Why do you work? The reason is pretty obvious. As adults, we work to earn money to cover our bills and other responsibilities. That is why a lot of people would say, ” Adulting is hard.” Indeed it is hard to be an adult, especially if you have to take care of a family and other younger siblings. That said, life is hard indeed. But did you know that by working, you’re not only taking care of yourself and your family? By working, you get to help fund the government by paying income taxes.

What Is Income Tax?

We don’t get everything that we worked for in full. Part of your salary is paid to insurance and other government agencies. You can’t refuse these deductibles because they are mandatory. And if it’s mandatory, there is no arguing or bargaining. Perhaps, the most noticeable deductible of all is the income tax. An income tax is a percentage taken from your income or salary. Income taxes paid by businesses, companies, individuals, and other entities make up the government funds that pay for the building and construction of public infrastructures. This is how each tax paying individual or entity helps in funding the government.

Income taxes imposed on individuals or entities vary and are based on their respective income or profit. Self-employed individuals who pay their taxes receive an income tax invoice. After paying the invoiced amount, a tax receipt or business tax receipt is issued as proof payment. Both tax invoices and tax payment receipts are documents worth keeping.

Why Is Income Subject to Tax?

Income tax was first introduced in Great Britain in a budget intended to pay for the equipment and weapons for the French Revolutionary war. In 1799, income tax was officially accepted and was levied until 1802. In the United States, income tax was first imposed on August 5, 1861, to fund the federal government’s efforts in the American Civil War. It went through a lot of changes until it became a permanent fixture of the US taxation system in 1913 through the Sixteenth Amendment to the United States Constitution.

You probably get the gist of why we’re paying income taxes. It’s all because of the war. But the war ended a very long time ago so why are we still paying taxes? That is because, after the war, a peacetime income tax was passed. Its purpose is to cover the revenue lost by tariff reductions. In the present, we continue to pay taxes that are used on a lot of government projects intended to make life convenient for a lot of people.

