Budgeting is an essential skill that every salaryman should possess, regardless if they earn a lot or if they earn a little, especially if they earn a little. If you’re earning a lot, you spend a lot. And even if you earn a little, you still spend a lot. Either way, you still end up without money for the coming days. Now, if you do this in business, your business will shut down in no time. A lot of money is spent on business operations alone, so just imagine the problem created without proper budgeting. Budget decisions in business are derived from its profit and loss report. The report is an important document where most financial decisions are made. What exactly is this profit and loss report? Let’s find out.

What Is a Profit and Loss Report?

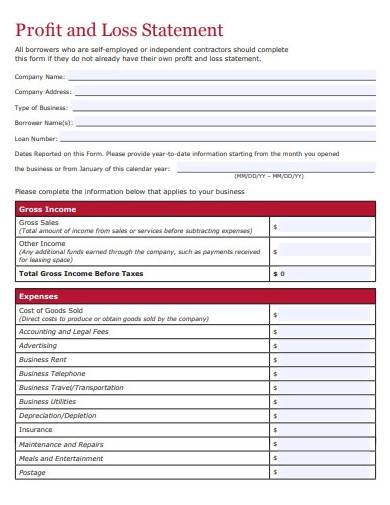

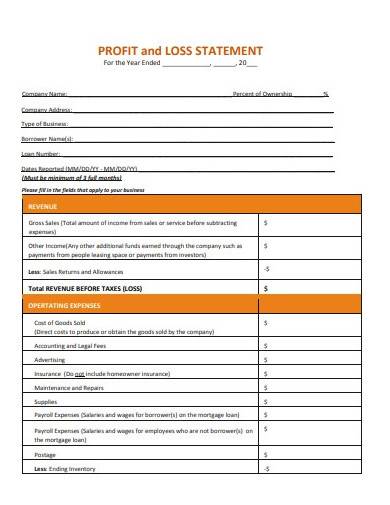

A profit and loss report goes by a few names, which includes income statement, statement of financial results, income and expense statements, and statement of operations. It is a type of financial statement that provides a summary of the total expenses and revenue of a business within a specific period. A sample report is generated weekly, monthly, quarterly, or annually depending on the standard operating procedure of a business. A profit and loss statement shows the net profit or how much the business is earning based on the recorded revenues and expenses. It also shows how the business cut costs and increase revenue in managing the profit earned.

Determining profit is one of the main goals of a profit and loss statement. The formula to calculate the total profit of a business is simple. You’ll need to determine the total revenue and take out the total expenses from it. So, profit = total revenue – total expenses. Through a profit and loss report, you can make reasonable business decisions. If you are spending more than you’re earning, then you can make an action plan or strategy to cut on the expenses based on the report sheet. You can also make a marketing strategy to increase product sales or profit based on the profit and loss report.

How to Make a Profit and Loss Report

The important think about a profit and loss statement is the accuracy of the data entered, which will result in accurate calculations. You’ll need to analyze data correctly and use the correct formula to derive specific components that make up the report.

1. Calculate Gross Profit

As mentioned, profit or gross profit is the total amount that a business earns from making and selling its products. Gross profit is calculated using the formula provided above, which is profit = total revenue – total expenses. It is also referred to as gross income.

2. Calculate the Net Operating Profit

The next step is to calculate the net operating profit. It is the amount that remains from the revenue after variable expenses and operating expenses are accounted for. The formula for this calculation is:

Net Operating Profit = Gross Profit – Total Operating expenses.

3. Calculate Net Profit Before Taxes

This is the net profit earned by the business or company before income tax is deducted. It is calculated using the simple formula below:

Net Profit Before Taxes = Net Operating Profit (derived from the previous step) + (Other Income – Other Expenses)

4. Calculate Net Profit or Loss

The formula used to calculate net profit or loss is:

Net Profit or Loss = Net Profit Before Taxes – Income Taxes

5. Format Report Sheet

Now that you have gathered all of the necessary information for the report, the next step is formatting the report sheet. Start with adding a header that has the name of your company and the accounting period covered by the report. Add a table below the header where you will enter most of the data gathered. Then add the income, expenses, and net profit to the table. You may use editable profit and loss statement samples provided below.

