The process of balance sheet reconciliation begins with the identification of the accounts that need to be reconciled. These may include cash, accounts receivable, accounts payable, and inventory management. Once the accounts have been identified, the next step is to gather the necessary information to perform the reconciliation. This may include bank statements, printable invoices, and other supporting documentation.

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word

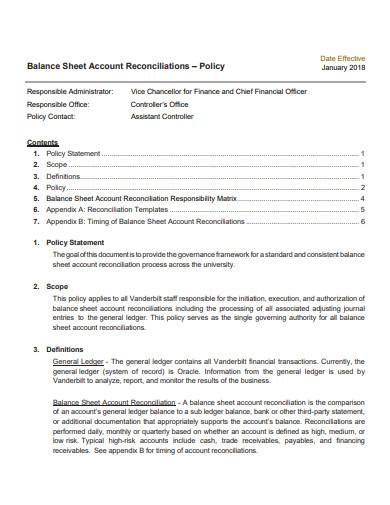

1. Balance Sheet Account Reconciliations Policy Template

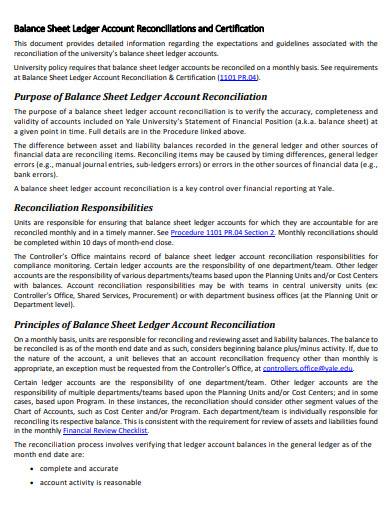

2. Balance Sheet Ledger Account Reconciliations Template

3. Capital Balance Sheet Reconciliation Template

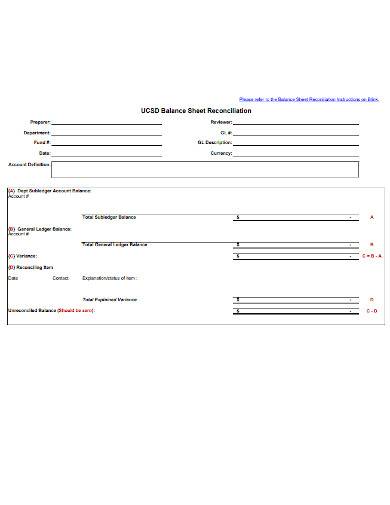

4. Sample Balance Sheet Reconciliation Template

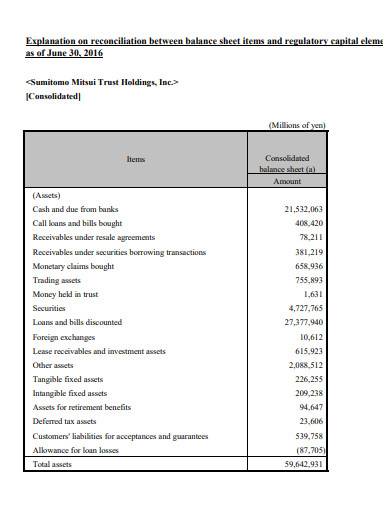

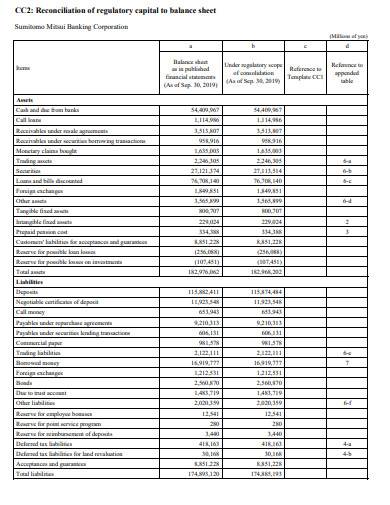

5. Reconciliation of Regulatory Capital to Balance Sheet

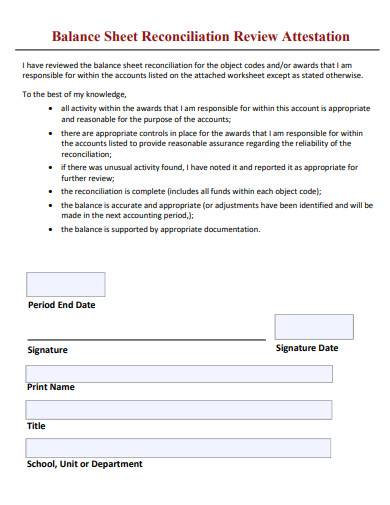

6. Balance Sheet Reconciliation Review Attestation Form

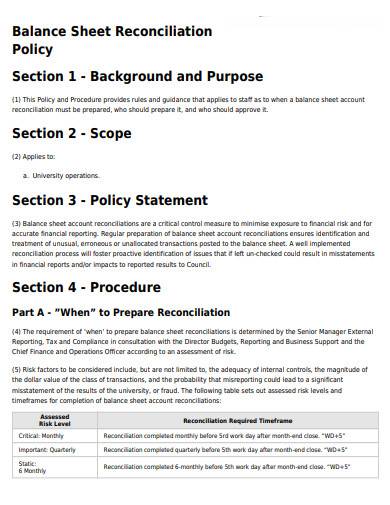

7. Basic Balance Sheet Reconciliation Policy Template

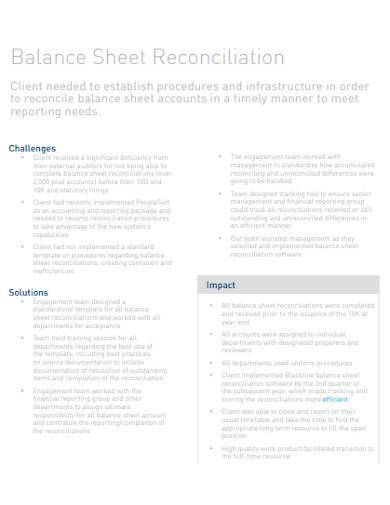

8. Case Study Balance Sheet Reconciliation Template

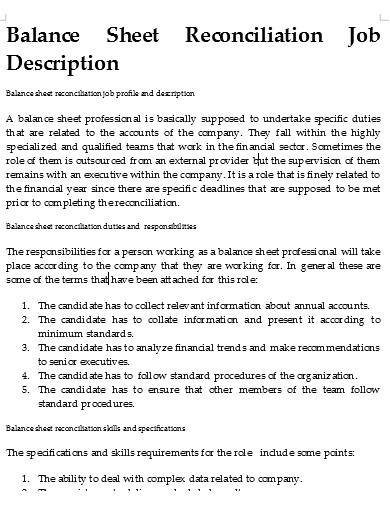

9. Balance Sheet Reconciliation Job Description Template

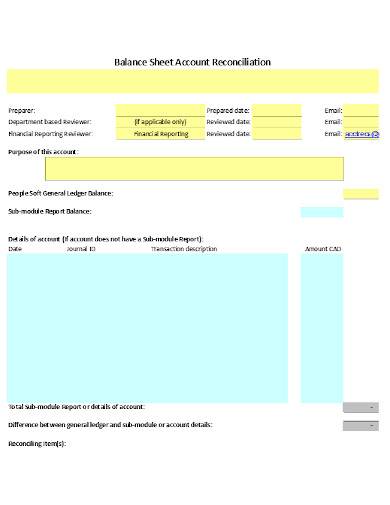

10. Balance Sheet Account Reconciliation

What Is a Balance Sheet Reconciliation?

A balance sheet reconciliation is the process of comparing a company’s balance sheet account balances to the corresponding balances in the company’s internal records or other external sources, such as bank statements. The purpose of this process is to ensure that the balances in the company’s financial statements are accurate and that any discrepancies are identified and explained. This process is typically performed by the company’s accounting or finance department on a regular basis, such as monthly or quarterly.

How to Make a Balance Sheet Reconciliation

The balance sheet reconciliation process is an important part of the financial reporting process. It ensures that the balances in the financial statements are accurate and that any discrepancies are identified and explained. This helps to provide assurance to stakeholders that the financial information that is being reported is reliable. So, to get started in crafting the sheet, you need to follow the steps below:

Step 1: Identify the Accounts and Gather Information

The first step in making a balance sheet reconciliation is to identify the accounts that need to be reconciled. These may include cash, accounts receivable, accounts payable, and inventory. Once the accounts have been identified, gather all the necessary information to perform the reconciliation. This may include bank statements, invoices, and other supporting documentation.

Step 2: Compare Balances

