Paying off debt can be quite a challenge especially if you have tons of it. Your debt can range from your college student loans, your credit card debt, mortgage, and any other debt that you want to pay off as soon as you can.

If you are having a hard time working on paying off your debts, we are here to help you out. We will be giving you a few tips and guidelines on how you can do so, plus, we have also included a few calculator spreadsheet samples and templates that will help you solve your debt problems. Just keep reading this article and check out our samples for more information!

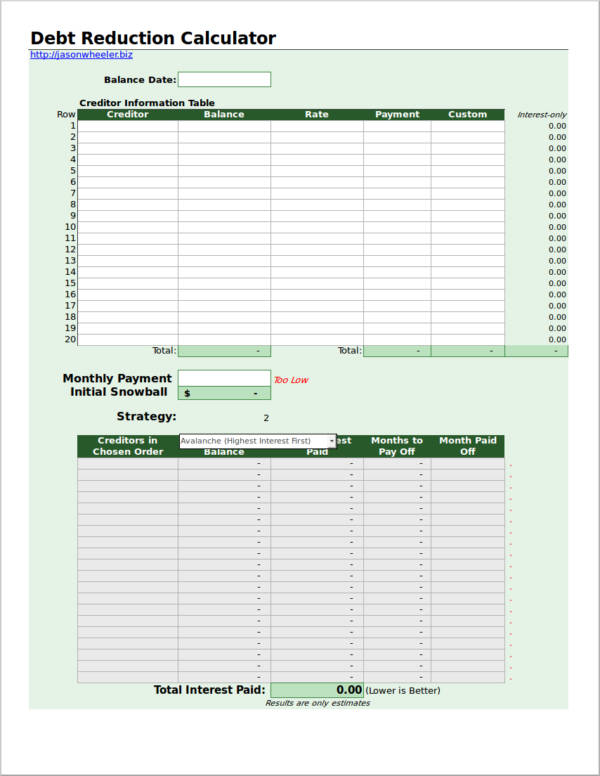

Debt Spreadsheet Template

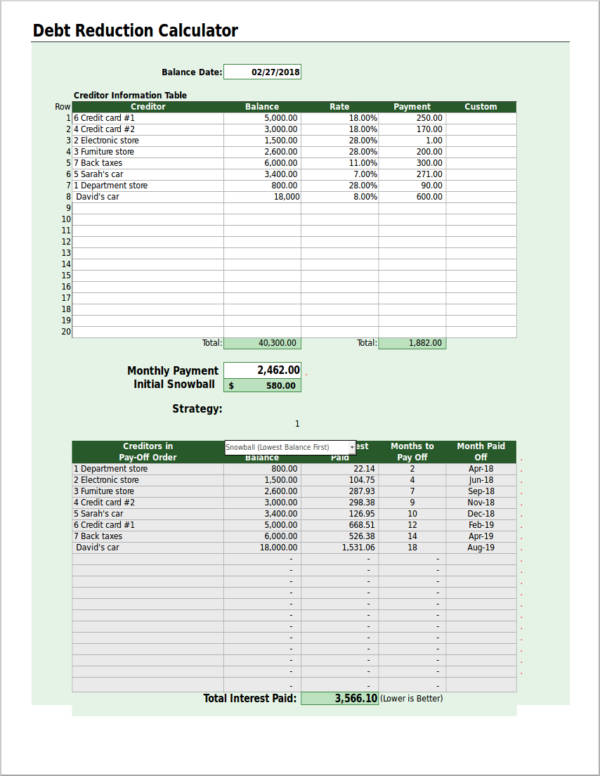

Fast Debt Reduction Payoff Spreadsheet Calculator

Debt Reduction Spreadsheet Calculator in Excel

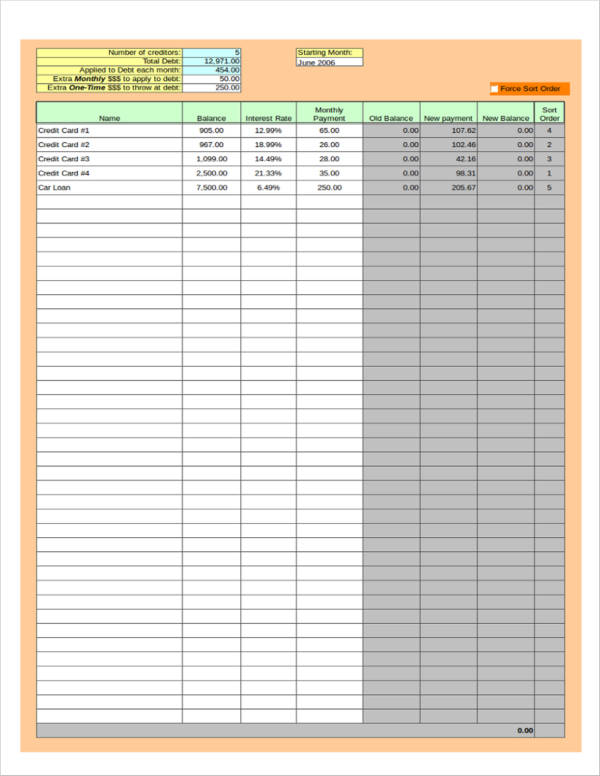

Debt Snowball Calculator Spreadsheet

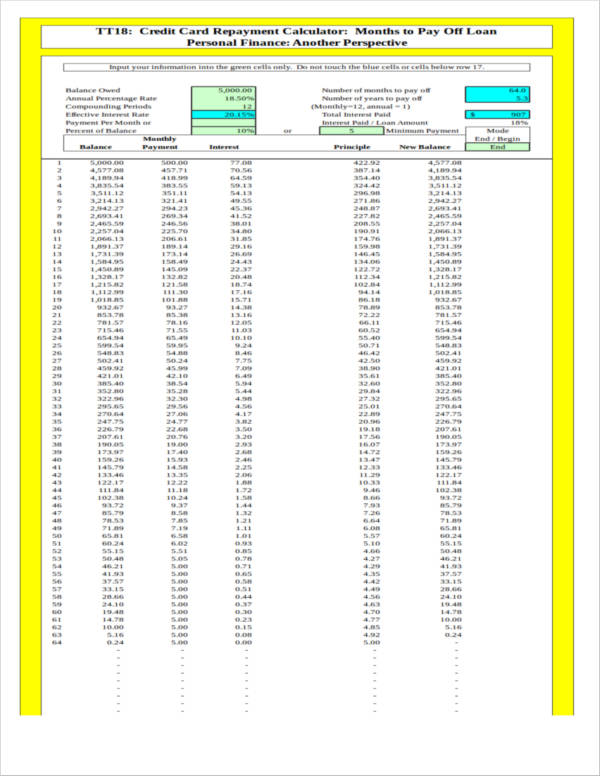

Credit Card Debt Repayment Spreadsheet

What Is Debt?

Before we start digging into how to pay your debts, let us first discuss quickly what debt is. Debt refers to anything that you owe someone else. Your student loans, credit card payments, and other loans fall under this category.

Step-by-Step Guide to Paying Off Your Debt

Being in debt is definitely something you do not want to be in for the rest of your life. You want to pay it all off as soon as you can so you can properly enjoy all the perks of being an adult without having to think of debt. You want to end your relationship with debt as soon as possible and we are sure that you will be able to feel like a big thorn has been plucked out of your chest as soon as you do. Taking it slowly but surely can help you pay it off without the need to worry that much.

