Do you want to be a financial professional who works like an agent between borrowers looking for mortgages and the institutions that offer them? As a mortgage broker, your job is to find a lender that provides a program that is really appropriate for the borrower’s needs. You will be working with a number of lenders. 65% of borrowers use a mortgage broker to secure a home loan according to the National Association of Realtors. In this article, we will discuss the importance and beneficial steps of creating a mortgage broker business plan, plus we have a wide array of downloadable business plan templates for you to use. Keep on reading!

FREE 11+ Mortgage Broker Business Plan Samples

1. Mortgage Broker Business Plan Template

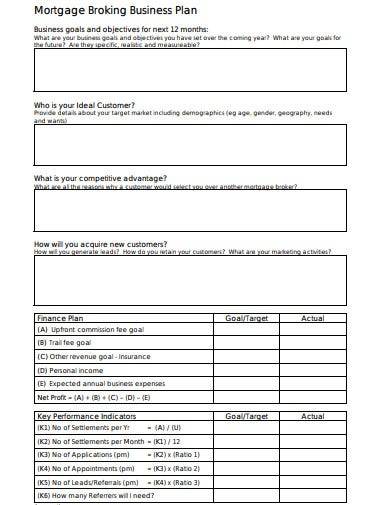

2. Mortgage Brooking Business Plan Template

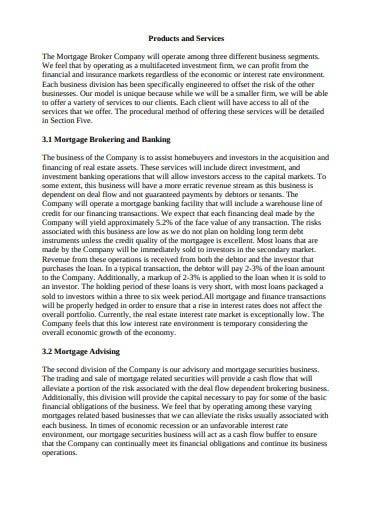

3. Mortgage Broker Activities Business Plan

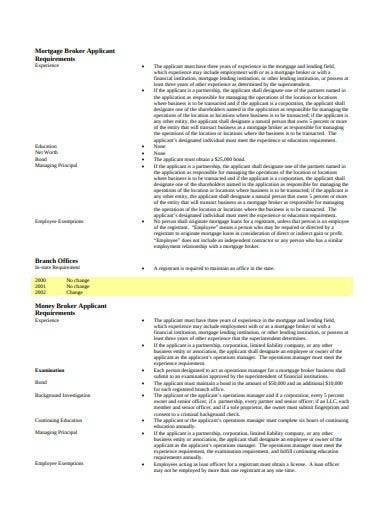

4. Sample Mortgage Broker Business Plan

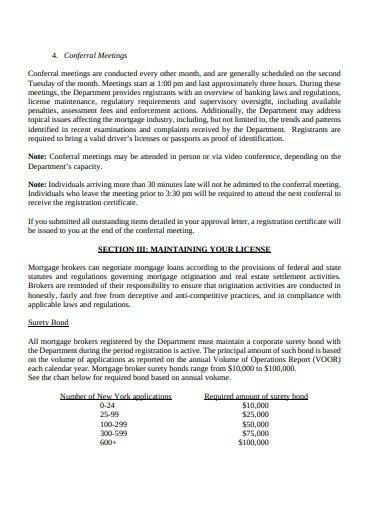

5. Mortgage Broker Business Plan Overview

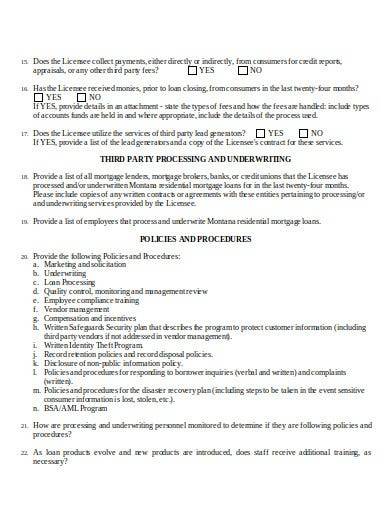

6. Wholesale Mortgage Broker Business Plan

7. Mortgage Broker Remuneration Business Plan

8. Basic Mortgage Broker Business Plan

9. Mortgage Broker Business Plan

10. Mortgage Broker Business Plan Format

11. Standard Mortgage Broking Business Plan

12. Mortgage Broker Business Plan Questionnaire

What is a Mortgage Broker Business Plan?

If you decide to enter the mortgage business, the best thing you need to do is create a business plan. Any professional who wants to start their own business prioritizes having a comprehensive plan that can help them achieve their business goals and objectives. If you’re serious and determined as a mortgage broker, your business plan is the best tool to attract lenders.

