Documents like receipts, invoices, cash statements, income reports, and other financial proofs are crucial for a growing business. Why? These documents help business accountants and bookkeepers monitor the financial health of the company. It helps business owners make decisions for the future of their companies. On top of that, it leads to the cash flow, which shows where the money is going. Since the business industry is capital-driven, without monetary resources, it will not survive. The need for a repository to record every document related to finances is essential. That is why all businesses use a general ledger. Find out how this accounting book dramatically affects the company’s finances. Read more below.

FREE 11+ General Ledger Samples & Templates in PDF | MS Word

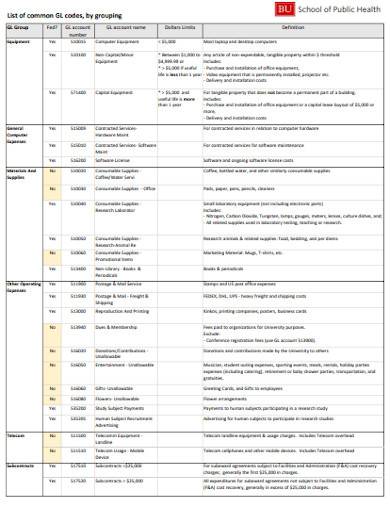

1. General Ledger Queries Template

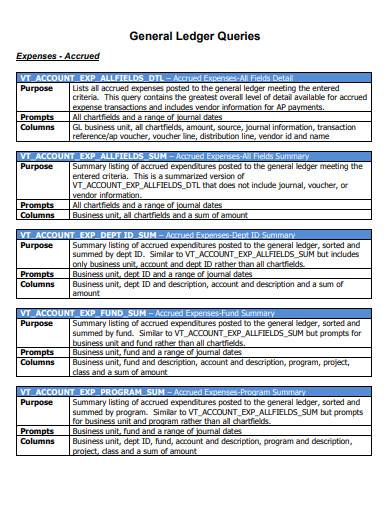

2. General Ledger Chart of Accounts Template

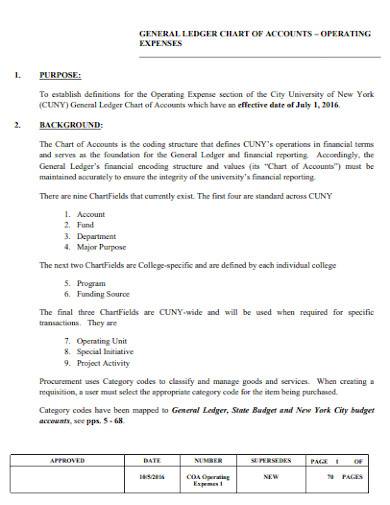

3. General Ledger of Codes Template

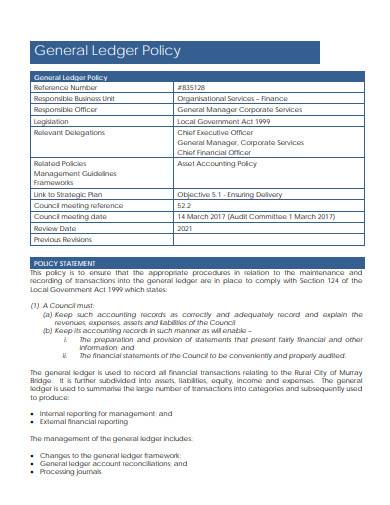

4. General Ledger Policy Template

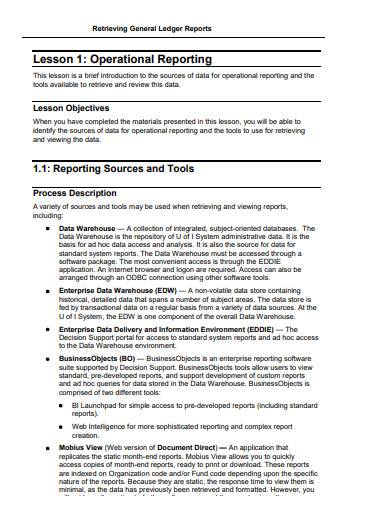

5. Sample Retrieving General Ledger Reports Template

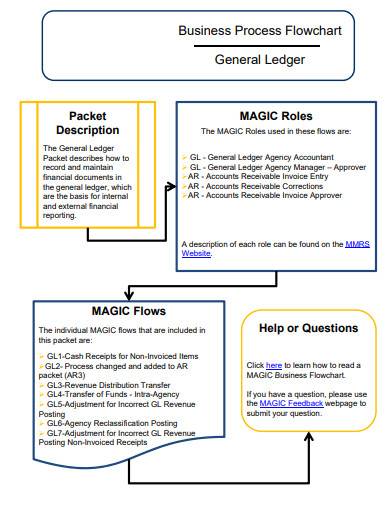

6. Business General Ledger Flowchart Template

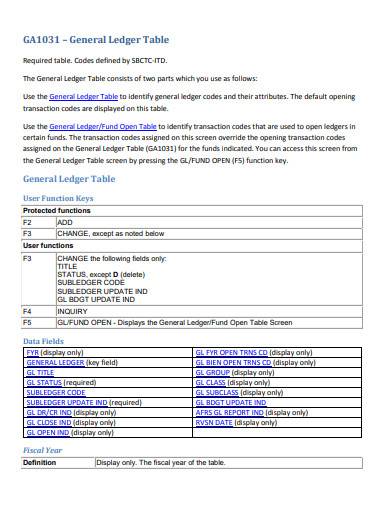

7. General Ledger Table Template

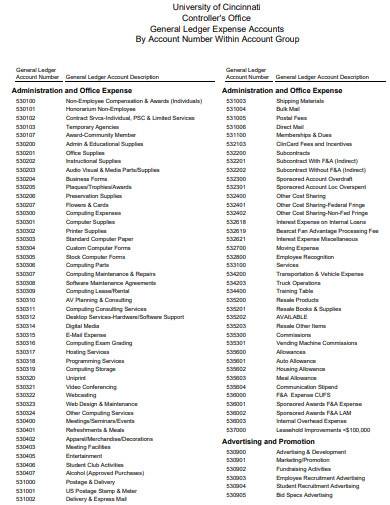

8. General Ledger Expense Accounts Template

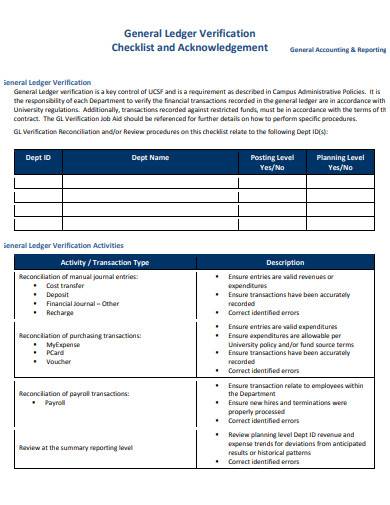

9. General Ledger Verification Checklist Template

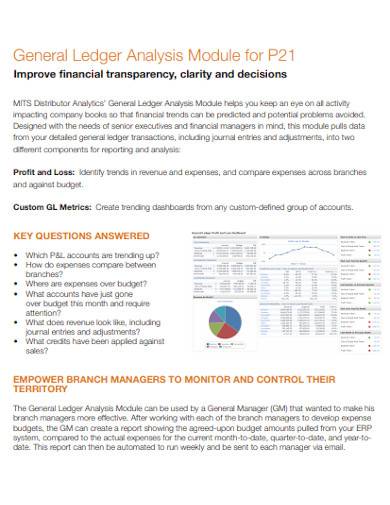

10. General Ledger Analysis Module Template

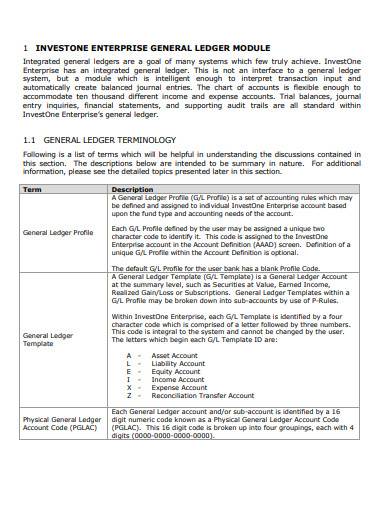

