Businesses need to regularly monitor their financial activity to make sure they don’t squander all of the money they earn from selling goods and services. A financial budget plan is an important tool for them to be able to allocate enough financial resources to the different departments to fund every operation and activity and manage their cash flow efficiently. Since it is an important aspect for a business to run efficiently and make profits, it must be done regularly and the information that will be included must accurate. This article will teach you what a financial budget means and what is included in it.

10+ Financial Budget Plan Samples

1. Financial Budget Plan Template

2. Financial Road Map Budget Plan

3. Financial Process Budget Plan

4. Sample Financial Budget Plan

5. Standard Financial Budget Plan

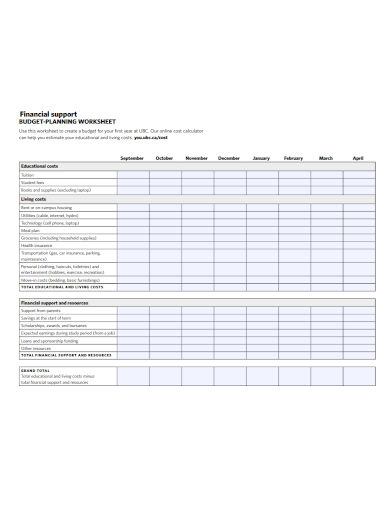

6. Financial Budget Plan Worksheet

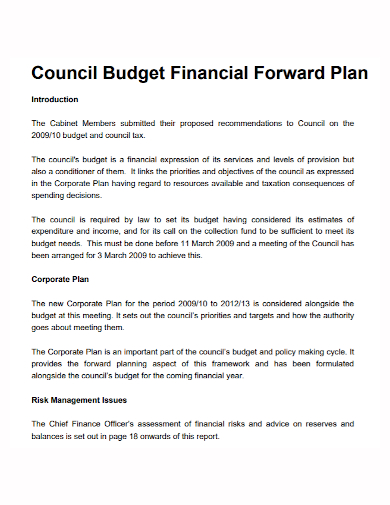

7. Financial Council Budget Plan

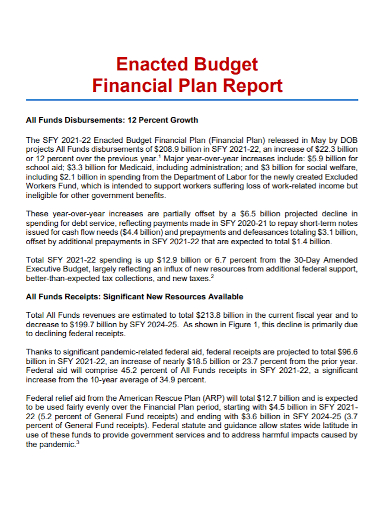

8. Financial Budget Plan Report

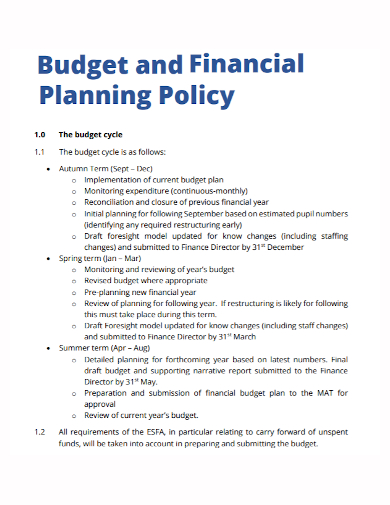

9. Financial Budget Plan Policy

10. Executive Financial Budget Plan

11. Financial Management Budget Plan

What is a Financial Budget Plan?

Financial budget planning means projecting the income and expenses of an organization or a business on a long-term and short-term basis to help achieve their financial targets Preparing a financial budget plan includes making a budget balance sheet, cash flow budget, the sources of income, and expenses, and monthly/quarterly/annual financial evaluation.

Details to Include in a Financial Budget Plan

1. Estimated Revenue

The first detail to focus on is your business revenue. The revenue is the money you made from the sale of your business’ products and services. For your budget plan, you can input your last year’s revenue.

