The real estate industry’s budget season begins in late summer every year. Multifamily experts work tirelessly during these months to develop a property management budget for the future year. The income and expenses are tracked in these annual operating budgets. They include everything from large-scale upgrades — such as installing additional apartment facilities — to routine building or common area maintenance. It’s always a good idea to update your knowledge and enhance your multifamily budgeting skills, whether you’re new to the sector or a seasoned pro. So read on to learn more about your property management budget, what should be included in it, and how you can establish one.

10+ Property Budget Samples

A property management budget is a breakdown of the building’s income and expenses that is used to track the finances and forecast future spending for a multifamily property. The annual operational budget for an apartment building is normally prepared a few months before the fiscal year begins. The daily operations of the building are detailed in a multifamily property management budget, which includes both income and expenses. It also offers forecasts for the building’s anticipated expenses and revenue.

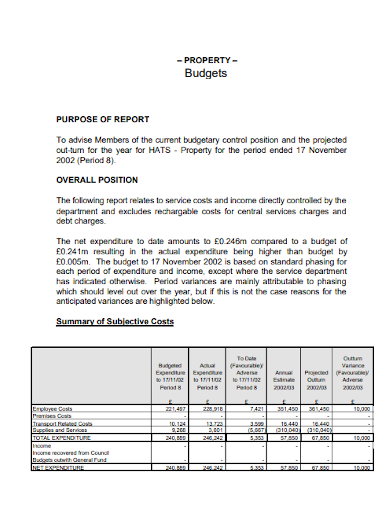

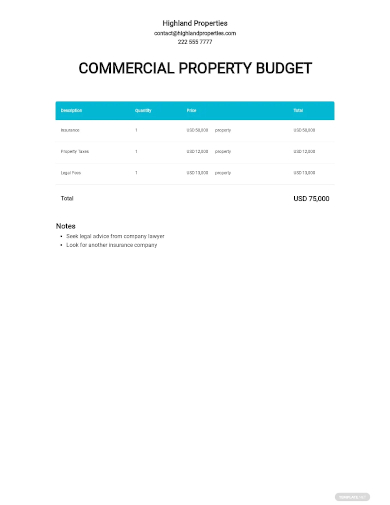

1. Commercial Property Budget Template

2. Property Assessment Fiscal Year Budget

3. Property Budget Report