Compare the balances in the company’s financial statements to the corresponding balances in the internal records or external sources. Any discrepancies that are identified must be explained and the necessary adjustments must be made to the financial statements.

Step 3: Make Adjustments

Make the necessary adjustments to the financial statements, such as recording any discrepancies as journal entries. Review and approve the reconciliation to ensure that it is accurate and complete.

Step 4: Keep Detailed Records

Keep detailed records of the reconciliation process, including the information used, any discrepancies found, and the adjustments made. The balance sheet reconciliation process should be performed on a regular basis, such as monthly or quarterly, to ensure that the balances in the financial statements are accurate and up-to-date.

FAQs

Who is responsible for performing balance sheet reconciliation?

Balance sheet reconciliation is typically performed by the company’s accounting or finance department. It should be performed by someone who is familiar with accounting principles and has the necessary knowledge to identify and explain any discrepancies.

How do I explain any discrepancies found during a balance sheet reconciliation?

Any discrepancies found during a balance sheet reconciliation should be explained through detailed documentation, such as journal entries or notes. These should include the reason for the discrepancy and the steps taken to correct it.

How do I ensure the accuracy of balance sheet reconciliation?

To ensure the accuracy of balance sheet reconciliation, it is important to gather all necessary information, compare the balances in the financial statements to the corresponding balances in internal records or external sources, identify and explain any discrepancies, make the necessary adjustments, and review and approve the reconciliation before finalizing it.

In conclusion, balance sheet reconciliation is a crucial process that helps to ensure the accuracy of a company’s financial statements. It helps to provide assurance to stakeholder management that the financial information that is being reported is reliable and helps detect errors or frauds. Regularly performing balance sheet reconciliation is an important part of maintaining a company’s financial integrity.

Related Posts

FREE 10+ Cheat Sheet Samples in PDF

FREE 20+ Signature Sheet Samples in PDF | MS Word

FREE 20+ Review Sheet Samples in PDF | MS Word

FREE 20+ Record Sheet Samples in MS Word | Google Docs | Pages | PDF

FREE 20+ Training Sheet Samples in PDF | MS Word

FREE 20+ Employee Sheet Samples in PDF | MS Word

FREE 10+ Employee Attendance Sheet Samples in PDF

FREE 12+ Balance Sheet Formats in MS Word | PDF | Excel

FREE 5+ Construction Bid Sheet Samples in PDF | MS Word | Excel

FREE 15+ Construction Timesheet Samples in PDF | MS Word

FREE 26+ Construction Sheet Samples in MS Word | Google Docs | Excel

FREE 20+ Continuation Sheet Samples in PDF | MS Word

FREE 25+ Program Sheet Samples in MS Word | Google Docs | Pages | PDF

FREE 33+ Student Sheet Samples in PDF | MS Word

FREE 32+ Planning Sheet Samples in PDF | MS Word