Businesses thrive when their employees are financially stable and well-compensated. One of the effective strategies for employers to ensure that their employees can avoid any financial difficulty is by helping them with their tax requirements. Without the proper withholding of an employee’s tax, an employee may be submerged by a huge amount of tax liabilities by the end of a fiscal year.

It is for this reason that employers and managers must ask their employees to fill out a standardized tax form. To know more about this form, download our employee tax forms on this page. You may also refer to our collection of Sample Forms, which you may download for free. Scroll down below to view our templates!

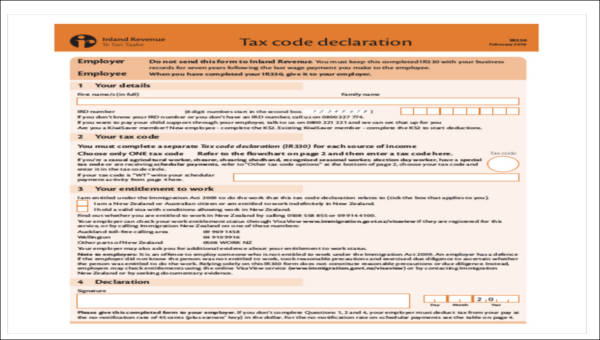

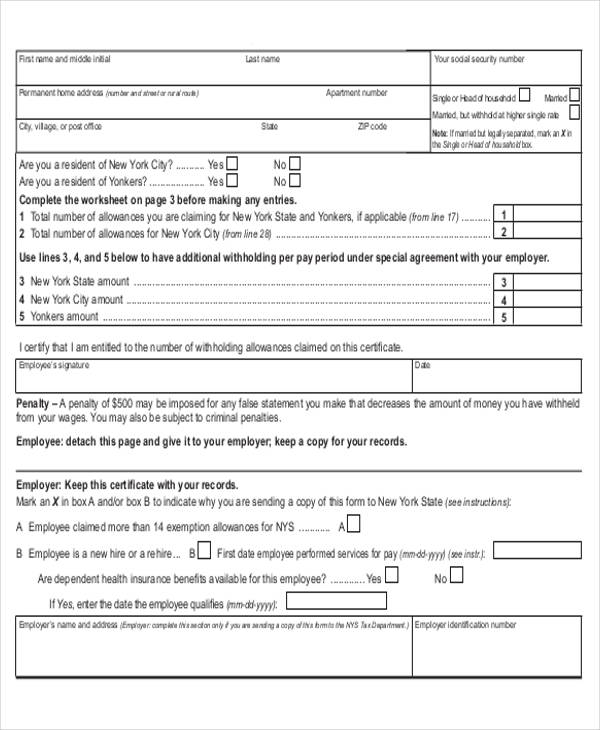

Sample New Employee Tax Form

