According to a report on the Philanthropy Round Table’s website, local philanthropists remain present in most American communities while omnipresent and modest. Based on the report, with more or less one million charities in the country in 2014, the charitable giving totaled to 358 billion US dollars, and only 14 percent of that came from foundation grants, 5 percent from corporations, the remaining 81 percent came from individuals. How did we know all this? Charity reports have always been an effective tool in recording details related to public charity giving. Let us help you learn more about charities and charity reports through this article. Continue reading below.

FREE 10+ Charity Report Samples & Templates in MS Word | MS Excel | PDF

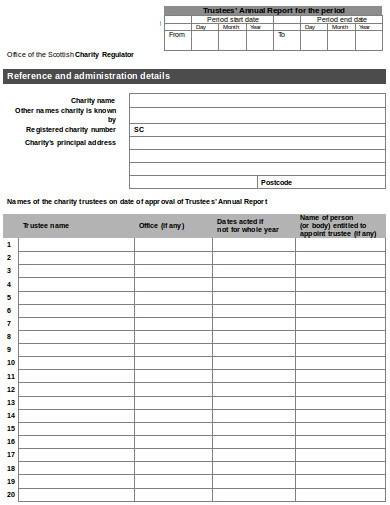

1. Trustee Annual Report Template

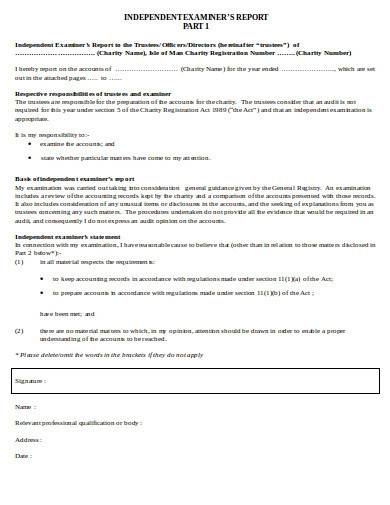

2. Independent Examiner Charity Report

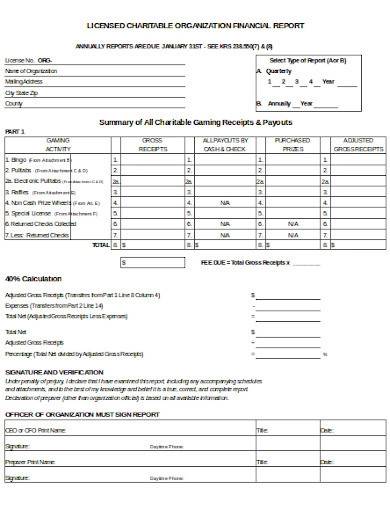

3. Licensed Charitable Financial Report

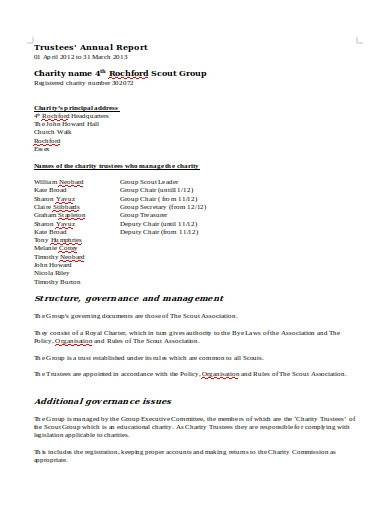

4. Trustee’s Annual Report Template

5. Charity Audit Education Report

6. Charities Annual Accounting & Reporting

7. Charity Commissioner Annual Report

8. Trustee Report Template

9. Hospital Charity Annual Report

10. Money Charity Annual Report

11. Charity Audit Report Template

What Is a Report?

A report is a written document that provides organized details to educate a specific group of people. Its purpose is to communicate information, which is a by-product of research and analysis of data regarding relevant events. Some present a summary report by orally delivering them, but a complete report must be written as it is required.

More so, a report is a versatile document because it caters to different subjects and a wide range of topics. One should know a good report based on its accuracy, objectives, and completeness. Following these will ensure the report’s clarity of structure. Also, well-written reports can hold the reader’s attention and meet their expectations. That is why writing a report can be a tricky task unless you stick to an information-finding process.

Charity Reports: How Is It Important?

Charity reports play a crucial role in the member-based industry. It has been said a thousand times before. Donations drive charity operations. And without donors, a non-profit organization will find it challenging to initiate fundraising events, social gala dinner, community service programs, and more. What does a report have to do with it? Think about this; if a charity does not write its report, it is less likely to be documented. With that, it would not be known by many. So, the charity would have the least chance to connect with potential volunteers and sponsors.

