An annuity is a type of financial contract that is designed to guarantee a predetermined amount of income on a regular basis for a predetermined amount of time. When contemplating the purchase of an annuity, there are a number of considerations that must first be given attention in order to guarantee that the investment will meet both your long-term financial objectives and immediate requirements.

FREE 11+ Annuity Checklist Samples & Templates in PDF | MS Word

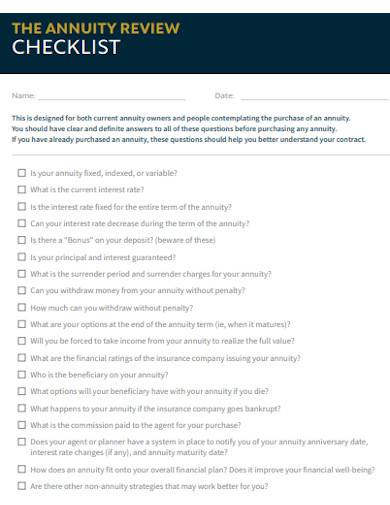

1. Annuity Review Checklist Template

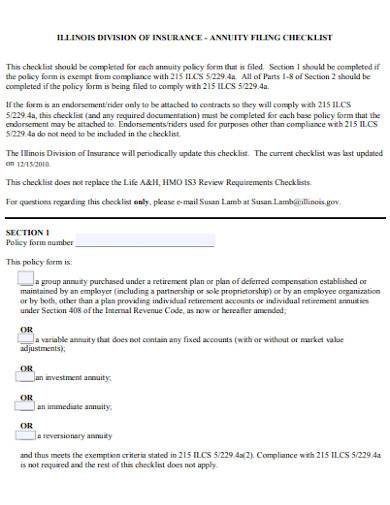

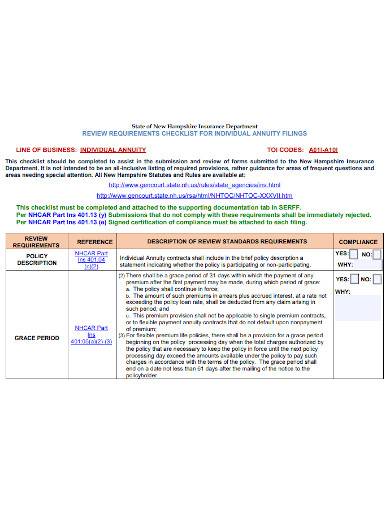

2. Annuity Filing Checklist Template

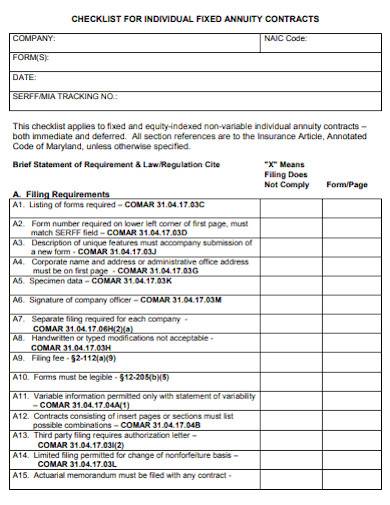

3. Checklist for Individual Fixed Annuity Contractors

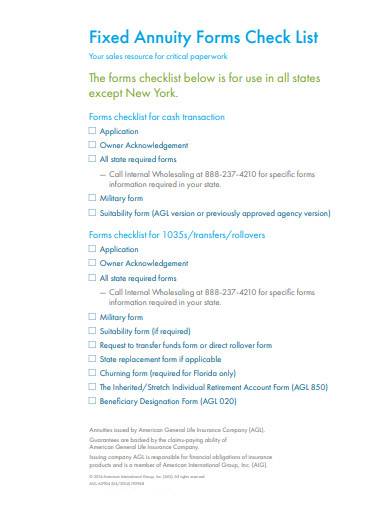

4. Fixed Annuity Forms Check List

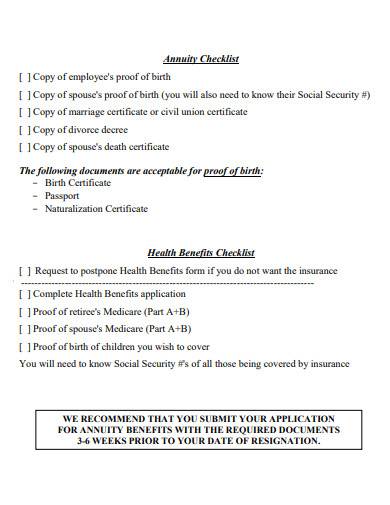

5. Sample Annuity Checklist Template

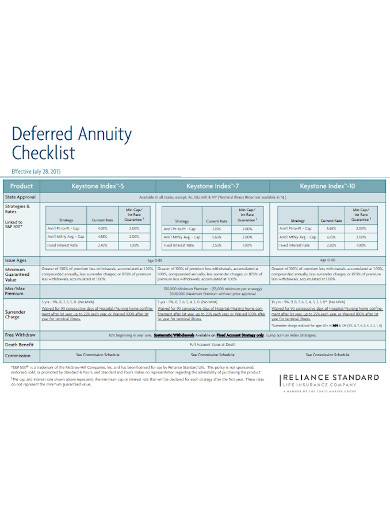

6. Annuities Deferred Annuity Checklist

7. Sample Individual Annuity Checklist Template

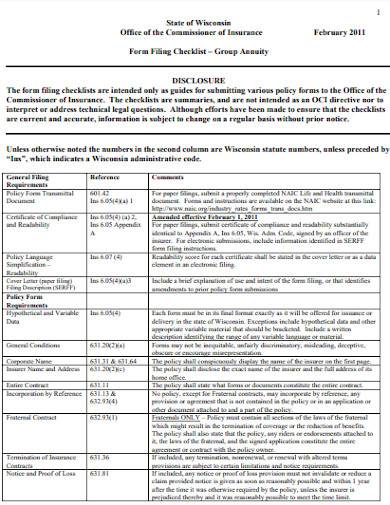

8. Group Annuity Checklist Template

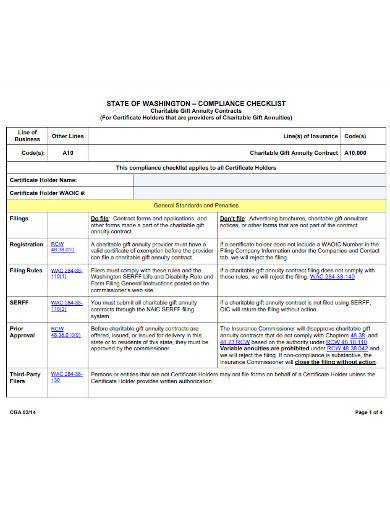

9. Charitable Gift Annuity Contracts Compliance Checklist

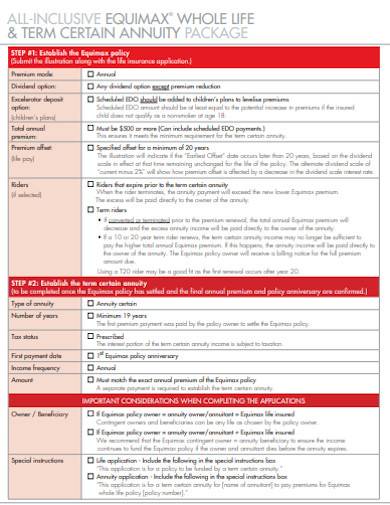

10. Annuity Package Checklist Template

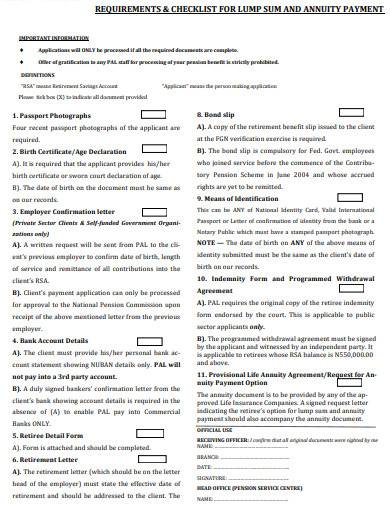

11. Checklist for Lump Sum and Annuity Payment Template

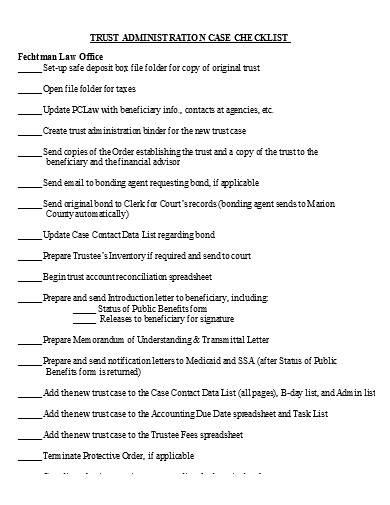

12. Trust Administration Annuity Checklist

What is Annuity Checklist?

When obtaining an annuity, there are a number of factors that you need to take into consideration, and this can be done with the help of an annuity checklist. A checklist for an annuity can contain things like your financial goals, the level of risk you’re willing to take, how much time you have, who your supplier is, and the terms.

How To Make Annuity Checklist?