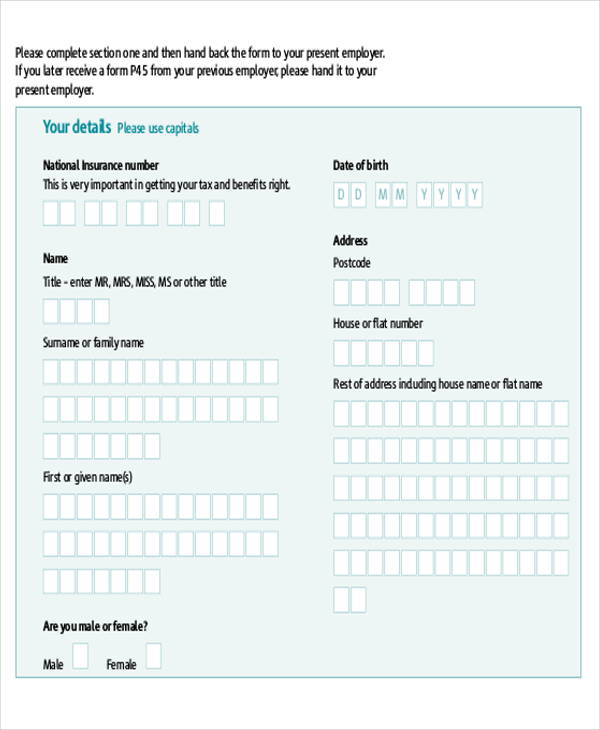

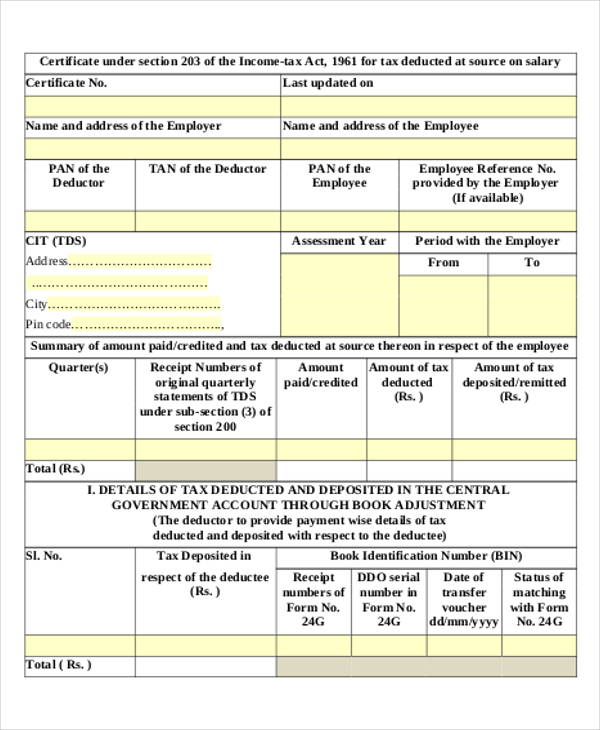

Employee Income Tax

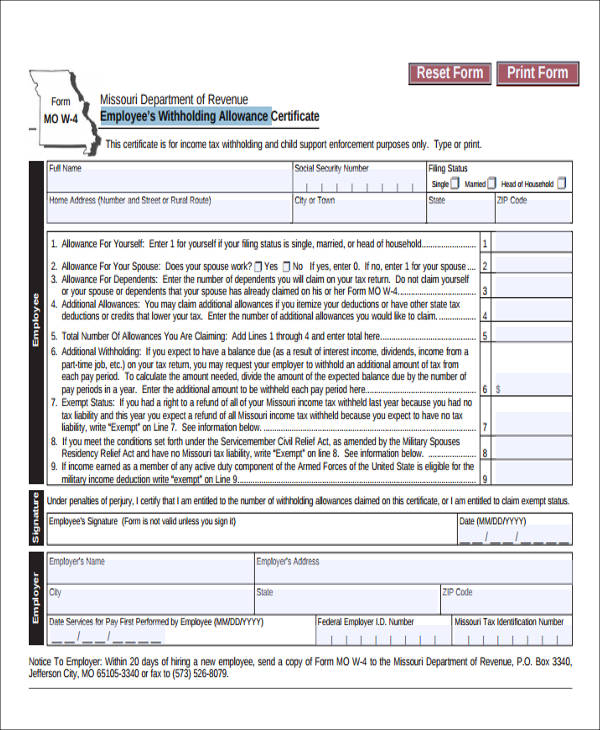

Employee Tax Withholding Allowance Form

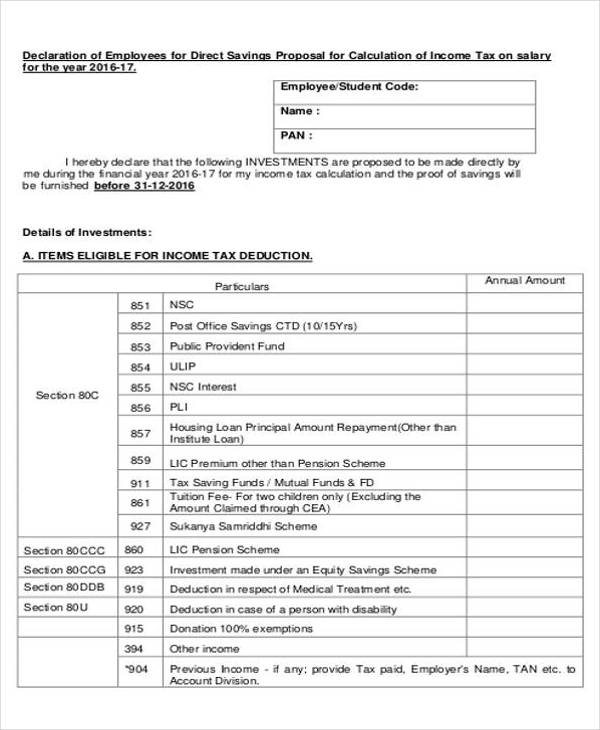

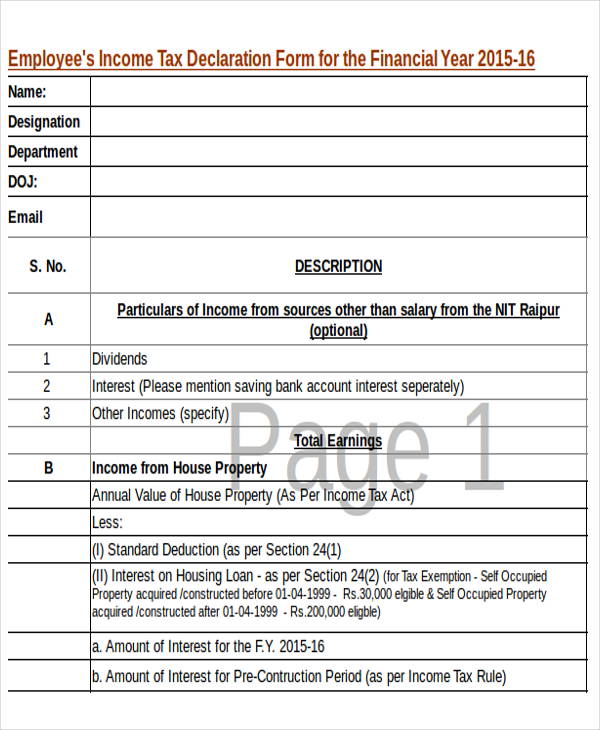

Employee Tax Declaration Form

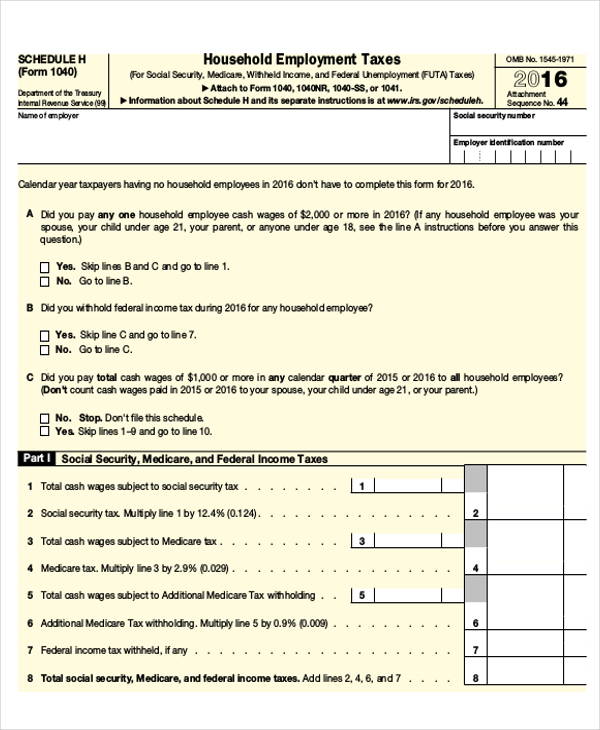

Household Employment Tax

What Is an Employee Tax Form?

An employee tax form is the document that an employer would ask newly hired employees to fill out during the initial stage of their employment. The purpose of this tax form is for the employees to determine the specific amount of money that they should deduct from their employees’ monthly salaries. The purpose of such deduction is for the employees to fulfill their government-mandated tax obligations.

In most states, their governments create a specific agency that is tasked to collect taxes from its citizens. Personal taxes are mandated from citizens of legal age who are employed in a registered company or organization. It is this personal tax that company owners and employers would withhold from their employee’s salaries. In order to know the amount that must be withheld, employers would ask employees to fill out employee tax forms.

Who Can Prepare an Employee Tax Form?

- Employers

- Business owners

- Human resource managers

- Payroll managers

- Payroll clerk

Speaking of tax forms, we also have Unemployment Tax Forms. For hiring managers and recruiters who are looking for more effective ways of screening out job applicants, you may use our Employee Application Forms. Access these templates by clicking on their corresponding links.