2. Fixed Costs

The next details to conclude are your fixed costs. There are your costs that never change for long periods such as rent, insurance, employees’ salaries, legal services, furniture/equipment lease, accounting, and utilities.

3. Variable Costs

Variable costs are costs that can change from time to time. Your variable costs may be related to the production and purchase of products that you sell or the costs of services you offer. Some examples of variable costs are raw materials, inventory, production costs, packaging, shipping. For services-only businesses, your variable costs can be the sales commission of your employee, credit card fees, and travel expenses. Make sure to outline these costs properly.

4. One-off Costs

The one-off costs are costs that are not the usual costs that your business incurs and only happen once in a blue moon. Some examples of one-off costs are moving to a new office location or fund a launch and research project.

5. Cash Flow

The cash flow is all the money that is going in and out of your business. Since your cash flow is where you base your revenue and losses, you need to monitor this regularly. This is important to know if you have enough money to pay for your expenses and still earn a profit. You can calculate your cash flow by subtracting the amount of money available at the start of a set period and the money available at the end of the period.

6. Profit

Your profit is what you earn after you deduct all the money from your revenue after you’ve deducted it to pay for your expenses. In your financial budget plan is where you plan what you aim to profit based on your projected revenue, expenses, and the cost of products sold or services you offer. If you have concerns regarding your profit margin, you can make some changes in your business operations such as raising prices or boosting your promotion and advertising to increase your sales.

7. Budget Calculator

Just so your financial budget plan is more comprehensive and understandable; attach a budget calculator where every calculation you made based on the things mentioned above is seen. Having all the numbers in your budget plan in one big summary makes it easy to check your calculations.

FAQs

What is the importance of a financial budget plan?

The importance of a financial budget plan for organizations is to manage their cash flows efficiently to help them control the financial activity of their business.

How to budget your money?

Knowing how to budget your money well is essential to stretch your money on taking care of different expenses and at the same time, have some money left to put in your savings. To budget your money, below is a process of how you should do it:

- Calculate your monthly income

- Get the 50% of your income to take care of your needs and your bills

- Get the 30% of your income to take care of your wants

- Get the 20% of your income to keep it in your savings or keep it for debt payment

- Monitor your progress monthly

What are some various budgeting techniques?

There are a lot of budgeting techniques done by people. Some common budgeting techniques that are done by most people are incremental budgeting, activity-based budgeting, value proposition budgeting, zero-based budgeting, cash flow budgeting.

What are the four types of expenses?

The four types of expenses are:

- Variable expenses: expenses that vary every month

- Fixed expenses: expenses that remain the same for a year or more

- Intermittent expenses

- Non-essential expenses

Before you present your budget plan, make sure to go over it and review the numbers and other important information you input to make sure every detail in the budget plan is accurate and factual. To help you get started making your financial budget plan, download our free sample templates provided above to serve as your format reference!

Related Posts

FREE 9+ 30-Day Marketing Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 3+ Sales Team Action Plan Samples in PDF | MS Word | Apple Pages | Google Docs

Marketing Plan For Small Business Samples

FREE 7+ Fashion Business Plan Samples in PDF

FREE 10+ Sprint Planning Samples In MS Word | Google Docs | PDF

FREE 10+ Wedding Planning Samples in MS Word | Apple Pages | Powerpoint | PDF

FREE 9+ Monthly Study Planner Samples in PSD | Illustrator | InDesign | PDF

FREE 9+ Sample Curriculum Planning Templates in PDF | MS Word

FREE 10+ Teacher Development Plan Samples in MS Word | Google Docs | Apple Pages | PDF

FREE 10+ Basketball Practice Plan Samples in PDF

FREE 12+ School Business Plan Samples in PDF | MS Word | Apple Pages | Google Docs

FREE 7+ Client Strategic Plan Samples in PDF | MS Word

FREE 11+ Trucking Business Plan Templates in PDF | MS Word | Google Docs | Pages

FREE 7+ Small Hotel Business Plan Samples PDF | MS Word | Apple Pages | Google Docs

FREE 14+ Bakery Business Plans in MS Word | PDF | Google Docs | Pages