When it comes to determining the worth of a company, most owners already have a number in mind that they want to stick to. A common misconception is that the value should be equal to a multiple of earnings or annual sales. This strategy, on the other hand, is rarely accurate and is unlikely to retain its validity if the company is sold or becomes embroiled in litigation. A strong company valuation involves not just calculating an accurate and appropriate value, but also being prepared to defend that value in the event that it is challenged, by providing a clear and succinct explanation to support the conclusions reached.

A professional assessment of the market value of a property conducted by a certified valuer is referred to as a valuation report or a valuation. In addition to the general condition of the home (as noticed during a visit), the report takes into account recent and relevant sales history as well as other relevant market data. Before you write up a valuation report of your own, feel free to check out these summary valuation report samples that we have listed for you down below. After getting to know the document, what it looks like and how it works, you can use these samples as guides or even as templates to assist you for the entire writing process.

10+ Summary Valuation Report Samples

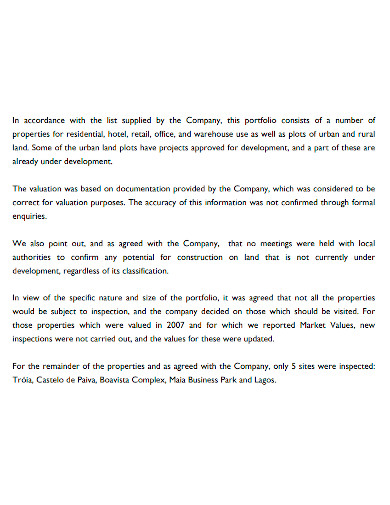

1. Summary Valuation Report Sample

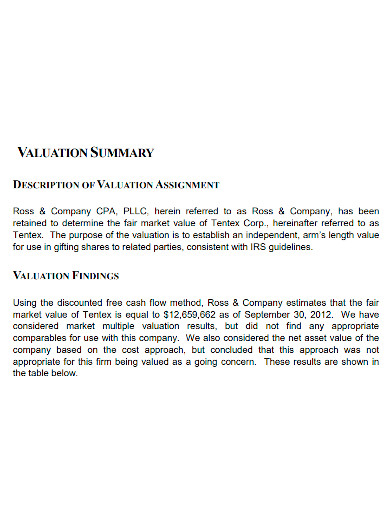

2. Summary Actuarial Valuation Report

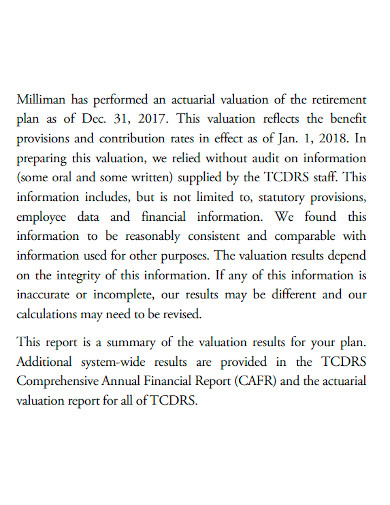

3. Business Summary Valuation Report.

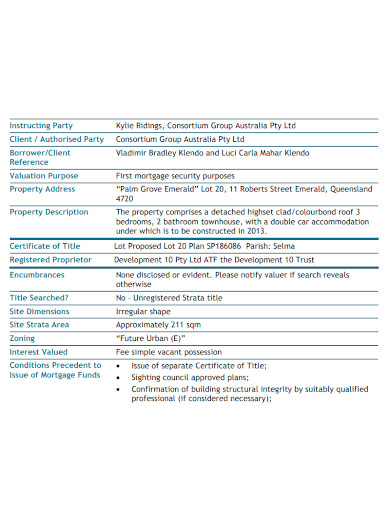

4. Printable Summary Valuation Report

5. Summary Valuation Report Format

6. Formal Summary Valuation Report

7. Professional Summary Valuation Report

8. Editable Summary Valuation Report

9. Standard Summary Valuation Report

10. General Summary Valuation Report

11. Basic Summary Valuation Report

What Is a Summary Valuation Report?

According to the definition of the term “business valuation report,” it is an attempt to properly document and analyze the value of a firm or a group of assets by taking into account all important market, industrial, and economic factors. Due to the nature of the appraisal, the standard of value to be utilized, as well as the valuation approach and assumptions used in generating the assessment, will be decided by the purpose for the appraisal. Each of these elements of company appraisal has an impact on the ultimate outcome. The purpose of the valuation will determine which standard of value will be applied. As an example, in a dissolution dispute, some states adopt a fair market value criteria, whereas others use fair value, which is a statutory metric that is not based on current market conditions.

