When you lease a car, you’re essentially paying the leasing company (or lessor) to drive a car it owns for a set period of time, usually two or three years. Most often you’ll be required to lease a new vehicle, although some dealerships will offer leases for certified pre-owned used cars. The payments on a lease are designed to cover the depreciation of the car during that period, plus interest, so they’re often cheaper than an auto loan on an equivalent vehicle would be. The process of leasing is similar to the process of buying. You’ll visit local dealerships to shop around, compare prices and pick a vehicle, then the dealer’s finance department will draw up a car lease contract for you to review and sign. At the end of your lease, you may also choose to buy the car with cash or a lease buyout loan or simply walk away. Leasing a car instead of buying is a great way to get a vehicle without a long-term commitment. But once you pick out a car, you’ll be presented with a lease agreement, which is a contract between you and the leasing company. Unfortunately, the contract may be filled with jargon you may not fully understand. Before you seal the deal, familiarize yourself with the basic elements that make up this type of document. Here’s what you need to know to make an informed decision.

6+ Vehicle Lease Proposal Samples

1. Vehicle Lease Proposal

2. Car Rent/Lease Proposal

3. Fleet Lease Proposal

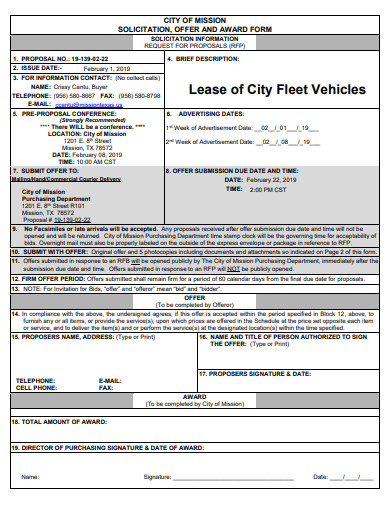

4. Municipal Vehicle Lease Proposal

5. School Bus and Vehicle Lease Proposal

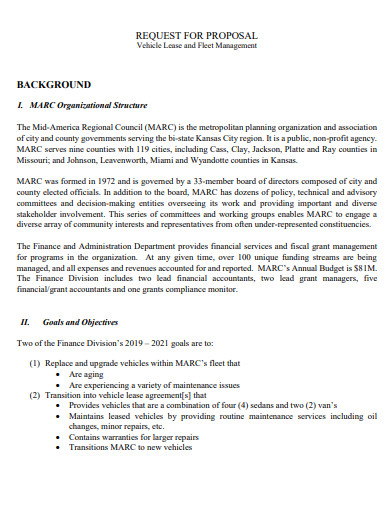

6. Sample Fleet Vehicle Lease Proposal

7. Fleet Vehicle Lease Services Proposal

What is a Vehicle Leasing Agreement?

A Vehicle Leasing Agreement is a contract made between a vehicle owner (lessor) and someone who pays the owner to have possession of the vehicle for a predetermined period (lessee). The lease payment, which is typically paid monthly, consists of a vehicle depreciation fee, a finance fee which is similar to the interest charged on a car loan, and any relevant sales taxes.

A Vehicle Leasing Agreement is commonly used with new and previously-owned cars, trucks, and motorcycles. However, the agreement can also be used with any motor vehicle that has a Vehicle Identification Number (VIN), which includes motorized scooters and mopeds, recreational vehicles, and power boats with a Hull Identification Number (HIN).

What is in the vehicle financing agreement?

The first sections of your car lease contract will likely be focused on what you’ll be expected to pay as part of the deal, including how the monthly payment is calculated. Then it will provide information about early termination, mileage limits, end-of-lease options and more.

Look out for these elements:

- Acquisition fee: An acquisition fee is the charge that leasing companies assess to arrange the lease. It’s generally not negotiable.

- Amount due at signing: One of the first sections of the agreement states exactly how much you will need to pay when you sign. That amount includes your down payment, but the agreement will also break down any fees, credits or rebates that factor into the total amount due. For example, trading in another vehicle will lower the amount due.

- Buyout price: Look for the amount you may be able to purchase the vehicle for — along with any related fees — at the end of your lease period.

- Capitalized cost: Also called cap cost, this is the selling price of the vehicle, which is used to calculate depreciation and how much you owe.

- Capital cost reduction: This includes any down payments, trade-ins and dealer rebates that lower the cost amount being financed.

