Annual budgets can be created for either the fiscal or calendar year. These budgets assist their creators in planning for the coming year and making the necessary changes to meet their financial objectives. Individuals can use annual budgets to better manage their finances. Annual budgets are critical and often mandated for planning purposes with respect to sources of income and necessary expenses—assets, liabilities, and equity required to support operations over a one-year period; and cash flows used for reinvestments, debt management, or discretionary purposes—for corporations, governments, and other organizations. Another important function of an annual budget, which is typically broken down into monthly periods, is to allow for comparisons of budgeted and “actual” performance. An internal annual budget is essential in keeping track of moving parts of a business in order to meet or exceed key financial objectives, whether you’re a sole proprietor or a large corporation.

10+ Corporate Annual Budget Samples

A well-planned annual budget allows you to keep track of a company’s financial health over time. You can set better priorities and objectives, make long-term commitments to clients and vendors, and make better hiring decisions when you understand a company’s obligations and opportunities. Reviewing tips for creating an annual budget can make it easier for you to create one for yourself.

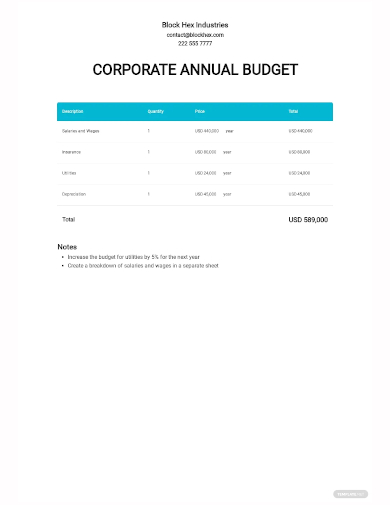

1. Corporate Annual Budget Template

2. Corporate Affairs Annual Budget

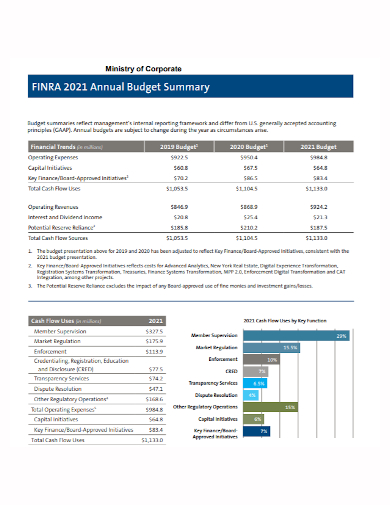

3. Corporate Annual Budget Summary

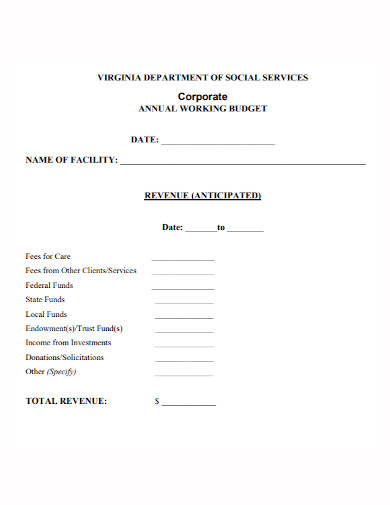

4. Corporate Annual Working Budget

5. Corporate Annual Capital Budget

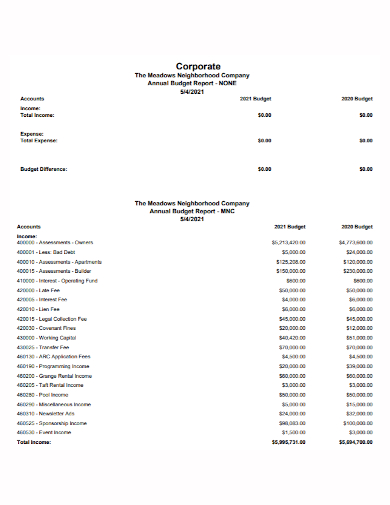

6. Corporate Company Annual Budget

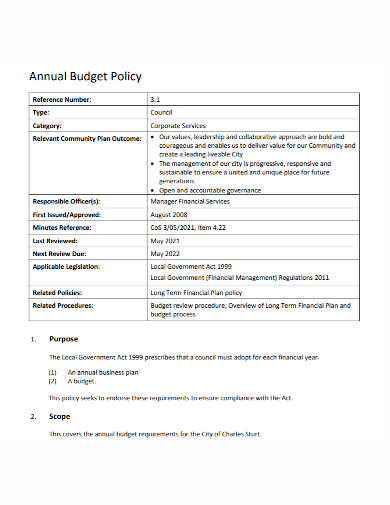

7. Corporate Annual Budget Policy

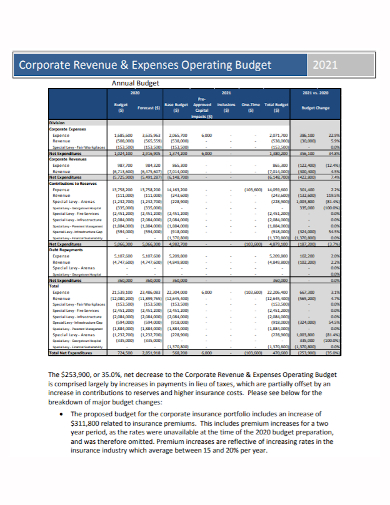

8. Corporate Revenue Expenses Annual Budget

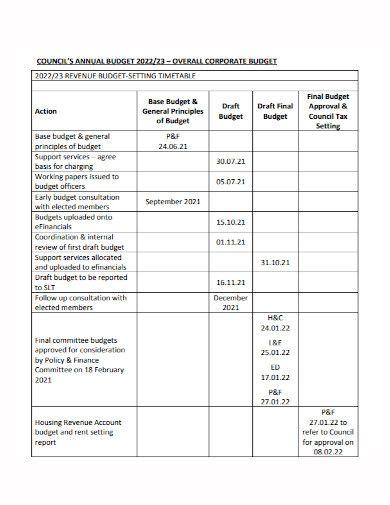

9. Corporate Council Annual Budget

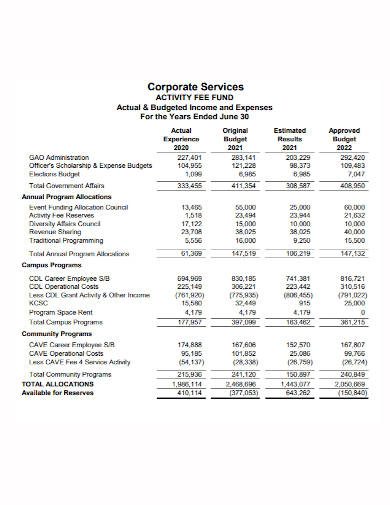

10. Corporate Services Annual Program Budget

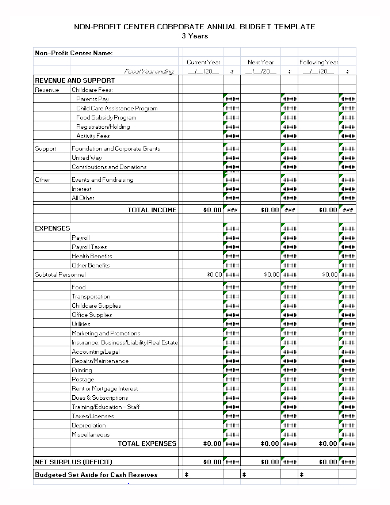

11. Nonprofit Corporate Annual Budget

Preparing Annual Budget

- Make time to review the profit and loss statement – Examine the profit and loss statements from the previous two years to begin the process of creating an annual budget. Remove any one-time revenue and unusual expenses that you don’t expect to occur in the coming year. Calculate the average of the two years’ profit and loss statements, then adjust for any expenses that increased during the year. Make any adjustments for expected changes in gross margins, one-time investments, market conditions, and revenue in the coming year. Take into account how changes in one area may have an impact on others. For example, if you hire more salespeople, your revenue should increase as a result of the increased sales, but you’ll also have to pay more for health insurance and other related expenses.

