Before you purchase a vacant lot, it’s important to have the land appraised so you can determine if it’s a good investment and worthy of your development plans. An appraisal answers one or more specific questions about a real estate parcel’s value, marketability, usefulness or suitability. An appraisal may be requested or required for many reasons: to facilitate the transfer of ownership of real property, to help prospective sellers determine acceptable selling prices or prospective buyers decide on offering prices, and to establish a basis for the exchange or reorganization of real property or for merging the ownership of multiple properties. Determining the value of improved property (upon which one or more commercial, residential, or other types of properties have been built) is a relatively straightforward process that includes comparing sales of similar properties in the area. But matters may not be as simple when the property is vacant and undeveloped. In this case, investors rely on professional appraisers experienced in determining residual land value and potential uses.

10+ Land Appraisal Report Samples

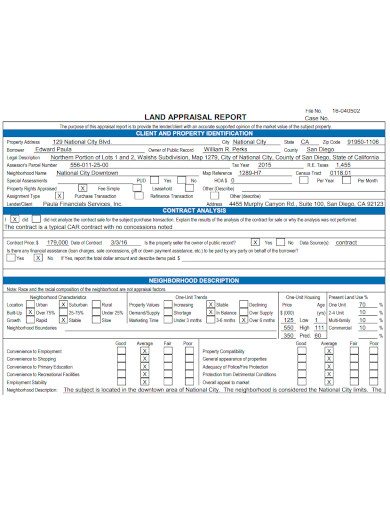

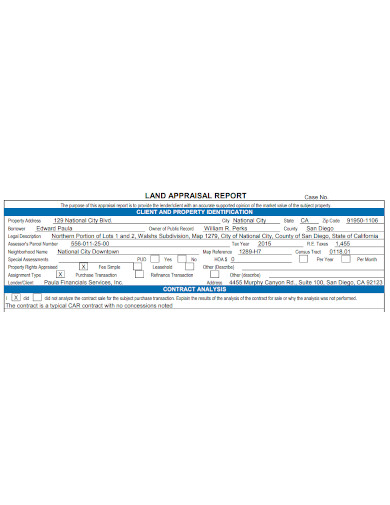