11. Sample Enterprise General Ledger Template

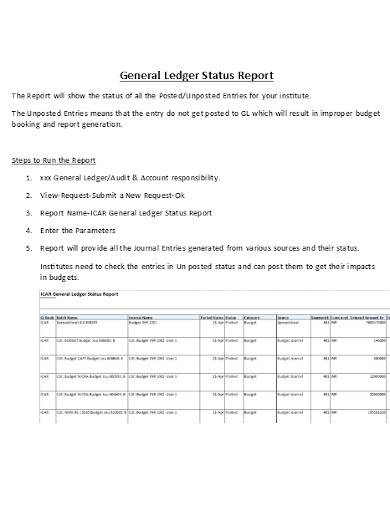

12. General Ledger Status Report

What Is a General Ledger?

Many factors can affect a thriving business, which, all in all, create the business environment—like financial transactions, business operations, services, business trends, and more. Directly impacting the business, all these factors should have storage where the company can record them. Because of that, companies keep a general ledger to document processes that they consider beneficial to the business. Together with subsidiary ledgers, a general ledger holds details needed to come up with financial statements, including assets, liabilities, revenue, and expenses. A financial statement conveys the financial plan and performance of the company, and auditors cannot write a financial statement without the records on the ledgers.

Subsidiary Ledger: How Important Is It?

According to Aptitude, accounting subsidiary ledgers make standard financial responsibilities clear. It centralizes the income of the business and supports various reporting needs. Additionally, it increases the accuracy of the calculated results and decreases the difficulty of the audit cycle. The balance of the accounts in a subsidiary ledger equals the balance in your general ledger. It is a separate account for various business components so that a company has total control on the general ledger. That said, a subsidiary ledger is the entry point for certain accounts to the general accounting book. Examples of subsidiary ledgers are the account payable, inventory, business properties, company equipment, and account receivable.