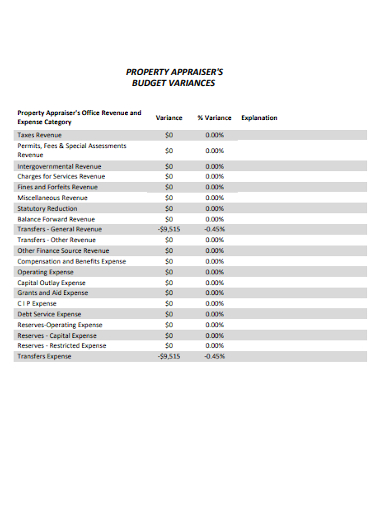

4. Property Appraiser Budget Variances

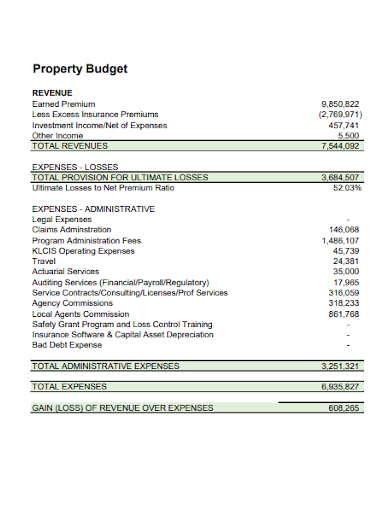

5. Sample Property Budget

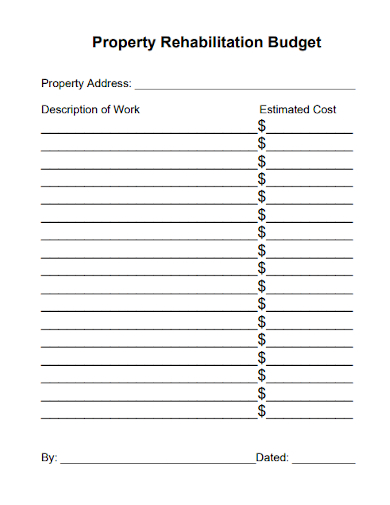

6. Property Rehabilitation Budget

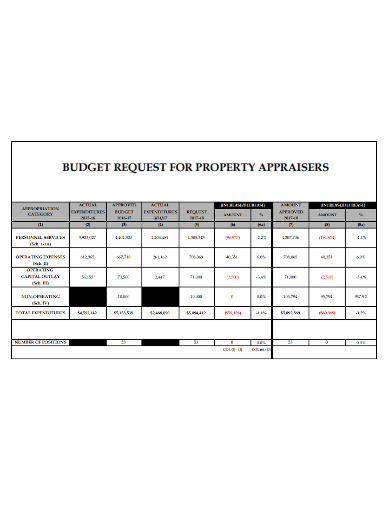

7. Budget Request for Propoerty Appraisers

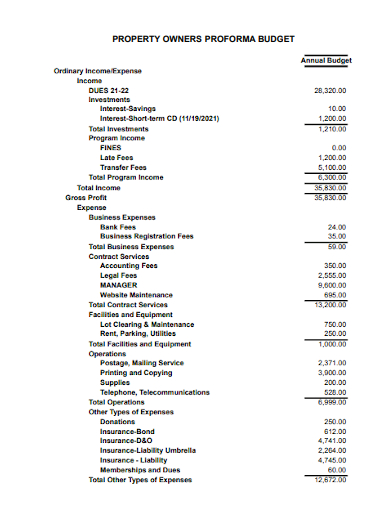

8. Property Owners Proforma Budget

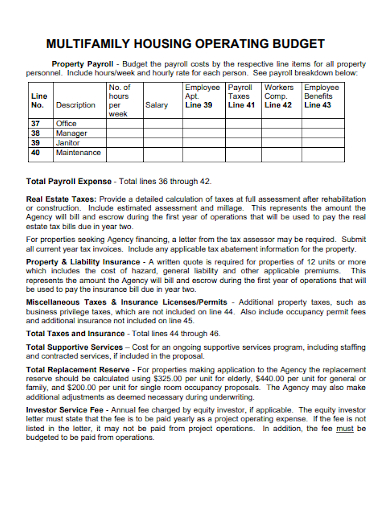

9. Multifamily Housing Operating Property Payroll Budget

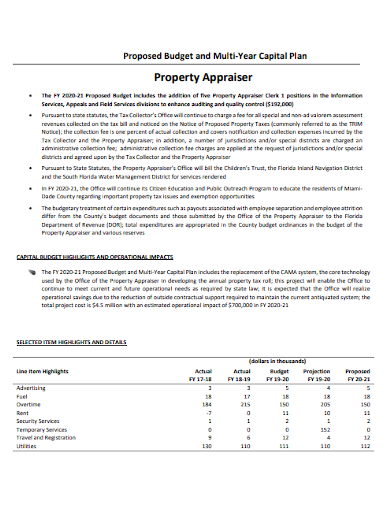

10. Property Appraiser Budget & MultiYear Capital Plan

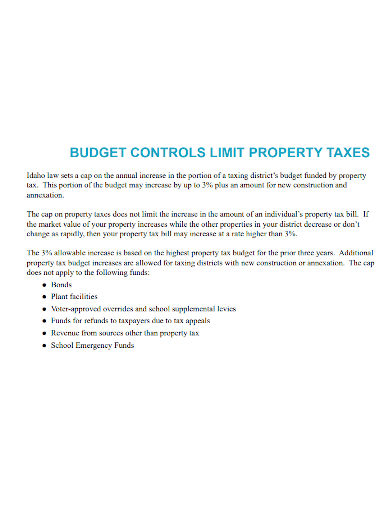

11. Budget Controls Limit Property Taxes

Budgeting Tips for Property Managers

- Budget for one time and ongoing costs – Make sure to account for both one-time and continuing expenses when creating your budget. Those on-going costs, according to Property Ware, include things like property inspections and maintenance. One-time expenditures could include the cost of preparing a home when an existing renter vacates or the cost of repairing a major problem, such as a burst pipe. Property Ware also recommends setting up a contingency fund to cover any unexpected significant bills. “Remember that although you may predict that the business will create a specific rate of revenue growth going forward or that certain expenses will be fixed or can be controlled, these are estimates and not set in stone,” says Investopedia.