1. Land Appraisal Report Sample

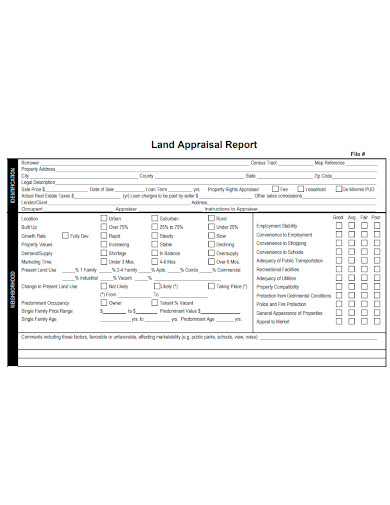

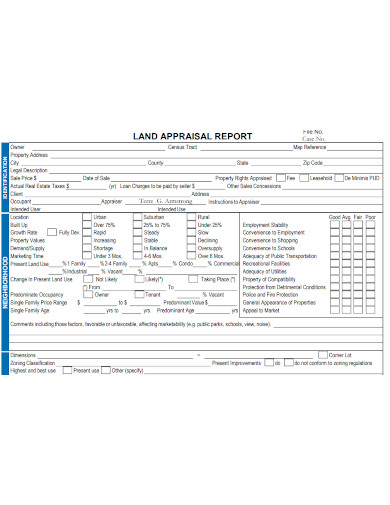

2. Printable Land Appraisal Report

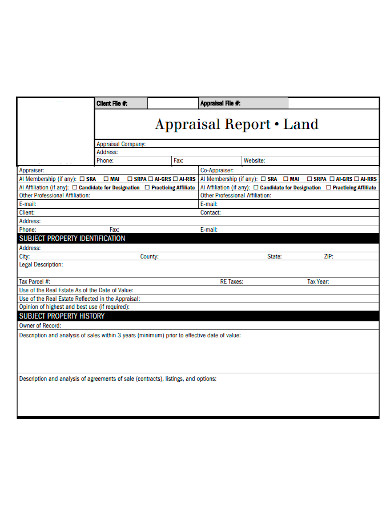

3. Standard Land Appraisal Report

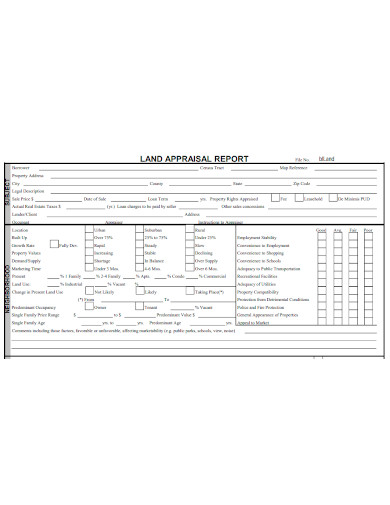

4. Formal Land Appraisal Report

5. Editable Land Appraisal Report

6. Land Appraisal Report Format

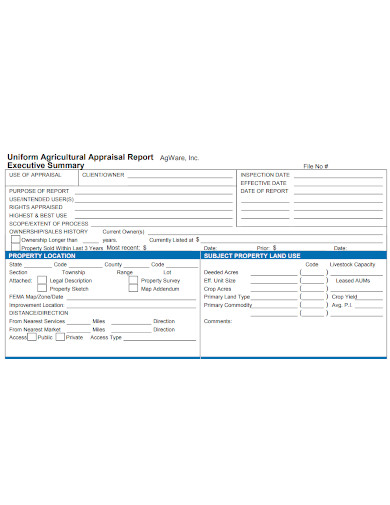

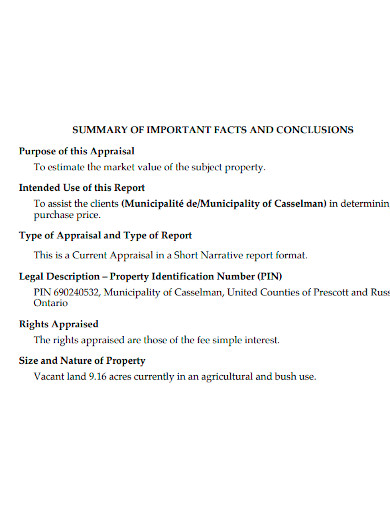

7. Agricultural Land Appraisal Report

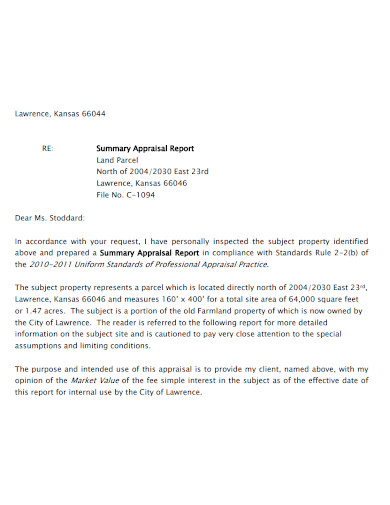

8. Land Appraisal Summary Report

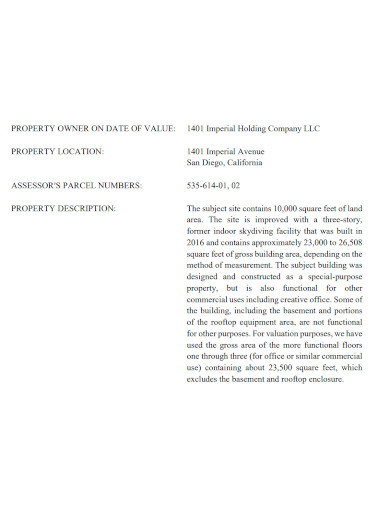

9. Restricted Land Appraisal Report

10. Creative Land Appraisal Report

11. General Land Appraisal Report

What Is an Appraisal Report?

An appraisal report is a detailed document that outlines a property’s value based on its quality, condition, location, and surrounding market conditions. A real estate appraiser compiles this objective report after performing an in-depth examination of the property. An appraisal and the corresponding report are one of the key final steps in a home sale, usually ordered by the mortgage lender to ensure they’re offering the correct home loan amount to the prospective homeowner.