How to Record On a General Ledger

Accounting tasks are significant parts of a business’s success. Without it, a company would have no grasp of their financial status. Yet, facing accounting seems an overwhelming job, not that it involves numerical figures, but the future of the business may highly rely on it. Considerably, big companies hire accountants to look after their finances and work on their general ledger. Still, small businesses can do the same if their income allows them to do so. Either of which, business owners must know how to create a ledger so that reading it comes in quickly. Remember that experience is the best teacher. The best way to understand your general ledger is by knowing how to make one. Here is how.

1. Consider a Ledger Template or Not

There is always a way around finishing your task quickly. Working for a business will require you to double-time since it is a fast-paced industry. Thus, it is understandable to do shortcuts as long as the results are exceptional. In working on a general ledger, templates are accessible to make your life more convenient. A template is usually editable, which means you can customize the content while you input your business data. However, if templates are not convincing enough, you can opt to create your general ledger manually. Do not sweat it out. General ledger making is not as hard as you think it is. Set your goals first before diving into the actual ledger. The things that you can stick to are the process of making this accounting book and understanding the concept of recording business deals, which affect your business in many aspects. You will acquire more knowledge if you personally create your ledgers. Do not hesitate to consult professionals, such a certified accountant or bookkeeper, if you are having difficulties.

2. Develop Journal Entries

Entries from accounting forms are vital components of the subsidiary and general ledgers. In that case, you must learn how to develop your journal entries properly. To do that, do not miss any financial transactions made by the business. Begin by monitoring the inflow and outflow of cash within the business. Why is it important? According to Medium, cash is considered as the driving force of a business. In one way or another, transactions and operations involve cash, which makes it the heart and soul of the trade. Keeping an eye on these transactions will make the recording of journal entries on point. Collect all the documents related to cash, such as receipts, cash disbursements, and payrolls. As the first step of the accounting cycle, journal entries must correctly take note of every transaction and the accounts it affected. Well-organized journal entries make the next step a lot easier.

3. Access Subsidiary Ledgers

Your access to subsidiary ledgers gives an update about the status of the business’s finances. A general ledger will summarize all business details in every subsidiary ledger. That said, if a subsidiary ledger is poorly-recorded, it can affect the accounts in the general ledger. Yet, you can trace back the errors and fix them.

4. Organize the Accounts

A well-drafted general ledger comes with a full understanding of the accounting book. Take note that many business persons will read the general, so make it easy-to-understand. To do this, format the ledger as simply as possible and use tables to organize the entries. Furthermore, ledger includes calculations. Hence, there is a need for accurate input formulas.

FAQs

Is general ledger the same as the balance sheet?

A general ledger is different from a balance sheet. The company’s transactions and accounts related to it are in the general ledger. On the other hand, balance sheets record accounts, such as the number of total assets, liabilities, and equity of the business.

What transactions are recorded in the general ledger?

A general ledger contains all the transactions made by the business. It even contains a summary of every transaction stored in other accounting journals like a subsidiary ledger.

What is general ledger journal entry?

Before an account lands on the general ledger, it has to be accounted as journal entry first—several sub-ledgers record journal entries as it rolled up to the general ledger.

Indeed, cash, business transactions, and accounting books are flesh and blood of a business. All these are related that whenever one is lacking, a business could stop operating. That said, looking after these factors is an obligation not just for the business owners but for all the business members. Keeping a general ledger is the first step in giving light to a business’s future. With this, the transparency of the finances is unquestionable. Hence, it ensures a clear path of what is ahead for your business.

Related Posts

FREE 10+ Writing Journal Entry Samples and Templates in MS Word | PDF

FREE 10+ Double Entry Journal Samples and Templates in MS Word | PDF

FREE 5+ Stock Ledger Samples and Templates in MS Excel | PDF

FREE 10 + Revenue Recognition Samples & Templates in PDF | MS Word

FREE 11+ Liability Insurance Application Samples and Templates in MS Word | PDF

FREE 11+ Petty Cash Reconciliation Samples and Templates in MS Excel | PDF

FREE 10+ Reconciliation Statement Form Samples and Templates in MS Word | PDF | MS Excel

FREE 10+ Annuity Disclosure Form Samples & Templates in PDF

FREE 9+ Absorption Costing Samples & Templates in PDF | MS Word

FREE 10+ Prepaid Expenses Samples and Templates in PDF | MS Excel

FREE 7+ Depreciation Worksheet Samples & Templates in PDF | MS Word

FREE 10+ Turnover Ratio Analysis Samples and Templates in PDF

FREE 11+ Cost Volume Profit Analysis Samples & Templates in PDF | MS Word

FREE 10+ Bank Reconciliation Statement Samples and Templates in PDF | MS Word

FREE 9+ Balance Sheet Reconciliation Samples & Templates in PDF | MS Word