Any new business that receives investment is overjoyed. Finding the right investor usually takes a lot of time and effort. When you do, it’s critical to have an investment contract in place that protects everyone’s interests. The investor will want to know that his money is safe, and the company will want to know that the funds are delivered quickly and that the founders’ stake in the company is secure.

10+ General Investment Contract Samples

An investment contract is a legal agreement between two parties in which one invests money with the expectation of receiving a profit. The Securities Act of 1933 governs investment contracts. A contract must contain the following elements, as laid out by the Howey test, to be considered valid in this category:

– A financial investment

– A cooperative venture

– Profit projections (s)

– Occurred as a result of the efforts of others

Although the Howey Test is not the only method for determining whether an investment contract meets the criteria for security, it is the most widely used.

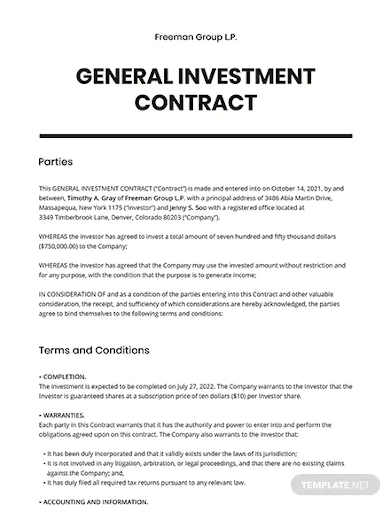

1. General Investment Contract Template

2. Foreign General Investment Contract

3. General Equity Investment Contract

4. General Investment Policy Contract

5. General Investment Contract

6. General Project Investment Contract

7. General Fund Investment Contract

8. General Science Investment Contract

9. General Legal Investment Contract

10. General Real Estate Investment Contract

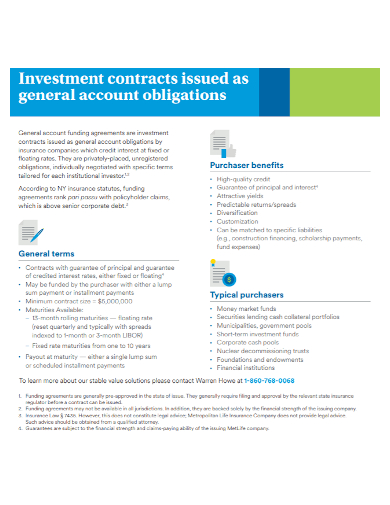

11. General Account Investment Contract

Types of Investment Contracts

- Stock Purchase Agreement – This is one of the simplest contracts, but it requires a lot of documentation because it is for non-publicly traded investments.

- Non-statutory Stock Option Agreement – Also known as nonqualified stock options, this type of contract is used when investors or employees of a company want to invest.

- Statutory Stock Option Agreement – Also referred to as “incentive” or “qualified” stock options, this type of contract is governed by the Internal Revenue Code. Even though there are stringent requirements for this option, the tax advantages make it worthwhile.

- Convertible Debt Agreement – This type of contract is known for its ingenuity in allowing an investor to lend money to a company and either be repaid later or gain an ownership interest in the company.

- A convertible note – is a short-term debt instrument that can be converted into stock in the issuing company. An investor in this case lends money in exchange for stock.

- Convertible Promissory Note – Depending on the terms of the agreement, this note converts debt to equity at a specific point in time.

- A SAFE note – is convertible security that acts as an option by allowing an investor to buy shares at a future price. This isn’t a real debt, and it doesn’t have any interest attached to it.

- Restricted Stock Agreement – A restricted stock agreement prevents an investor from acquiring an ownership interest in a company. This type of investor is expected to devote time and effort to maintaining current interest.

- Deferred Compensation – While not an outright investment, employees are considered to be investing in this category because ownership or pay increases are expected in the future.

- Royalty, Commission, or Percentage of Revenue – This type of contract is for people who don’t want to own the company but want to invest in its profits or products instead.

It’s critical to spell out exactly what you’ll be providing as an investor and in what form, as well as when the investment will be activated, in the contract. It should be stated whether investments will be transferred in the form of cash, check, assets, or wire transactions. It is critical to include all specifics in the contract, no matter how minor they may appear, in order to avoid future confusion or disputes.

FAQs

What is inside an investment contract?

– The names and addresses of those who are interested

– The investment structure as a whole

– The investment’s goal

– A date for implementation has been set.

– Both/all parties’ signatures

What is the purpose of a recital?

The recital should include the date the agreement was signed, as well as the names and addresses of the contracting parties. Because the company contact will be identified later in the agreement, use the company name and address if applicable.

The contract must be signed by both parties in the presence of two witnesses. The contract must be signed by each witness. One of the witnesses should ideally be a Notary Public who can notarize the signatures, but this is not required. Sign two copies of the contract, one for each party to keep and the other for their records.

Related Posts

Sample Excuse Letter for School

Feature Writing Samples

FREE 10+ Security Guard Contract Samples in PDF | MS Word

FREE 10+ Option to Purchase Agreement Samples in MS Word | Apple Pages | PDF

FREE 26+ Curriculum Form Samples in MS Word | PDF

FREE 20+ Cleaning Service Proposal Samples in PDF | MS Word

FREE 29+ Sample Loan Application Form Templates in MS Word | PDF

FREE 10+ Event Venue Contract Samples in PDF | MS Word | Pages | Google Docs

FREE 10+ SBAR Samples in PDF | DOC

FREE 12+ Music Band Contract Templates in PDF | MS Word

FREE 10+ HVAC Maintenance Contract Samples in PDF | MS Word

FREE 10+ Social Media Marketing Contract Samples in MS Word | PDF

FREE 10+ Wholesale Assignment Contract Samples in PDF

FREE 18+ Financial Proposal Samples in PDF | MS Word | Google Docs | Pages

FREE 10+ Feasibility Study Samples in PDF