How To Write a Summary Valuation Report

A business valuation study provides the owner of a company with a variety of data and numbers about the company’s genuine worth or value in terms of market competition, asset values, and income values. Market competition, asset values, and income values are all considered in the report. This is the kind of knowledge that every business owner should have at their fingertips. A business valuation should be achieved at least once a year in order to indicate the progress of the organization. Below is a list of the most common elements included in a well-written business valuation report:

- Assignment Identification

There should be a clear indication of the report’s intended use, such as a gift or estate planning document or a buy-sell agreement, finance, or litigation. The standard of value, such as fair market value, fair value, strategic value, or liquidation value, will be determined by the goal of the transaction. The standard of value should be communicated in plain language. - Business Description

The valuation professional should be able to properly communicate their understanding of the business in this area. Specifically, this should include information about the nature of the company’s operations, including its strengths, weaknesses, opportunities, and threats, as well as other relevant information. It is probable that errors or omissions will occur if the professional does not fully comprehend the organization. Either of these scenarios could jeopardize the credibility of the report. - Industry and Economic Trends

External factors have an impact on future cash flow and risk perceptions, which in turn have an impact on the value of a company’s stock. It is important that the expert’s expertise of the environment in which the organization currently operates is supported in this part. - Financial Analysis

Past performance may be a significant source of information about future cash flow. The value of a firm is influenced by how well (or poorly) it has done in the past – or how well (or poorly) it has fared in comparison to other companies in the same industry. In order to arrive at “normalized” cash flows, it is often necessary to make adjustments to the company’s financial statements to account for discretionary or nonrecurring items, as well as unique accounting procedures. In order to properly appraise the future, the report should also include a prognosis of future activities, or at the very least, a discussion of the company’s hopes for the future. - Valuation Methods

Included in this section should be a clear description of which procedures were used on the subject company and why they were used. The importance of this section cannot be overstated because different ways or combinations of methods may be utilized in the same situation on a regular basis. Detailed details of the computations that lead to the appraiser’s findings should be included in this section. - Discounts and Other Considerations

It is possible that additional discounts will be applied such as voting, important person, and obstruction discounts. During this section of the value report, the appraiser should discuss which discounts are justified and why they are appropriate. It should provide actual information to back up the discount rates that have been chosen. In addition to traditional sources of valuation evidence, such as previous transactions and offers, loan applications, previous appraisal reports, and rules of thumb, comprehensive reports will provide values derived from nontraditional sources of valuation evidence, which will be reconciled against the values derived under the appraiser’s methodology.

FAQs

What makes a good valuation report?

To be more specific, this should include information about the nature of the company’s operations, including strengths, weaknesses, opportunities, and threats. In order to properly appraise the future, the report should also include a prognosis of future activities, or at the very least, a discussion of the company’s hopes for the future.

Who gives a valuation report?

When a lender commissions a mortgage valuation assessment to appraise the worth of a property at a certain point in time as part of the mortgage application process, the applicant is responsible for the cost of the report. Any information a purchaser receives is provided as a courtesy by the lender, and he or she has no rights to the information contained in the report.

How long does it take to get valuation?

A mortgage offer is generated as a result of a property valuation, and it typically takes one week to get the offer from the lender.

Having an accomplishment report is beneficial to both the company and the employees since it keeps both parties informed of what is really going on in the office. Each employee’s contributions and productivity during the week, including overtime, are detailed in a thorough report generated by the system. It is vitally critical, and the templates and suggestions provided above should assist you in putting together a near-perfect electronic achievement report.

Related Posts

17+ Sample Visit Reports

FREE 16+ Sample Audit Reports

FREE 12+ Sample Home Inspection Reports

FREE 12+ Sample Company Reports

FREE 9+ Sample Business Analysis Reports

FREE 10+ School Visit Report Samples

FREE 9+ Sample Stock Market Analysis Templates

FREE 8+ Sample Project Estimate Templates

FREE 10+ Real Estate Company Profile Samples

FREE 30+ Sample Business Reports

FREE 29+ Sample Business Report Templates

FREE 19+ Management Report Templates

FREE 17+ Sample Visit Reports

FREE 16+ Sample Marketing Reports

FREE 10+ Profit and Loss Report Samples