How to Create a Mortgage Broker Business Plan

Establishing a solid plan will help you to be able to provide an appealing business image to the lender and you may also have the opportunity to indicate your future plans and the overall achievements of your business.

Also, you need to be able to create a persuasive business plan. So, we suggest that you use our templates above that you can use comfortably. Here are the steps that you can do after you download your selected template:

1. Start with a compelling introduction

In writing a compelling introduction, you need to build your trustworthiness to your reader. Explain thoroughly and in a creative way why you are reaching out to the lender. Your introduction should have the legal structure of the business. Indicate your personal experience, samples of past achievements, and many more. Include a good mission statement as it clearly determines the road your company will take. It lets your prospect clients be able to know what you stand for and what you want to accomplish in your mortgage business.

2. Indicate your financial information

Show how your business is funded by indicating the essential financial information of your company. Of course, your lender needs to know whether you have the capability to repay the money that you’re planning to borrow. So, you will inform them about the comprehensive budget for managing your business successfully, project and operating expenses, external financial sources from investors and partners, savings, and others. For you to win the lender’s trust and loyalty, calculate your estimated income reasonably.

3. Develop an effective marketing plan

A dressing like a honey lemon vinaigrette is great for green salads. Without a certain type of dressing, your salad becomes a boring and bland food. Turning your food wholesome and sumptuous with a drizzle of a citrusy dressing in your salad is like developing an effective marketing plan for your business plan. It brings out the real essence of your business by the use of advertising. List all the marketing costs and types of advertising you need. To have an effective marketing plan, include any market research that you initiate as you begin your business.

4. Provide details of your operational structure

Provide your day-to-day business operations, systems, and additional details such as the processes and methods how your business is conducted. Describe how you implement your plans and explain clearly the various methods you executed. Add the type of quality control you’re doing for your business.

5. Create a solid conclusion

Finally, create a solid conclusion tone as you move and entice the lenders in receiving their full support and earning their complete trust. According to an article by Pen & the Pad, “creating a positive tone that conveys the message with amiable, heartfelt language usually results in a more favorable reader response.” So, you need to create a strong opening for your conclusion, organize your sentence and accentuate positive words in the right way.

FAQ

First, you will go through the pre-licensing mortgage broker training. Then you must pass the SAFE Mortgage Loan Originator Test. After you pass the exam, register your company and business name. You need to complete the mortgage broker license requirements and get a mortgage broker bond. Establish a network of lenders and buyers, and select a software solution for your brokerage.How do I start my own mortgage brokerage business?

Lenders usually pay a higher commission than borrowers do. They typically pay between 0.5% and 2.75% of the total amount of the loan when lenders compensate mortgage brokers.How much does a mortgage broker make on a sale?

It is a much better option because brokers commonly have access to far more loan products and types of loans than a large-scale bank, whether it’s FHA loans, VA loans, etc.Why is a mortgage broker better than a bank?

You should accomplish 20 hours of pre-licensing training through an approved organization. The training has three hours on federal law and regulations, three hours on ethics, two hours on nontraditional mortgage products, and twelve hours of elective courses. Plus, you need to have analytical and sales skills.How long does it take to become a mortgage broker?

The book “The Complete Guide to Becoming a Successful Mortgage Broker” stated that developing relationships with lenders appears to be one of the most essential components of getting started in the mortgage broker business. You need to work with many mortgage lenders. If you build good relationships with underwriters and processors that work for the lenders, your job can be much effortless. Therefore, have a strong confidence while you transform your business into the next level. Get a business plan template today and we hope that you will succeed in your mortgage business journey!

Related Posts

FREE 5+ Customer Perception Survey Samples in PDF | DOC

FREE 7+ Customer Ledger Samples in PDF | MS Word | Excel

FREE 10+ Corporate Social Responsibility Policy Samples in PDF | MS Word

FREE 10+ Corporate Bylaws Samples in PDF | MS Word

FREE 8+ Consultant Business Plan Samples in PDF | MS Word

FREE 11+ Construction Application Samples in PDF | MS Word

FREE 9+ Client Information Sheet Samples in MS Word | Excel | Pages | Numbers | Google Docs | Google Sheets | PDF

FREE 10+ Cleaning Business Proposal Samples in PDF | MS Word | Google Docs | Pages

Sample Chart of Accounts Templates

FREE 10+ Business Travel Report Samples [ Market, Industry, Trip ]

FREE 10+ Business Debt Schedule Samples in PDF | MS Word

FREE 17+ Branding Proposal Samples in PDF

FREE 10+ Art Gallery Business Plan Samples in MS Word | Pages | Google Docs | PDF

FREE 6+ Acknowledgement for Audit Report Samples in PDF

FREE 7+ Account Bookkeeping Samples in PDF | MS Word