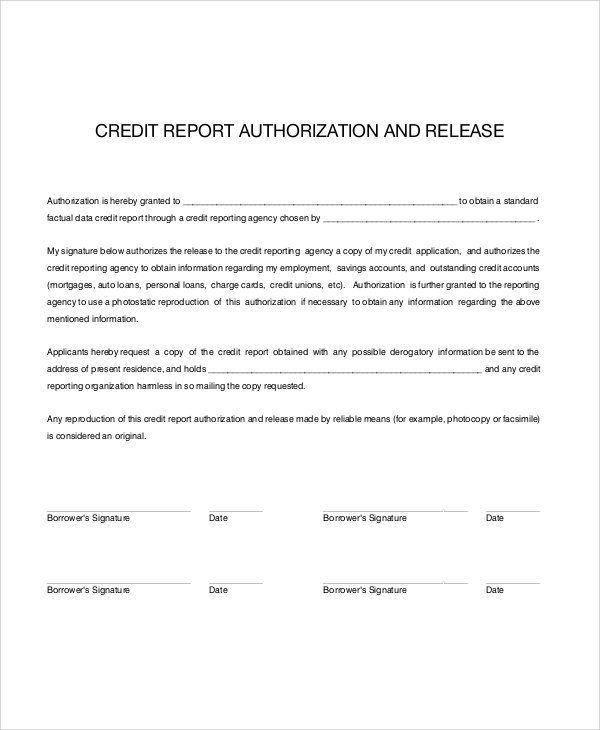

When applying for a loan, credit card, or even renting an apartment, you may have to supply the necessary information to your creditor or landlord before your application can be accepted. This is part of the industry’s procedure to ensure you are financially capable to meet your obligations.

Our Sample Forms for credit check release are all based on standard authorization forms that users can download and modify or print and use immediately after signing up all the necessary spaces.