Employee Tax Return Form

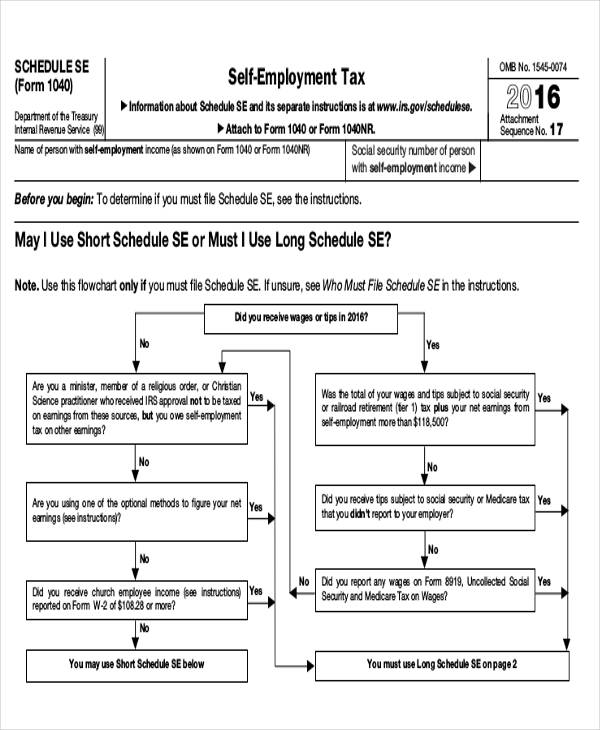

Self-Employment Tax

Employee Tax Withholding

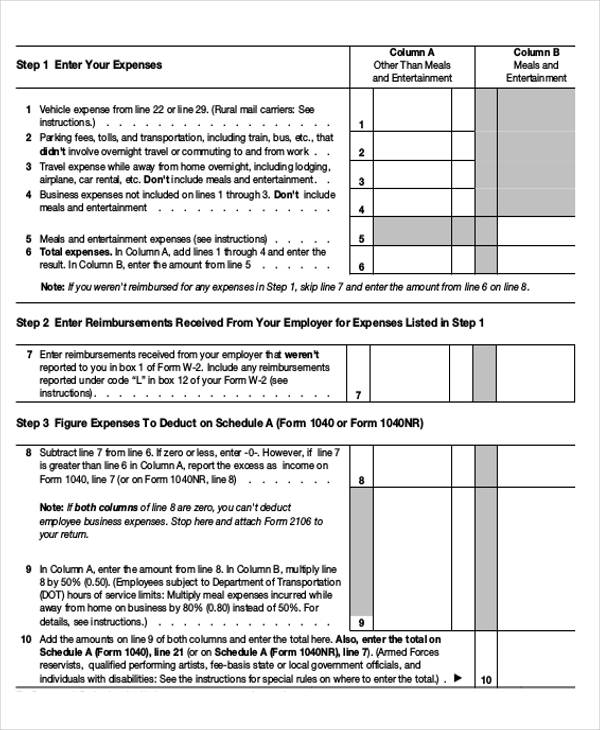

Employee Expense Tax Form

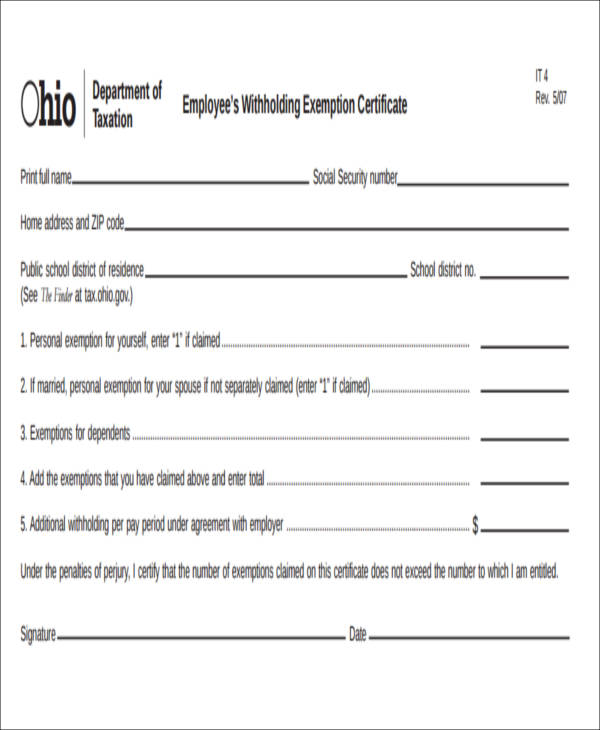

Employee Tax Withholding Exemption Certificate

What Is the Importance of Employee Tax Forms?

Amount of Income Per Month

By asking an employee to fill out an employee tax form, it would be easier for managers and employers to view their employees’ salary grade or salary level. This, in turn, enables them to easily classify the taxable amount based on the tax table provided by the government in charge of collecting personal taxes.

Dependents

Another factor is the number of dependents that an employee has. This information is asked for in the employee tax form. The number of dependents that an employee has would greatly affect the amount of tax that he/she is expected to pay per month.

Avoidance of Tax Liabilities

Since employers are actively involving themselves in ensuring that their employees are able to fulfill their government-mandated obligations to pay their taxes gradually, then these employees would avoid having tax liabilities. Tax liabilities are incurred when individuals fail to pay their taxes on time. On top of their taxes, they are also required to pay a penalty for their late payment.

For future employee-management needs, check out our Employee Termination Forms.

Related Posts

Agreement Form Samples & Templates

Vehicle Inspection Forms Samples & Templates

Sample Employee Advance Forms

Sample Child Travel Consent Forms

Sample Testimonial Request Forms

Sample Employee Details Forms

Sample Divorce Forms

Sample Attestation Forms

Employee Performance Appraisal Form Templates

FREE 9+ Sample Presentation Evaluation Forms in MS Word

FREE 10+ School Admission Form Samples & Templates in MS Word | PDF

FREE 30+ Patient Consent Form Samples in PDF | MS Word

FREE 10+ Sample Sign Off Form Templates in PDF | MS Word

FREE 11+ Sample Medical Consultation Forms in PDF | MS Word

FREE 8+ Sample Donation Forms in PDF | MS Word