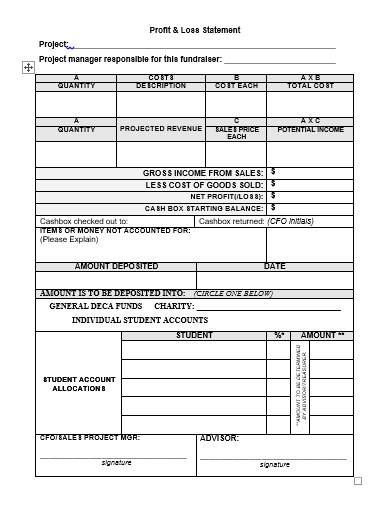

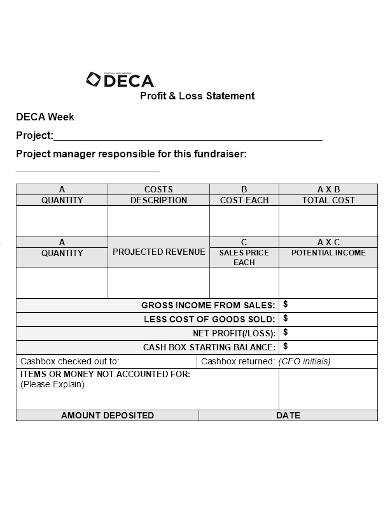

FREE 10+ Profit and Loss Report Samples and Templates in MS Word | PDF

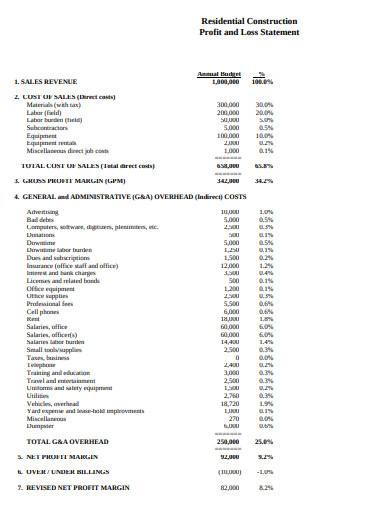

1. Construction Profit and Loss Statement Report

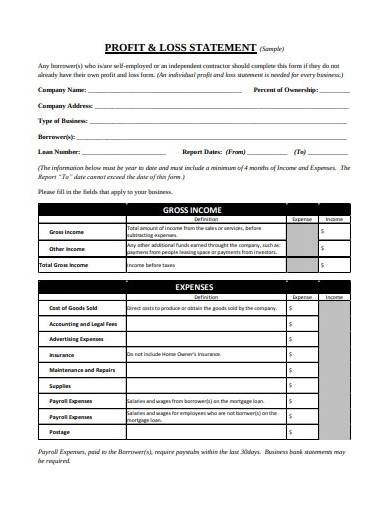

2. Sample Profit and Loss Statement Report

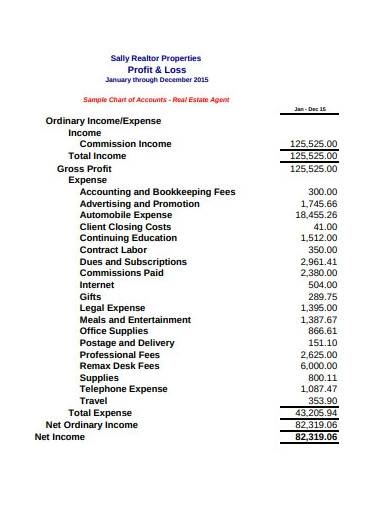

3. Real Estate Profit and Loss Report Format

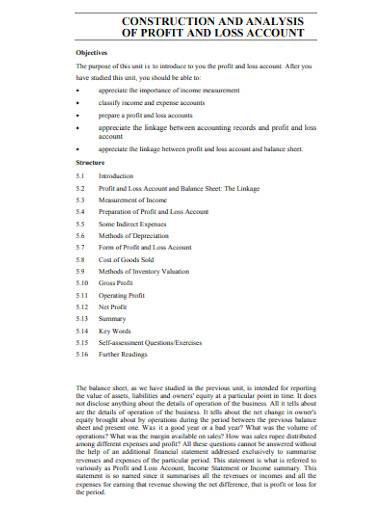

4. Report Analysis of Profit and Loss Account

5. Profit and Loss Statement Example

6. Profit and Loss Statement Report in Word

7. Profit and Loss Statement Reort Sample

8. Property Profit and Loss Statement

9. Sample Report of Profit and Loss Statement

10. Real Estate Profit and Loss Report Format

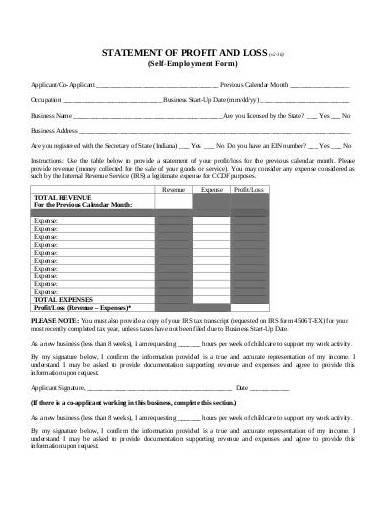

11. Statement of Profit and Loss Report Form

What are the components of a profit and loss report?

A profit and loss report is made up of six main components. They are revenue, cost of goods sold, gross profit, operating expenses, operating income, and net profit.

What are the two methods of creating a profit and loss report?

The two methods are the single-step method and the multiple-step method. The single-step method is called such because it uses a single subtotal for all revenue items and a single subtotal for expense items. Small businesses and service-based industries use it. If you’re doing inventory-based business, then the multiple-step method is better suited for your needs. This method separates the operating revenue and expenses from all other revenue and expenses.

Am I required to present a profit and loss report to the IRS?

IRS will require a profit and loss report of your business so that they can asses the taxes on the profit earned by the business.

A profit and loss report helps determine the overall financial health of a company. That is why it is considered an important document in reporting business finances. Here, you will find different types of profit and loss reports using different styles and formatting. These samples and templates will help you quickly and conveniently come up with an accurate and presentable profit and loss report. Check them out now!

Related Posts

FREE 10+ Writing Journal Entry Samples and Templates in MS Word | PDF

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word