Sample Credit Check Form in PDF

Credit Check Release Authorization Form

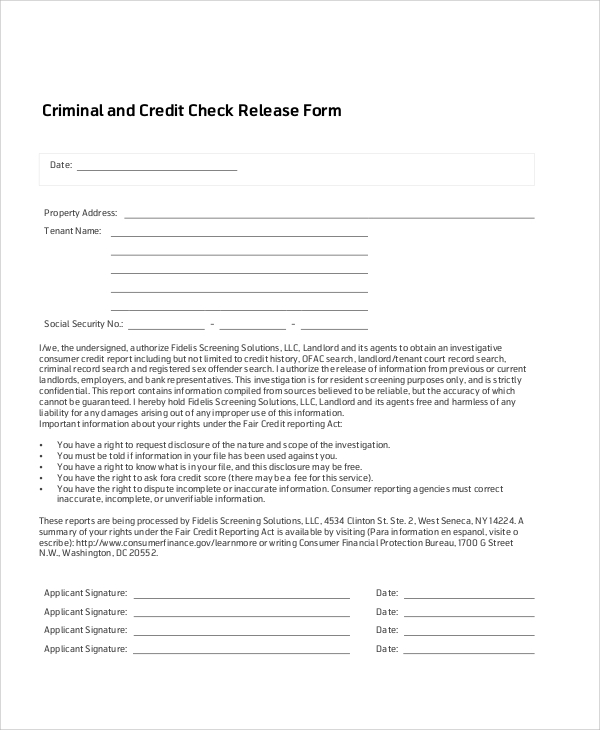

Criminal and Credit Check Release Form

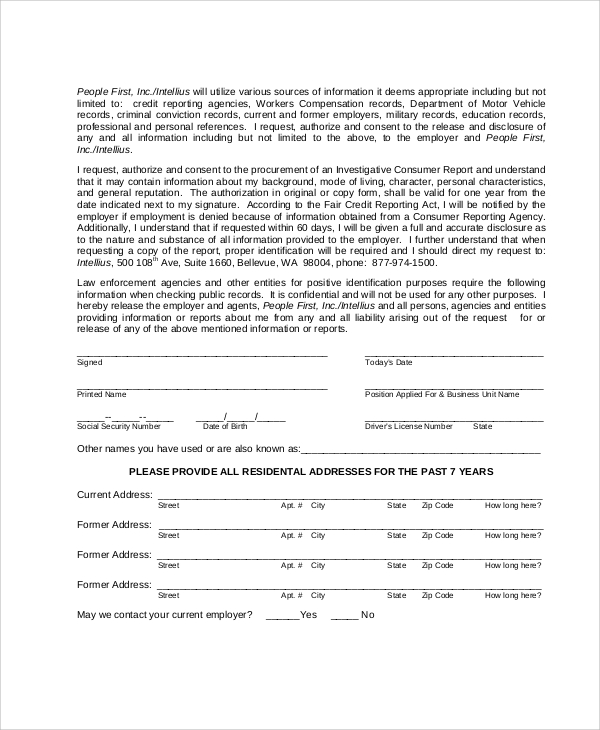

Credit Check Consent Release Form in PDF

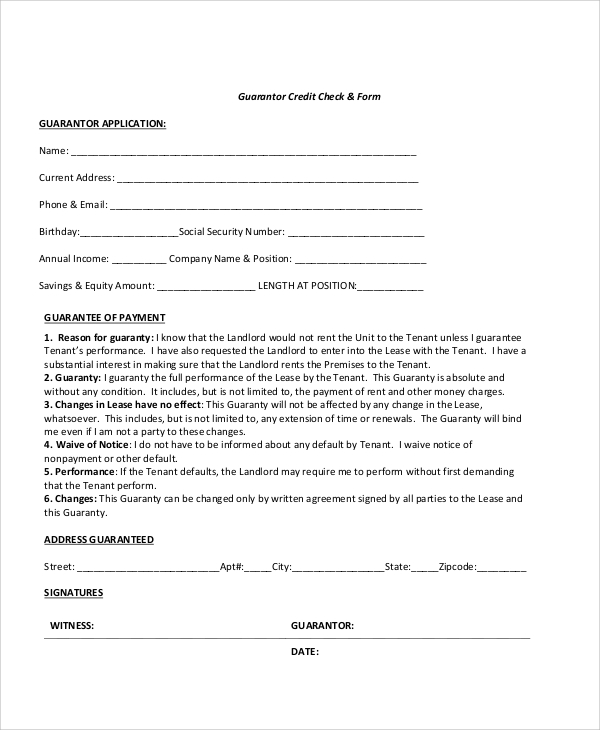

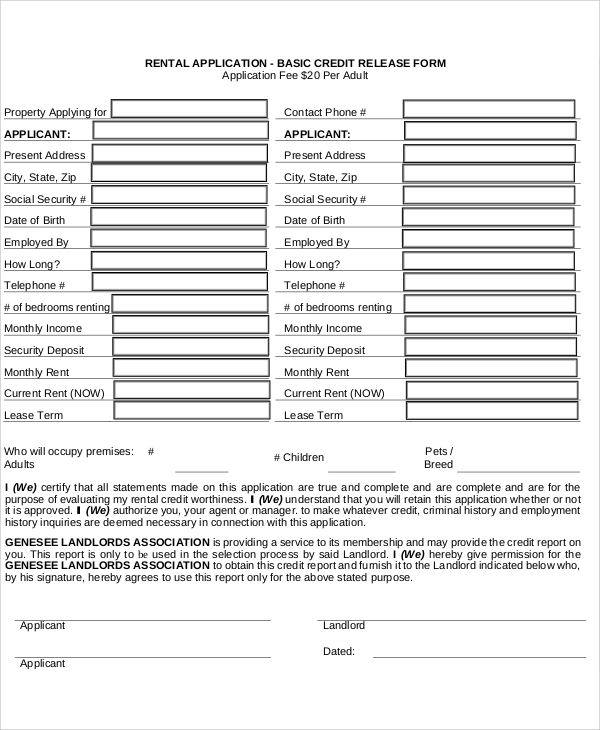

Rental Credit Check Release Form Example

Credit Worthiness

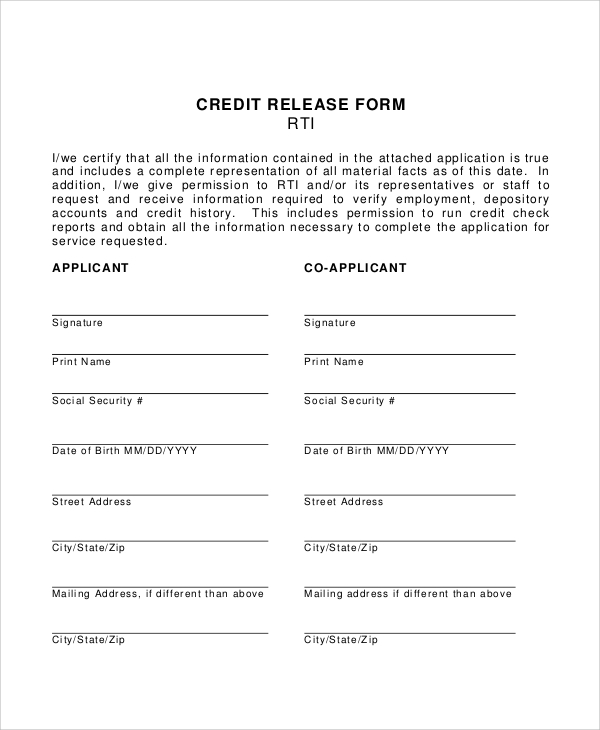

Most of the time, when you apply for a credit card or other kinds of loan, you are obliged to the terms and conditions of the creditor company. This includes the assessment and evaluation of your credit capacity to make sure you will not default on your payments and continue to have good credit standing. Once your application is approved, your credit limit will be based on your income and capacity to pay. This is often based on whatever information your creditor obtains about your financial capacity from different sources. Most banks and credit card companies emphasize unconditional affirmation when collecting fees, charges, and penalties. This is part of the conditions that the cardholder is obligated to once he is eligible for the credit card or loan. Failure to pay may mean additional charges and penalties, which the cardholder will not be able to contest whatever litigation may arise due to failure to settle obligations.