11+ Income Tax Samples in PDF | DOC

1. Income Tax Sample

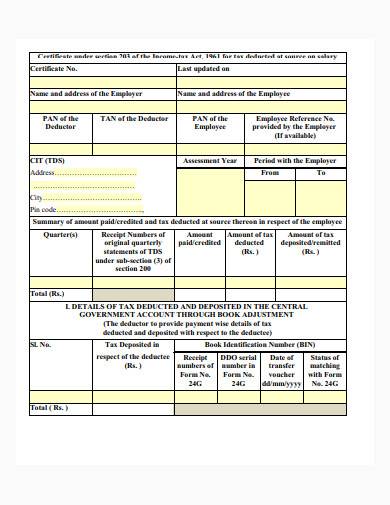

2. Income Tax Template

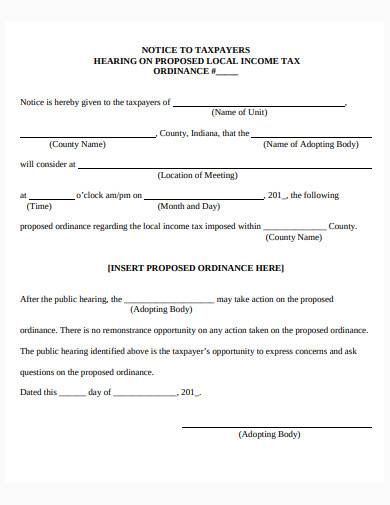

3. Income Tax in PDF

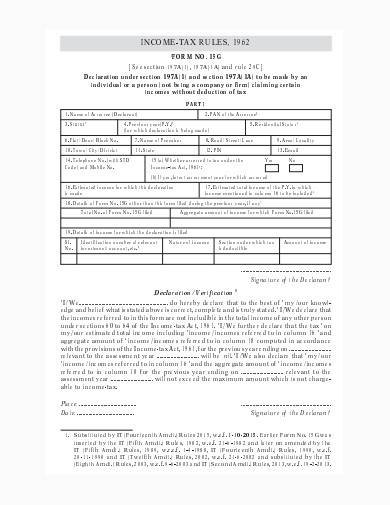

4. Income Tax Return Sample

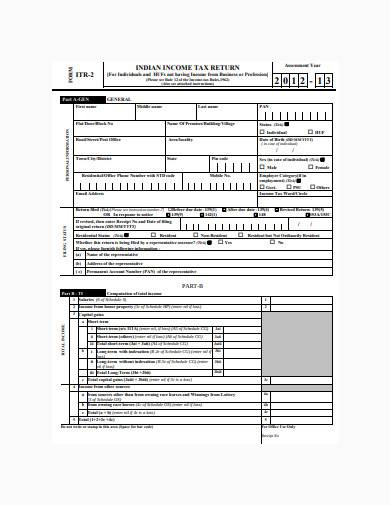

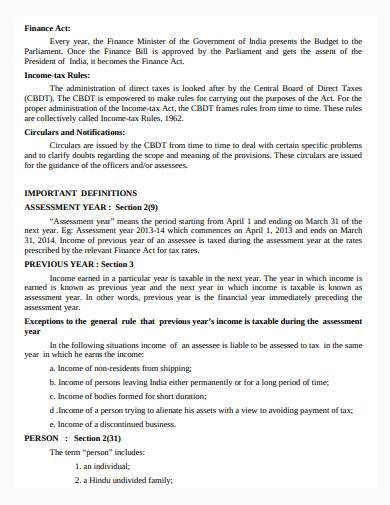

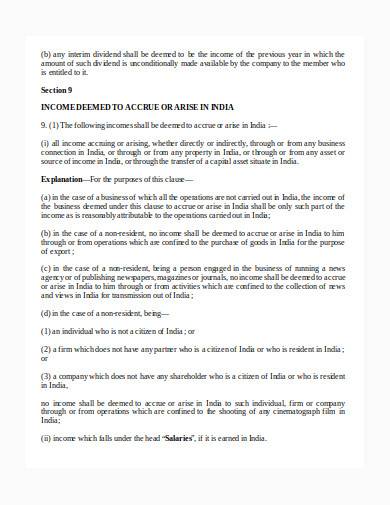

5. Income Tax in India Template

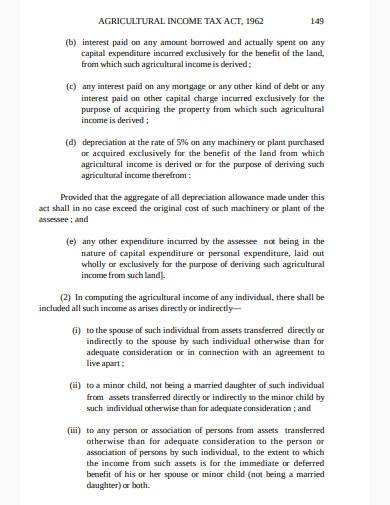

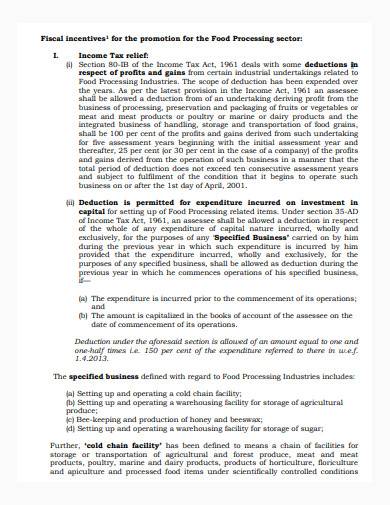

6. Agriculture Income Tax Sample

7. Income Tax Example

How to Format Income Tax Forms

Need help filling-up an income tax form or receipt?? Here are simple instructions on how to format tax receipts or forms.

Step #1: Prepare the needed tax form.

You can look for printable tax forms online. There are a lot of websites where you can find free and downloadable tax forms. You may also check out the samples provided here. If you’re applying for tax-exempt status, then you’ll need a tax exemption form.

Step #2: Gather essential information.

The information you need to put in an income tax form would include your basic information and some income tax specific details. These details include your income from different sources, business income, adjusted gross income, etc.

Step #3: Use the provided tables and brackets as reference.

Fill in the required information in the boxes or spaces provided for on the form or receipt. Tables are provided on how much tax is owed for taxable income. Use it to make your task easy.

Step #4: Avoid erasures.

Write neatly and clearly. Erasures on the form make it unreliable so avoid having erasures. Print and use a new form if you must so that the form you submit won’t seem suspicious.

Step #5: Review your form before submission.

Everything you put on the form must be accurate. When you’re done, submit your form to the appropriate agency.

8. Formal Income Tax Sample

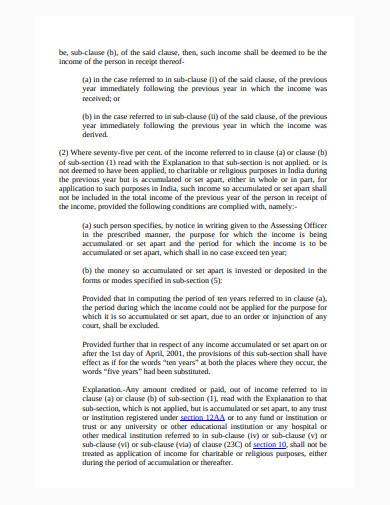

9. Income Tax in India Example

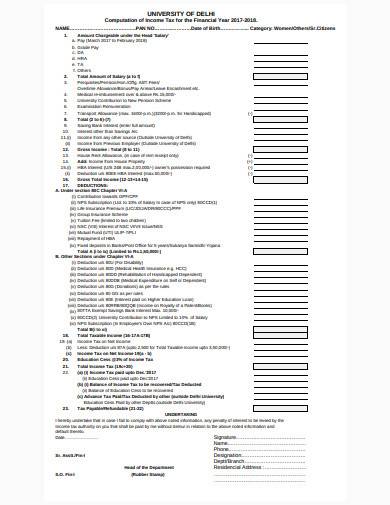

10. Income Tax for Financial Year Template

11. Income Tax Relief Sample

12. Income Tax in DOC

There is definitely good in the bad. And income tax is proof that continues to exist today and in the future. Speaking of taxes, we still have a lot to learn about them. So we need useful tools like income tax extension form, tax invoice template, and sales tax receipts. You’ll surely learn a ton from them.

Related Posts

8+ Sample Employee Declaration Forms

7+ Sample Payroll Tax Calculators

6+ Sample Self Employment Tax Forms

Payroll Tips from

7+ Sample Unemployment Tax Forms

9+ Sample Rental Receipts

10+ Tax Audit Report Samples

6+ Sample Income Based Repayment Forms

6+ Simple Income Statements

8+ Sample Self Assessment Forms

7+ Sample Rent Receipt Form Templates

7+ Sample Rent Receipts

9+ Sample Rent Receipt Formats

7+ Sample Traditional Income Statements

10+ Sample Payroll Deduction Forms