- Conduct a research – Before you start inputting statistics, Multifamily Executive recommends gathering all pertinent historical data, such as current rents, current occupancy, trailing–12-month financial reports, payroll information, and utility pricing hikes. Look for contracts for lawn care, advertising, software, copiers, and other similar products and services; you should be able to keep track of the things that don’t vary throughout the year.

- Determine Any Applicable New Budget Categories – You should meet with your staff to discuss the budget, according to Multifamily Executive. What modifications should be made? Which categories should be added and which should be removed? Will you, for example, upgrade your amenities by putting electronic parcel lockers? If you want to boost resident relations and create a high-quality living environment, you’ll need to budget for parcel lockers, smart homes, on-site pet facilities, and other amenities.

- Go Digital with Your Accounting – According to Property Management Insider, a web-based, integrated accounting system is essential for budget management because it integrates all operations into a single work solution. With only a few clicks, you can scan receipts, post expenses, and make deposits. Furthermore, a digital accounting solution is eco-friendly. Property management companies can remain on top of the money going in and out of their portfolios and help establish a healthy business by following a few basic strategies.

- Set Aside Budget for Marketing and Advertising – According to The Balance Small Business, word of mouth can bring in new tenants, but effective market competition necessitates a marketing plan and advertising budget. Don’t forget to budget for regular advertisements in media with a track record of attracting tenants. The expense of maintaining web listings should be included in an advertising and marketing budget. When vacancy rates rise, it’s also a good idea to budget for more marketing. Your budget approach should also include greater promotion to advertise renovations or enhancements.

- By bringing everything together, you may create a comprehensive budget – According to The Balance Small Business, comprehensive budgeting entails a full understanding of rival properties, their comparative qualities, and rental pricing. Prepare a budget for upgrades and enhancements. Estimate continuing management expenses for repairs, maintenance, and administration as precisely as possible. Maximize rental prices in light of current market conditions and competition. Hopefully, once you’ve completed all of this, your income will surpass your expenses, and you’ll be in charge of a lucrative property.

FAQs

What are the potential sources of ancillary income for multifamily properties?

- Fees for applications

- Fees for late payments

- Processing costs for credit cards

- Laundry

- Fees and/or rent for parking

- Vending machines, coffee shops, and other amenities are available on-site.

- Rent/fees for pets

- Rental of furniture

- Fees for breaking a lease early

- Fees for property damage

- Fees for access to amenities

What does it mean to say having a “solid budget”?

Your property’s financial blueprint is a strong budget. Make sure it accounts for both current and future cash inflows and outflows, as well as anticipated expenses.

Budget period can assume like a whirlwind of research, planning, and calculating. However, putting in the effort to create a property management budget pays dividends. With a deliberate effort throughout budget season, you can create a detailed annual budget that will help you optimize revenue, spend wisely, and run a profitable, competitive building.

Related Posts

FREE 10+ Expense Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 4+ Vacation Budget Planner Samples in PDF

FREE 10+ Budget Outline Samples in PDF | MS Word

FREE 10+ Conference Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | Apple Pages | PDF

FREE 10+ Monthly Budget Worksheet Samples in PDF | MS Word | Google Docs | Google Sheets | Excel

FREE 10+ Monthly Project Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 10+ Corporate Budget Samples in MS Word | MS Excel | Google Docs | Google Sheets | PDF

FREE 9+ Primary School Budget Samples in MS Word | Google Docs | Google Sheets | MS Excel | PDF

FREE 10+ Operational Budget Samples in PDF | DOC

FREE 5+ Budget Layout Samples in PDF

FREE 6+ Paycheck Budget Samples in PDF | MS Word

FREE 10+ Architecture Budget Samples in PDF

FREE 10+ Capital Budget Samples in PDF | MS Word | Google Docs | Google Sheets | Excel | Apple Numbers | Apple Pages

FREE 10+ Budget Tracker Samples in PDF | DOC

FREE 4+ Corporate Monthly Budget Samples in MS Word | Google Docs | Google Sheets | Excel