Annuities can be a useful financial tool for individuals who are looking for a steady stream of income over a specified period of time. To create an annuity checklist, follow these steps:

Step 1- Determine Financial Goals

Determine your desired level of financial success: Why do you want to buy an annuity, and what do you intend to accomplish by doing so? Are you trying to save money for retirement, start a new business, or accomplish something else entirely? In addition to this, evaluate how comfortable you are with taking risks: How much of a loss would you consider acceptable if you lost all you invested? This will assist you in selecting an annuity that is suitable for the level of risk you are willing to take.

Step 2- Consider Time Horizon

How long do you anticipate keeping the annuity in your possession? Taking all of this into consideration will assist you in deciding whether a long-term or short-term annuity is better suited to meet your requirements.

Step 3- Research Annuity Providers

When selecting a provider for your annuity, it is essential to choose with a business that has a strong reputation and is in a sound financial position. Look for businesses that have received positive ratings and comments. Be sure that you have a solid understanding of the annuity’s terms, which should include the interest rate, fees, and any restrictions or penalties that may be applicable.

Step 4- Evaluate Financial Situation

Take into consideration your existing state of finances and ask yourself if an annuity would be a good fit for your requirements. If you have any questions or concerns regarding your finances, you should discuss them with a financial counselor.

What are the different types of annuities?

There are several different types of annuities, including fixed annuities, variable annuities, indexed annuities, and immediate annuities. Each type of annuity has its own unique features and benefits, so it’s important to understand the differences before making a decision.