Now, let us do a little something about that. Get off your debt-hating chair and let us face that hate together to ensure that we don’t have to face it again in the future, or if we do, then we already know how to handle it.

If you already have a personal budget spreadsheet, bring it out or open it up on your computer! We are gonna need it. Just make sure that it is updated with the list of names and corresponding amounts that you owe each person or establishment. The main idea is to first make sure you have a complete list of creditors and the balances due, as well as interest rates if there are any.

Now, we will give you a list of the steps that you need to take in order to properly pay off your debt.

- Step 1 – Download your desired debt spreadsheet template. Choose from the spreadsheet samples that we have in this article. Make sure to choose the one that best suits your debt-solving needs.

- Step 2 – List and add. As we have said earlier, it would be a good idea to have a list of the creditors and the corresponding amount that you need to pay each creditor. Once you have listed all the names and all the numbers, it is now time for you to start adding up your total debt, as well as the interest rates. Here’s what you need to list down:

- The list of lenders or creditors. This would include credit card companies, lending companies, the university/college you attended, banks, people you owe money from, etc.

- The balances due. Beside the names of your lenders or creditors, you can list down the amount you owe each one.

- Interest rates (if applicable). If your lenders or some of your lenders have interest rates on debts, make sure to list it down as well. Make sure that you track it all down to ensure that your calculations are accurate.

