarks, and other intangible assets that hold value for the organization.

- Office Equipment:

- Printers, scanners, copiers, and other office equipment necessary for day-to-day administrative tasks.

- Leasehold Improvements:

- Renovations or improvements made to leased properties that increase their value.

- Specialized Tools:

- Tools and equipment used in specialized industries, such as construction tools, medical equipment, or scientific instruments.

- Library Books and Collections:

- For educational institutions or organizations with libraries, the sample books and collections could be considered fixed assets.

- Art and Antiques:

- Artwork, antiques, or other valuable items owned by the organization for aesthetic or historical purposes.

- Security Systems:

- Surveillance cameras, access control systems, and other security infrastructure.

- Communication Equipment:

- Phones, intercom systems, and communication devices used within the organization.

- HVAC Systems:

- Heating, ventilation, and air conditioning systems installed in buildings.

- Renewable Energy Assets:

- Solar panels, wind turbines, or other renewable energy infrastructure owned by the organization.

These examples illustrate the diverse nature of fixed assets, and the Fixed Asset Register helps organizations manage, track list sample, and account for these assets throughout their lifecycle. The specific assets included in a register depend on the nature of the business and its operational requirements.

10. Fixed Assets Register in DOC

11. Council Fixed Asset Register Template

How to Create a Fixed Asset Register

It is expected that business owners are knowledgeable about their business assets and their location as well as the proper way to maintain them. The people who manage them must also be informed about their roles and responsibilities. Fixed assets such as tools, properties, machinery, vehicles, lands, and furniture are often listed on the company’s balance sheet. A fixed asset register is a detailed list or documentation of all the company’s fixed assets so businesses can keep a record of both their financial reports and non-financial details relevant to every asset and quickly identify when an asset is required.

Step 1: Provide an Account Record For Every Fixed Asset

Each asset must have its own account where you can store its information. This information includes the asset’s description, serial number, date of purchase, purchase price, insurance coverage, warranty information, the date the asset was placed in service, the estimated life of the asset, salvage value, and the depreciation method.

Step 2: Choose a Depreciation Period

The depreciation period refers to the period in which the asset’s value will decrease. To determine this, make sure that you know first the time period that the depreciation will occur within. This period is also based on the forecasted useful life of a particular asset.

Step 3: Select the Appropriate Method for Depreciation

As every asset depreciates after a certain period of time, it is also important to know the common depreciation methods so they could be provided in your fixed asset register.

Step 4: Perform Periodic Audits

Perform a physical inventory check every year to ensure the accuracy and completeness of your register. Make sure to make a comparison between the physical assets with assets on the book and make sure that the asset register is updated.

FAQs

What is the information needed for creating a fixed asset register?

When creating a fixed asset register, provide a list of all the assets, their location with your company, their condition and status, if they require annual assessments or checks, expiration dates, if replacements are required, their documentation and sample certifications, and relevant user guides.

What are the benefits of a fixed asset register?

With a fixed asset register, you are provided with complete information about each asset’s status, assist in complying with relevant regulations, ensure that balance sheets reflect the accurate value, improves asset utilization, and more.

What are the different types of asset registers?

The common types of asset registers include fixed assets, IT assets, digital assets, facility assets, information assets, and hardware assets registers.

What is the process of asset register?

The process of creating and maintaining an asset register involves identifying, categorizing, recording, and regularly updating information about an organization’s fixed assets to ensure accurate financial reporting and management.

Who prepares fixed asset register?

The fixed asset register is typically prepared by the finance or accounting department of an organization, with input from relevant stakeholders such as operations and procurement teams

Fixed assets refer to all machinery, office equipment, and property that a company or business owns and uses over a long period of time. These assets are listed in a fixed asset register which is the business’s catalog for each asset and their corresponding purchase price, depreciation, values, current location, and more. With a fixed asset register, companies and businesses can maximize the utility of their asset, prevent duplication of purchases, ensure legal compliance with relevant laws, and effectively manage auditing requirements.

In conclusion, a well-maintained fixed asset register is essential for effective financial management sample, providing transparency, compliance, and strategic insights for informed decision-making.

Related Posts

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

FREE 7+ Annuity Review Checklist Samples and Templates in MS Word | PDF