If you own a business, you know fairly well that there are a lot of activities involved in its management. One of the important activities that a business should be keen on is the management of its cash flow. A business should never run out of cash to use for business operations. A business that runs out of cash is as good as a business that is done for. Such a situation is avoidable if a business knows how to manage their accounts receivable.

What Is Accounts Receivable?

Accounts receivable is one of the entries recorded in an accounting journal. It is defined as the amount that customers or clients owe to a company. The said amount is from the goods or services already delivered to the customer or client but has not been paid. Accounts receivable is the opposite of accounts payable, which is the amount that the company owes for goods and services received but has not yet been paid. Managing both accounts receivable and accounts payable are crucial to a business. That is because if both accounts are not managed properly, it will significantly affect the cash flow of the business and risk running out of cash.

In a balance sheet, accounts receivable is recorded as a current asset. That is because customers have an obligation to pay for the goods and services that the company delivered. Payment for accounts receivable is usually due for a short period but may last up to one calendar year. Managing accounts receivable is like boosting the cash flow of the company. And the best way to manage it by not creating the receivable. Instead of waiting for the receivables, companies can have their clients or customers pay for the product when it is delivered, through credit card or online payment.

How to Manage Accounts Receivable

When a business runs out of cash, it is forced to draw funds from its cash reserves or get funds from outside resources. This is the story of how most businesses end up in debt and often never recovers. Good thing, there are now ways to manage accounts receivables effectively.

1. Go Digital

People go online every day, and some even work online for more than 8 hours. That is because the internet is now accessible to a lot of people. And through mobile devices, checking emails is a breeze. So, why not take advantage of technology and go digital. You can send bills and invoices using invoice templates to your customers or clients via email. Just make sure that you get their preferred active email address. Customers receive bills and invoices sent through email quickly compared to sending them by post.

2. Create a Positive Relationship

Building a positive relationship with your clients and customers increases the chances that they’ll pay their dues with you first if they run short on cash and need to choose which company to pay first. Customers are likely to remember doing good business with you, thus making your company their number one choice. That way you’ll not have to go for collections to get paid.

3. Make Multiple Payment Methods Available

One of the reasons why customers make late payments is the limited number of available payment methods. A lot of customers would prefer to pay using a credit card or debit card online or over the phone, so you might want to consider having the said options available. Of course, customers have their preferences, so it would be best to provide multiple options for their convenience.

4. Hire an Accountant or Accounting Company

The best people to entrust the management of your company’s accounts receivables are the accountants. Don’t wait for a problem to arise before deciding to hire an expert. If you own a big company, it’s good to have a small group or department dedicated to doing accounting tasks for your company.

5. Be Clear with Your Credit Policies

Clearly state the terms and conditions covering your credit policies. Also, consider shortening payment terms so that you won’t have to wait for too long for the payment. This will have a good effect on your company’s cash flow and ensure that you won’t run short of cash.

6. Collections Should Be Your Last Resort

Before you put a customer or client in the collections list, make sure that you have exhausted all possible ways to collect payment. That is because this will strain your relationship with the customer, and you may lose them in the process. But you still have to collect payment for your business to recover, so always treat collections as a last resort.