- Minimum payments. Sometimes, lenders/creditors will have a minimum payment that you would need to make in order to make sure that your credit score remains in good standing.

- Step 3 – Find money to pay the debt. Budgeting, budgeting, and more budgeting are what you need to do when it comes to paying off your debt. Setting aside a little wiggle room to include your debt in your budget is highly recommended. Here’s how you can do it.

- Cost cutting. A little cost cutting never hurt anyone. Cutting back and spending a little less on some expenses can definitely add a few more dollars to your budget to pay off your debt. You can lower down some of your subscriptions and reduce some of your grocery bills. Eating in your house instead of ordering take-away food is going to save you more as well. Making weekly meal plans and cooking ahead of time will ensure that you have food for the rest of the week without the need to go out and buy food.

- Boost income. Work an extra shift. Work overtime. Work on some of your rest days and some holidays. This is another surefire way of getting more money and be able to pay off debt as soon as possible. Even selling some of your unused items can aid in boosting your income. Start decluttering your closets and shoe cabinets and sell what you can.

- Appeal for a lower credit card interest rate. Writing an appeal letter to the credit card company or the bank that issued your credit card is highly doable. You can also do a quick phone call. By asking to lower your interest rate, you are doing yourself a favor not just for the present but for the future as well.

- Step 4 – Making extra payments. Just because you need to pay a minimum fee to maintain good credit standing doesn’t mean that you should stick to the minimum payment, right? Going the extra mile with a few hundred dollars can help get way ahead of the track. You may opt to do the following:

- Pay your debt with the highest rate first. Attacking your highest amounting debt will leave you with debts that are lower and are easier to pay.

- Pay your debt with the lowest balance. Starting out with a debt that has a lower balance can help you psychologically as it will give you a boost of confidence that you can continue with what you are doing and you will feel more accomplished. You might even find yourself seeing results sooner which is the ultimate goal, right?

- Start with debts with higher interest first. Note that you can also start paying off debts with higher interest rates first to ensure that your debts will not get larger and larger as time goes by. Start with the ones that you can surely pay off first and work your way down to the debt with the lowest interest rates or even frozen interest rates.

- Step 5 – Save a date for debt paying. Picking a date for paying your debt does not actually mean that you should pay it all off at once because let’s face it, that is quite impossible, right? So what you can do is pick a date for every month when you intend to pay some of the debt you have. This way, it will not put too much pressure on you financially. You can write this on your schedule planner or mark it on your calendar. Take a look at our free calendar templates to make it easier for you to plot your schedules.

- Step 6 – Stick to your plan. This is probably the hardest one to do but sticking to your plan is the main key to ensuring that you are on the right path to paying off all of your debts. It can get tiring and you may even find yourself falling short of your budget plan. You have to remember that it’s okay and that everybody makes mistakes sometimes. Just make sure that you do your best to ensuring that falling short will not happen again. Every successful payment you make should be seen as a form of encouragement to finish paying off your debt and reach your goal on your set deadline.

