Market research is critical for organizations of all types and sizes at different phases of their life cycles. It is a significant step in firms and brands mapping their growth directions in a data-driven environment. Many market intelligence surveys are aimed at consumers, but firms that market to other enterprises also need to know their target market’s primary pain points, anxieties, and dreams, and market research surveys can supply such information. B2B market research examines the attitudes, motivating factors, and behaviors of B2B customers in order to create strategies for firms that serve other businesses.

10+ B2B Survey Samples

B2B refers to business-to-business survey. These B2B surveys are aimed at business professionals at all levels who work in the field. In comparison to a typical B2C survey, B2B surveys are far more specific and tailored. Business professionals with certain titles or functions are addressed in surveys. The survey’s focus is on company decision-making, procedure, and sales. Because this demographic operates in a professional setting, getting them to respond can be tough. Response rates to B2B consumer or non-customer surveys of 2% or less are not unreasonable. B2C response rates have a larger chance of being higher.

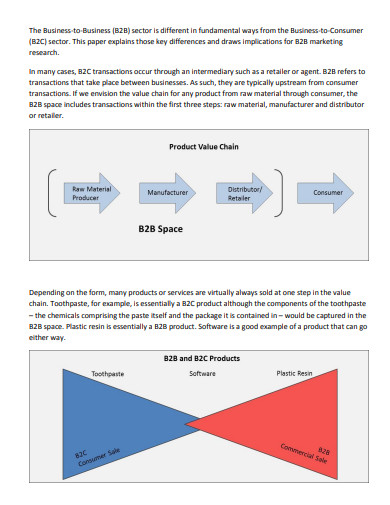

1. B2B Survey

2. B2B Marketing Survey

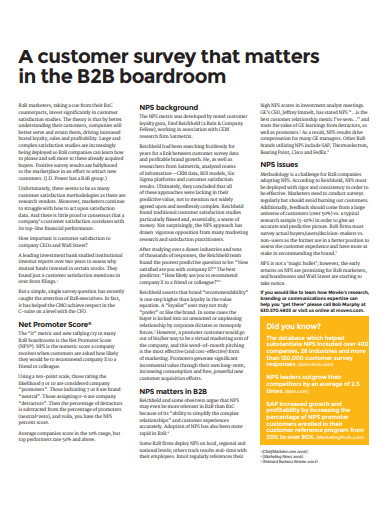

3. B2B Customer Survey

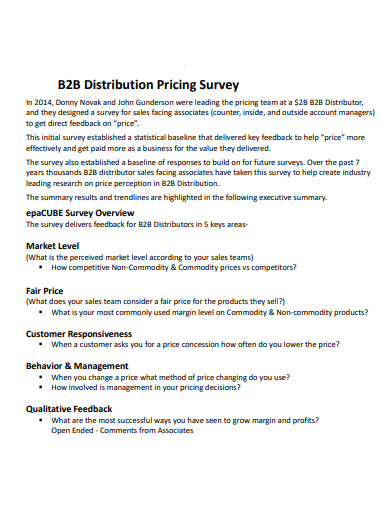

4. B2B Distribution Pricing Survey

5. Sample B2B Survey

6. Simple B2B Survey

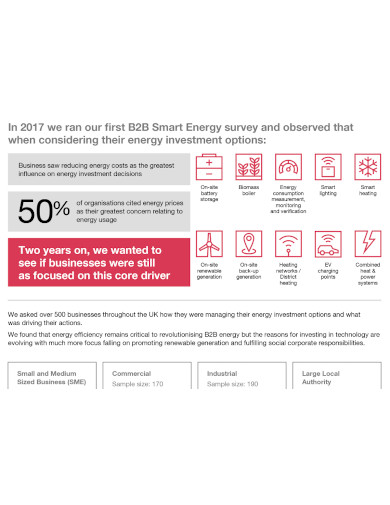

7. Smart Energy B2B Survey

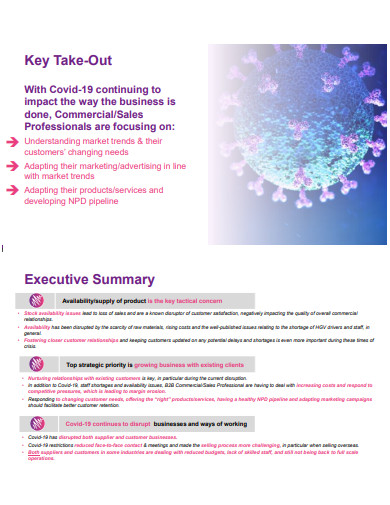

8. B2B Commercial Survey

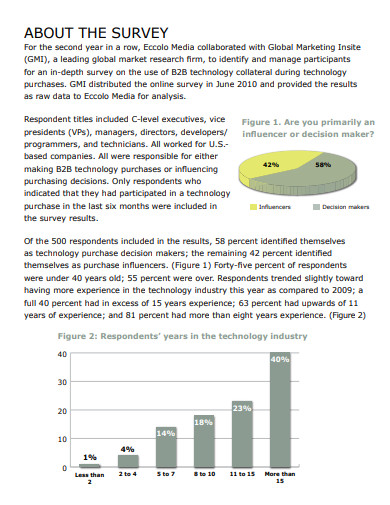

9. Technology B2B Survey

10. B2B Buyers Survey

11. Formal B2B Survey

Conducting B2B Market Research Survey

Identify your research topic and develop your questions

The survey questions are determined by the underlying study topic or purpose. Pay special attention to the scope of the survey and the complexity of the questions in B2B surveys so that participants do not perceive like they are spending all their time.

Decide on a methodology

Determine the optimal technique for your goals and requirements. These approaches include online panels, phone polls, email surveys, face-to-face interviews, and even a mixture of the above, and each has its own set of advantages and disadvantages. It all relies on how you want to involve your participants and the survey’s purpose.

Choose the respondents

A B2B responder database may be more difficult to build than a customer database for a variety of reasons. Businesses are smaller than people, the audience is more specialized, and duration may be limited based on the participant’s status. The good news is that your study sample may not even need to be as large as a comparable B2C survey to be accurate. You can use your internal information to survey your current customers and contacts, develop your own panel, plug into an existing dataset, or place targeted adverts in places where your possible participants are likely to be, depending upon the type of the study.

Conduct the survey