In most cases, the buyer pays for the appraisal, though some lenders offer to bundle the fee with closing costs. An appraisal report is different from a home inspection report, which is a document compiled by a home inspector that details the condition of the home and land without an assessment of its value.

What Are the Key Components of an Appraisal Report?

A home appraisal report usually has a few components:

- The estimated fair market value of the property: The key figure in a residential appraisal report is the appraised value conclusion, which is a specific number that an appraiser settles on after a detailed analysis of the home’s features and recent sales in its surrounding market, working within the Uniform Standards of Professional Appraisal Practice (USPAP) and stamped with an effective date.

- Approach to fair market value: The appraiser also details which approach they used to come to the final number. Standard methods include the market data or sales comparison approach (which considers comparable sales of similar properties in the area), the cost approach (which factors in the cost of improvements), and the income approach (which factors in the potential revenue from rental properties).

- Property overview: A home appraiser will include several details about the residential property, such as the age, location, square footage, recommended occupancy, floor plan, living area, number of bedrooms and bathrooms, design and quality of construction, heating and cooling systems, landscaping, type of ownership (usually either fee simple or leasehold). An appraiser will not consider moveable pieces of personal property (like furniture) in their appraisal. In some instances, the appraiser may need to make certain assumptions about the property—for example, if construction is still underway, the appraiser can assume the value of the finished property (called a hypothetical condition). If the home is vacant and the utilities are turned off, the appraiser can assume they work (called an extraordinary assumption).

- Issues: Along with the various features of the real property, which refers to land and immovable assets attached to the land, like homes or buildings, an appraiser will include any issues that they come across during the walkthrough, including structural problems, abnormal depreciation due to lack of upkeep, or design defects.

- Summary of local market trends: Home appraisers stay informed of local and national market area trends to estimate a home valuation within the broader context. Most appraisal reports will include a brief overview of comparable properties, relevant public records, and local market analysis to help the lender better understand how the subject property fits in. This section includes whether the appraiser considers the home to be the “highest and best use” of the particular property’s zoning.

- Other considerations: Where relevant, appraisers will include further details or limiting conditions that may affect the home’s estimated value—for instance, easements or encroachments. In many cases, when there’s not sufficient room to include specific details, appraisers may attach them to the report as an addendum.

FAQs

What Are the Differences Between an Appraisal and an Appraisal Report?

An appraisal and an appraisal report have similar focuses but serve different functions. An appraisal is a process by which an appraiser estimates their opinion of the value of a property, including a walkthrough inspection and current market research. The appraisal report is the culmination of the home appraisal process, where the appraiser summarizes their findings.

What Is the Importance of an Appraisal Report?

An appraisal report is important for a few reasons:

- Offers a neutral assessment of a home’s market value. Unlike the proposed asking price or agreed-upon purchase price of a home, the real estate appraisal report details the home’s value based on the findings of a neutral third party, who considers the home’s strengths and weaknesses and factors those into the greater picture of the market. The appraiser’s unbiased opinion is key for home sales, mortgage refinances, and less common situations like divorce and estate proceedings—it can affect the home’s value on the market and the ability to refinance.

- Can prevent overlending. The primary purpose of an appraising report is to prevent a mortgage lender from offering an oversized loan to a borrower. Mortgage lenders are the intended users of the report; they usually order a home appraisal assignment in the final stages of a sale.

- Can help a buyer negotiate a lower price. After a home buyer agrees on a price with a home seller, the mortgage lender schedules an appraisal. In cases of a low appraisal value (for instance, lower than the sale price), the home buyer may negotiate a better deal with the property owner.

Related Posts

Trip Report Samples & Templates

Sample Book Report Templates

Sample Chemistry Lab Reports

School Accomplishment Report Samples & Templates

Field Report Samples & Templates

Sample Science Project Reports

Business Report Samples & Templates

Survey Reports Samples & Templates

Sample Feasibility Reports

Psychological Assessment Report Samples [ Clinical, Child, Intake ]

Report Format Samples & Templates

Acknowledgement for Internship Report Samples [ Hotel, Hospital, Teaching ]

Field Trip Report Samples [ Agriculture, Educational, Environmental ]

Student Counseling Report Samples

Narrative Accomplishment Report Samples [ Science, Teacher, Reading ]