What is a receipt? A receipt is a document that is used to acknowledge that a payment has been received for the sale of goods and services. These are essential documents in every business. A receipt format is important especially if you want to write your own receipt for your business.

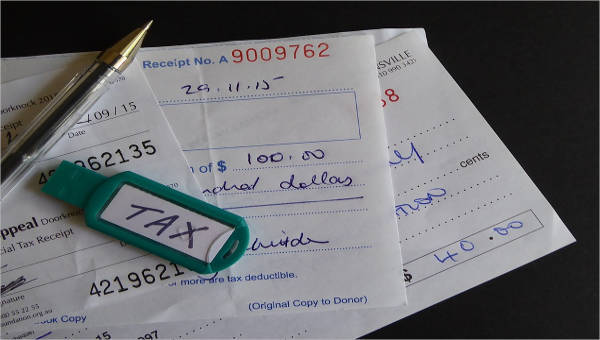

A tax receipt is a type of receipt used for tax purposes. A tax receipt sample is provided by the internal revenue service after a business has filed their taxes. This is useful in order to prove that a particular tax has been remitted. A tax receipt is also provided by the business to their customers, which includes the taxes paid for the goods sold.

Tax Receipt Template

How to Format a Tax Receipt

Businesses and organizations typically receive goods or donations from individuals. The purpose of these donations are mainly for charity reasons. This is where a tax receipt can be useful. Keeping business tax receipts is important for the filing of tax returns to be able to provide documents as proof of these donations. Now, if you need to write a tax receipt from scratch, the sample receipt templates available here will be useful in providing you a template. Here are the steps in formatting your tax receipt.

- Write the name of the donor of the products and goods that are being donated. It is important to indicate who is giving the donation, especially for tax purposes.

- Also indicate the name of the organization or business that the items are being donated to.

- Write the date the donation is made.

- For tax purposes, write the list of items including the description and the individual market value. Organizations can also leave it blank for the donors to fill out. These information will determine the total tax for the items.

- Indicate if your organization is a nonprofit one, and also write your tax identification number. A tax identification number is important when filing your taxes.

Types of Taxes

When you own a business or even if you are employed to a certain company, you are required to pay certain taxes. There are many types of taxes that a business is obligated to pay and remit to the internal revenue service. These taxes depend on the location of the business, the type of business that you are running, and the structure of your business. Here are the various types of taxes that a business or individual is required to pay.

- Payroll tax – a payroll tax refers to the taxes paid by the business in behalf of the employees. Companies and businesses also collect taxes from their employees.

- Unemployment tax – an unemployment tax is a type of tax used in the assistance of laid-off employees. Every business is required to compensate workers who have lost their jobs.

- Sales tax – a sales tax refers to the taxes imposed on the sale of goods and services. The tax is based on a percentage of the prices being sold. A sales tax also increases the purchasing price of these goods and services.

In addition, our templates for tax receipts for donation, printable payment receipts, and company receipt template are available should you need them.

Related Posts

FREE 8+ Loan Receipt Templates Examples In MS Word | PDF

FREE 16+ Printable Hotel Receipt Templates in PDF | MS Word

FREE 6+ Sample rent receipt form in MS Word | PDF

FREE 10+ Sample Receipt Voucher Templates in PDF | MS Word

FREE 10+ Fee Receipt Samples in PDF | MS Word | Google Docs | Excel | Apple Numbers | Apple Pages

FREE 7+ Vehicle Sales Receipt Samples in MS Word | PDF

FREE How to Create a Car Rental Receipt [9+ Samples]

FREE 13+ Taxi Receipt Templates in PDF | Google Docs | Google Sheets | Excel | MS Word | Numbers | Pages

FREE 10+ Receipt Book Samples in PDF

FREE 10+ Online Receipt Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Personal Analysis Samples in MS Word | Google Docs | Pages | PDF

FREE 5+ Non Profit Receipt Samples in PDF

FREE 10+ Advance Receipt Samples in PDF | DOC

FREE 3+ Investment Receipt Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 3+ Enterprise Receipt Samples in PDF