Pick a good survey mode and a period when the company respondents you’re speaking with are most accessible and agreeable when it comes to administering the survey. Offer a thoughtful reward for completing your survey, just like you would for individual responses. It might be a discount, an upgrade, or a recognition in the published report as a present to the participant or the company. Modify the survey and outreach to the participants as much as possible to boost response rates.

Analyze the data to answer your research question

The ultimate purpose of any B2B research effort (or any research study, for that matter) is to extract actionable insights into the data. The survey data can be valuable, but if not properly examined, it can be useless. It’s critical to remember that everything you’re doing is aimed at answering the original research question; stay focused on gathering facts to back up your claims. Depending on the tools used, experience, and the scope of the survey, data analysis might be simple or complex, so plan ahead of time.

FAQs

What are the benefits to doing a quantitative survey in-house?

Giving someone else manage of a project is a risk. You have less quality control because you don’t have as much oversight of any faults. Also, agencies have their own ways of doing things, such as preparing questionnaires, that may differ from yours. This may not be a major issue, but it may increase the amount of time you spend on the project adjusting items.

What is a sample size?

This one has to do with reduced response rates as well as tiny pools. There may not be as many respondents available to finish your survey because the audience is more targeted than a general population sample. A market research firm in New York will find it more challenging to create more reliable data due to the lower response rate and smaller sample sizes. It becomes increasingly harder to generate responses as the targets and titles become more detailed.

Discuss your findings and turn them into actionable things. Detail your procedures for constructing, administering, and assessing the results, as well as major discoveries and limits. Consider using data technology to describe your findings and then connecting the significance to your initial study challenge for a good outcome.

Related Posts

FREE 10+ Community Survey Report Samples [ Preliminary, Data, Final ]

FREE 10+ Building Survey Samples [ Cost, Property, Home ]

FREE 10+ Survey Questionnaire Samples in MS Word | Google Docs | Pages | PDF

FREE 5+ Customer Perception Survey Samples in PDF | DOC

FREE 14+ Sample Restaurant Survey Templates in MS Word | PDF

FREE 10+ Sample Feedback Survey Templates in MS Word | PDF

FREE 7+ Sample Survey Result Templates in MS Word | PDF

FREE 11+ Sample Employee Survey Templates in MS Word | PDF

FREE 8+ Sample Church Survey Templates in MS Word | PDF

FREE 13+ Sample Satisfaction Survey Templates in MS Word | PDF

FREE 8+ Sample Product Survey Templates in PDF | MS Word

FREE 5+ Sample Demographic Survey Templates in PDF

FREE 5+ Sample Email Survey Templates in PDF

FREE 8+ Sample Survey Question Templates in MS Word | PDF

FREE 5+ Sample Patient Survey Templates in MS Word | PDF