FREE 10+ Accounts Receivable Templates and Samples

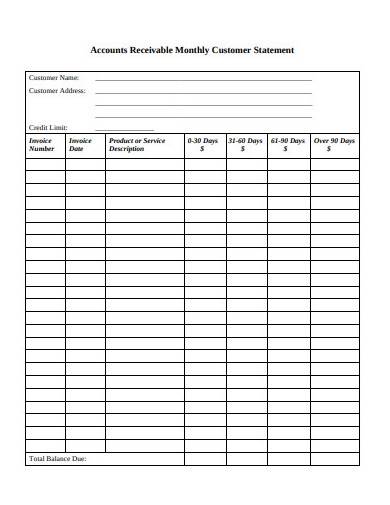

1. Accounts Receivable Monthly Statement

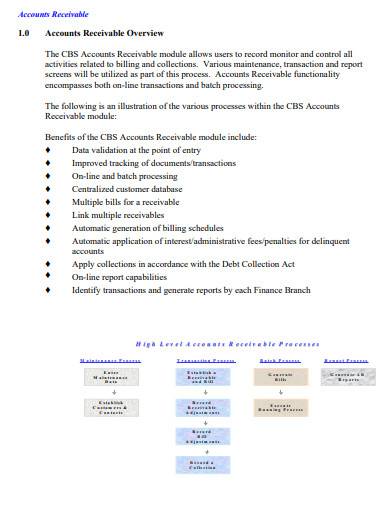

2. Accounts Receivable Template

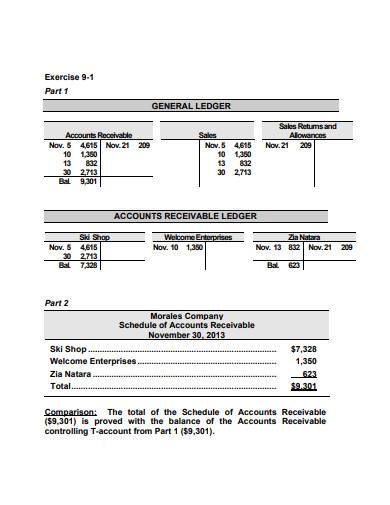

3. Accounts Receivable Ledger Sample

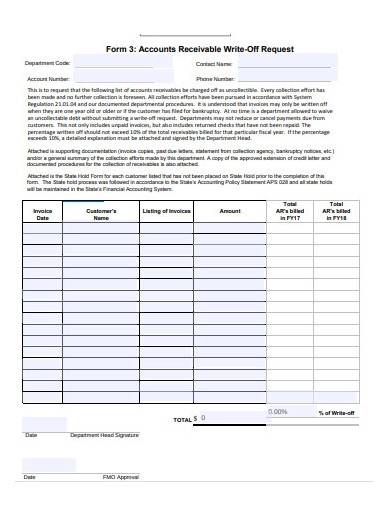

4. Accounts Receivable Request Template

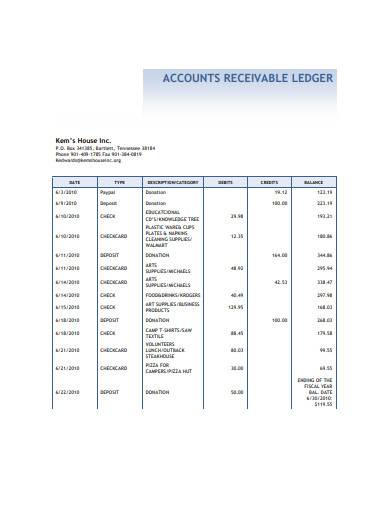

5. Accounts Receivable Ledger Template

6. Accounts Receivable Collection Policy Template

7. Accounts Receivable Example Template

8. Accounts Receivable Internal Procedure

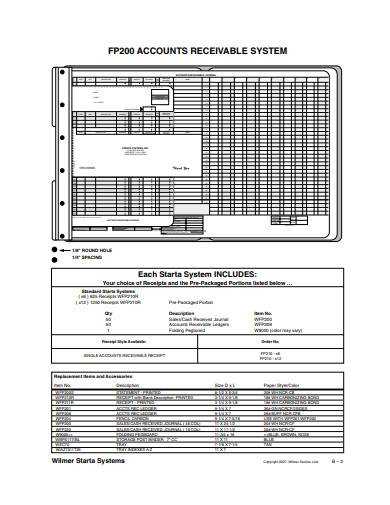

9. Accounts Receivable System Template

10. Sample Accounts Receivable Ledger Template

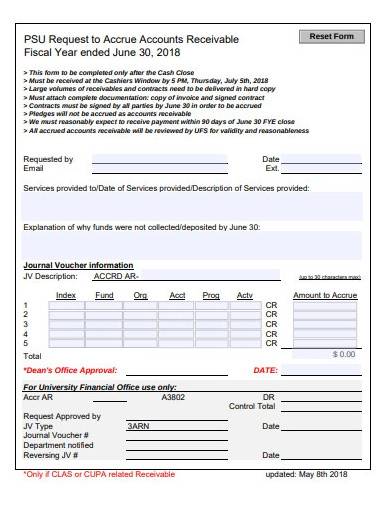

11. Accrued Accounts Receivable Example

Is it okay to charge customers with a late fee?

Some companies charge a late fee if their customers fail to pay their dues on time. This is only applicable if it is stated in the terms and conditions of the agreement that you had with your customers. You can provide a couple of days extension before finally charging the late fee.

When should I send customers to collections?

If you have done everything that you can to collect payment and if the invoice is already past due for 90 days, then that is the time when you forward a customer to collections.

Effectively keep track of your company’s accounts receivables through proper management and with the use of ready-made and customizable accounts receivable samples and templates. We have a collection of free templates above that you can choose from. Check them out now!

Related Posts

FREE 10+ Writing Journal Entry Samples and Templates in MS Word | PDF

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word