- Disposition fee: If you decide to walk away from the lease instead of trading it in for another lease or buying the vehicle, you’ll be charged this fee. The disposition fee covers the costs the dealer incurs to prepare it for resale. You’ll often be able to get the fee waived if you sign up for a new lease.

- Early termination fee: The agreement should explain any fees you’ll be charged if you need to get out of your lease early. Ending a lease early usually comes at a steep cost.

- Excessive use: Your lease will show you how many miles you’re allowed to drive each year. If you exceed that limit, you’ll be charged a fee based on the number of miles you drive. It may also reference damage to the vehicle that you’ll need to pay for when the lease is over.

- Money factor: This helps determine the interest rate on the loan. To find out what your interest rate is, multiply the money factor by 2,400. For example, a money factor of 0.0032 times 2,400 gives you an interest rate of 7.68 percent.

- Monthly payments: The agreement should state the amount you’ll pay each month and include a detailed breakdown of the factors — including sales tax and estimated depreciation — that were used to determine that amount.

- Residual value: This is the value of the vehicle at the end of the lease due to depreciation. Cars that depreciate more slowly than others have a higher residual value and lower monthly payments.

Restrictions in the car leasing agreement

Part of the purpose of the agreement is to explain the restrictions that are placed on your use of the car. Look for these factors:

- Customizations: Because the leased vehicle doesn’t belong to you, you’re not allowed to make any customizations, such as adding a new stereo system or painting the vehicle.

- Early termination: If you’re not sure whether leasing is right for you, you’ll be better off buying. If you terminate the lease early, you’ll be assessed a fee, and the earlier you end the agreement, the more expensive it will be.

- Excessive wear: Your agreement will likely say that you must return the car at the end of the lease with no more than “normal” wear. Read this section closely so you clearly understand the condition you must maintain for the car.

- Maintenance: The car you’re leasing is sure to need some maintenance during the period you’re using it, and it might even need significant repairs. Make sure to read the section of your agreement that explains your responsibility for covering these costs.

- Mileage charges: Your agreement will stipulate a certain number of miles, usually 15,000 or less, that you are allowed to drive each year with no extra charge. It will also state the amount you will be charged per mile if you exceed this threshold.

FAQs

What Happens at the End of the Vehicle Lease Term?

At the end of the vehicle lease term, the lessee returns the vehicle to the lessor or, if the option is provided, agrees to purchase the vehicle. If the lessee opts to purchase the vehicle, their lease payments are applied against the total purchase price.

A Vehicle Leasing Agreement also lists any penalties associated with ending the lease before the term is up. Early termination penalties can include having to pay the balance of the remaining lease payments, along with additional charges.

What is the difference between a car loan and a car lease?

A car lease gives you “ownership” over a vehicle for a certain amount of time, but you’ll be limited by the terms and conditions laid out by your lessor. A car loan, on the other hand, gives you money that can be used to buy a car. While you’ll make payments on your loan for a number of years, the car is yours to keep.

Buying a car outright is typically a better option for people looking for a long-term vehicle or those who do a lot of driving — car leases typically impose mileage limits, and exceeding those limits could add significantly to the cost of your lease. Additionally, you may end up spending more in the long term with leasing than you would if you bought a car and used it for many years.

Related Posts

Title Project Proposal Samples [ Community, School, Student ]

FREE 10+ Health Project Proposal Samples [ Public, Mental, Healthcare ]

FREE 11+ Engineering Project Proposal Samples in PDF | MS Word

FREE 4+ Racing Sponsorship Proposal Samples [ Team, Car, Driver ]

FREE 10+ Nursing Project Proposal Samples [ Community, Health, Clinical ]

FREE 11+ Student Council Proposal Samples in PDF | DOC

FREE 8+ Joint Venture Proposal Samples [ Commercial, Real Estate, Construction ]

FREE 10+ Scholarship Proposal Samples [ Project, Grant, Sponsorship ]

FREE 10+ Network Project Proposal Samples [ Design, Security, Bank ]

FREE 14+ Accounting Proposal Samples in PDF | MS Word

FREE 10+ Church Event Proposal Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ History Proposal Samples [ Dissertation, Thesis, Paper ]

FREE 34+ Sponsorship Proposal Samples in PDF | MS Word | Pages | Google Docs

FREE 11+ Cost Proposal Samples & Templates in PDF

FREE 11+ Maintenance Proposal Samples in MS Word | Google Docs | PDF