You may also be made to sign a guaranty agreement by credit card companies who have the right to change or alter any provisions in the agreement like cancelling the credit card or reducing credit capacity when the company determines you may not be able to fully comply or in danger of defaulting on your payments. This is part of the evaluation on your credit worthiness.

For other kinds of release forms, do check out our Credit Release Forms and Photo Copyright Release Forms. These are part of our different kinds of samples for different instances that users may find very helpful. These are all available free for downloading in both Word Doc and PDF files.

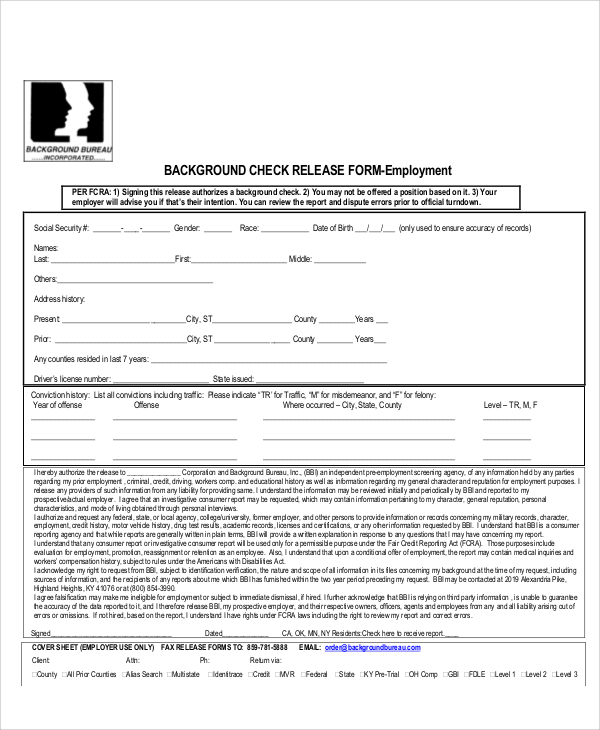

Background Credit Check Release Form

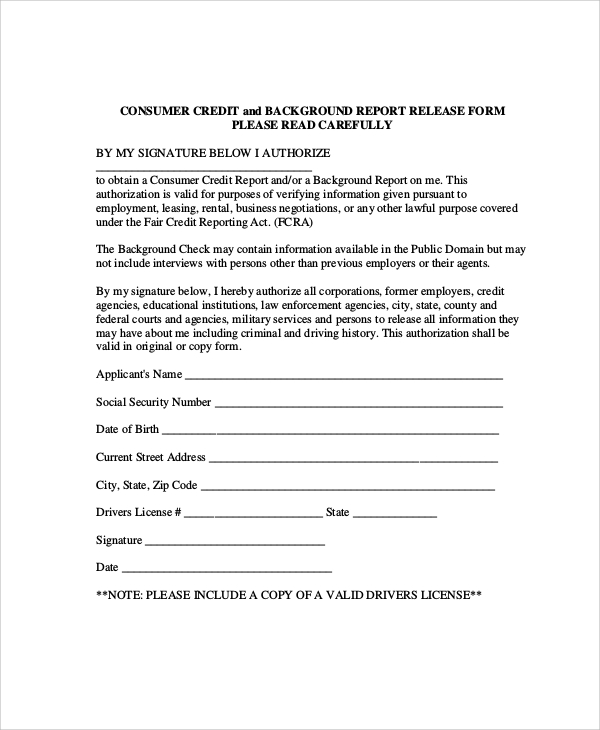

Consumer Credit Check Release Form

Credit Check Release Form in PDF

Although the Fair Credit Reporting Act has some of your rights protected like having the right to know any disclosure done about you by the reporting agency, this may not be enough to prevent credit companies from looking deeper into your financial dealings in the past to decide whether to make you eligible for loans or to decline your application altogether.

Consumer reporting agencies, on the other hand, must need to be careful in reporting an individual’s information. Any incomplete or inaccurate information must be corrected immediately, otherwise the individual has the right to complain or even sue the agency responsible for any wrong or inaccurate information being supplied to credit companies.

For even more release form samples, please click on the link for Actor Release Form Samples. These may be used by entertainment artists and agencies in making a check on their talent pool before making a contract to work for their agency.

Related Posts

Agreement Form Samples & Templates

Vehicle Inspection Forms Samples & Templates

Sample Employee Advance Forms

Sample Child Travel Consent Forms

Sample Testimonial Request Forms

Sample Employee Details Forms

Sample Divorce Forms

Sample Attestation Forms

Employee Performance Appraisal Form Templates

FREE 9+ Sample Presentation Evaluation Forms in MS Word

FREE 10+ School Admission Form Samples & Templates in MS Word | PDF

FREE 30+ Patient Consent Form Samples in PDF | MS Word

FREE 10+ Sample Sign Off Form Templates in PDF | MS Word

FREE 11+ Sample Medical Consultation Forms in PDF | MS Word

FREE 8+ Sample Donation Forms in PDF | MS Word