How do I choose an annuity provider?

When choosing an annuity provider, it’s important to research the company’s financial stability and reputation. Look for companies with strong ratings from independent rating agencies and read reviews from other consumers.

How do I understand the terms of the annuity?

It’s important to carefully review the terms of the annuity, including the interest rate, fees, and any restrictions or penalties that may apply. If you have any questions or concerns, don’t hesitate to ask the annuity provider or a financial advisor for clarification.

Individuals who are contemplating the acquisition of an annuity may find that a comprehensive checklist for annuities to be a useful instrument. You may benefit from using a well-crafted annuity checklist, so have a look at our example templates.

Related Posts

FREE 10+ Turnover Checklist Samples [ Project, Apartment, Cleaning ]

FREE 12+ Vehicle Maintenance Checklist Samples [ Preventive, Service, Routine ]

FREE 20+ House Checklist Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 18+ Hospital Bag Checklist Samples in MS Word | Google Docs | PDF

FREE 20+ Student Enrollment Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Improvement Checklist Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 23+ Education Checklist Samples in MS Word | Google Docs | PDF

FREE 21+ Course Checklist Samples in MS Word | Google Docs | PDF

FREE 11+ Freelancer Checklist Samples in MS Word | Google Docs | PDF

FREE 23+ Party Checklist Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 18+ Scheduling Checklist Samples in MS Word | Google Sheets | PDF

FREE 17+ Response Checklist Samples in MS Word | Google Docs | PDF

FREE 17+ Survey Checklist Samples in MS Word | Google Docs | PDF

FREE 18+ Background Checklist Samples in MS Word | Google Sheets | PDF

FREE 18+ Facilitator Checklist Samples in MS Word | Google Sheets | PDF