- Take a closer look at your expenses – Some of your business’s costs are fixed, such as insurance, rent, leases, and other services you use on a regular basis. This is a good time to take a closer look at your current rates to see if you can get better insurance or other services at a lower cost. You should also consider employee compensation, which should be in line with the company’s revenue and growth. You should also consider whether you’ll need to hire, how hiring will affect other areas of your budget, and what level of experience you’ll need for that person to optimize operations.

- Examine your capital expenditures – Capital expenditures, such as new computers, machinery, furniture, and other items, must also be factored into the budget. If you’re hiring new employees, for example, they’ll need computers and other equipment to do their jobs effectively. Consider what kind of equipment you’ll need to hire new employees. Consider any equipment you’ll need to buy or upgrade in order to produce your product or service. Keep in mind the potential impact of the investment on output. While deferring large investments may seem appealing, this decision can have an impact on delivery times, product quality, and output, all of which can have a significant impact on revenue over time.

- Calculate your cash flow – It’s critical to keep cash flow income in mind when making your annual budget. For example, you might need to buy inventory before making sales, and you’ll need to make sure you have enough cash on hand to do so. You can create a cash flow statement using your income statement and AR/P turnover rates in these situations.

- Secure your budget in the finance system – You can use your annual budget to evaluate your monthly revenue and expenditures by dividing it by the 12 months of the year. Compare your monthly financial statements to the budget every time you review them to get a better idea of how close your projections were. This can help you stay on track with your spending while also allowing you to create a more accurate annual budget in the future.

FAQs

What is fiscal year?

A fiscal year (FY) is a one-year period used by a business or government for accounting and financial statement preparation.

What counts as income?

Money received in exchange for working, providing a product or service, or investing capital is referred to as income. Income can also come from a pension or a gift.

Why annual budgets are important?

Businesses need an annual budget because it allows them to set priorities, goals, and spending limits. It enables the company to keep track of its financial position, allowing for more effective long-term planning. The ability to hire new employees, set new earning goals in line with company objectives, and invest in new profit lines can all be identified by creating an annual budget.

There aren’t many business owners who enjoy budgeting, finances, and spreadsheets. That isn’t why people go into business for themselves. When you own a business, however, budgeting is a necessary part of life. Knowing how to create a budget and manage it effectively step by step will make your job as a business owner a little easier.

Related Posts

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages

FREE 10+ Budget Tracker Samples in PDF | DOC

FREE 4+ Corporate Monthly Budget Samples in MS Word | Google Docs | Google Sheets | Excel