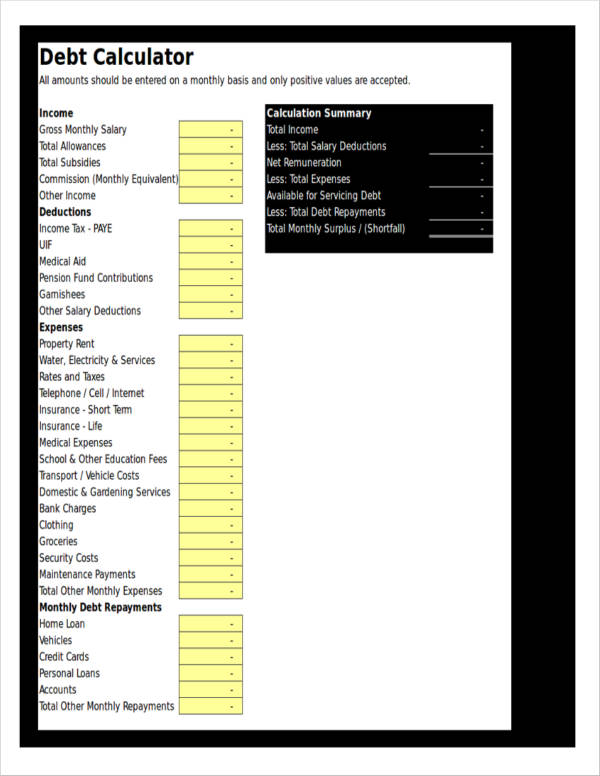

Debt Calculator Spreadsheet Template

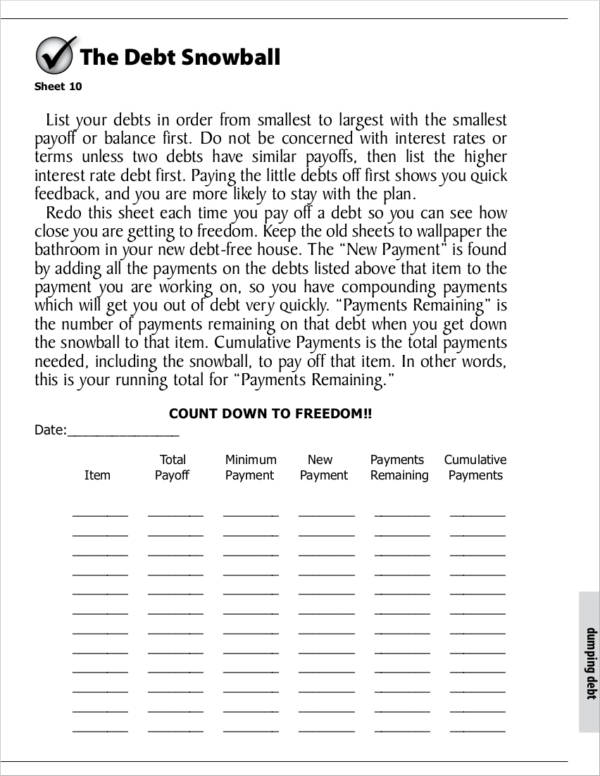

Debt Snowball Spreadsheet in PDF

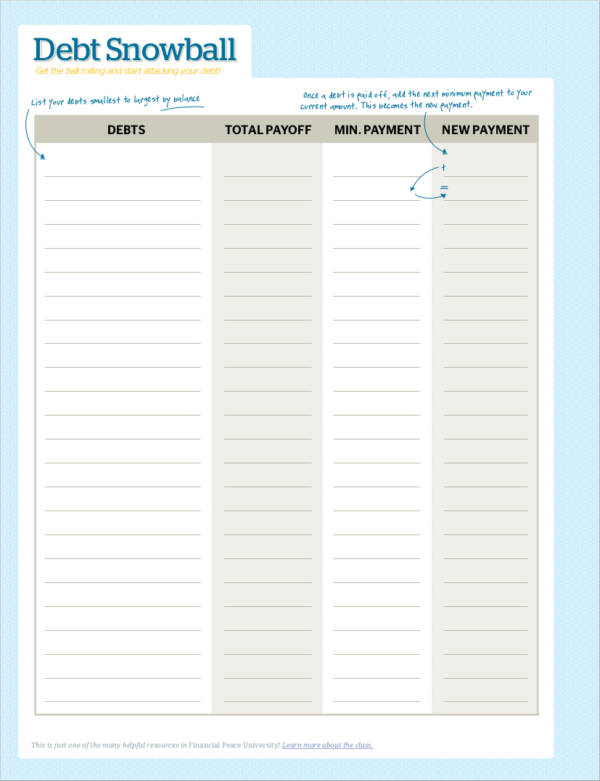

Blank Debt Snowball Spreadsheet Form

Getting out of your debt should not be seen as a daunting task. Sure, it may take long but taking it one payment at a time is key to making sure that everything will work out fine for you in the end.

Our tips will also help you out should you acquire debts in the future. It will also be able to help out anyone you know who is going through the same struggle of paying off debts that have accumulated has become bigger and bigger as time passes by.

Need more references regarding debt? Check out our article on Sample Debt Payoff Calculators. You will find useful tips and high-quality samples that can help you make your debt-paying task a whole lot simpler.

Related Posts

9+ Sample Log Sheets

8+ Sample Talent Show Score Sheets

8+ Sample Editable Tracking Sheets

7+ Sample Project Sheets

7+ Contact Sheet Templates

5+ Fax Cover Sheet Templates

5+ Sample Rate Sheet Templates

23+ Sign Up Sheet Templates

11+ Specification Sheet Samples

10+ Sample Quote Sheets

10+ Yahtzee Score Sheet Templates

10+ Sample Fax Cover Sheets

9+ Sample Balance Sheets

9+ Reference Sheet Templates

6+ Sales Sheet Samples