Furthermore, a report is required for legal processes, such as filing tax-exemptions and Internal Revenue Service (IRS) registration. Even in monitoring the charity’s financial condition requires writing a report. If an organization fails to make its charity report, it will take away the chance to grow and improve in areas it is lacking.

Charity Giving and the Most Generous States: From Top to Bottom

At first glance, we can easily think of charitable works as something done by wealthy individuals. However, an article posted by a philanthropy website called Philanthropy Round Table proved it wrong. Though there are wealthy Americans who donate to charities, 60 percent of the donations come from the average citizens who earn between two to three thousand dollars per year.

Moreover, the post stated that the giving varies on what state a donor lives in. The website listed the Top Ten Most Giving States (in 2010) which includes Utah, Wyoming, Georgia, Alabama, Maryland, South Carolina, Idaho, North Carolina, Tennessee, and New York. On the other hand, New Mexico, Iowa, Ohio, Hawaii, Montana, Vermont, Wisconsin, New Hampshire, Rhode Island, and Maine comprise the Bottom Ten Least Giving States.

How to Craft a Charity Report

Before starting a reflective charity report, make sure you have enough knowledge to create one. Also, know your objectives first so that you can set your goals. It will save you time because you will know how to write the report correctly. Also, do not make a charity report out of the blue, or you will be making a purposeless document. To get started, below are tips you can follow in making your charity report.

1. Know Your Readers

Like charity membership form, donation letter, formal letter, and sponsorship form, a charity report is a document for professionals and ordinary readers. This means writing the report will depend on who is reading it. So, before going straight to making the charity report, take the time to identify who will be your audience. This way, you can adjust your writing style—language, tone, and vocabulary.

As much as you want the report to sound good, hifalutin words must be minimized, it will simplify the report even more. Be mindful of the report’s organization, clarity, and content as well. Your goal is not only to complete the report on time but also to keep it as comprehensive as possible. Always think of your readers as you continue writing the content of the charity report.

2. Familiarize the Report

You cannot make a charity report if you do not know its basic components. For references, you can scan through old books from the library or look it up online. If you have old charity reports, you can refer to them as well. It can get easier if you write down what you have learned with a checklist. You can monitor your task this way.

More so, you can draft the report now that you are equipped with enough knowledge. The draft is like a skeleton of the report in which you have to support it with relevant details to make it substantial. These details should be based on facts from surveys, charts, research, graphs, and other reports.

3. Consider the Format

The right format makes a charity report appealing. Some charities follow their report format to maintain uniformity to their documents. However, you can use your format as long as you keep the report informative. With this, writing the report will be smooth. The versatility of your charity report can extend to considering it as a platform to promote the charity. Hence incorporate notable representations into it, such as logo, slogan, color scheme, etc.

4. Keep It Concise and Straightforward

Nothing can beat an easy-to-understand report, so use the simplest sentence structure in the content as much as possible. Conciseness is important too. Hence, only write the ideas that you want the readers to know and do not overstate them. Providing unnecessary information will only make the report crowded. If you want to include more of it, make sure it is relevant.

FAQs

Can I pay myself a salary in a non-profit?

Yes, state law and IRS allow a non-profit organization to pay salaries to people who are working in it. This also benefits the organization to extend its tax exemption.

Why should you not donate to charities?

There are different factors why people do not donate to a charity. Based on a result from NP Tech For Good’s survey, 43% of the respondent said they do not donate to charities because they do not have extra money for it. While 20% of the respondents prefer to volunteer than to donate, the other 17% prefer to donate goods and services, and the remaining 12% do not trust organizations.

Is cancer research a good charity?

Yes, cancer research is a good investment. Why? It impacts and improves cancer treatment, not just about developing and testing cancer medicines.

Writing reports is beneficial for a charitable organization. It does not only keep records of your previous charitable undertakings, but also an entry for more opportunities. The business industry is not the remaining competitive field out there. For more than one million charities in the United States, the competition is becoming tight. Step up and write your charity report today.

Related Posts

FREE 9+ Survey Templates in MS Word PDF

FREE 27+ Sample Sponsor Thank You Letter Templates in PDF ...

Event Evaluation Sample

FREE 25+ Sample Community Service Letter Templates in PDF MS ...

FREE 10+ Project Scope Statement Samples in PDF MS Word

FREE 10+ Sample Donation Sheet Templates in Google Docs ...

FREE 8+ Sample Employee Performance Review Templates in MS ...

FREE 36+ Introduction Speech Samples in PDF

Sample Non Profit Budget Template

Silent Auction Bid Sheet Template

FREE 12+ Consignment Agreement Examples & Samples in PDF ...

FREE 9+ Sample Fundraising Letter Templates in MS Word PDF

FREE 4+ Sample Course Evaluation Templates in PDF

Sample Supplier Evaluation

FREE 8+ Non Profit Balance Sheet Templates in MS Word PDF